Nvidia has become an AI superpower, but fellow chip stalwart AMD has unveiled its own AI chip to help data centres cope with an ever-increasing volume of AI traffic. Despite an initially lukewarm reaction, AMD is well-positioned to challenge Nvidia in the long-term.

- AMD will be hoping its MI300X AI chip can stymie Nvidia’s H100 ‘Hopper’ GPU dominance.

- The data centre AI accelerator market will grow five-fold to $150bn by 2027, according to AMD CEO Lisa Su.

- How to invest in AI chips: WisdomTree Artificial Intelligence and Innovation Fund offers exposure to stocks within the AI trend, including AMD and Nvidia. The fund is up 35.6% in the past six months.

Artificial intelligence (AI) depends on chips with powerful graphics processing units (GPUs), but a supply shortage is looming, creating both challenges and opportunities in the space.

OpenAI CEO Sam Altman is reportedly concerned that the company is “extremely GPU-limited and this is delaying a lot of their short-term plans”, according to a now-deleted blog post from a developer who had an off-the-record meeting with Altman.

Whether or not a GPU shortage could impact OpenAI in the near future, the statement underlines the strain the AI frenzy has put on chip supply and demand.

The problem is that Nvidia [NVDA] is the major player when it comes to designing advanced chips for AI applications — OpenAI used the chipmaker’s H100 ‘Hopper’ to train and run ChatGPT. Nvidia’s enviable position is what helped its market cap breach the trillion-dollar mark and fuelled a 36.3% share price rally in May...

“To put Nvidia’s May rally in perspective — the chip giant boosted the Wilshire 5000, which aims to represent the whole market, by 0.59% with its 2.19% month-end weighted. Nvidia alone outpaced the index’s 0.41% return,” noted Beth Kindig, tech analyst and CEO of I/O Fund.

This could all be set to change, however, as Advanced Micro Devices [AMD] looks set to take on Nvidia with its own AI GPU. All eyes will be on whether AMD can curtail Nvidia’s dominance.

AMD’s powerful AI chip

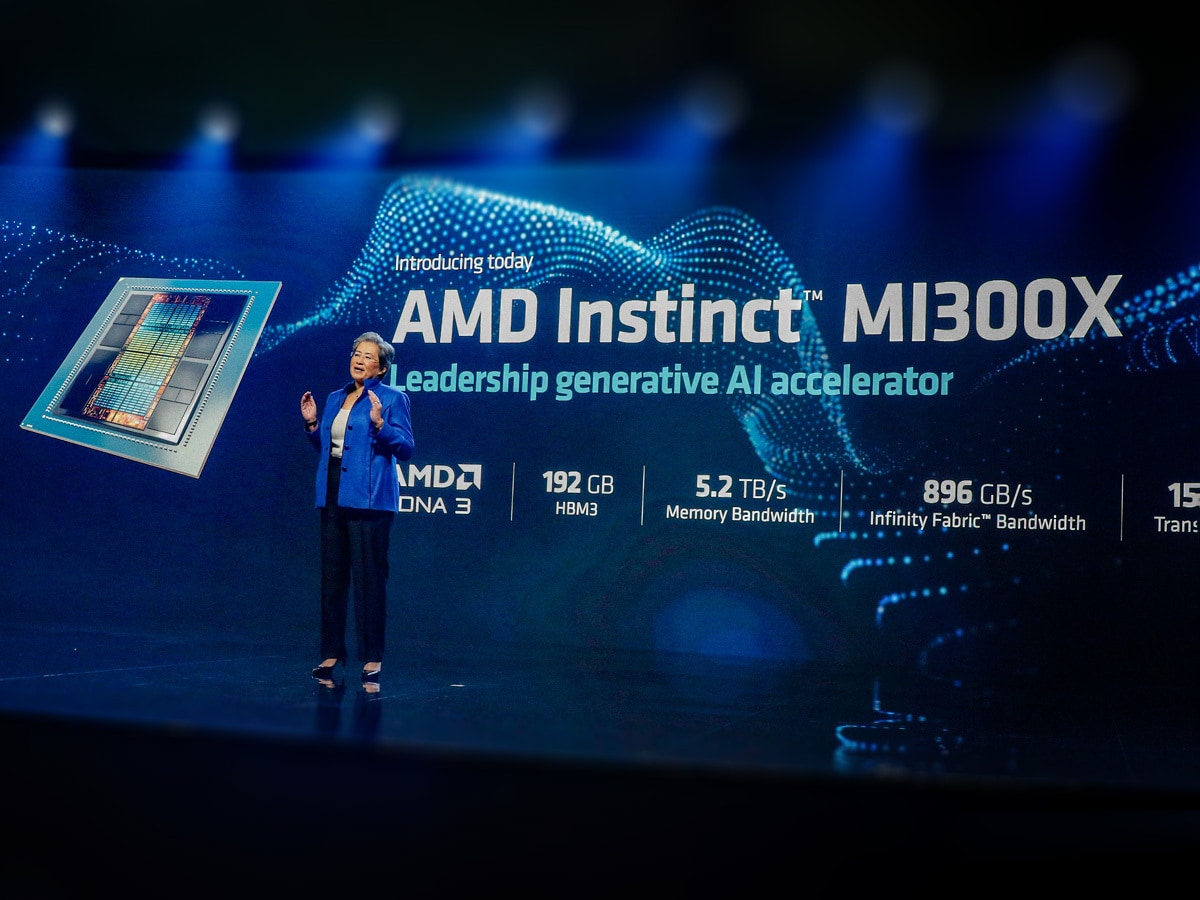

AMD last week unveiled its chip, the MI300X, which is designed to accelerate generative AI. The MI300X will offer 2.4 times the memory density of Nvidia’s H100 ‘Hopper’ GPU, as well as 1.6 times the memory bandwidth.

With the need for computational power growing exponentially, AMD CEO Lisa Su hopes that its chip will help make AI more accessible.

“So everybody who wants to use AI needs more GPUs, and we have a GPU that is incredibly powerful; very, very efficient”, she said, adding that AMD believes it will be “a significant winner in the AI market”.

The AMD share price fell 3.9% in the trading week commencing 12 June versus a 10.1% gain for the Nvidia share price. While this might imply a lukewarm reaction to the MI300X, it’s worth noting that the chip won’t be available until later this year.

Are you finding this content insightful? Leave us some feedback here.

Winning customers key to AMD’s AI story

The litmus test for AMD will be whether it can win enough major contracts to eat into Nvidia’s dominance. AMD is reportedly already lining up Amazon’s [AMZN] cloud division AWS as a potential customer.

As AWS vice president Dave Brown told Reuters last week, “We’re still working together on where exactly that will land between AWS and AMD, but it’s something that our teams are working together on.”

However, the lack of confirmation of a big customer already lined up will have disappointed Wall Street, argues Kevin Krewell, principal analyst at TIRIAS Research. “They want AMD to say they have replaced Nvidia in some design”, or provide an indication of sales projections, he told Reuters. It’s “just a matter of time until a hyperscaler adopts the AMD MI300”, he tweeted later.

Patrick Moorhead, founder and CEO of Moor Insights & Strategy, believes AMD was never going to deliver an immediate “knockout blow”. Instead, “the company is making the investments to compete with Nvidia long-term in the hyperscale cloud AI accelerator market,” he wrote in a Forbes article.

AI demand will boom

Moorhead has forecast that the hyperscale cloud AI accelerator market could have a total addressable market of $125bn by 2028. Meanwhile, Su sees the data centre AI accelerator market growing five-fold between now and 2027, by which time it should be worth $150bn.

As the generative AI services trend continues to grow and puts more pressure on the data centres handling AI traffic, market research firm TrendForce has predicted that AI server shipments will surge 38.4% in 2023 to an estimated 1.2 million units.

Nvidia is expected to hold a majority market share of between 60% and 70%. And shipments of AI servers equipped with Nvidia’s flagship H100 and A100 GPUs are forecast to increase by 50% this year. The TrendForce research was published on 30 May, before the MI300X launch, and no estimates were provided for AMD.

Training AI efficiently

According to Nvidia, the data centre industry is at “the beginning of a 10-year transition” as spend shifts from traditional computing to accelerated computing, CEO Jensen Huang said on the first quarter 2024 earnings call in May.

In the future, data centres will likely need to be optimised to power generative AI applications and to be able to train AI efficiently. Data centres require an enormous amount of energy and use a vast amount of water to keep them cool and ensure they operate smoothly.

Meta [META] has announced that it’s to build an optimised data centre that will support “liquid-cooled AI hardware” as well as “a high-performance AI network connecting thousands of AI chips together for data centre-scale AI training clusters”.

How to invest in semiconductors

ETFs, or exchange-traded funds, offer an economical and diversified way to invest in a variety of stocks within a particular theme.

Funds in focus: WisdomTree Artificial Intelligence and Innovation Fund

The VanEck Semiconductor UCITS ETF [SMH] offers exposure to pure-play semiconductor stocks. Nvidia is the top holding, while AMD also appears in its top 10 as of 31 May. The fund is up 50.9% in the past year and up 47% in the past six months.

The iShares Semiconductor ETF [SOXX] holds US companies that “design, manufacture and distribute” chips. Semiconductors account for 80.71% of the portfolio, while semiconductor equipment has a 19.16% allocation as of 15 June. Nvidia and AMD are the top and third-biggest holdings respectively as of 16 June. The fund is up 45.1% in the past year and up 42.5% in the past six months.

The WisdomTree Artificial Intelligence and Innovation Fund [WTAI] primarily offers exposure to information technology companies (79.36%) benefitting from the AI trend, with lesser exposure to those involved in consumer discretionary, communication services, industrials, healthcare and financials, as of 16 June. The fund is up 29.4% in the past year and up 35.6% over the past six months.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy