Professional spread betting tips and strategies

Spread betting is a leveraged trading method that can be used to trade markets around the world. Suitable for both beginner and professional traders, this article covers tips that can help improve your spread betting success and strategies that can be used when spread betting.

Spread betting tips

- Know spread betting’s risks and rewards. The risks and advantages of spread betting make it the most popular leveraged trading product in the U.K. Therefore, learning about the tax efficiency of spread betting can help realise its full potential.

- Trading plan. Trading without a plan is like driving without knowing what direction you are going. A trading plan can be used to help to keep trades consistent, disciplined and reduces the likelihood of unplanned trades. For more information, visit our article on creating a trading plan when spread betting.

- Risk management. Use of risk management conditions such as stop-loss and take-profit orders can help manage your exposure to risk. Risk management conditions paired with a sound trading plan provide a good basis for the improvement of any trader’s strategy.

- Focus on one market. Although trading multiple markets yields many more trading opportunities, beginners are best to focus their energy on one market. Markets are complicated and trying to learn too many asset classes at once could cause you to lose focus and potentially make mistakes.

- Discipline. Improving discipline is one of the most important tips for all levels of spread betting traders. Traders need to actively work on how disciplined they are when opening and closing trades, as trading based on emotions is often a traders biggest downfall.

- Adopt a professional trader’s psychology. Most advanced traders will follow a consistent, replicable strategy. Therefore, they can easily measure results and better manage inconsistent variables such as fear and worry.

- Practise on a demo account. Open a demo account to trade with £10,000 of virtual funds in a risk-free environment. This way, you can perfect your trading strategies and monitor your success before staking any real funds.

Spread betting strategies

Several strategies can be used alongside the above tips in an attempt to increase the likelihood of trading success. However, it is worth noting that this is not a complete list of all spread betting strategies, and only provides the most common ones. Visit our trading strategies article for more information on strategies that can be used when spread betting.

Many traders eventually customise the trading strategy they use or merge it with another to help it work with their trading style. Some of the common trading strategies used when spread betting include:

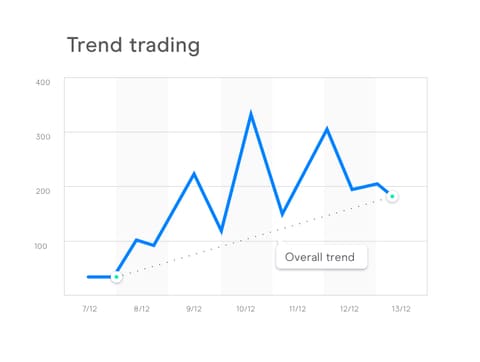

Trend following strategy

When spread betting a trending market, traders use technical analysis to define a trend and only enter trades that follow the direction of the trend. Trend following is a medium-term strategy and success in trend trading is often dictated by an accurate system to follow and follow trends. Trend following is suited for beginner traders to advanced traders as it is relatively simple to understand but can take some practise to master.

Trend traders take a predominantly technical view of the markets and open and close trades based on charts and technical indicators. To establish a trend’s direction traders use moving average indicators and place their own trend lines. To identify when to open and close spread bet positions traders use indicators such as the moving average convergence divergence (MACD) and the relative strength index (RSI).

Trend traders have the option to place spread bets whatever direction the market is heading. However, they need to stay alert as a trend can quickly change, due to market reversal and other factors.

News strategy

A news trading strategy can also be a good strategy for beginner spread betting traders. Although it can be very difficult to master, the concept of news trading is relatively simple and can be practised as a hobby. News traders enter and exit markets based on news releases and place spread bets both before and after releases. Therefore, news traders need to quickly assess the market’s reaction to the news and make quick decisions on what direction they think the market will head following the news release.

News trading is predominantly a spread betting strategy based on fundamental analysis, so a solid understanding of global markets is important. Additionally, success is determined by traders understanding news from the market’s perspective and not being influenced by their bias and opinions.

Using spread betting as a hedging tool

Traders often use spread betting as a hedging tool. Spread betting is a tax-efficient method of trading that traders can use to hedge positions in their wider portfolios.

Another common spread betting strategy involves using a spread betting account as a hedging tool. Say, for example, an investor owns 1,000 shares in Apple and is investing for the long-term. However, their long-term position generates risks if Apple enters a downward trend, even over the short-term.

Apple is soon to release an earnings report, and the investor believes that Apple has been underperforming, which could impact its share price. In the lead up to Apple disclosing their results, the investor opens a position to ‘sell’ the value of 1,000 shares in a spread betting trade.

If the trade is set up correctly, and Apple’s share price falls, any losses on his shareholdings should be countered by the gains of the spread bet. However, any appreciation in share price would also be neutralised by the losses of the spread bet. Therefore, using spread betting as a hedging tool can be useful if you believe the market to take the opposite direction to your existing market exposure.

The strategy can reduce the market risk of holding a share to zero when executed correctly. However, there are other risks and costs that investors must consider when using spread betting as a hedging tool.

Summary

Spread betting is an effective trading technique for traders that reside in the U.K. or Ireland. It is the most tax-efficient* method of trading that we offer, and by following our spread betting tips and strategies and understanding the risks involved, you can begin to start placing spread bets.

Disclaimer

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

* Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.