Microsoft boss Satya Nadella is hoping that the company’s new line of artificial intelligence (AI) hardware can reignite its rivalry with Apple. The Copilot+ PCs will initially be powered by Qualcomm’s Arm-based chips, while AMD and Intel’s next generation of chips should be capable of supporting it, too.

Microsoft [MSFT] is entering its AI era. At the annual Build conference last week, Redmond unveiled Copilot+ PCs, a new series of computers designed to capitalise on the AI opportunity.

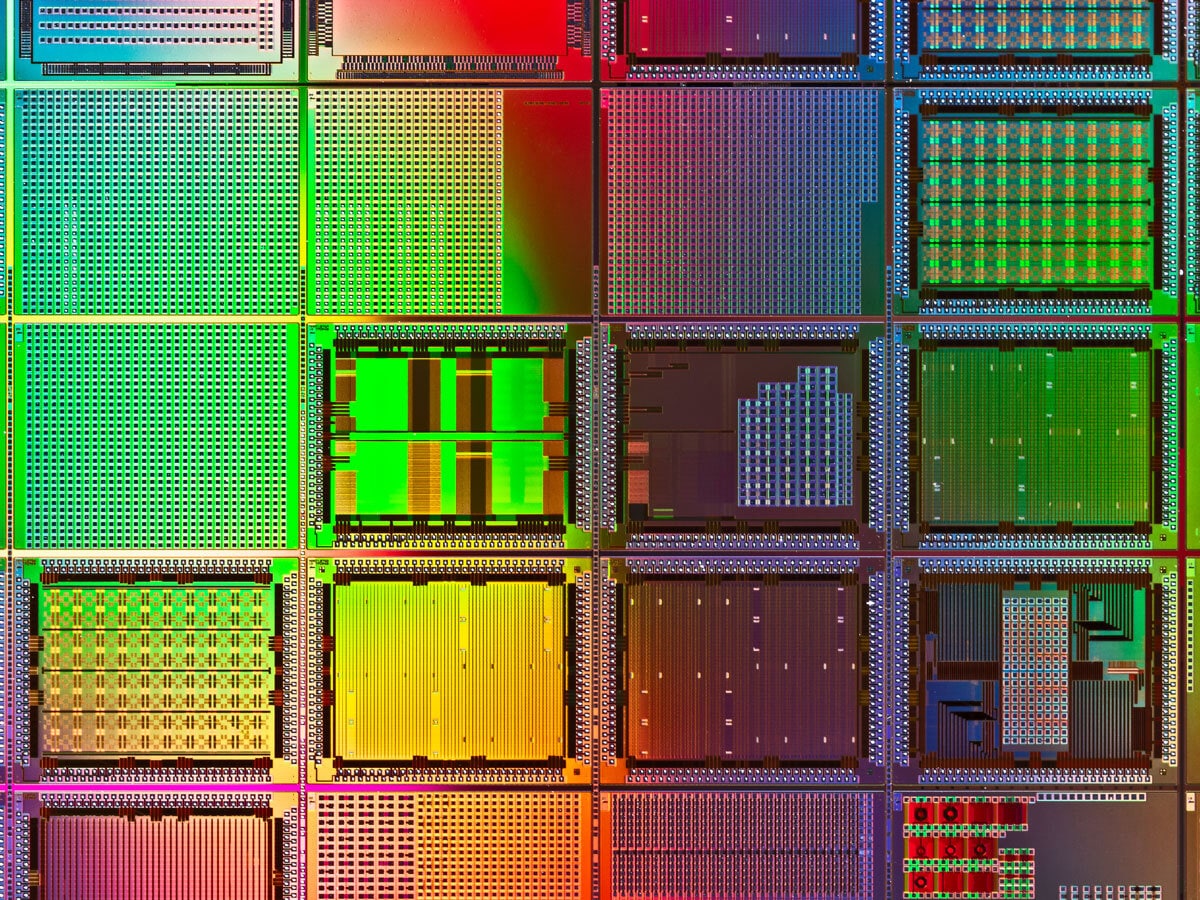

“Breakthrough AI experiences like these are only possible because of a quantum leap in computing performance,” said Pavan Davuluri, Corporate Vice President of Windows and Devices, at the launch on 20 May. Copilot+ PCs are 20 times more powerful and 100 times more efficient than traditional PCs from just a few years ago, he added.

Shipments of AI PCs are forecast to reach 50 million units this year, according to IDC, before hitting 167 million in 2027, by which time AI PCs are expected to account for 60% of all PC shipments. Microsoft will be hoping it can capture a significant share of these shipments

The Microsoft share price hit a new all-time high of $433.60 on 23 May and rose 2.4% last week, to close up 14.8% year-to-date.

Qualcomm Chips to Power Microsoft’s AI PCs

The Copilot+ chatbot will run on new Surface and Surface Pro tablets, starting from $999, as well as PCs and laptops from original equipment manufacturing partners, including Dell [DELL], HP [HPE], Lenovo [0992:HK] and Samsung [005930:KS].

Microsoft’s new Surface tablets will be powered by Arm-based [ARM]Qualcomm [QCOM] chips that are capable of running AI applications. The other PCs that will be able to support Copilot+ will also be powered by Qualcomm’s Snapdragon X series.

“This is a huge coup for Qualcomm, an endorsement of the power and performance it has delivered with its Snapdragon X series and gives it a huge opportunity to finally break into an Intel and AMD-dominated PC market,” Geoff Blaber, CEO of research firm CCS Insight, said in comments shared with OPTO.

Copilot+ is expected to be brought to AMD and Intel-powered PCs at a later date. The problem is that their current chips don’t meet the required number of neural processing units (NPUs), which are essentially the portions of a chip allocated to powering AI applications. AMD and Intel “must ensure sales momentum until next-generation silicon supporting Copilot+ is available,” Blaber added.

Microsoft Targets Apple

With the launch of Copilot+, Microsoft is betting that Qualcomm’s energy-efficient chips can help it to take a bite out of Apple’s [AAPL] PC dominance. The Cupertino company famously switched from Intel [INTC] chips to its own Arm-based ones at the end of 2020 in order to improve the battery-life and performance of its hardware.

Apple’s global PC shipments declined to 21.9 million units in 2023, from 26.8 million in 2022, with its market share also falling by 18.4%, Gartner data shows.

However, Apple took 16.1% of the US market in Q4 2023, up from 14.3% a year earlier, and it will be hoping to continue increasing its share with the release of the M4 neural engine, which launched earlier this month. The company claims the M4 is more powerful than any NPU available on today’s AI PCs.

The superior performance of the M-series chips has posed “a significant competitive threat to Windows PCs and succeeded in taking customers in part due to battery life and performance credentials,” according to Blaber. It was therefore imperative that Microsoft responded if it was to avoid being left behind in the AI PC market.

“Microsoft is pushing hard with Qualcomm to take the fight to Apple and close the performance gap with Apple’s M-series silicon,” he concluded.

Microsoft Remains a Popular AI Play

The Microsoft share price has been riding the AI wave in the past few weeks on the back of reporting a 20% jump in profit for the first three months of the year — an indication that its AI investments are starting to bear fruit.

As well as holding Microsoft shares outright, another way to invest in the stock is through thematic ETFs that offer broader exposure to the AI industry.

The Roundhill Generative AI and Technology ETF [CHAT] has Microsoft as its second-biggest holding, with a weighting of 10.5% as of 27 May, while it also holds AMD, Apple, Arm and Intel. The fund is up 28.5% in the past year and up 16.2% year-to-date.

The Alger AI Enablers and Adopters ETF [ALAI] has Microsoft as its top holding, with a weighting of 15.2%, as of 30 April, while it also holds AMD and Apple. The fund is up 4.8% since its launch on 8 April.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy