Ray Dalio’s Bridgewater Associates increased its stake in both Visa and Mastercard during Q4 2023. The companies both have established positions within their markets, which has enabled them to post sustainable margins and grow earnings and revenue over recent years.

Visa [V] and Mastercard [MA] both saw net sales of stock by ‘super investors’ during Q4 2024, according to data from Stockcircle.

However, one of the world’s most renowned investors bucked the trend, and appears to have banked a profit while doing so.

Ray Dalio’s Bridgewater Associates added to its holdings of both fintech stocks, with 237,287 Visa shares and 117,673 Mastercard shares purchased during the quarter.

Whalewisdom estimates an average purchase price of $218.16 for Dalio’s Visa shares during Q4. By the end of the quarter, the stock was priced at $260.35 — implying gains of 19.3% during the quarter, and 28.5% as of the stock’s close on 6 March.

Meanwhile, Whalewisdom estimates an average price of $370.00 for Bridgewater’s Q4 Mastercard share purchases, implying a gain of 15.3% during Q4, and of 27.5% as of Thursday.

About Ray Dalio

Ray Dalio is Founder of Bridgewater Associates, an investing firm he set up at the age of 26 following a brief career in agricultural investments. Though he is no longer the firm’s CEO, Dalio remains on the company’s board, and plays an active role in mentoring its two Co-Chief Investment Officers, Greg Jensen and Bob Prince.

Bridgewater’s portfolio is worth approximately $18.3bn as of 7 March. It is a diversified fund designed to weather any form of economic surprise. Its largest sectoral weighting is towards consumer staples, to which 22.7% of its holdings are exposed.

READ: Ray Dalio’s Recipe For Balancing Risks

Accruing Value

There are several fundamental factors to both fintech stocks that could appeal to an investor like Ray Dalio.

First, both have posted strong profit margins over an extended period of time.

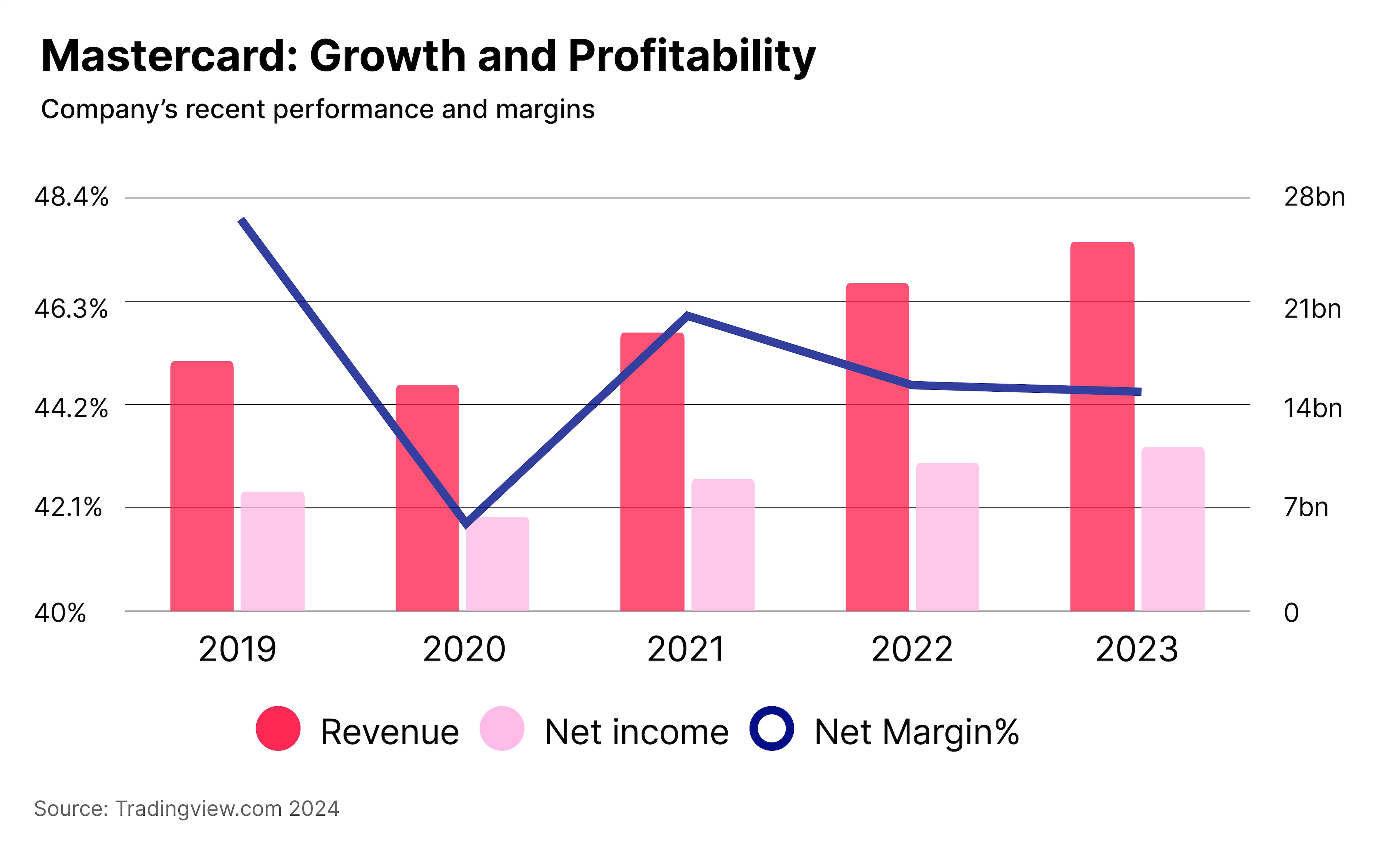

Mastercard’s profit margins have been consistently in the mid-40% range for the last five years.

This compares favourably with the broader market: the S&P 500’s (blended) net profit margin for Q4 2023 was 10.7%, according to FactSet. Even during 2020, when Covid-19 dented performance, the company’s margins only fell slightly below 42%.

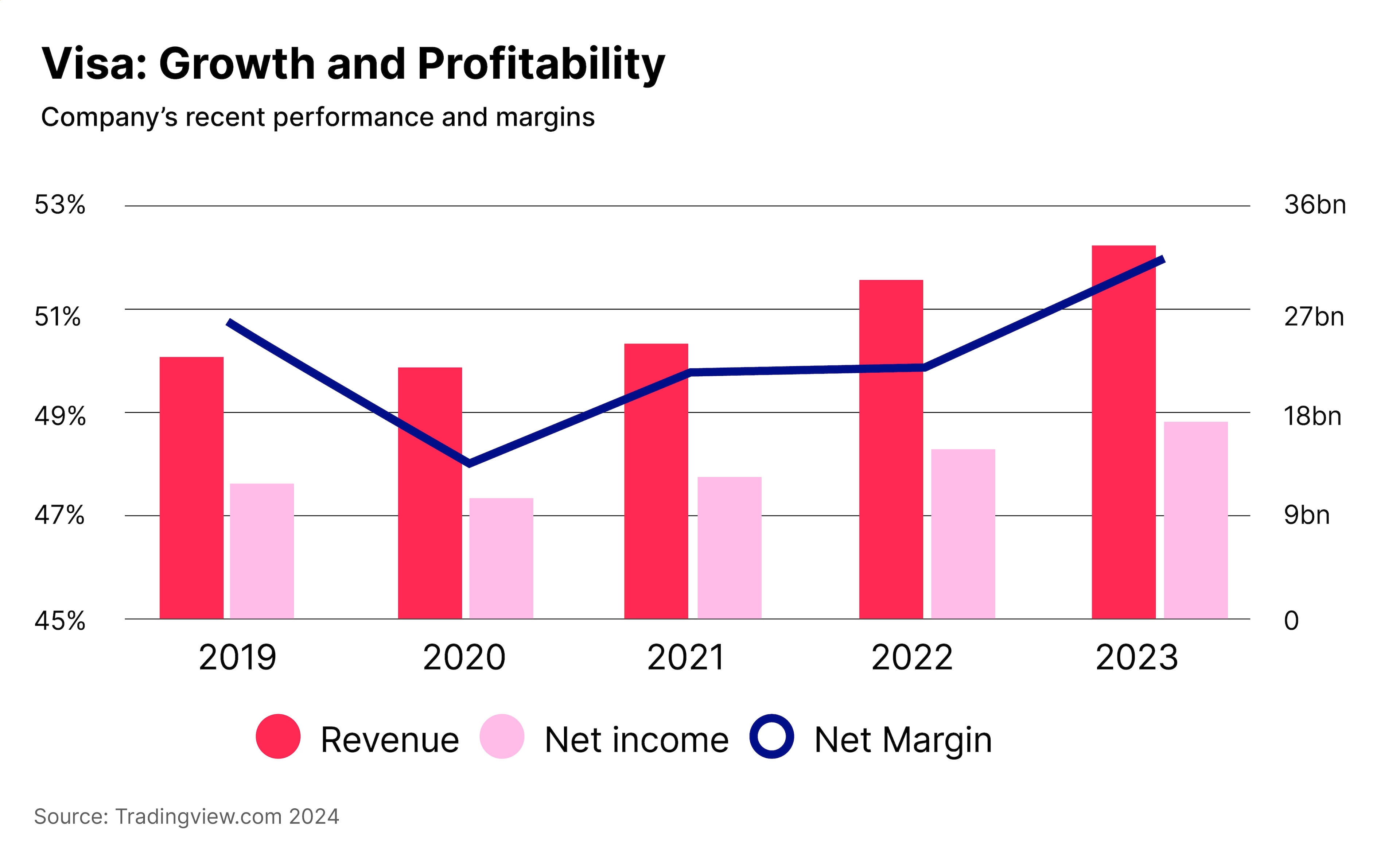

Visa’s margins are even more impressive. Consistently in the high-40% range over the past five years, its net margin topped 52% during 2023.

Yuri Khodjamirian, Chief Investment Officer at Tema ETFs, previously spoke to OPTO Sessions about how the ubiquity of companies like Visa enables them to sustain these kinds of margins.

“Visa has accrued this beautiful network for people to use to be able to make payments whenever they want. It’s really telling that all of the fintechs that say they’re trying to disrupt payments actually end up taking Visa’s rails…

“That’s why Visa has very strong financials, because it just accrues this value over time for customers and for itself”.

Both companies (2020 notwithstanding) have also been steadily increasing their revenue and net income over recent years. In 2023, Mastercard’s revenue and EPS increased 12.9% and 15.1% year-over-year, respectively. Visa’s equivalent figures were 11.4% and 16.9%.

TOLL Paying Out

Mastercard’s share price gained 31.8% in the 12 months to 7 March, and 10.7% year-to-date.

Visa has gained 26.6% over the past 12 months, and 7.9% year-to-date.

Thanks to the monopolistic advantages it gains from its ubiquitous global payment network, Visa is included in the Tema Monopolies and Oligopolies ETF [TOLL]; as of 6 March, it is the fourth-largest holding, with a 4.8% weighting. TOLL is up 26% since its inception in May 2023 and up 9.2% year-to-date.

Investors can get exposure to both stocks via the iShares US Financial Services ETF [IYG]. As of 5 March, Visa and Mastercard are the third- and fourth-largest holdings in the fund, with weightings of 9% and 7.9% respectively. IYG has gained 18.3% in the last 12 months and 7.1% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy