US President Donald Trump’s latest target is the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, signed into law by his predecessor President Joe Biden in August 2022.

What is the act, why is Trump targeting it and what could this mean for the US chip industry?

What Does the CHIPS Act Do?

The CHIPS Act was created in response to the increasing use in the US of semiconductors manufactured by foreign companies.

In 1990, the US produced almost 40% of the world’s supply of semiconductors, but this figure has dropped to just 12%. Taiwan is responsible for 60% of the world’s supply, with big names in the space including Taiwan Semiconductor Manufacturing Co (TSMC) [2330.TW].

The Act was established to bring this industry back to US soil, and so bolster skilled jobs and the wider economy.

It aimed to foster this domestic business by allocating $53bn worth of federal incentives for both production and R+D on US soil.

Has the Act Been Successful?

It is difficult to judge the success of an Act positioned for long-term benefits just two and a half years after it was signed into law, but the semiconductor industry in the US has certainly seen a significant uptick.

In the two years to August 2024, there had been nearly $450bn in private investments announced in addition to those issued under the CHIPS Act.

The US still has some way to go before it gains the semiconductor supremacy it is aiming for, but the Act has stimulated some economic movement.

Why Does Trump Care?

Given these positive signs, why did the semiconductor industry, and an Act designed to stimulate domestic economic activity, come under fire in Trump’s address to Congress on March 4?

While it is difficult to pin down the President’s precise motivations, Trump suggested that sending billions of dollars to “rich companies” was the wrong move, and that money should instead be directed to the national debt.

Somewhat conversely, Trump has publicly celebrated TSMC’s $100bn investment pledge in US operations — including three new foundries — as proof that his “America First” plans are coming to fruition. He neglected to acknowledge the role Biden’s Act likely played in this decision.

Instead, Trump seemed to suggest full credit lay in his tariff threats — a claim Taiwan’s Economic Minister Kuo Jyh-Huei flatly denied.

What Happens Next?

In short, the likely answer is not much. Trump announced his desire to overturn the Act in his address to Congress, which does not amount to legislative action.

The CHIPS Act enjoyed bipartisan support when it passed in 2022, and Republican senators do not seem to be in a rush to support Trump in this view.

The next move, suggested by House of Representatives Speaker Mike Johnson, was “to wait until the president’s FY26 budget to see how he handles it.”

From there, it is possible a motion to defund the Act via an act of Congress might be tabled, but as things stand it seems unlikely to garner the support needed to effect change.

How Have Semiconductor Stocks Reacted?

The impact of Trump’s comments on the CHIPS Act have been varied so far. However, with little clarity on whether his statement will lead to any real change, the industry has largely bounced back.

TSMC

Following Trump’s Congressional address, TSMC stock dipped 4.90% between Wednesday March 5 and Monday March 17, although this dip follows a flat performance since the end of January.

A variety of factors have contributed to this, including warnings from the firm that its Q1 revenues would sit towards the lower end of its forecasts due to the $161m it lost as a result of an earthquake in Taiwan in January.

Other headwinds include a shift in some areas to more bearish views on the artificial intelligence (AI) boom, the chip restrictions being threatened by Trump, and tariff risks more broadly.

Intel [INTC]

Conversely, Intel has seen a notable uptick in recent days. While the Trump address seems to have knocked the stock somewhat, dipping 7.27% between March 4 and March 11, news of a new CEO and TSMC partnership plans have seen it recover 29.87% to March 17.

Lip-Bu Tan’s appointment was announced on March 12, and he took the helm on March 18. Formerly CEO of Cadence Design Systems [CDNS] from 2009 to 2021, seeing the firm more than double its revenue in that time, investors seem to trust him to replicate this success for Intel.

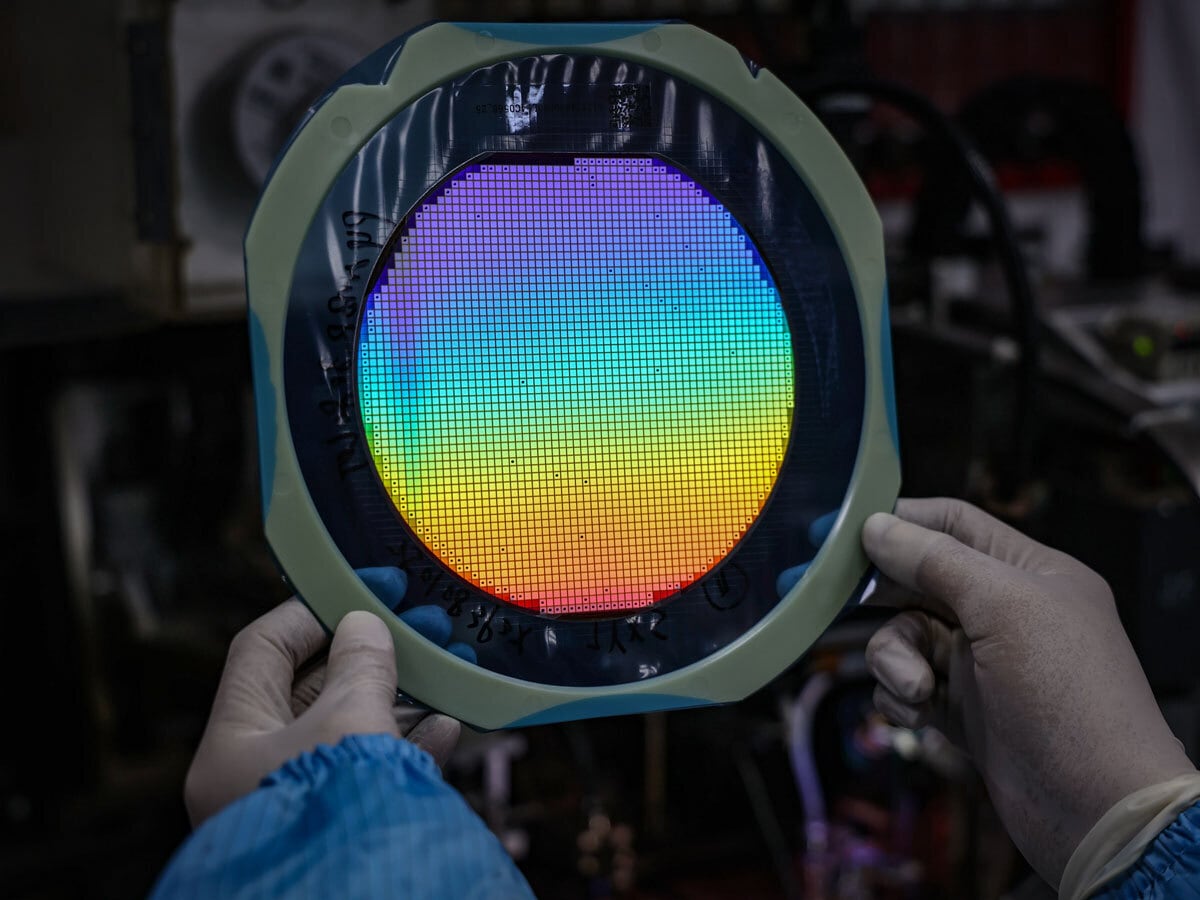

On the TSMC partnership front, much is still to be decided, but the plan seems to focus on TSMC forming a joint venture for Intel’s wafer plants, which could see Intel exit the chip manufacturing business altogether.

Intel’s more diverse product offering, and the fact that its semiconductor branch has struggled to compete with bigger names, means this move could be welcome among investors.

Nvidia [NVDA]

The Nvidia share price tells a similar story, dipping 8.80% from March 5 to March 10, before recovering 11.74% to March 17.

Possible reasons for the rebound include speculation around CEO Jensen Huang’s speech at the company’s semiannual GTC conference in San Jose.

Analysts had suggested this speech could unveil the company’s next generation graphics processing unit (GPU), a reveal that could help Nvidia continue to thrive in spite of CHIPS Act and tariff concerns.

Conclusion

In summary, then, Trump’s call to repeal the CHIPS Act may have caused a brief fright in the market, but it is unlikely to cause any lasting damage to stocks that are otherwise performing well.

The challenges could come if Trump continues to push for the overturning of the legislation, but with tariffs and geopolitical crises to keep him busy, this may be unlikely.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy