Why trade commodities with us?

What is commodity trading?

Commodity trading is the buying and selling of standardised raw materials or primary agricultural products such as oil and gas, precious metals such as gold and silver, and soft commodities like cocoa, coffee, wheat and sugar.

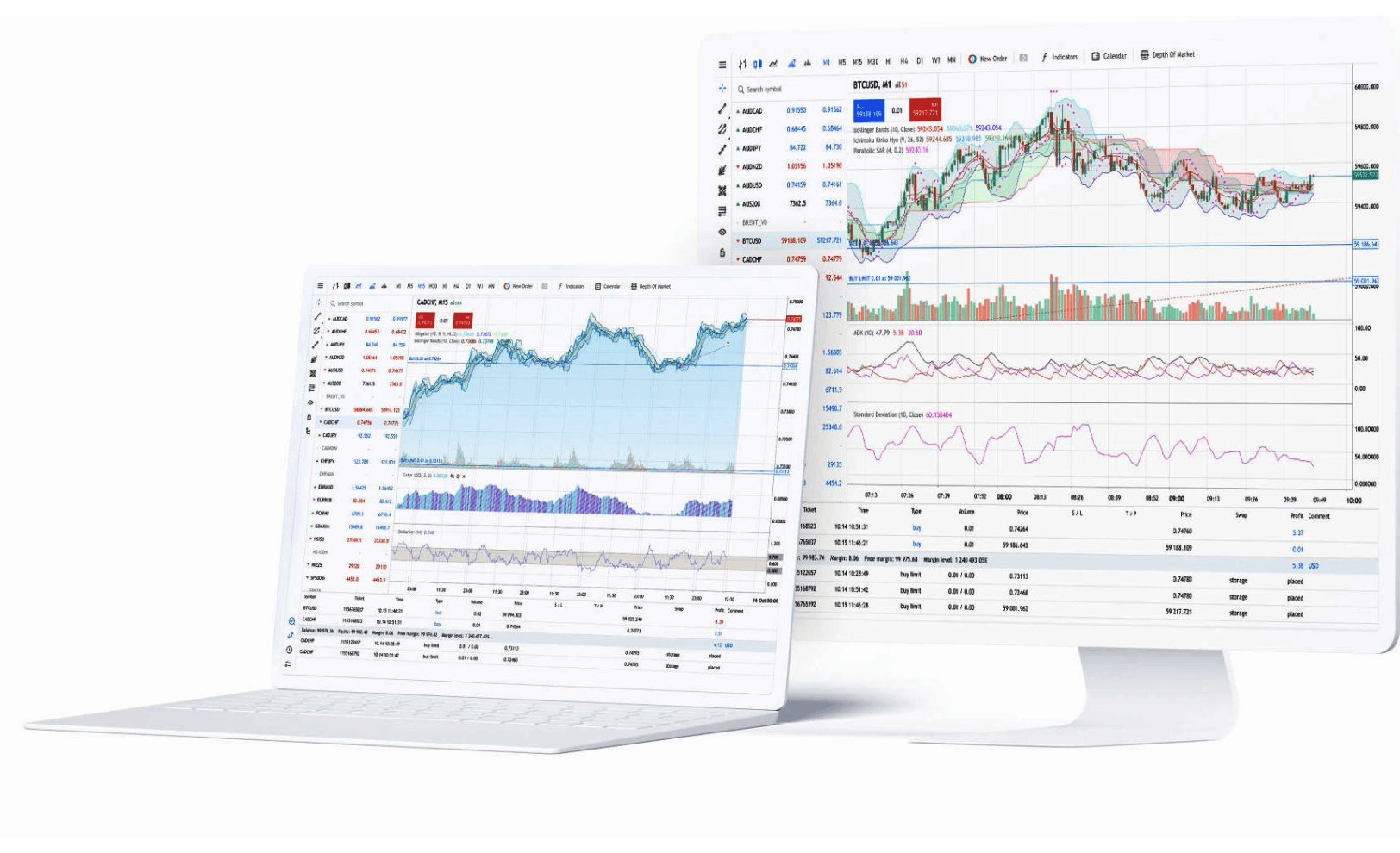

When you trade on these commodities through spread betting and CFD trading, you're speculating on the price of these raw physical assets, without taking ownership of the underlying asset. Commodity trading is popular among short-term traders who often focus on just on one or two commodities.

Any questions?

Email us atWe're available whenever the markets are open, from Sunday night through to Friday night.

10.0030 seconds CFD median trade execution time on CMC Markets' web platform, 1 April 2022-31 March 2023.

2Max discount in tier. Discounts are based on our tiered-volume discount scheme and are variable per product. View our Price+ page for more details.

3FSCS is an independent body that offers protection to customers of financial services firms that have failed. The compensation amount may be up to £85,000 per eligible person, per firm. Eligibility conditions apply. Please contact the FSCS for more information.

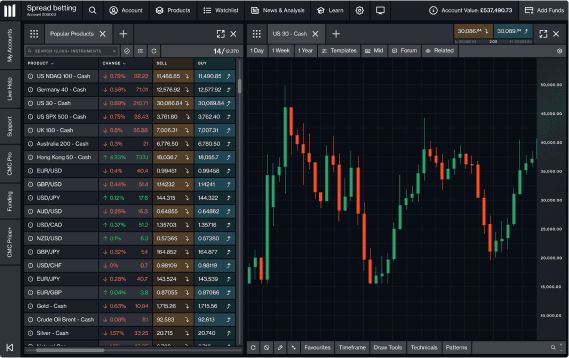

4Awarded No.1 Web Platform and No.1 Most Currency Pairs, ForexBrokers.com Awards 2023; Best Forex Broker, Good Money Guide Awards 2023; Best In-House Analysts, Professional Trader Awards 2023; CFD Provider of the Year, Investors' Chronicle/Financial Times Celebration of Investment Awards 2023; Best CFD Provider, Online Money Awards 2022; No.1 Platform Technology, ForexBrokers.com Awards 2022; Best Mobile Trading Platform, ADVFN International Financial Awards 2022.

51.388 million unique user logins for the CMC Markets invest and CFD platforms globally, as at August 2023.

6Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

7Interest scheme T&Cs apply.