Forex trading

- Trade on up to300 forex pairs with leverage ¹

- Spreads from 0.0² pips on major FX pairs

Ultra-fast execution³ with no partial fills

Experienced customer service

What is forex trading?

Foreign exchange (forex) trading, is the buying and selling of one currency against another, in what is the world's most actively traded market.

The forex market operates 24/5, and many traders are drawn to it because of its volatility, and the potential trading opportunities.

Forex trading explainedWhy trade forex with us?

Our London based server and industry reputation helps us provide a tier-one liquidity solution, so we can consistently deliver lightning-quick execution speeds⁵.

Our MetaTrader platforms have no restrictions on minimum stop-loss or take-profit distances and limits, especially useful for high-volume traders.

Go long and short at the same time on a specific instrument, with no interruption for traders using Expert Advisors (EAs) on MetaTrader.

Hone your technical analysis with our suite of free additional premium indicators and EAs.

Deposit and withdraw funds easily, and whenever you want to.

Powerful technology you can rely on

To trade with us, you choose a CFD account that suits the platform you want to use.

Standard CFD account provides access to our proprietary and award-winning Next Generation platform, available on PC and mobile. This account can also be linked to TradingView.

To trade on Metatrader 4, you must create a separate MT4 CFD account. This account is only compatible with MT4 and does not provide access to Next Generation or TradingView.

Note: MetaTrader 4 only offers trading in currencies, indices, commodities, and cryptocurrencies.

Read more below about the platforms we offer and find out which one best suits your trading style.

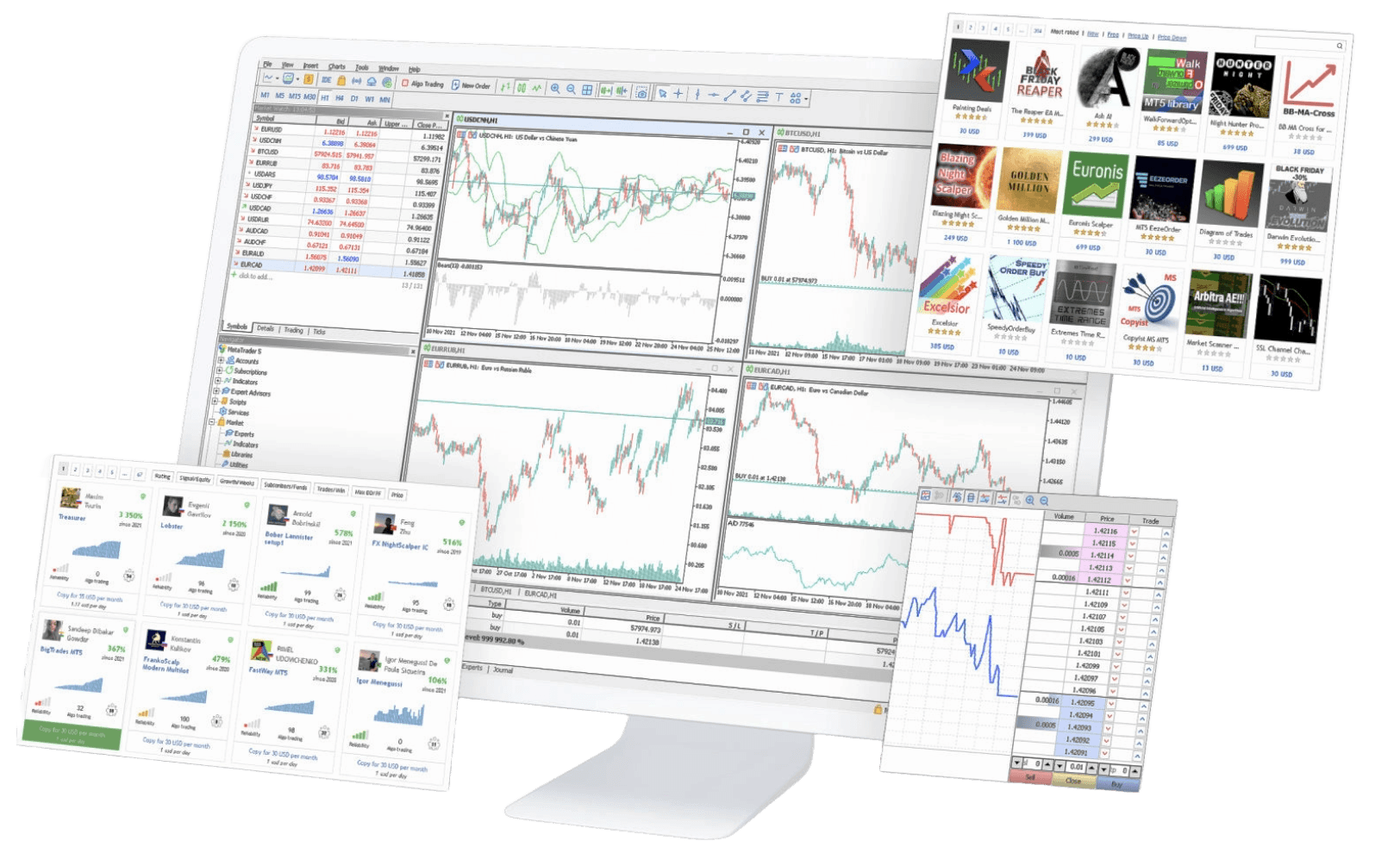

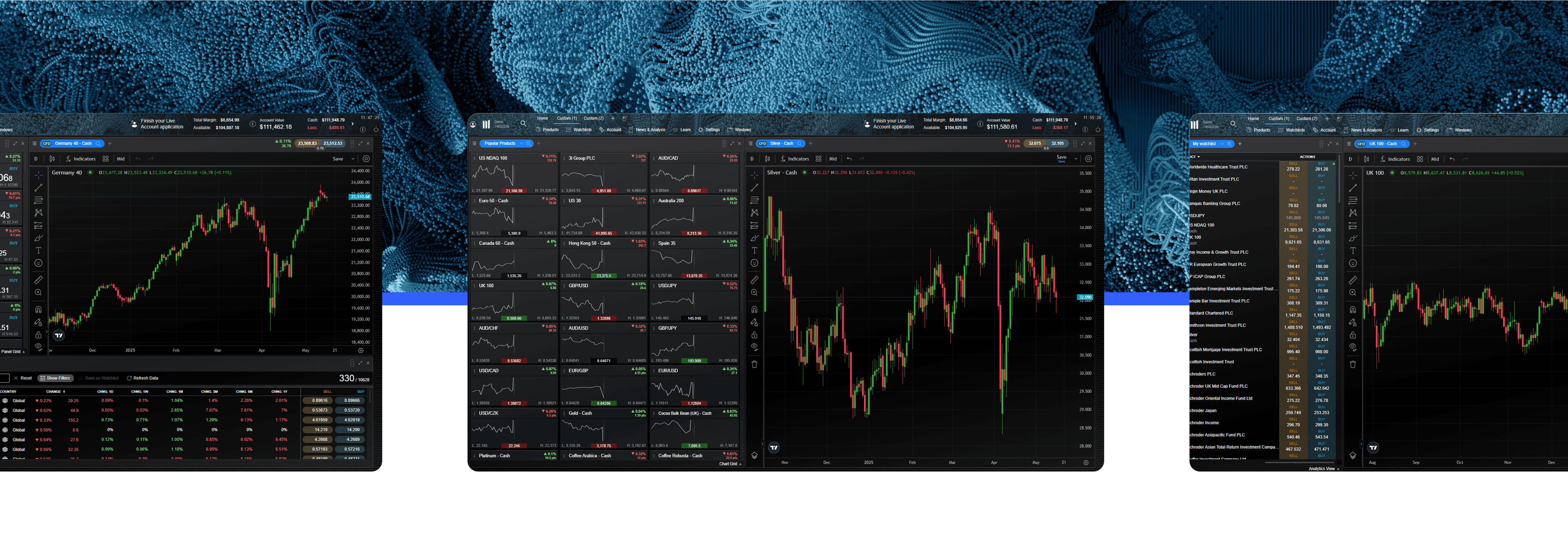

MetaTrader 4

Trade on the world's most popular trading platform, with tight spreads and ultra-fast execution.

Trade on forex, indices, commodities and cryptocurrencies

- Spreads start from 0.0 pips with our FX Active account²

Fast, one-click trading

- Lightning-fast execution ³

Customisable charts with pre-installed indicators

Automated trading with Expert Advisors

Mobile

Desktop

Download MetaTrader 4 for PC or MAC and trade on the world's most popular trading platform.

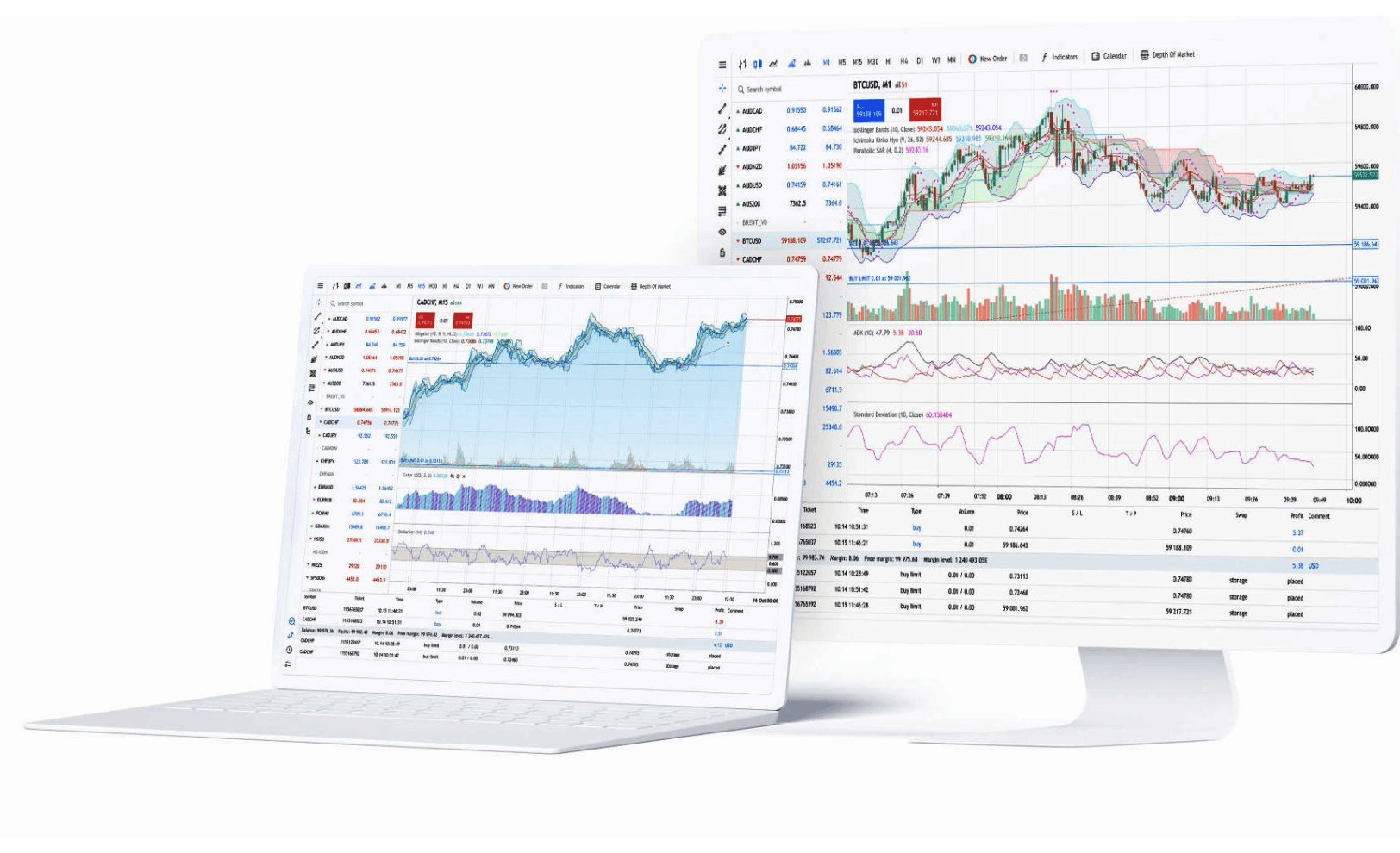

MetaTrader 5

A powerful trading platform designed to provide access to global markets, with advanced trading features and real-time data.

Trade on forex, indices, commodities, shares and cryptos

- Spreads from 0.0 pips with our FX Active account²

One-click trading

- Ultra-fast execution³

More order types, timeframes, and pre-installed indicators than on MT4

Depth of market display and inbuilt economic calendar

Experts Advisors with faster strategy tester

Mobile

Desktop

Download MetaTrader 5 for PC or MAC to experience its advanced trading tools and features from an industry’s leading provider.

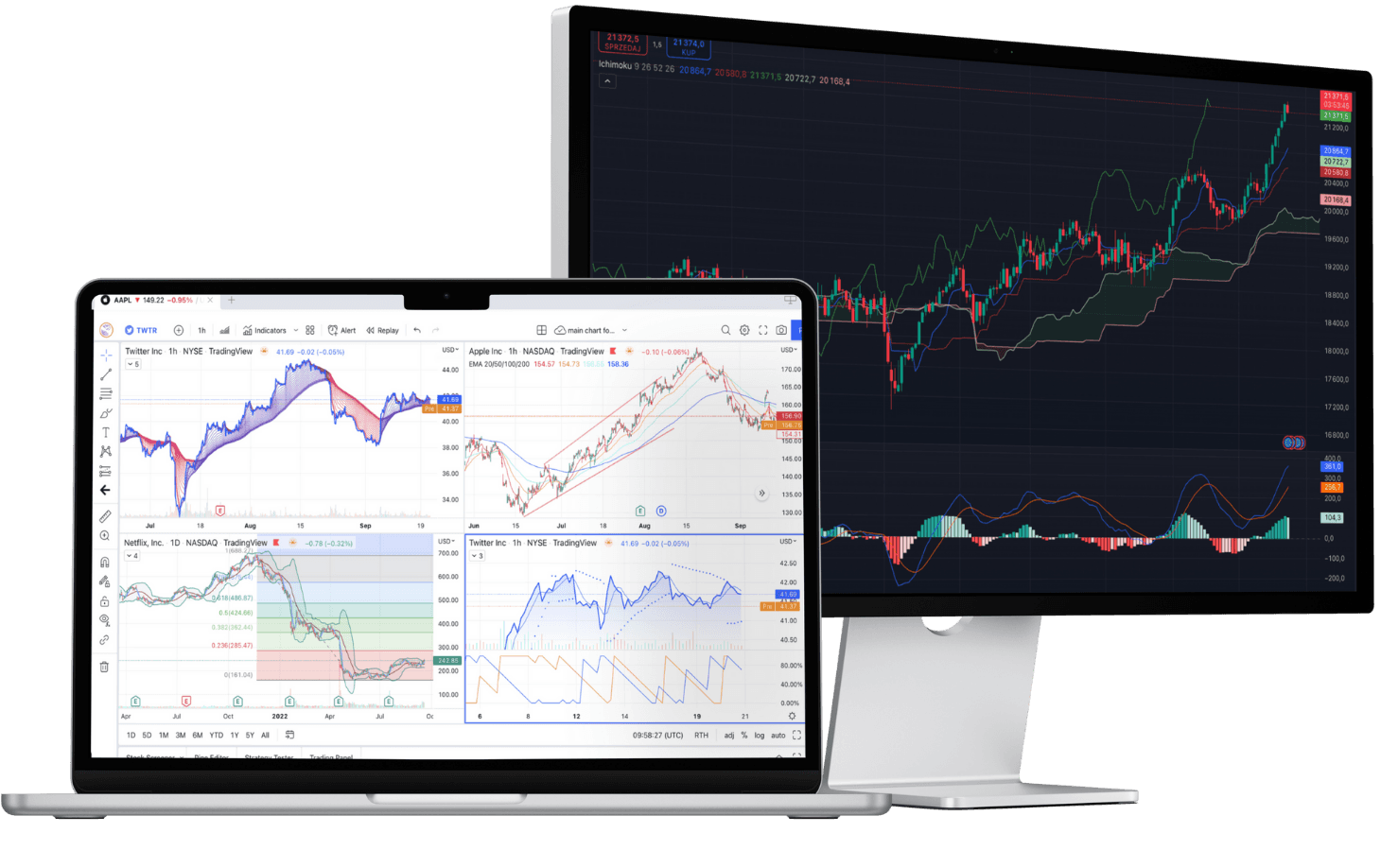

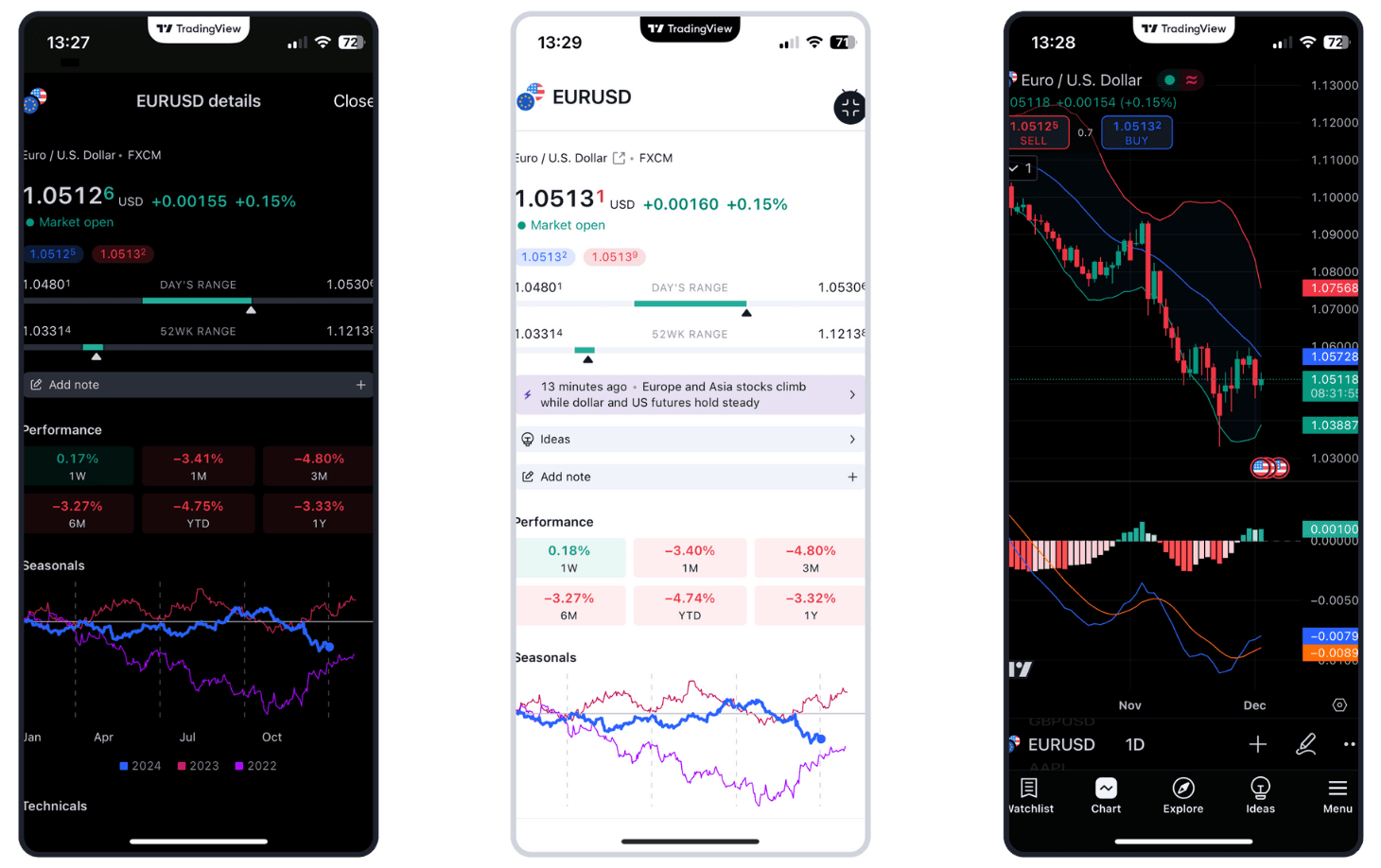

TradingView

Enjoy the best of both worlds: view and analyse charts on TradingView; trade with our tight spreads and fast execution.

Enhance your trading experience with TradingView’s renowned charts and indicators.

Get inspiration and ideas from one of the world’s largest online trading communities.

Prepare for key announcements with TradingView's easy-to-use financial calendar.

Set up personalised alerts using 13 built-in conditions based on price and volume.

Open, manage and close your trades with us in TradingView.

Mobile app

TradingView's mobile apps are available on the App Store and Google Play Store. Ensure that your device is up to date and your operating system is supported.

Google PlayApp StoreCMC Web platform

Integrated TradingView charts

Advanced order execution

Optimised mobile platform

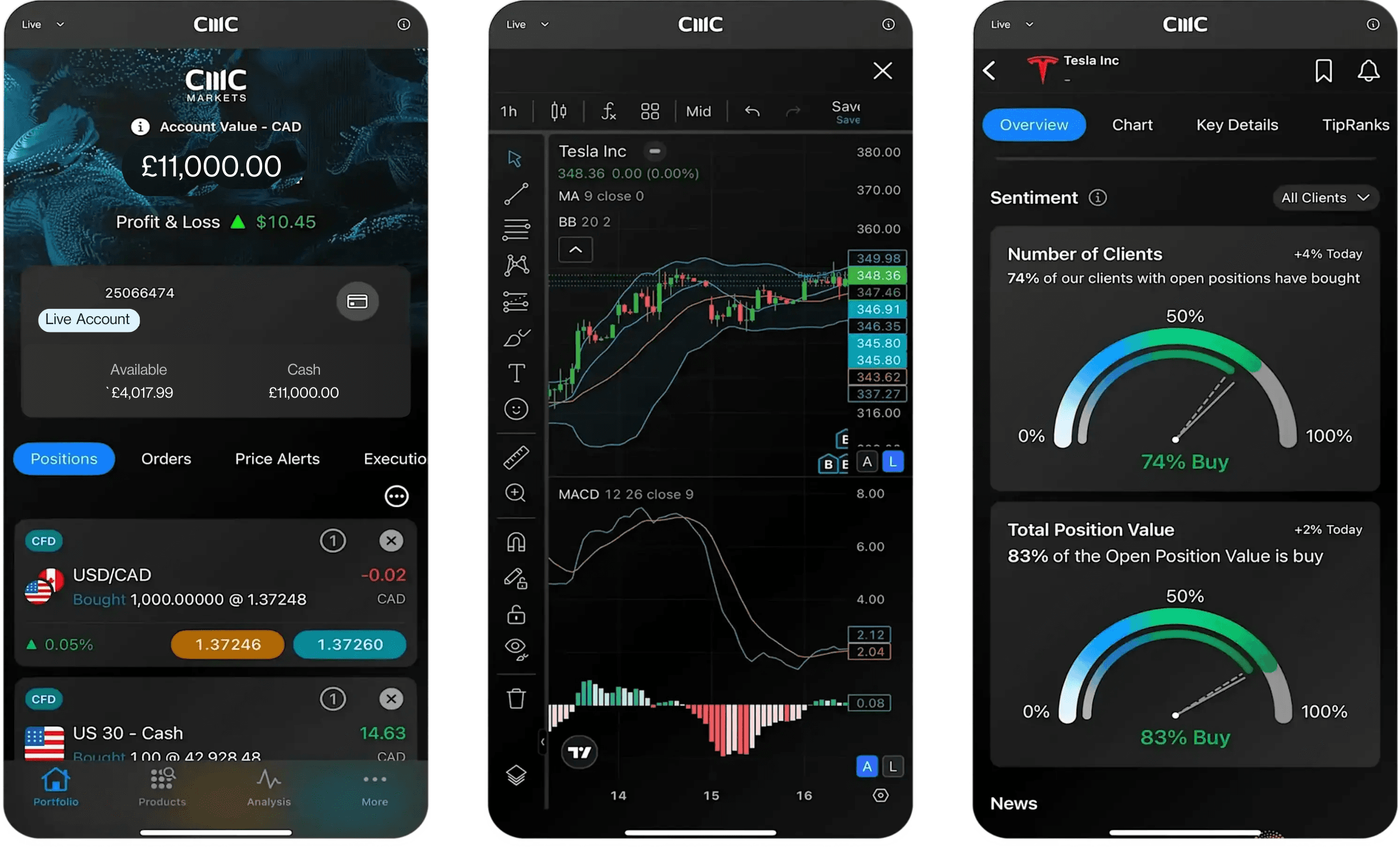

TipRanks analysis

Client sentiment tracker

Pattern recognition scanner

Morningstar equity research and Reuters news

Mobile

Packed with powerful features, yet intuitive, and available to all traders. Whatever the next step in your trading journey, our mobile platform can help you get there.

Desktop

We've built our web trading platform to be powerful and intuitive. It combines leading-edge features and security, fast execution, and best-in-class insight and analysis. Designed to support any strategy.

Forex trading costs

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you're trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes. Please log in to our platform for more information.

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

A minimum spread is the lowest spread that will be shown on the given product. Minimum spread will vary subject to after-hours trading. If the underlying market spread widens throughout the trading day, or you are trading out of hours, the platform spread may also widen. The spreads shown are for the first price available for the average market trade/bet sizes in the relevant product. The spread will widen for larger trade/bet sizes, see our platform for more information.

Account types for every trader

CFD trading

CFD trading is a derivative product which enables you to trade on the price movement of underlying financial assets.

- Access over 300+ FX pairs – more than anyone else¹

- Access 12,000+ global financial instruments¹

Available on MT4, MT5, CMC Next Generation, TradingView

FX Active

- Spreads from 0.0 pips on 6 major pairs²

25% spread discount on 300+ FX pairs

- Access to 10,000+ financial instruments¹

Available on MT4, MT5, Next Generation, TradingView

Become a CMC Markets partner

Partner with one of the industry's leading CFD and forex brokers. With our advanced IB portal reporting functions and high customer conversion rates, our program is designed to help you grow your business. Be rewarded with generous remunerations, including support for multi-tiered and customisable deals and payments structures. Contact us today to talk with one of our experienced regional representatives.

Become a partner Log in to partner portalSuperior execution and reliability

Our pioneering technology and highly-regarded customer service, alongside a choice of powerful platforms, offers an ideal combination for serious traders.

Your trades will be filled without any dealer intervention.

We fulfil your order without off-quotes, and wherever possible at the price you see.

We consistently achieve almost 100% core platform uptime, so you can focus on your trading.

FAQs

When trading forex, you speculate on whether the price of one currency will rise or fall against another. For example, if you believe that the value of the British pound will rise, relative to the value of the US dollar, you would trade the GBP/USD pair.

To open a position you first need to deposit an amount of money known as a margin. The margin required reflects a percentage of the full value of the position. Trading on margin means you place an initial deposit, rather than the full value of the trade upfront.

The margin requirement for forex starts at 3.34%, which means you only have to put up 3.34% of the full trade value. This gives you greater exposure to your chosen financial instrument. It's very important to remember that your profits and losses will be magnified, as they're based on the full value of your trade and not just your initial margin.

One of the advantages of trading CFDs is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can also amplify losses, so it's important to manage your risk.

CMC Markets has 15 global offices, including in the UK, Australia, Germany, Canada, New Zealand, Singapore and Bermuda. CMC Markets' entities are licensed and regulated by the local authorities, for example, CMC Markets Bermuda is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority (‘BMA’).

As a CMC Markets' client, your money is held separately from CMC Markets' own funds. It is held in segregated client bank accounts distributed across a range of major banks, which are regularly assessed against our risk criteria. Under the BMA rules, retail clients must be provided with negative balance protection. This means that your maximum loss is the amount you have deposited with us.

If you're trading on MT4 or MT5, select the instrument you wish to trade ('double-click' on your PC), and a new order window will appear. Enter your desired volume (in lots), add any risk-management orders such as a stop-loss or take-profit order. Then place a market order in the direction you wish to trade; buy to go long, or sell to go short. There are several ways to place trades or orders using MT4 or MT5 – you can learn more about MT4 or MT5 functionality by navigating to Help > Help topics or Help > Video guides.

If you’re trading on our Next Generation platform, search for your desired instrument from the 'Product Library'. Select your chosen instrument ('right-click' on your PC), and select ‘Order Ticket’. In the order ticket box, choose your order type (from Market, Limit, and Stop-Entry Order), and then enter your desired volume in units or amount (this can be configured from the ‘Settings’ menu in the main navigation). Add stop-loss and take-profit levels to minimise your risk, and choose to ‘BUY’ or ‘SELL’, depending on whether you want to go long or short. When you’re ready, select ‘Place Buy Market Order’, or ‘Place Sell Market Order’.

For retail clients, the maximum leverage you can currently trade with is 200:1 (or 0.5% margin) with our CFD trading and FX Active accounts.

TradingView is a trading research platform where you can view charts, analyse trends and interact with an online community. You can connect your TradingView account to your CMC Markets account, enabling you to open, manage and close trades within TradingView. Learn more about TradingView here.

MetaQuotes' MetaTrader 4 and MetaTrader 5 are globally popular forex and CFD trading platforms. TradingView is a trading and charting platform which you can link to your broker account to place trades. Our proprietary web-based platform is feature-rich and enables access to trade CFDs on 12,000 instruments.

With each platform you can choose from our CFD trading or FX Active accounts. Our FX Active account offers spreads from 0.0 pips on six major FX pairs, with a 25% spread discount on all other pairs. There is a fixed, low commission at $2.50 per $100,000 notional value traded.

Our trading platform doesn’t require any downloads, while MT4 and MT5 requires downloading to fully utilise its features, such as algorithmic trading (through Expert Advisors) and social trading available via the MQL4 and MQL5 communities.

The MetaTrader platforms offer hedging positions by default, while CMC’s trading platform offers netted positions by default.

Yes, you can open an opposite, related, or alternative trade, with no interruption for traders using Expert Advisors.

Log in to your MT4 or MT5 client portal or our trading platform and follow the instructions in the funding section.

You can reset your password by selecting 'Forgot password?' on the login page. We'll then send instructions for changing your password to the email address you use to log in to your account.

Our aim is to provide a high level of service to all our clients, all of the time. We value all feedback and use it to enhance our products and services. We appreciate that from time to time things can go wrong, or there can be misunderstandings. We are committed to dealing with queries and complaints positively and sympathetically. Where we are at fault, we aim to put things right at the earliest opportunity. You can find our complaint handling procedure here or contact us at global@cmcmarkets.com to begin your account query. Please note that all queries and complaints will be handled in English.

What are other traders saying about CMC Markets?

Ready to get started?

If you already have an account, log in to your chosen platform.

Don't have one yet? Open an account now.

Do you have any questions?

Email us at1 The CMC Markets platform has 10,000 share CFDs available. The MetaTrader 5 platform has around 2,000 share CFDs available. The MetaTrader 4 platform has no share CFDs available. Figures subject to change.

30.066 seconds MT4 CFD median trade execution time, August 2023

5Recent awards include: No.1 for Commissions & Fees & No.1 Most Currency Pairs, ForexBrokers.com Awards 2025; Best-in-class for Overall Excellence, Mobile Trading App, Platform & Tools, Research; ForexBrokers.com Awards 2025; Best Mobile Trading Platform, ADVFN International Financial Awards 2024; Best Forex Broker, Good Money Guide Awards 2023; Best In-House Analysts, Professional Trader Awards 2023.