Gold trading on MT4

Złoto to popularny instrument inwestycyjny zarówno wśród początkujących, jak i doświadczonych traderów. Ten metal szlachetny, uznawany za tradycyjną „bezpieczną przystań”, należy do najczęściej wybieranych surowców w naszej ofercie. Na cenę złota wpływ mają m.in. inflacja oraz stopy procentowe. Złoto postrzegane jest również jako forma twardej waluty, przechowywanej przez banki centralne jako część rezerw.

Which factors affect the price of gold?

A number of factors can affect the price of gold, including:

Interest rates: when interest rates rise, the opportunity cost of holding gold increases, which can lead to a decrease in the price of gold

Inflation: when inflation rises, the value of gold may rise, as gold is seen as a hedge against inflation.

US dollar strength: as gold is primarily USD denominated, gold tends to have an inverse relationship with the dollar. When USD is weak, gold appears more attractive to collectors and investors.

Political and economic stability: when there is political or economic instability, demand for gold can increase, as gold is seen as a safe-haven asset.

Supply and demand: the supply and demand for gold also affects its price. If demand for gold exceeds supply, the price of gold will rise. If supply exceeds demand, the price of gold will fall.

Trading opportunities in gold

The factors that affect the price of gold can create trading opportunities for traders. For example, if traders believe that interest rates are going to rise, they may sell gold in anticipation of a decline in price. If traders believe that inflation is going to increase at a faster rate, they may buy gold in anticipation of a rise in price.

Risks of trading gold

There are several risks associated with trading gold, including:

Volatility: gold is a volatile asset, which means that its price can experience sharp swings. This can make it difficult to profit from trading gold, and it can also lead to large losses.

Margin risk: Trading gold on leverage amplifies both your profits and losses, as your position is based on the full value of the trade, rather than just your initial deposit, or margin.

Geopolitical factors: gold prices can also be affected by geopolitical factors such as wars, political instability, and natural disasters. If these factors occur, gold prices could become volatile and unpredictable.

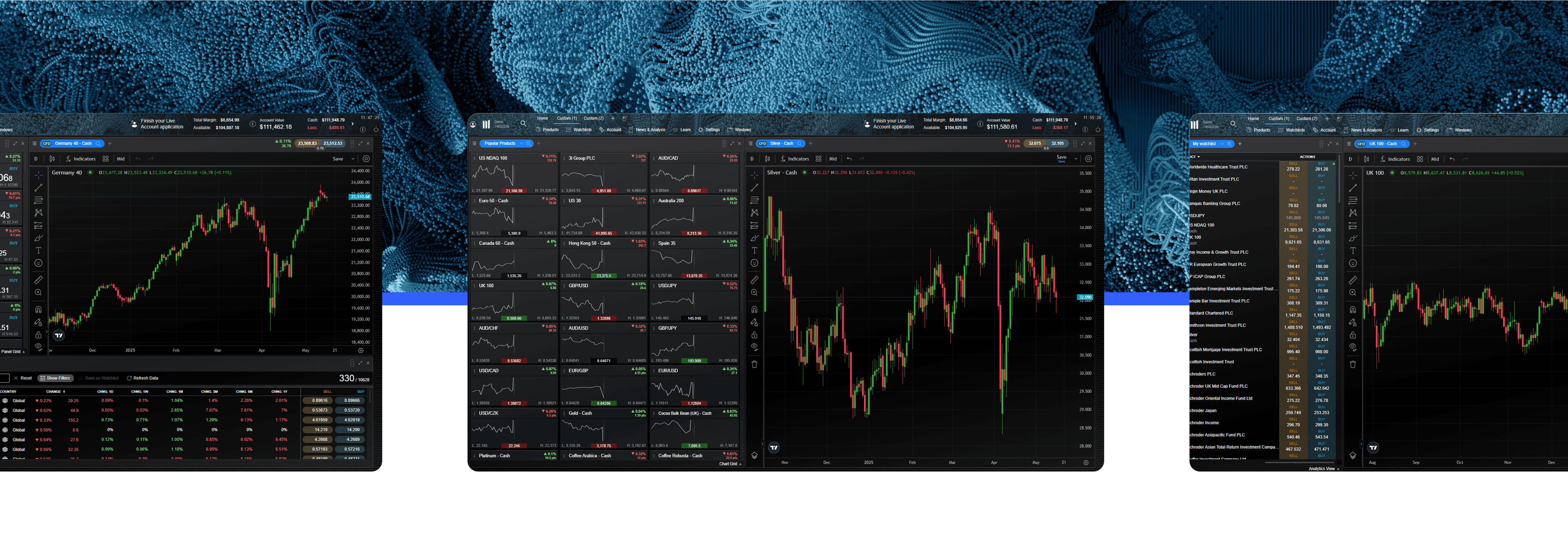

Go long or short on forex, indices, commodities, cryptos and more

Trading on MT4 with CMC Markets

We offer trading on a large range of key asset classes and instruments, including gold. Traders on MT4 with us can access:

Tight spreads on gold, which means that you can keep more of your profits.

Leverage: trading on leverage allows you to control a larger position with a smaller deposit. This can amplify your profits as well as your losses.

MT4 support: we support the MT4 trading platform, which is a popular platform for trading gold. MT4 offers a huge range of features and tools that can help you to trade gold effectively.

Minimise your risks

Trading on gold can be profitable, but it’s important to be aware of the risks involved. It’s important to be aware of the various factors that can affect the price of gold and manage your risk accordingly. You may wish to consider using stop-loss and take-profit orders, and should monitor your trades regularly. Making sure these measures form part of your trading plan and help to minimise your risks and improve your overall chances of trading successfully.