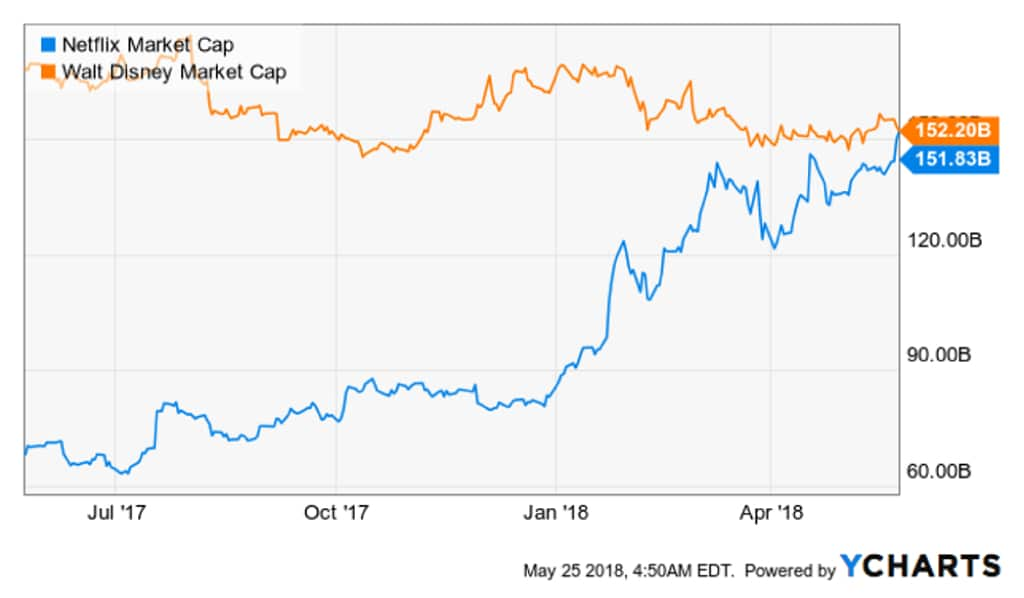

At times Netflix [NFLX] looks unstoppable. Its stock has surged by 80% in 2018, and it briefly overtook first Comcast [CMCSA], then Disney [DIS], in May to become the world’s highest valued media company.

Part of its recent success has been linked to stellar results for the first quarter in 2018, which saw Netflix grow its revenues by 43% year-on-year and gain over 7 million new subscribers, bringing its total count to 125 million.

Past performance is not a reliable indicator of future results

But many predict that the Netflix bubble may burst: Its model is easily replicated and spend on producing shows and films astronomical. Most recently it pledged to spend $8bn on content alone by the end of 2018, a figure that has led to questions over sustainability.

Major studios have been planning an offensive for some time, and have set up a range of direct-to-consumer services. But the biggest assault on Netflix’s dominance is yet to come: Disney will launch a new streaming platform in early 2019.

$8 billion

Amount Netflix is set to spend on films and shows in 2018

Disney is notable for two key reasons. Firstly, it announced in 2017 that it would strip Netflix of Disney content, including lucrative Marvel titles, robbing the service of some of it’s most watched films.

Secondly, Disney is planning to buy 21st Century Fox for $52bn, giving the studio a 60% majority share in US streaming service Hulu – Fox and Disney currently own 30% each, with Comcast and Time Warner holding the remaining 40%.

Hulu has been incredibly successful in the US market, reaching 20 million subscribers. It recently started making original shows, which gained critical success with The Handmaid’s Tale. Many speculate that this platform could be rolled into Disney’s planned service.

The deal also has the potential to hand Sky to Disney, if Fox’s bid to takeover the broadcaster is successful.

Hulu’s Handmaid’s Tale

Credit Still released by studio

For the most part Disney is still top dog in the market – it’s cap is now back ahead of Netflix and it’s 2017 revenue was $55.1bn against Netflix’s $11.7bn. Adding streaming value on top of its TV and film portfolio and events and licensing business, may well keep it in the top seat for a while yet.

Investment blogger and trader Howard Lindzon says Disney is one of the top media stocks to watch pending the launch of the service: “Currently, the market refuses to pay Disney an internet business valuation until it launches its ‘DisneyFlix’ with a blockbuster early release movie…[I] continue to believe Disney will nail the subscription business.”

$55 billion

Disney’s 2017 revenue

Each of the remaining ‘top five’ studios have also dipped into the on-demand streaming pool. CBS has begun rolling out a localised service CBS All Access internationally. The platform has had success with its first original Star Trek: Discovery, a top rated show in 2018.

Comcast has had some success with its platforms Epix and Hayu, but its main move to stay competitive is a counter-bid to take over Sky, which includes a satellite TV business, a streaming TV service, an enviable content library, and broadcast rights to some of the most important European sports. If the acquisition is completed, Comcast would be in a position to launch a service as far reaching as Disney’s.

“It will likely result in the creation of at least two global behemoths spanning content and distribution” - Ed Barton, chief entertainment analyst at Ovum told this reporter

“I think it’s important to think about how this looks to the customer who will have to subscribe to more services to access the same breadth of content which was previously available from fewer services,” Ed Barton, chief entertainment analyst at Ovum told this reporter.

“There’s a good chance that some countries will end up with more services than the size or spending in the market justifies and there will be a shakeout. It will likely result in the creation of at least two global behemoths spanning content and distribution.”

With Disney’s growing assets combined with a new streaming service, it’s perfectly placed to take such a position.

Tomas Jivanda

Tomas Jivanda