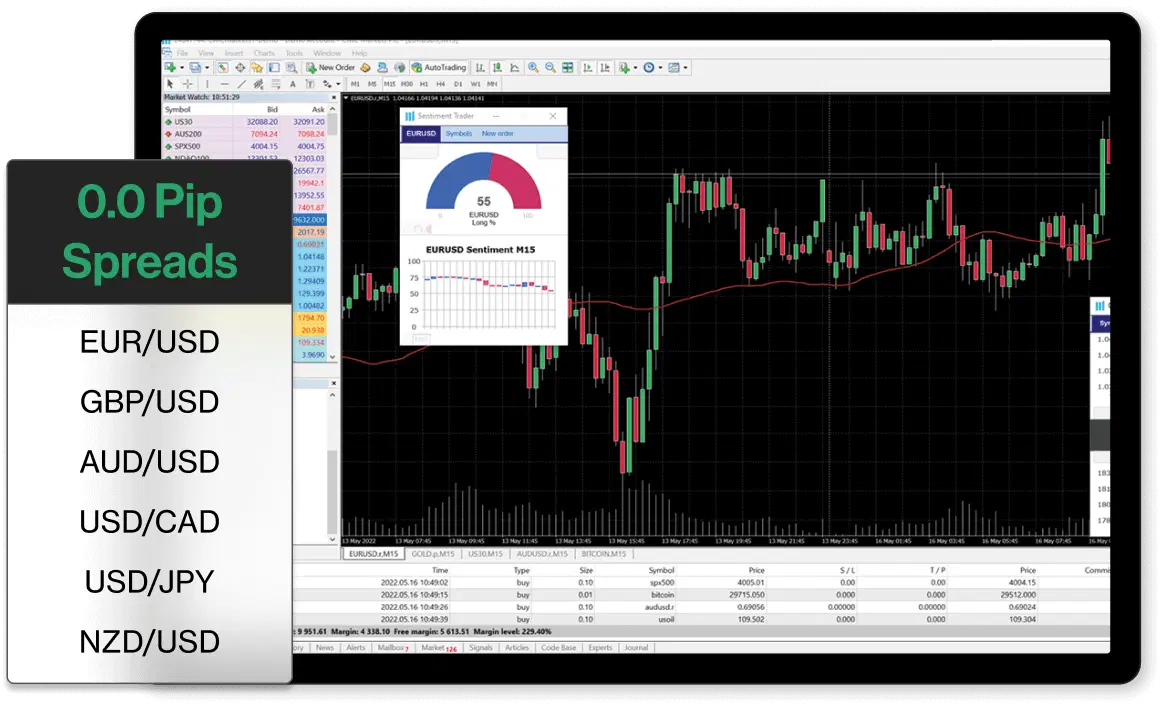

Pips FX minimum spread¹

Maximum retail leverage

Micro lot trading*

Financial instruments²

Dedicated customer support

*Trade one-hundredth the size of a standard lot

INSTRUMENT | FX ACTIVE MIN SPREAD | STANDARD CFD ACCOUNT MIN SPREAD | MARGIN RATE | COMMISSION |

|---|---|---|---|---|

0.0 | US $2.50 | |||

0.0 | US $2.50 | |||

0.0 | US $2.50 | |||

0.0 | US $2.50 | |||

0.0 | US $2.50 | |||

0.0 | US $2.50 |

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

NAME | STANDARD CFD ACCOUNT MIN SPREAD | MARGIN RATE | SPREAD DISCOUNT |

|---|---|---|---|

25% | |||

25% | |||

25% | |||

25% | |||

25% | |||

25% | |||

25% | |||

Show more | |||

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

NAME | MIN SPREAD | STANDARD CFD ACCOUNT MIN SPREAD | MARGIN RATE | SPREAD DISCOUNT |

|---|---|---|---|---|

25% | ||||

25% | ||||

25% | ||||

25% | ||||

25% | ||||

25% | ||||

25% | ||||

Show more | ||||

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

See bid and ask prices, premiums, and more up front, helping you to understand your costs before you place a trade.

We combine multiple feeds from tier-one banks, to get you the most accurate bid/ask price.

Factor in your cost per trade, with fixed low commission at just $2.50 per $100,000 notional value.

With a combination of feeds from tier-one banks, you'll always receive our most accurate price.

Deposit and withdraw funds easily to and from your FX Active account, and whenever you want, at no cost.

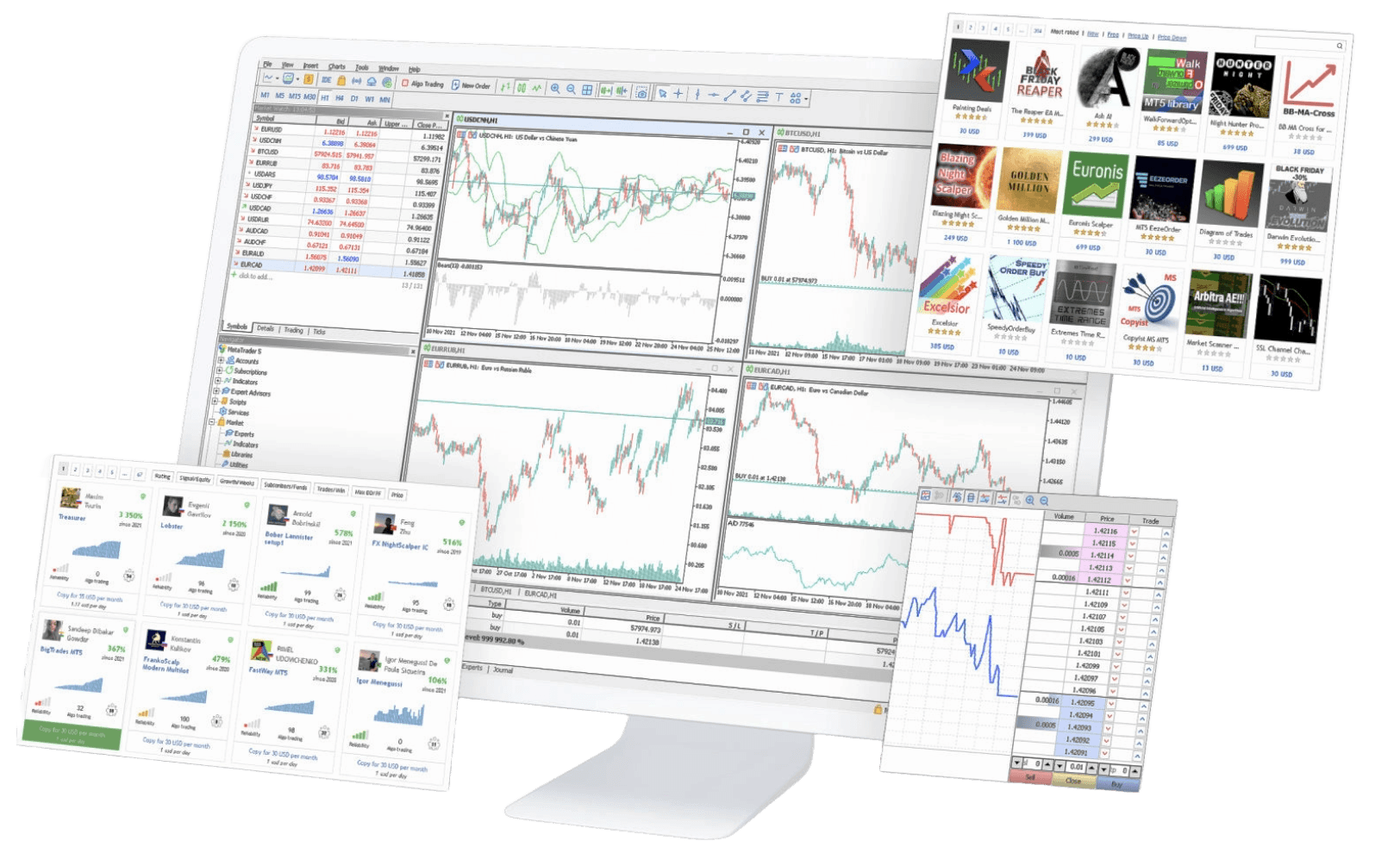

Trade on the world's most popular trading platform, with tight spreads and ultra-fast execution.

Trade on forex, indices, commodities and cryptocurrencies

Fast, one-click trading

Customisable charts with pre-installed indicators

Automated trading with Expert Advisors

Download MetaTrader 4 for PC or MAC and trade on the world's most popular trading platform.

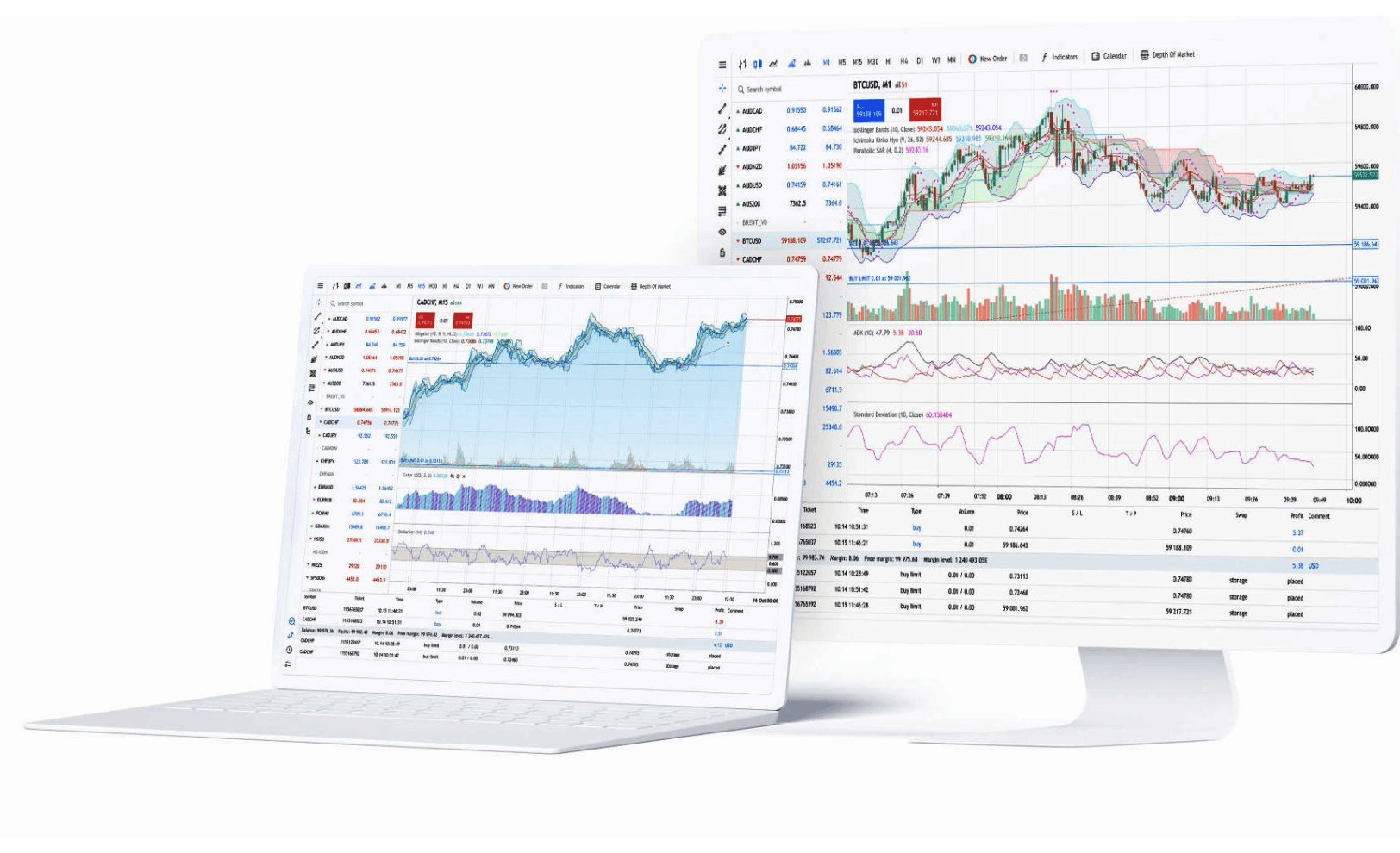

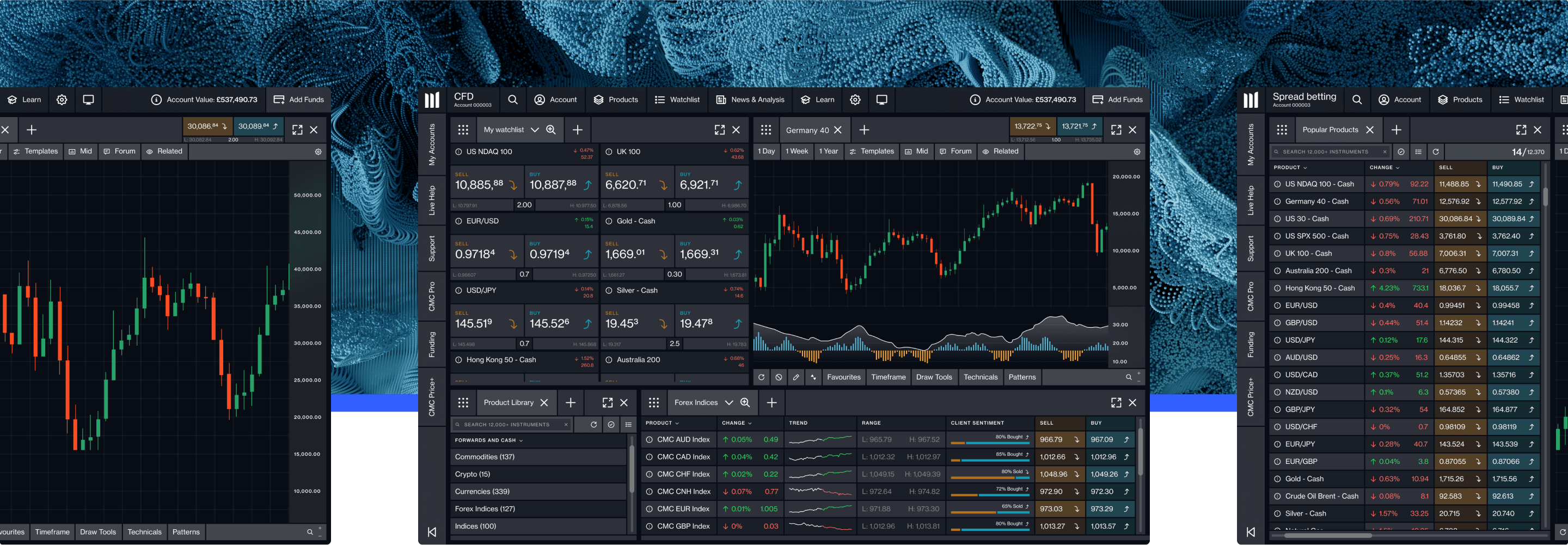

A powerful trading platform designed to provide access to global markets, with advanced trading features and real-time data.

Trade on forex, indices, commodities, shares and cryptos

One-click trading

More order types, timeframes, and pre-installed indicators than on MT4

Depth of market display and inbuilt economic calendar

Experts Advisors with faster strategy tester

Download MetaTrader 5 for PC or MAC to experience its advanced trading tools and features from an industry’s leading provider.

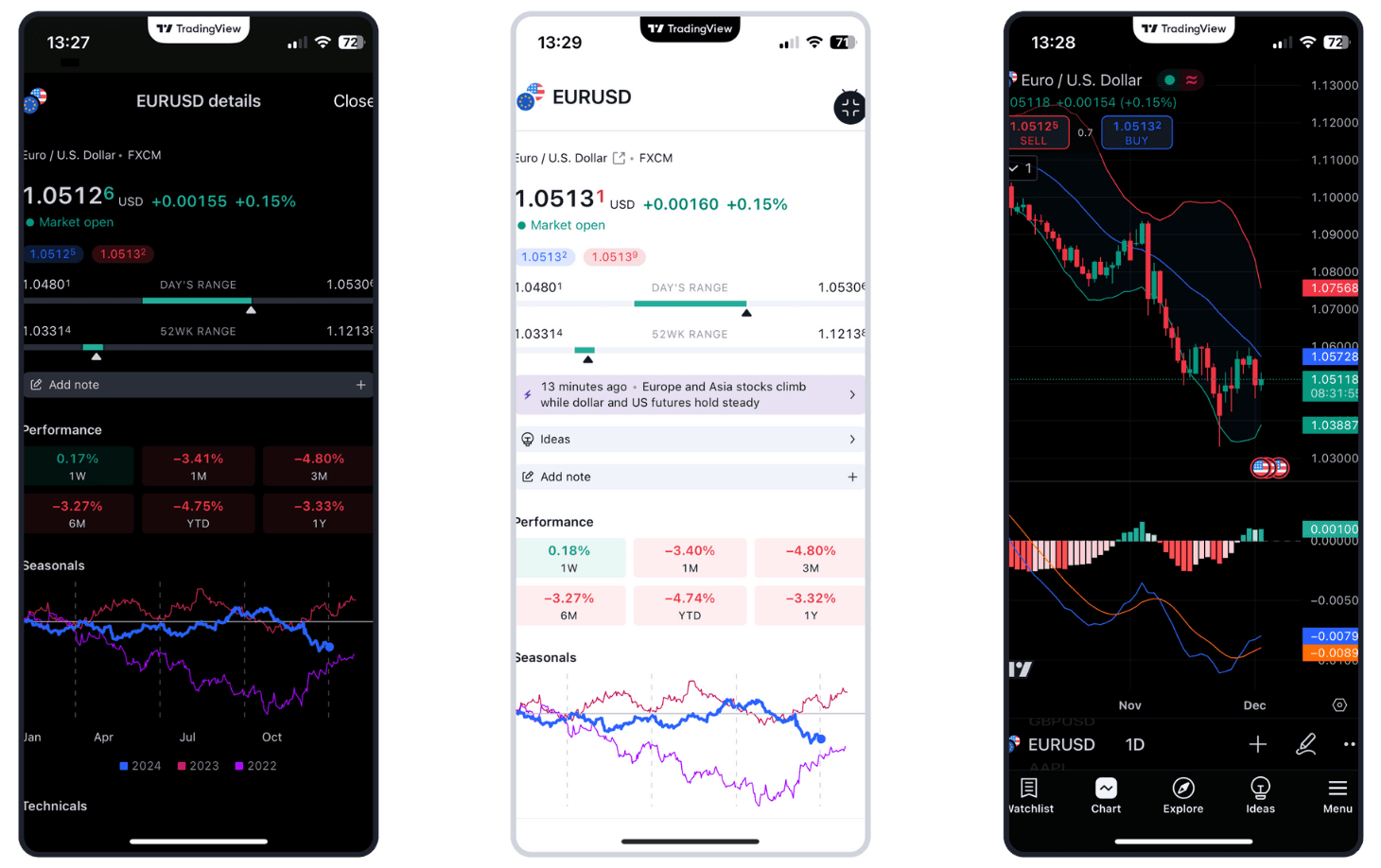

Enjoy the best of both worlds: view and analyse charts on TradingView; trade with our tight spreads and fast execution.

Enhance your trading experience with TradingView’s renowned charts and indicators.

Get inspiration and ideas from one of the world’s largest online trading communities.

Prepare for key announcements with TradingView's easy-to-use financial calendar.

Set up personalised alerts using 13 built-in conditions based on price and volume.

Open, manage and close your trades with us in TradingView.

TradingView's mobile apps are available on the App Store and Google Play Store. Ensure that your device is up to date and your operating system is supported.

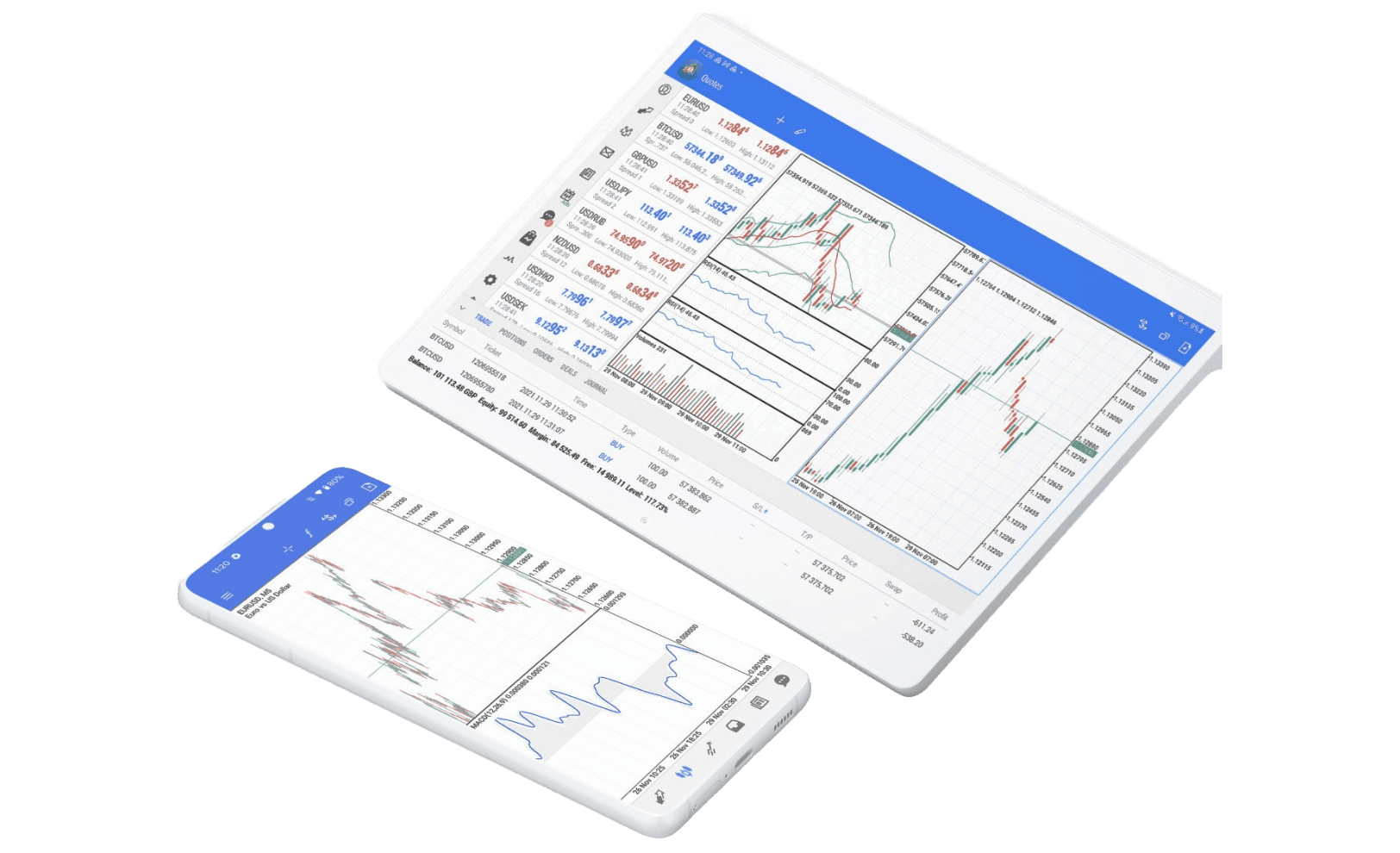

Google PlayApp StoreAdvanced order execution

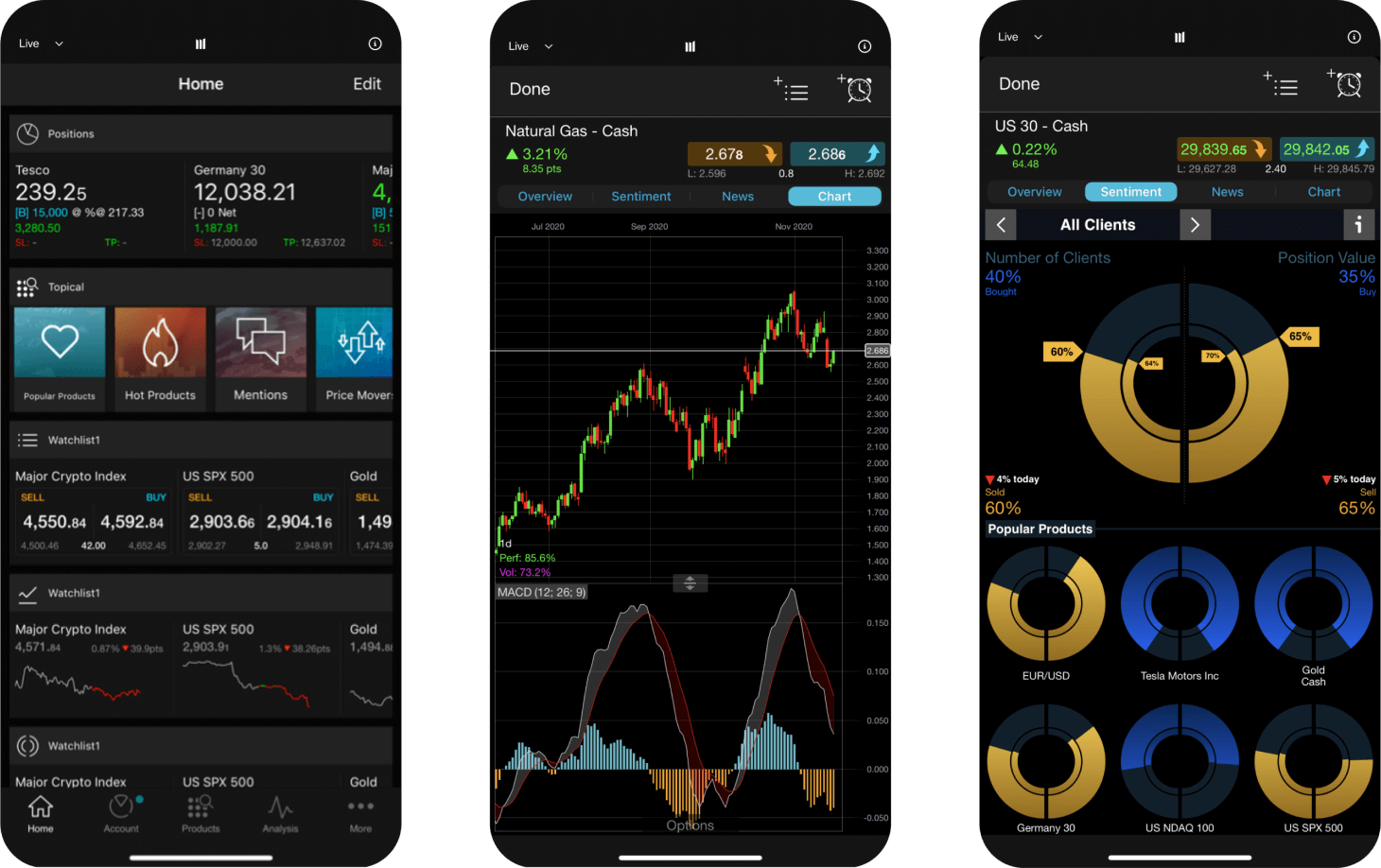

Intuitive charting, with mobile-optimised charts

Pattern recognition scanner

Market sentiment gauge

Morningstar equity research & Reuters news

Packed with powerful features, yet intuitive, and available to all traders. Whatever the next step in your trading journey, our mobile platform can help you get there.

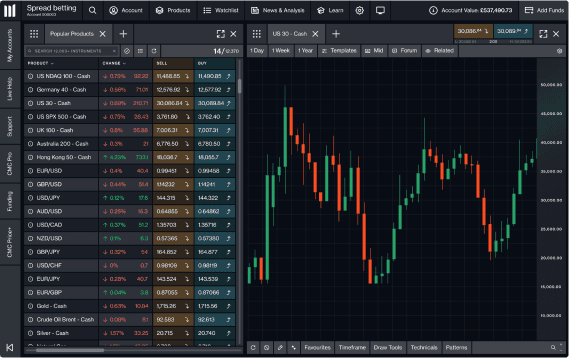

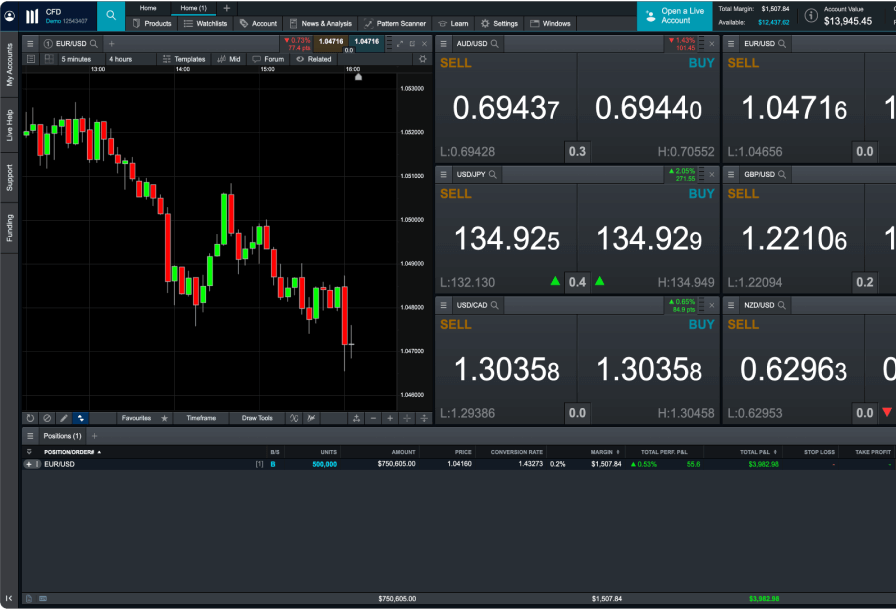

We've built our web trading platform to be powerful and intuitive. It combines leading-edge features and security, fast execution, and best-in-class insight and analysis. Designed to support any strategy.

What is FX Active?

Which currency pairs are available with an FX Active account?

What are the costs associated with an FX Active account?

FX Active has fully transparent commissions across all forex pairs at 0.0025% per transaction, as well as minimum spreads from 0.0 pips on six major FX pairs, and a 25% spread reduction compared with our standard CFD account on all the other currency pairs we offer.

How does the commission work with FX Active?

Commission is charged at a fixed rate of 0.0025% per transaction. This works out as $2.50 per $100,000 worth of currency trade. At this notional volume, it would cost $5 to open and close a trade. MT4 commissions are charged upfront for opening and closing trades.

Do you have an FX Active demo account?

Yes, there is an FX Active demo account.

What is an FX Active demo account?

An FX Active demo account allows you to experience the platform's wide range of innovative features and tools in a risk-free environment. You can practise trading on your favourite instruments and try out trading strategies and techniques with £10,000 of virtual currency.

Is CMC Markets regulated?

CMC Markets has 15 global offices, including in the UK, Australia, Germany, Canada, New Zealand, Singapore and Bermuda. CMC Markets' entities are licensed and regulated by the local authorities, for example, CMC Markets Bermuda is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority (‘BMA’).

How does CMC Markets protect my money?

As a CMC Markets' client, your money is held separately from CMC Markets' own funds. It is held in segregated client bank accounts distributed across a range of major banks, which are regularly assessed against our risk criteria. Under the BMA rules, retail clients must be provided with negative balance protection. This means that your maximum loss is the amount you have deposited with us.

How do I place a trade?

If you're trading on MT4 or MT5, select the instrument you wish to trade ('double-click' on your PC), and a new order window will appear. Enter your desired volume (in lots), add any risk-management orders such as a stop-loss or take-profit order. Then place a market order in the direction you wish to trade; buy to go long, or sell to go short. There are several ways to place trades or orders using MT4 or MT5 – you can learn more about MT4 or MT5 functionality by navigating to Help > Help topics or Help > Video guides.

If you’re trading on our Next Generation platform, search for your desired instrument from the 'Product Library'. Select your chosen instrument ('right-click' on your PC), and select ‘Order Ticket’. In the order ticket box, choose your order type (from Market, Limit, and Stop-Entry Order), and then enter your desired volume in units or amount (this can be configured from the ‘Settings’ menu in the main navigation). Add stop-loss and take-profit levels to minimise your risk, and choose to ‘BUY’ or ‘SELL’, depending on whether you want to go long or short. When you’re ready, select ‘Place Buy Market Order’, or ‘Place Sell Market Order’.

What is the maximum leverage offered by CMC Markets?

For retail clients, the maximum leverage you can currently trade with is 200:1 (or 0.5% margin) with our CFD trading and FX Active accounts.

What is TradingView?

TradingView is a trading research platform where you can view charts, analyse trends and interact with an online community. You can connect your TradingView account to your CMC Markets account, enabling you to open, manage and close trades within TradingView. Learn more about TradingView here.

What are the key differences between MT4, MT5, TradingView and CMC's trading platforms?

MetaQuotes' MetaTrader 4 and MetaTrader 5 are globally popular forex and CFD trading platforms. TradingView is a trading and charting platform which you can link to your broker account to place trades. Our proprietary web-based platform is feature-rich and enables access to trade CFDs on 12,000 instruments.

With each platform you can choose from our CFD trading or FX Active accounts. Our FX Active account offers spreads from 0.0 pips on six major FX pairs, with a 25% spread discount on all other pairs. There is a fixed, low commission at $2.50 per $100,000 notional value traded.

Our trading platform doesn’t require any downloads, while MT4 and MT5 requires downloading to fully utilise its features, such as algorithmic trading (through Expert Advisors) and social trading available via the MQL4 and MQL5 communities.

The MetaTrader platforms offer hedging positions by default, while CMC’s trading platform offers netted positions by default.

Can I hedge positions in MetaTrader?

Yes, you can open an opposite, related, or alternative trade, with no interruption for traders using Expert Advisors.

How can I withdraw my funds?

Log in to your MT4 or MT5 client portal or our trading platform and follow the instructions in the funding section.

How do I reset my password?

You can reset your password by selecting 'Forgot password?' on the login page. We'll then send instructions for changing your password to the email address you use to log in to your account.

What is the complaints procedure at CMC Markets?

Our aim is to provide a high level of service to all our clients, all of the time. We value all feedback and use it to enhance our products and services. We appreciate that from time to time things can go wrong, or there can be misunderstandings. We are committed to dealing with queries and complaints positively and sympathetically. Where we are at fault, we aim to put things right at the earliest opportunity. You can find our complaint handling procedure here or contact us at global@cmcmarkets.com to begin your account query. Please note that all queries and complaints will be handled in English.

If you already have an account, log in to your chosen platform.

Don't have one yet? Open an account now.

English

繁体中文

ภาษาไทย

Filipino

Tiếng Việt

العربية

বাংলা

Français

हिंदी

Indonesian

한국어

Melayu

Português

Español

Türkçe

Select your country and preferred platform for your account

Unfortunately we are currently unable to process applications from residents of undefined

Our Next Generation trading platform combines institutional-grade features and security, with lightning-fast execution and best-in-class insight and analysis.

Trade contracts for difference (CFDs) on over 12,000+ products including FX Pairs, Indices, Commodities, Shares and Treasuries.

Competitive spreads on 200+ instruments including FX pairs, indices and commodities

Fast, automated execution, with tier-one market liquidity

Advanced charting tools, EA's and algorithmic trading