Cardiovascular and metabolic diseases are a vast chronic burden on patients and society and the leading cause of death globally. However, recent scientific innovations have marked a turning point in the tackling of their root causes. This blog explores this burgeoning theme and what the launch of the first of its kind Tema Obesity & Cardiometabolic ETF (HRTS) means for investors.

Key Takeaways

- Cardiovascular and metabolic diseases are very closely inter-related conditions that are increasingly common, serious, costly and chronic.

- A recent burst of innovation, particularly in obesity where new agents have shown to significantly improve cardiovascular outcomes, could transform the lives of patients.

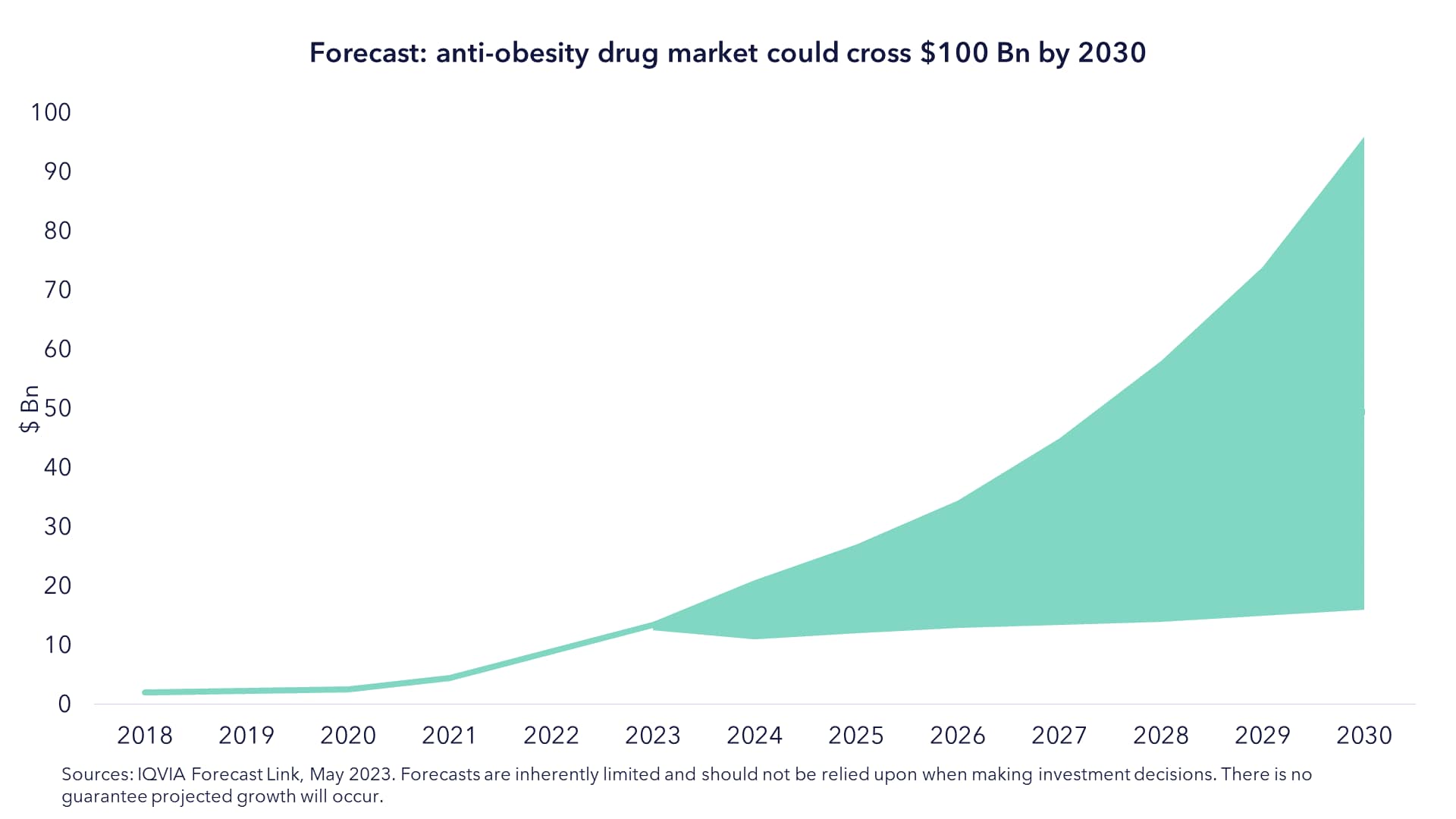

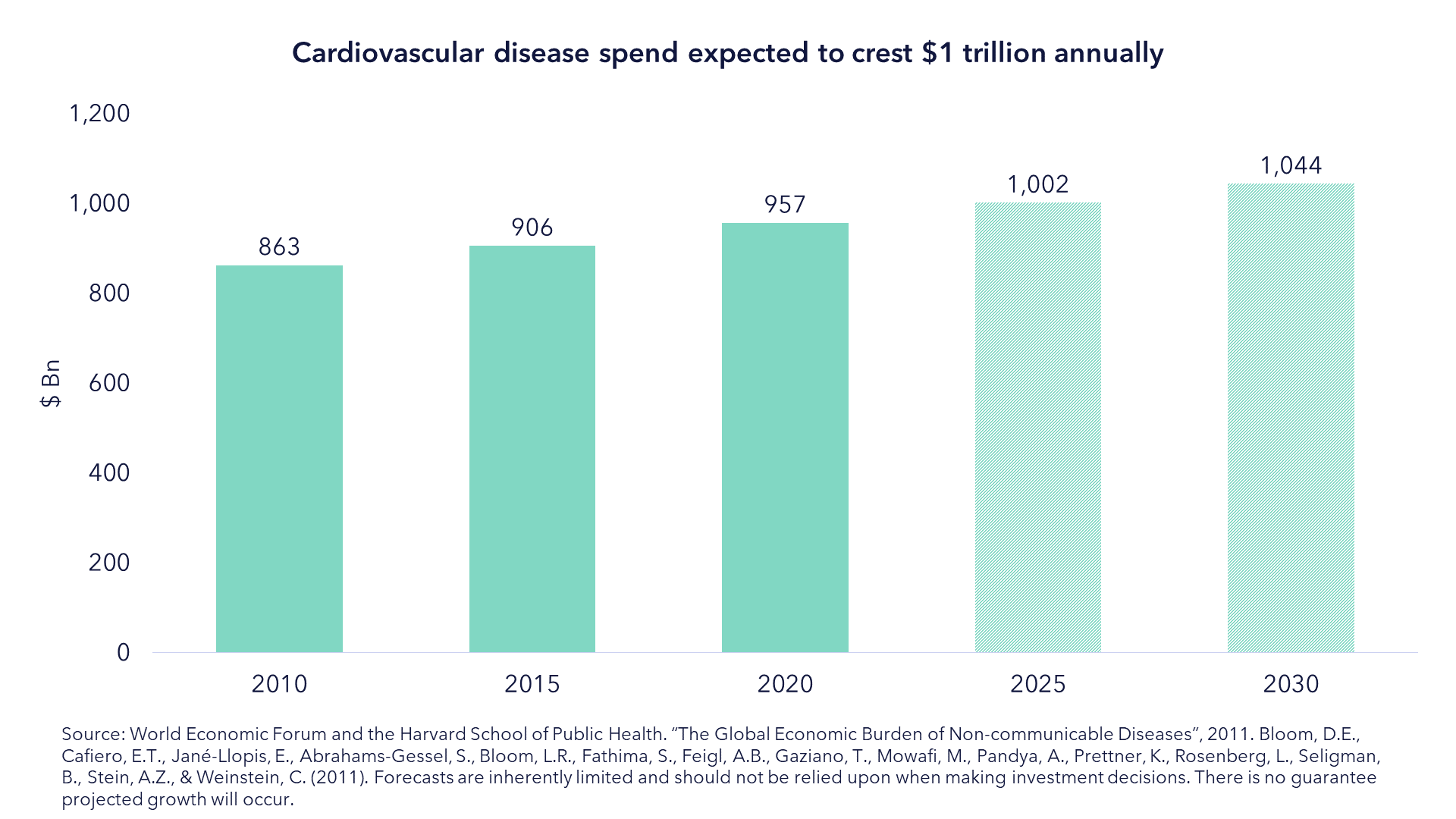

- Spend on cardiovascular diseases, the leading cause of death globally, is nearing $1 Tn, with the obesity therapeutic market alone potentially worth $100 Bn by 2030.

- The biotech sector has undergone a sharp downturn, offering compelling valuation opportunities while the pace of innovation and growth appears to remain unchanged.

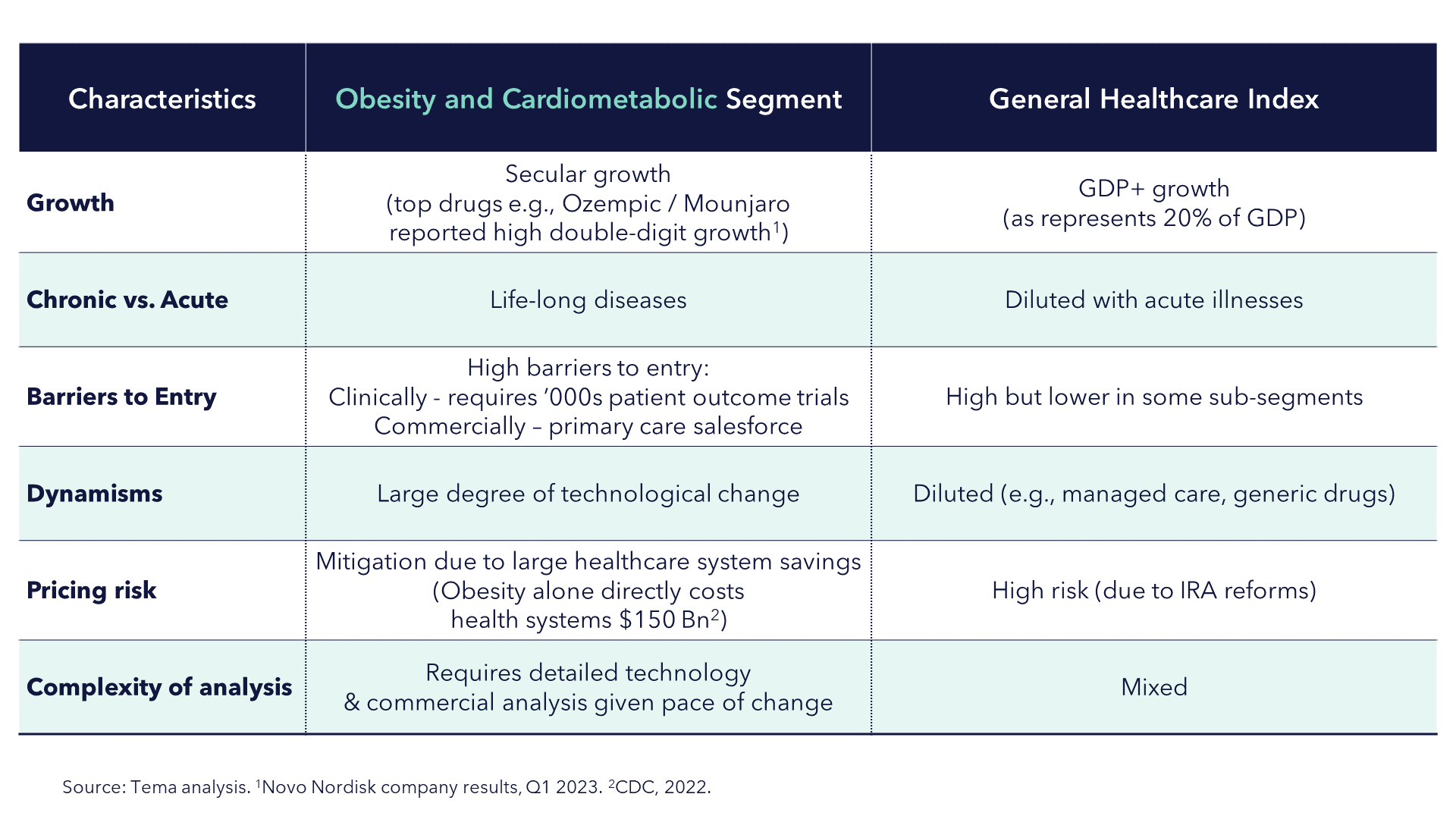

- In our view, the cardio-metabolic segment distinguishes from broader healthcare in having secular growth, watershed innovation and high barriers to entry.

- The Tema Obesity & Cardiometabolic ETF (HRTS) aims to select the firms winning the fight against this epidemic.

For a list of current fund holdings, please visit the fund web page at www.temaetfs.com/hrts. All investments involve risks, including possible loss of principal. For a more complete discussion of the potential investment risks to the topics discussed below see the disclosure section at the end of the document.

What is cardiovascular and metabolic and why is it a burden?

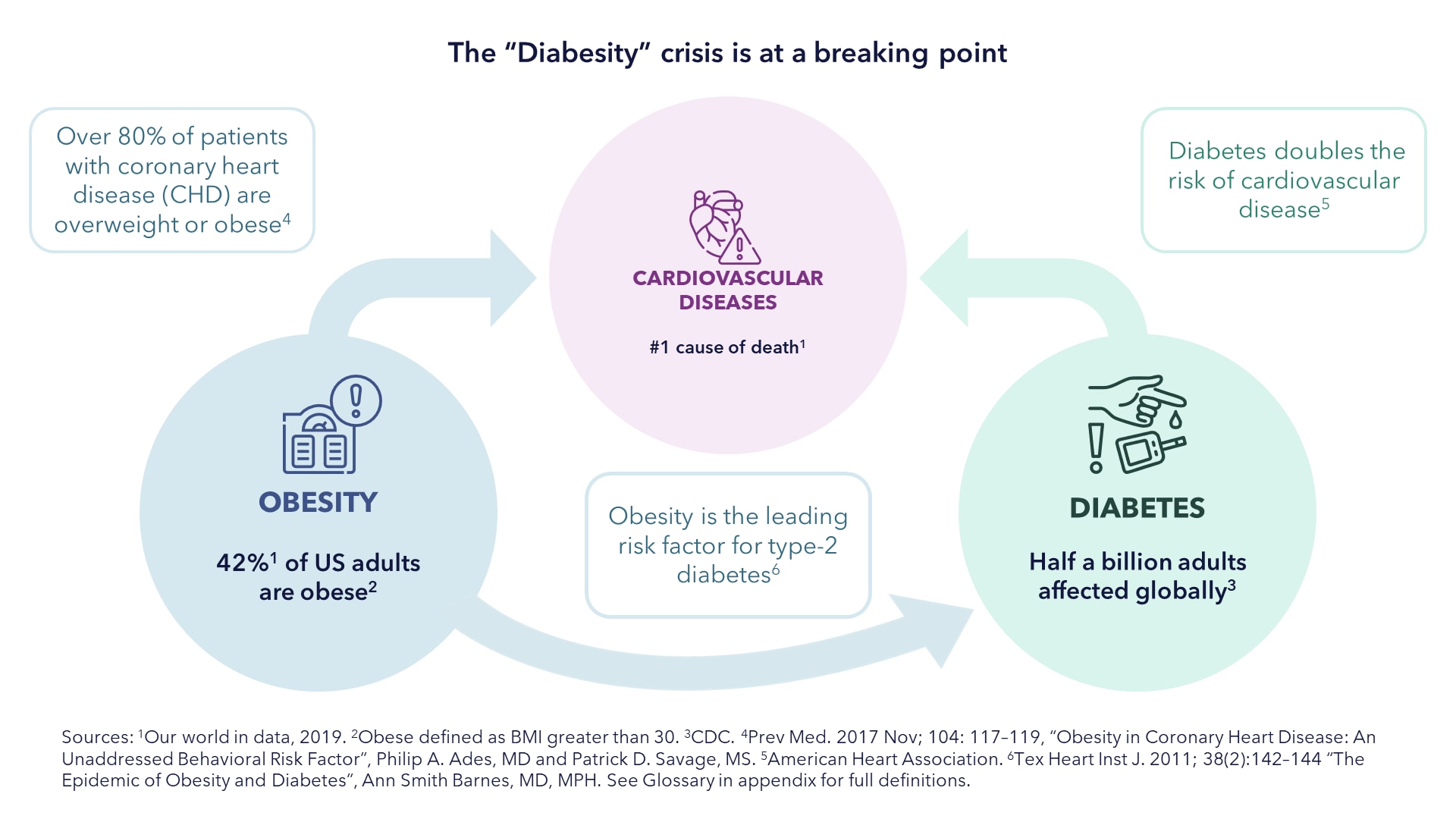

Cardiovascular and metabolic is a term that captures three inter-related conditions – obesity, diabetes, and cardiovascular disease. Diabetes, a chronic condition in which the body does not produce or has an impaired response to insulin, a hormone that regulates blood sugar, affects almost half a billion adults globally. Having diabetes doubles a patient’s risk of cardiovascular disease, which is the leading cause of death in the world today.

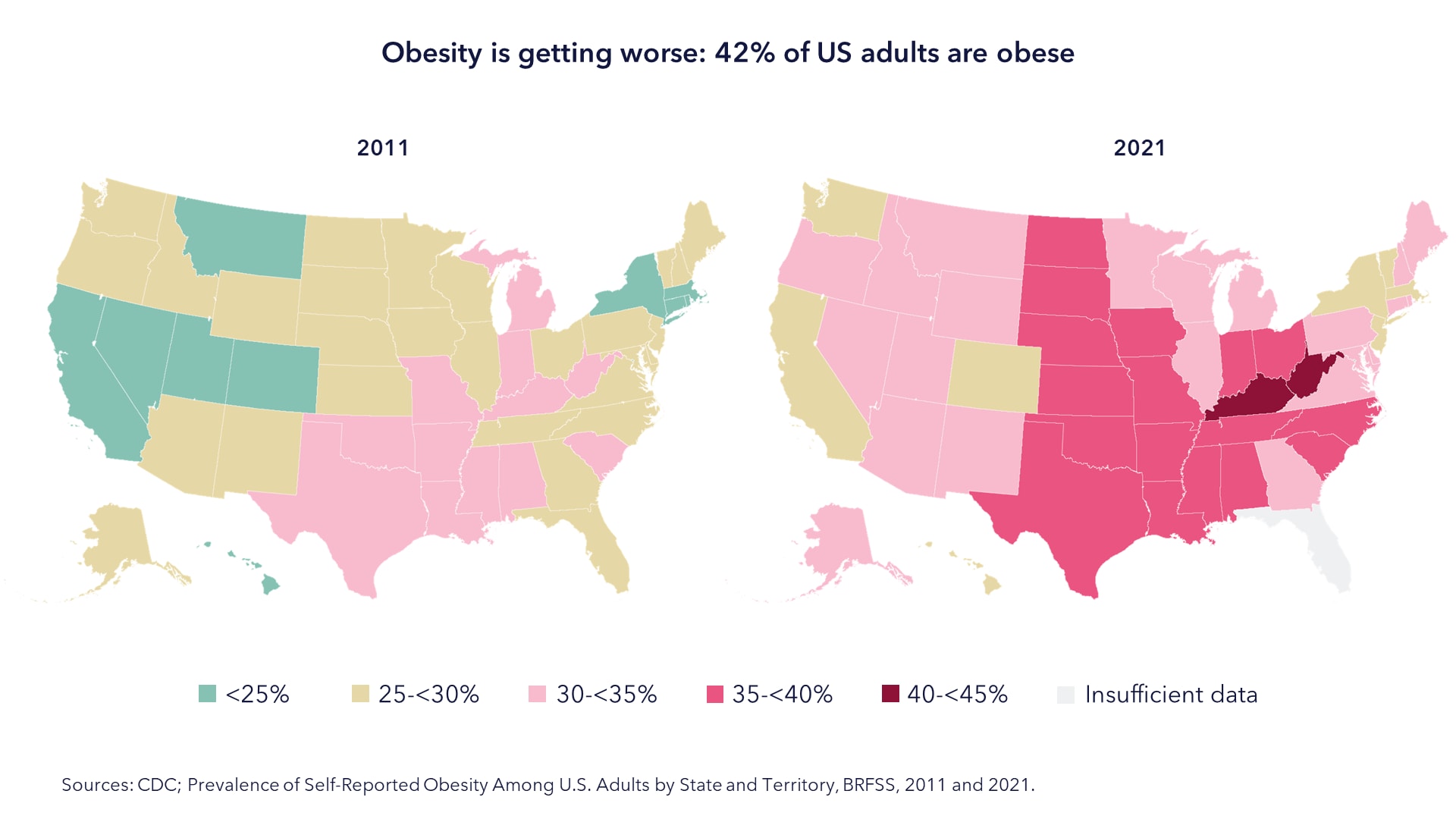

Obesity, defined by CDC as “a common, serious, and costly chronic disease of adults and children”, is a key underlying condition of both. Nearly 80% of patients that have some form of coronary heart disease (CHD) are obese or overweight. Obesity prevalence has been increasing at a dramatic pace and today 42% of US adults are classified as obese.

What are some of the breakthroughs in metabolics?

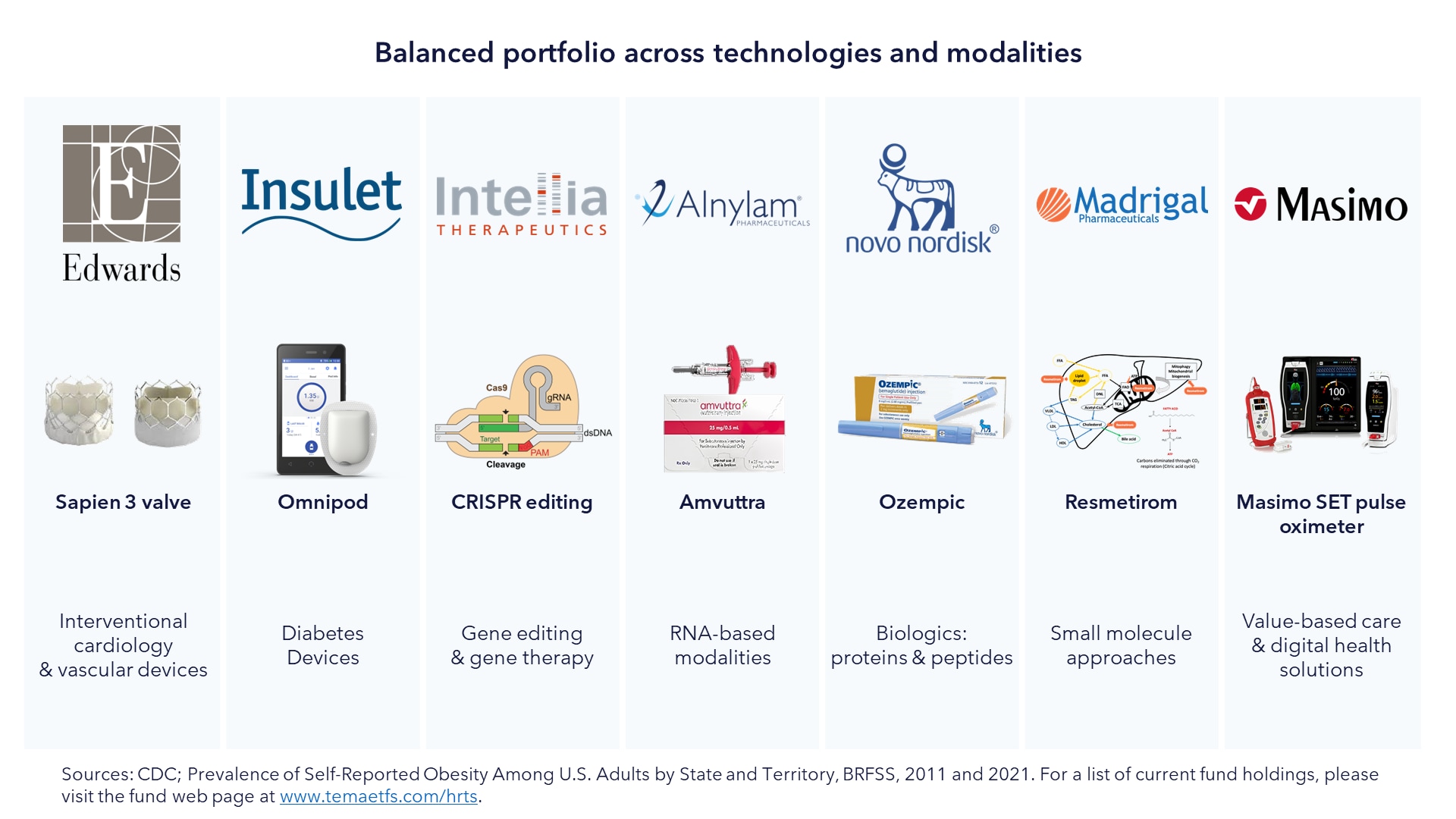

The biopharmaceutical industry is in the early innings of bringing breakthrough medications to obesity, which could ultimately revolutionize the treatment of many overweight patients with comorbid conditions like diabetes, heart disease, and other chronic diseases. In addition, insights into human genetics, as well as tools like gene editing and gene therapy, have spurred a new generation of therapeutics in cardiovascular disease. At the same time, innovation in medical devices, such as continuous glucose monitoring (CGM) sensors and interventional devices in structural heart disease, continues to be robust.

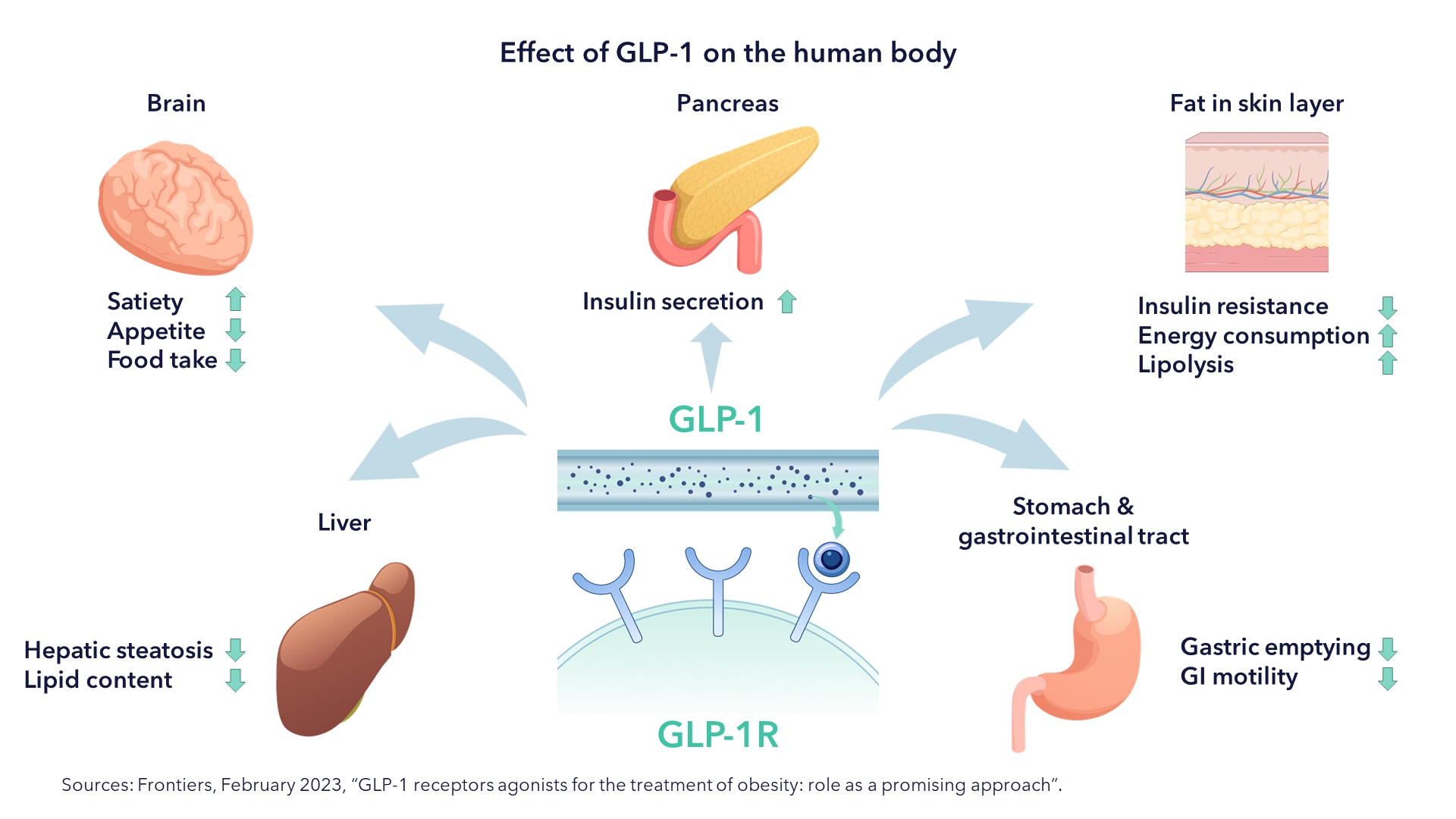

GLP-1 agents (Ozempic/Wegovy and Mounjaro) are enormous breakthroughs in the treatment of obesity and its comorbidities

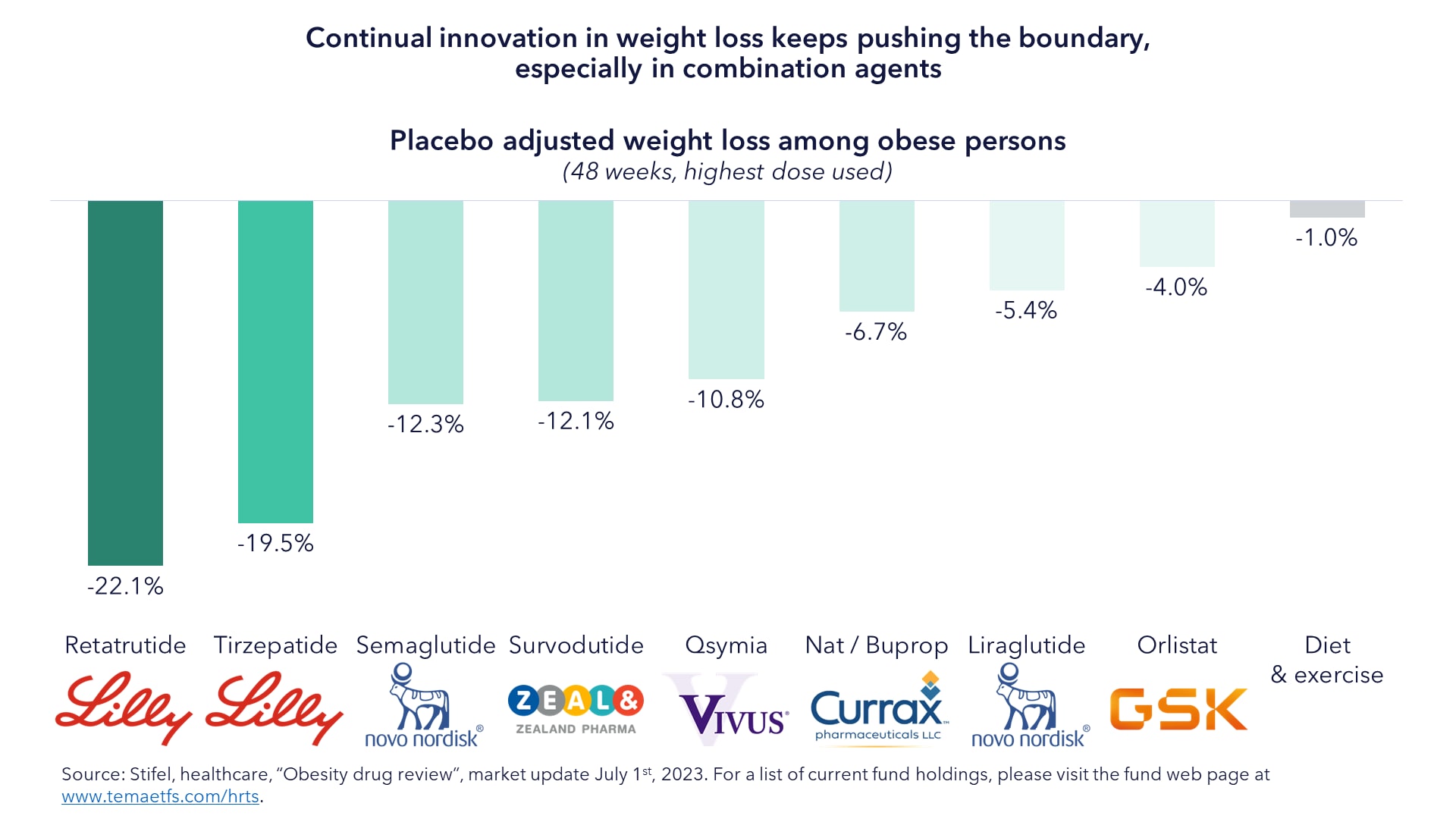

Leading the wave of obesity innovation are the GLP-1 agents, which are primarily injectable peptides that have shown significant weight loss in overweight patients with or without diabetes. The mechanism of weight loss of such agents involves increasing satiety, decreasing appetite, delaying gastric emptying, and increasing energy consumption and fat burning.

SELECT trial readout is a watershed moment

In August 2023, Novo Nordisk announced positive cardiovascular outcomes data of Wegovy for the treatment of overweight and obese non-diabetic patients who had prior heart attack, stroke, and/or peripheral artery disease. This randomized study of 17,000+ patients – also known as the SELECT trial - demonstrated a 20% improvement in cardiovascular outcomes. The details of the study will be released at an upcoming medical conference (American Heart Association) in November. If there are significant improvements in mortality, as well as cardiometabolic parameters like cholesterol and blood pressure, the implications on chronic care management, even prevention of heart disease, are transformational. The detailed AHA dataset, as well as numerous approaches in obesity therapeutics, could provide significant catalysts for investors for years to come, in our opinion.

Genetic breakthroughs are the new frontier in cardiovascular disease

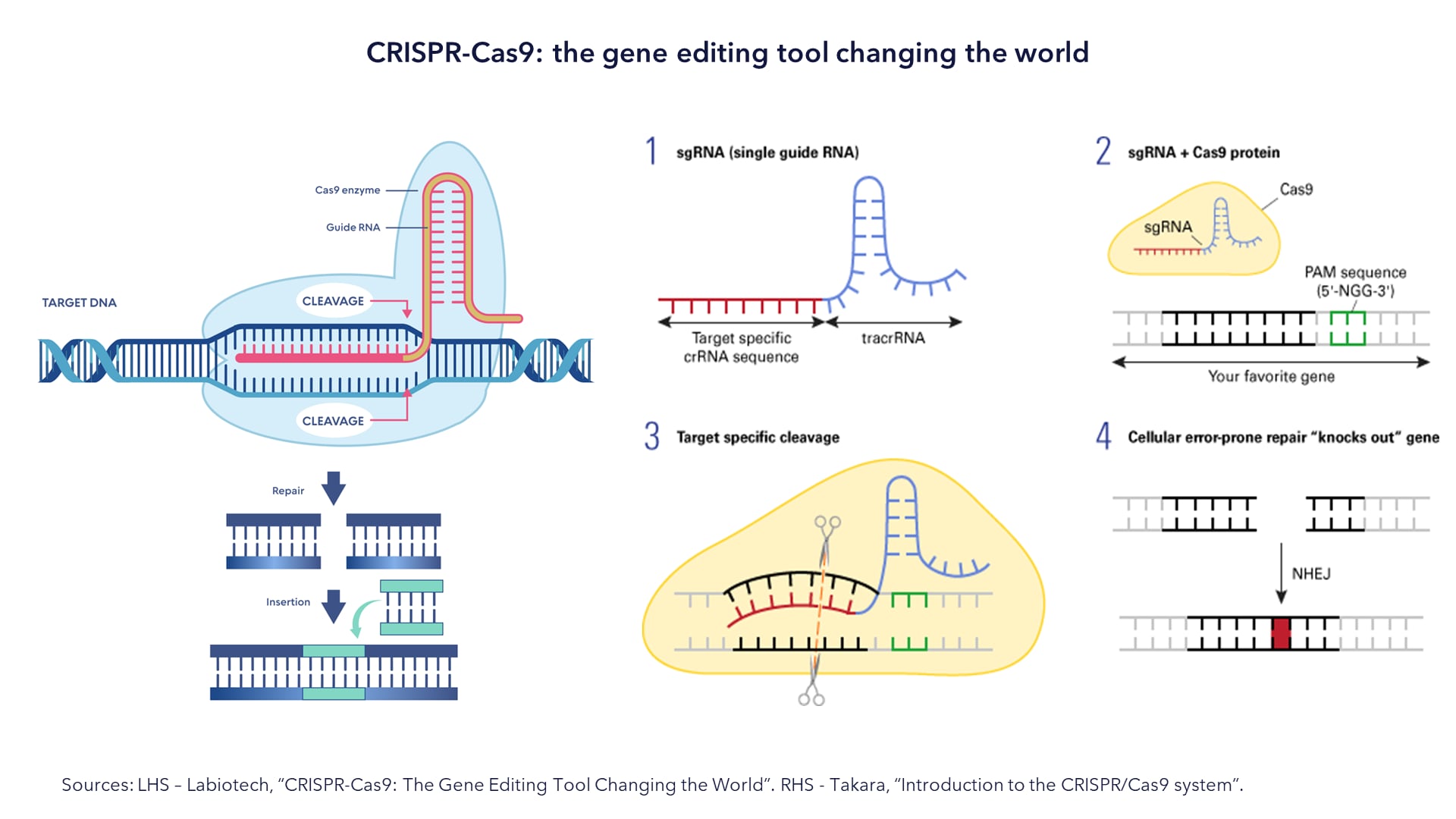

A second area of innovation in metabolic and cardiovascular disorders, involves insights from human genetics combined with tools to manipulate the genome, including CRISPR gene editing and silencing of gene expression.

Back in 2021, Intellia Therapeutics released the first clinical results of a CRISPR gene editing approach in patients with an uncommon form of heart failure called TTR cardiomyopathy (transthyretin amyloid cardiomyopathy). The results demonstrated significant blockade of a protein called TTR through editing out the TTR gene. Since then, there have been multiple efforts underway - applying these gene medicines in both common heart diseases and rare genetic cardiovascular conditions.

Medical devices continue to be the bedrock of metabolic disease management and intervention and prevention

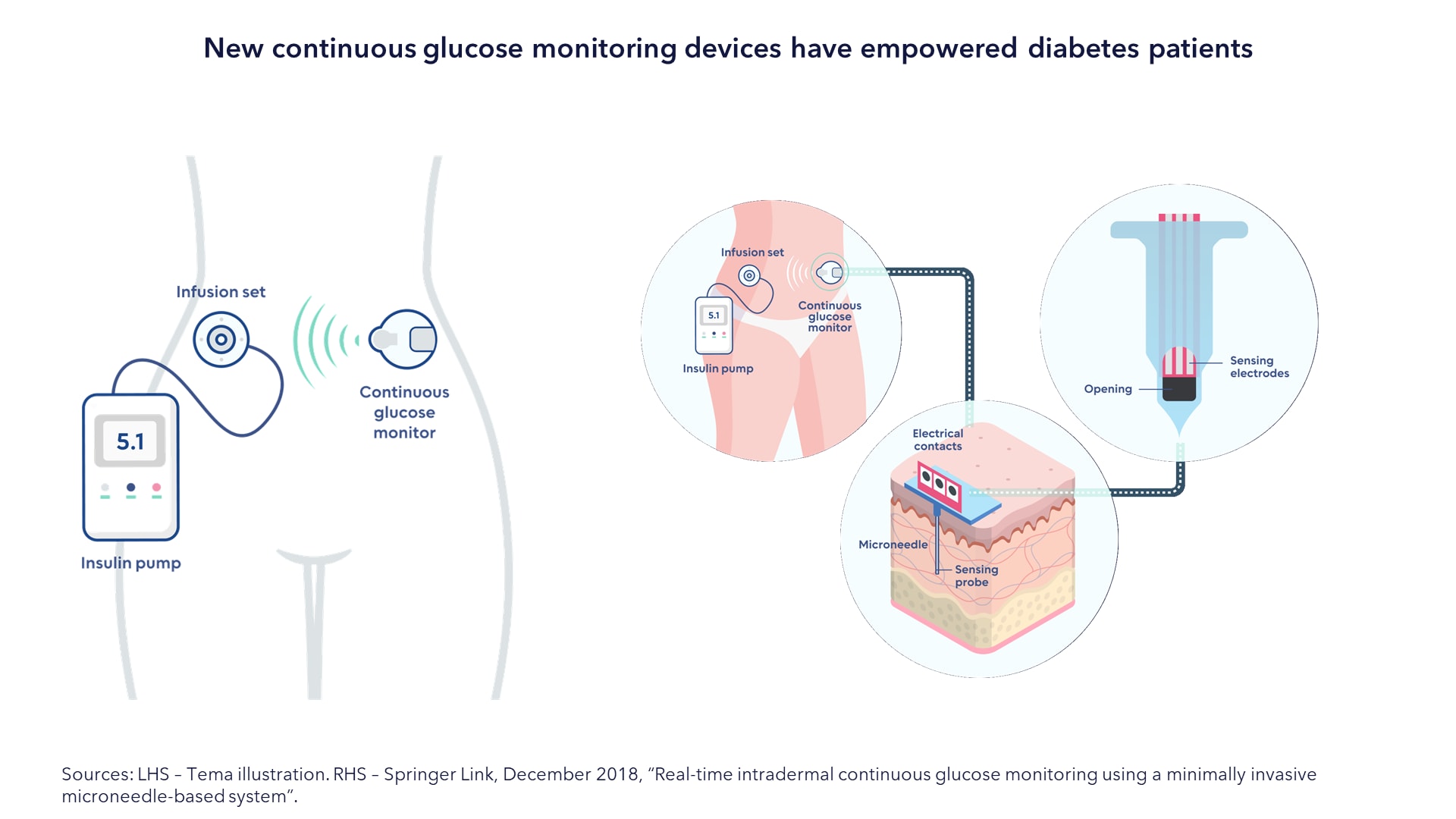

A third area of enormous progress is ongoing innovation in medical device approaches in metabolic and cardiovascular disease. One example is the area of continuous glucose monitoring. Sensors, which have become more consumer friendly and discreet in their form factor, have empowered diabetes patients by providing actionable, accurate real-time insights into their blood sugar levels. These innovations have the promise of improving diabetes outcomes and lowering healthcare costs.

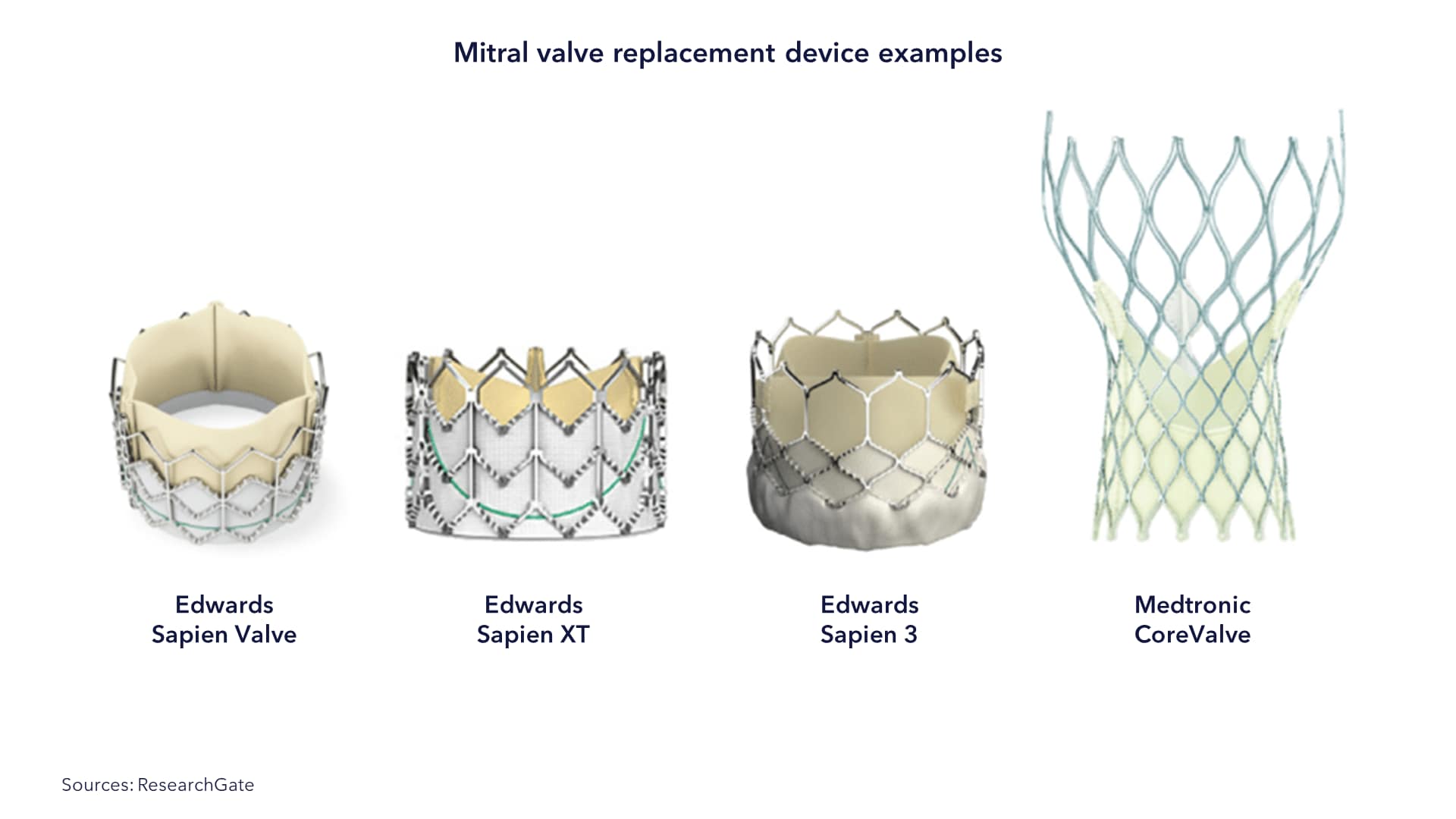

A second example is work done by companies like Edwards Lifesciences and Medtronic in structural heart disease. The introduction of minimally invasive methods to replace aortic valves has transformed the field of interventional cardiology. These and other companies are looking to introduce devices in less invasive approaches to mitral valve replacement, an area whose market size could be potentially much larger than that of transcatheter aortic valve replacement, which itself is expected to be a $10 billion market by 2028.

The boom in obesity

The breakthrough in obesity therapeutics leads us to believe that there could be significant growth given the large patient pool and currently low penetration rates. IQIVIA estimates the anti-obesity drug market could be between $15bn to $100bn by 2030. We believe this range speaks not only to the enormous potential but also the wide dispersion of forecasts, an opportunity for investors.

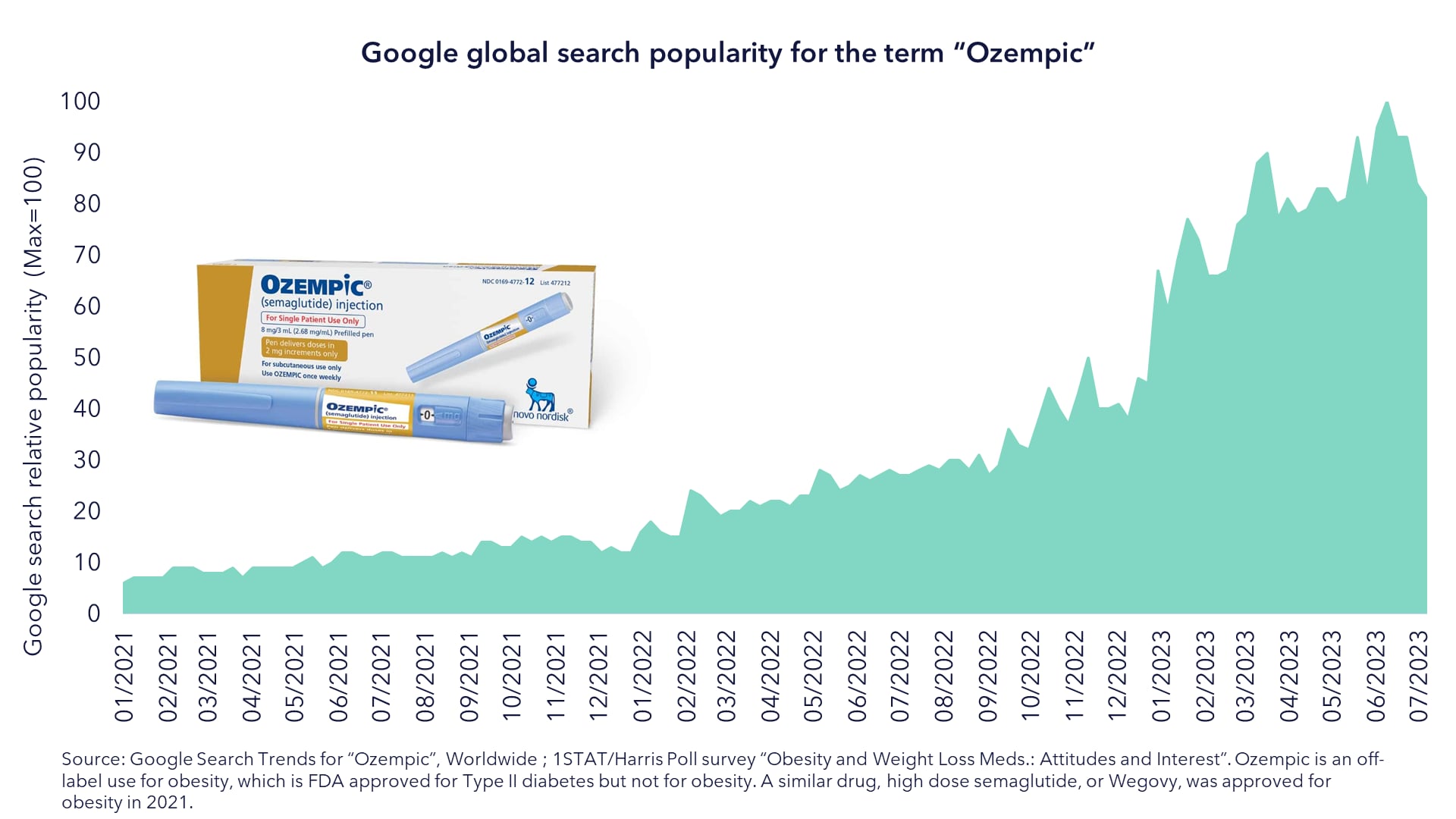

Given that there are over 100 million US citizens with obesity, even assuming some discount in current prices, our estimates suggest the total addressable market in the US alone could be well over $100 billion. While there are reasons why such a number might not be achieved - including reimbursement, potential for rates of discontinuation, and likely formation of a generic or low-cost market – overweight patients with comorbid conditions, as well as populations outside the US, could benefit from a therapy. It is no surprise to see a huge rise in search interest for Ozempic around the world.

In the context of metabolics more generally, it is worth remembering that cardiovascular disease is the leading cause of death globally. This explains in part why that market is forecast by the World Economic Forum/Harvard School of Public Health to crest $1 Tn in the next two years.

Exploring investment opportunities in Metabolics

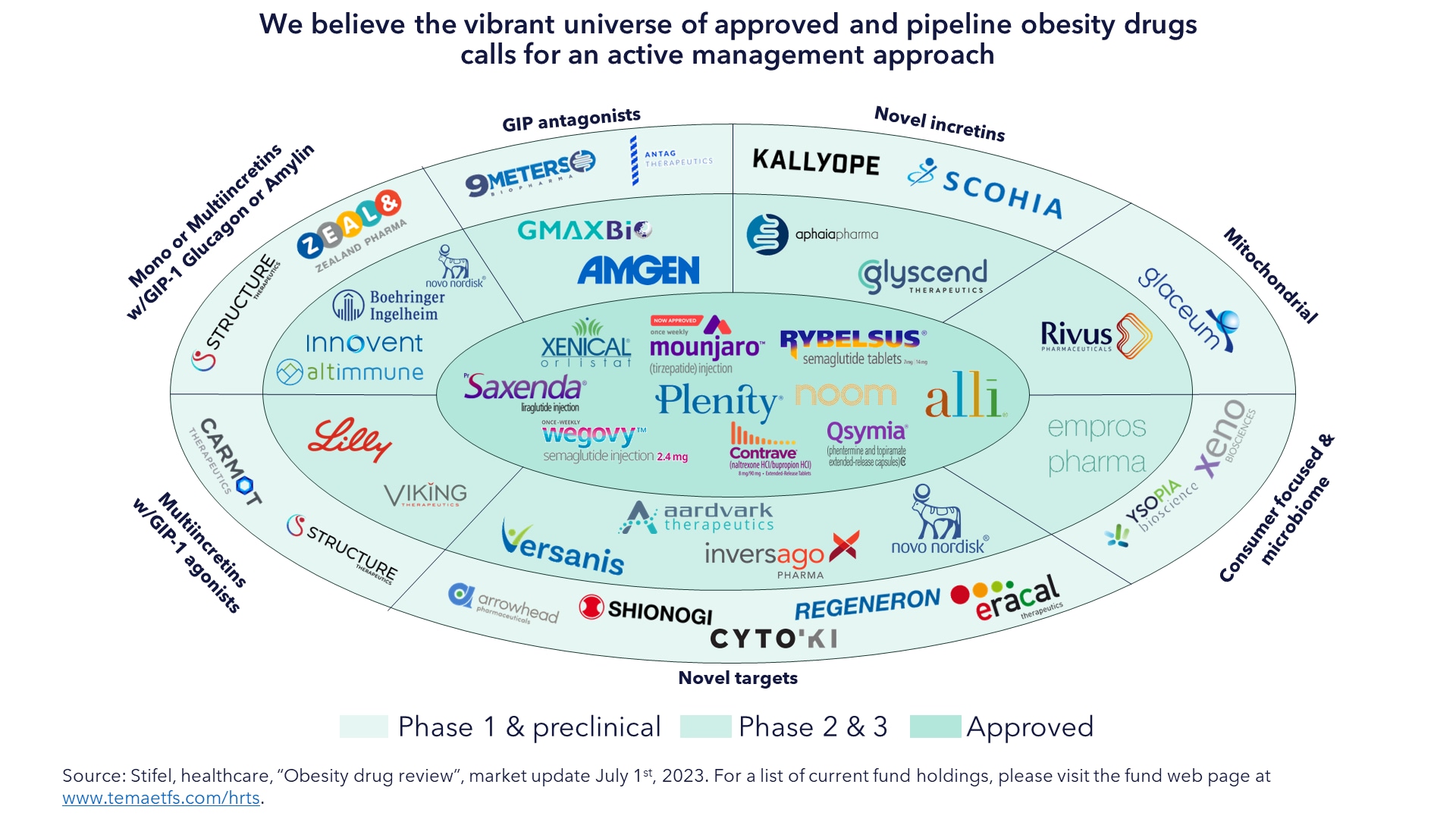

As a result of the unmet need and the revolution in obesity treatments the landscape has exploded with new drugs, diagnostics and medical devices. This has created an ever-expanding investable ecosystem for metabolic and cardiovascular disease.

Navigating this universe requires focus and considerable expertise.

How does the cardiovascular and metabolic segment compare to broader healthcare?

Investors might ask whether investing in a broader healthcare index might be a better alternative.

We believe the cardiovascular and metabolic segment is attractive compared to a general healthcare index:

- As we have seen this disease group is large but also fast growing. For example, the leading drugs for obesity are currently growing 70+% p.a. Broader healthcare in general grows slightly above GDP.

- Metabolic illnesses are chronic, which means they require lifelong treatment. The health system more broadly has exposure to acute illnesses that have a more finite treatment regimen.

- This segment also benefits from high barriers to entry when compared to broader healthcare on two dimensions. To get a treatment approved in metabolic or cardiovascular disorders requires huge clinical trials with patient numbers running in the ‘000s (for example the latest SELECT trial lasted 5 years and enrolled 17,000 patients). The rising use of background GLP-1 therapy in these disorders will further raise this barrier as reduced CV events means that trials will need to be even bigger to show statistical significance. Once treatments are approved, they can only succeed commercially by having a very large primary care salesforce.

- Risk management is crucial in this healthcare sub-segment, which can’t be addressed properly via an index approach.

Is there an obesity ETF?

Tema Obesity & Cardiometabolic ETF (HRTS) is the first ETF in the world focused on this exciting area of healthcare. HRTS is managed by an experienced portfolio manager, David Song MD, PhD, CFA, who has over 25 years of healthcare industry and investing experience.

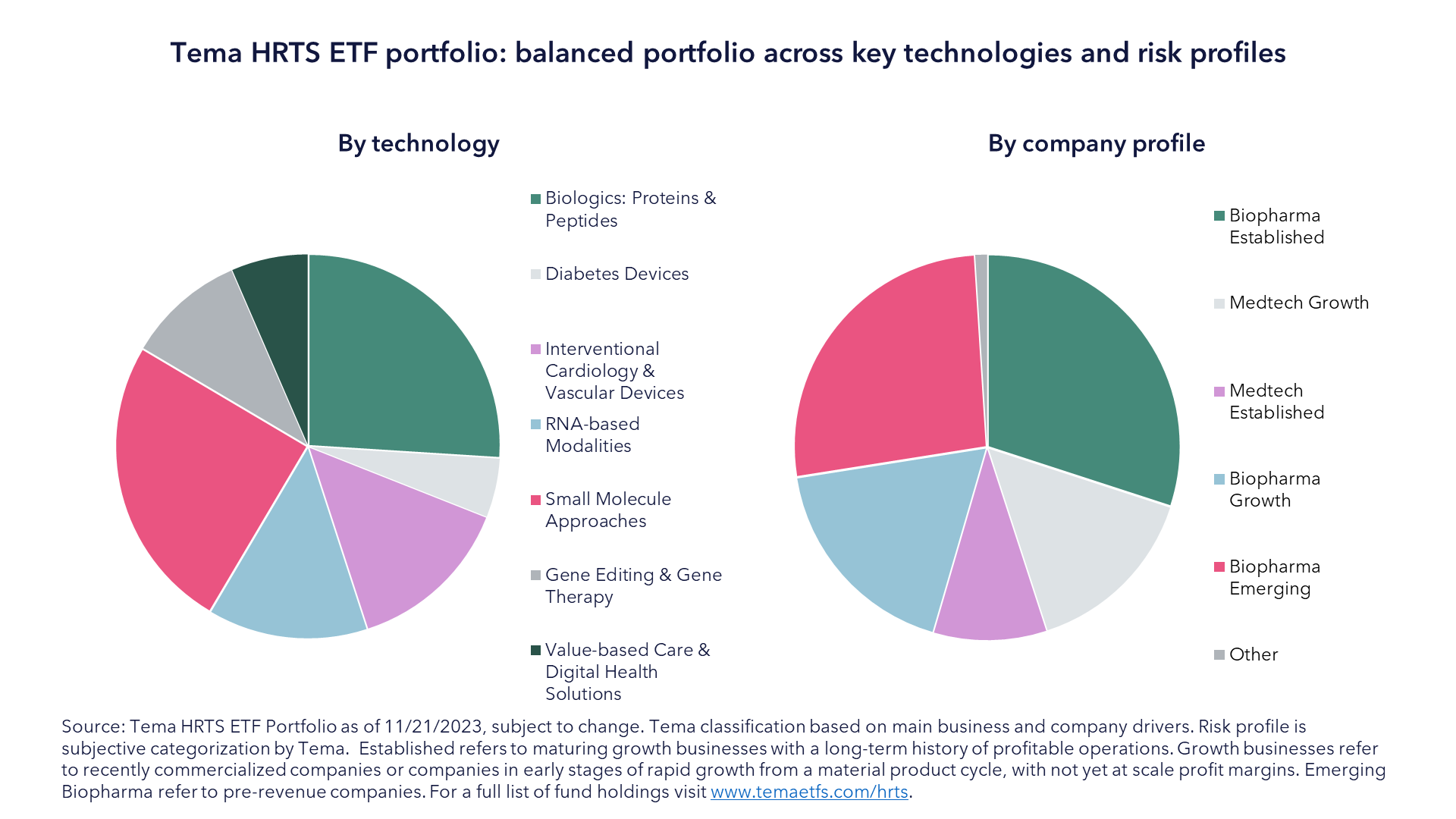

The HRTS portfolio aims to be broadly exposed to breakthrough innovation and to balance risk profiles – with a mixture of emerging biotechnology firms, growing firms with inflecting revenues and more established companies.

The ETF has a acute focus on valuation and understanding risk-reward of the ever-expanding cardiovascular and metabolic investment opportunity set.

Why should you consider investing in the HRTS ETF in the current environment?

The biotechnology sector currently offers exceptional value

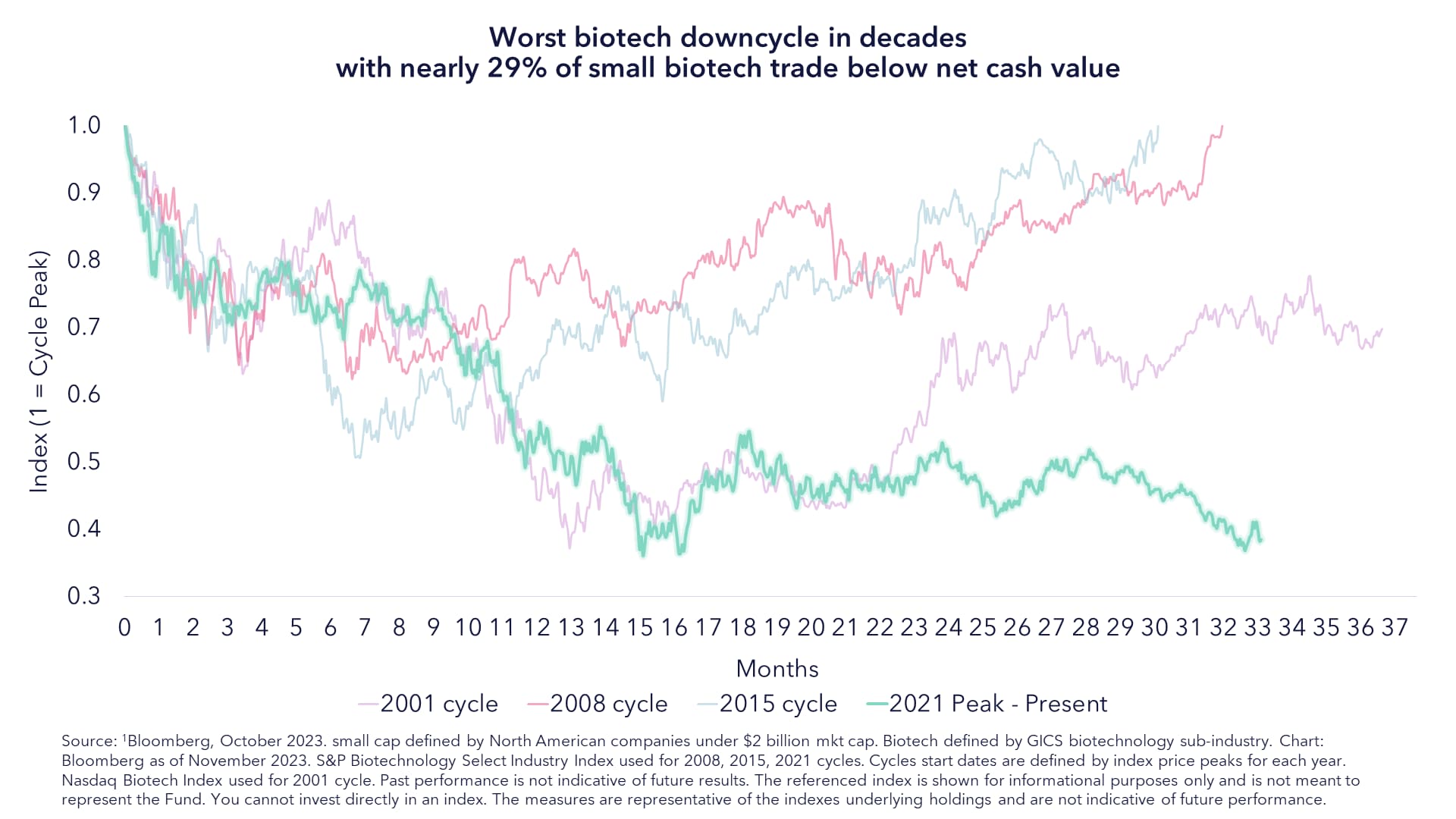

The biotech sector, a key part of the HRTS ETF, has had a difficult past two years registering the worst downcycle in decades.

In our analysis, almost 29% of small biotech firms are trading at market caps below the net cash on their balance sheets i.e., negative enterprise value. Although some of these firms require cash resources to deliver their R&D programs, this is a stark reading of how far valuations have come down.

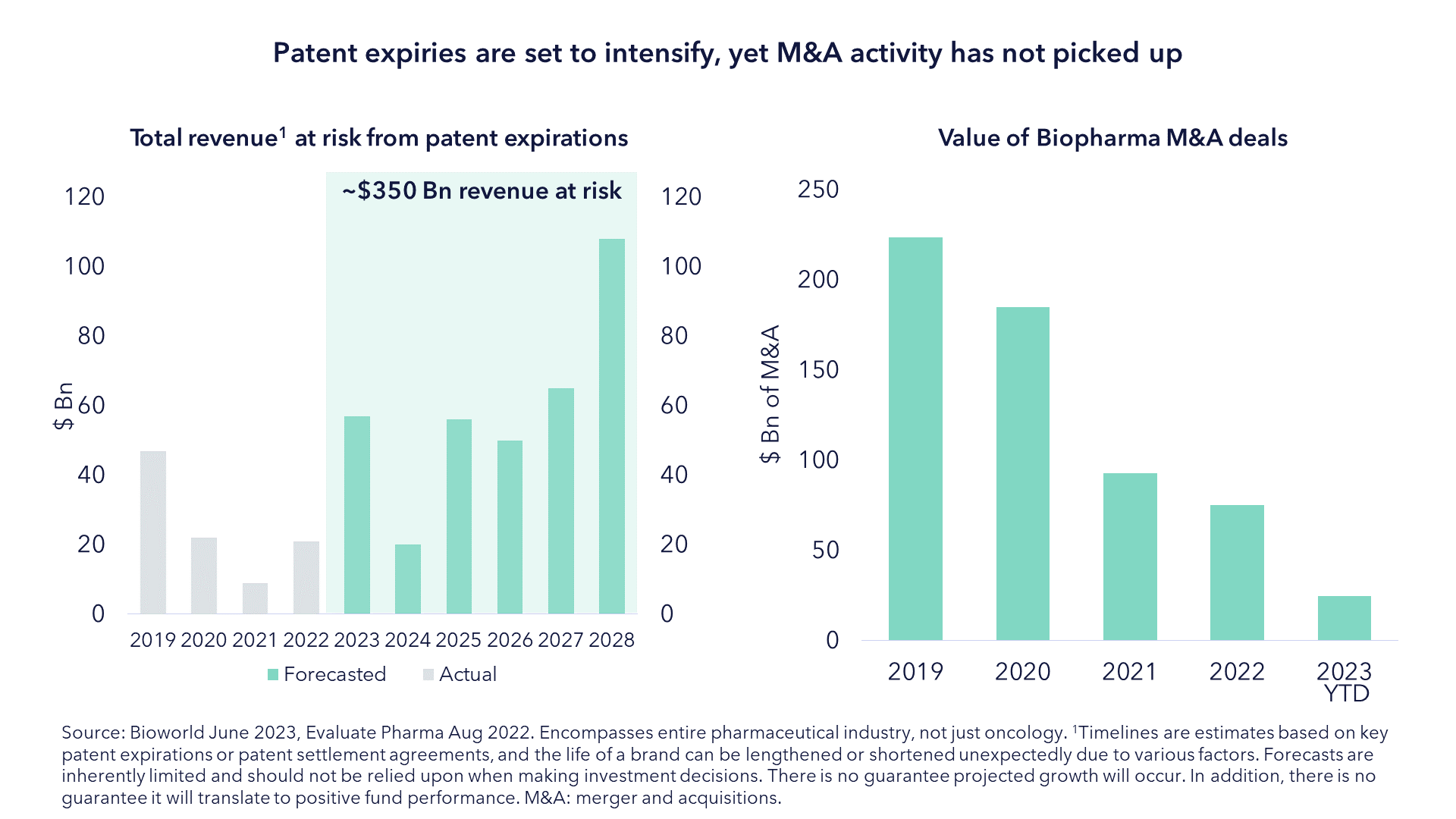

Big pharma needs to replace revenue streams and have the firepower to do it

In the next five years, large pharmaceutical firms must find a way to replace an expected $350 Bn of revenue at risk from patent expiry. One approach is to acquire smaller innovative biotechnology firms especially in the highly prospective metabolics space. In our calculations big pharma today is sitting on $838 Bn of “dry powder” to acquire these firms, representing 74% of the entire market cap of the S&P biotechnology index.

The metabolic space has featured some bellwether M&A already, and this is likely to continue:

- Bristol-Myers acquired MyoKardia for $13.1 billionto revitalize its presence in the cardiovascular space by accessing a first-in-class medicine for the treatment of a devastating structural heart condition.

- Merck acquired Acceleron for $11.5 billionto obtain a potential blockbuster drug used in pulmonary arterial hypertension.

- More recently, Novo Nordisk acquired pre-IPO company Inversago, whose lead developer of a potential oral treatment for obesity, for up to $1.075billion in cash, diversifying their own pipeline further.

What are the risks of investing in Metabolics?

There are several risks for investors to consider:

- Product risk: consisting of scientific risk (the biological hypothesis doesn’t work), clinical risk (the product does not work in humans) and commercial risk (the product doesn’t produce adequate revenue). We seek to mitigate these risks by avoiding unfavorable risk-reward data read-outs, conduct expert analysis of clinical data, and model potential market sizes using third-party commercial data.

- Funding risk: arising from some biotech firms requiring additional financial resources to complete their R&D programs. The fund will seek to risk manage exposure to these firms both via rigorous balance sheet analysis and restricted position sizing.

- Regulatory risk: always present in the healthcare space. We believe the most recent Medicare pricing regulation in the US, though negative, is a manageable risk for the industry. Obesity therapeutics also tend to be more dependent upon adoption in non-Medicare populations. In addition, our fund will also be investing in medical device companies, which tend to be relatively insulated from direct policy pressure in the US.

Bottom line

We believe the fight against the metabolic epidemic is having its watershed moment, creating a new pool of investment opportunities on compelling valuations, requiring expertise and diligent risk management to navigate.

About Tema

Tema is a SEC-registered investment adviser and investment management firm focused on active ETF investing and infrastructure, backed by Accel and Index Ventures. Tema aims to pioneer active thematic ETFs, which offer investors unique access not available in traditional passive investments. The firm provides defined exposure to innovative, underpenetrated themes through its bottom-up research process, underpinned with risk management and industry expertise. Tema is led by a team of experienced professionals and focused on delivering first-in-class exposure to the themes of its products.

For more information about HRTS or other offerings, please visit www.temaetfs.com.

Media Contact

Alex Stokes

Gregory FCA for Tema Global

Risk Information

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s prospectus or summary prospectus, which may be obtained by visiting www.temaetfs.com. Read the prospectus carefully before investing.

Important Risks

On 03/25/2024 the Tema Cardiovascular and Metabolic ETF was renamed Tema Obesity & Cardiometabolic ETF. Investing involves risk including possible loss of principal. There is no guarantee the adviser’s investment strategy will be successful.

Industry Concentration Risk: Because the Fund's assets will be concentrated in an industry or group of industries, the Fund is subject to loss due to adverse occurrences that may affect that industry or group of industries.

Biotechnology Industry Risk: The biotechnology industry can be significantly affected by patent considerations, including the termination of patent protections for products, intense competition both domestically and internationally, rapid technological change and obsolescence, government regulation and expensive insurance costs due to the risk of product liability lawsuits. In addition, the biotechnology industry is an emerging growth industry, and therefore biotechnology companies may be thinly capitalized and more volatile than companies with greater capitalizations.

Sector Focus Risk: Obesity and Cardiology companies are highly dependent on the development, procurement and marketing of drugs and the protection and exploitation of intellectual property rights. A company’s valuation can also be greatly affected if one of its products is proven or alleged to be unsafe, ineffective or unprofitable. The stock prices of Obesity and Cardiology companies have been and will likely continue to be very volatile. The costs associated with developing new drugs can be significant, and the results are unpredictable. Newly developed drugs may be susceptible to product obsolescence due to intense competition from new products and less costly generic products. Moreover, the process for obtaining regulatory approval by the U.S. Food and Drug Administration or other governmental regulatory authorities is long and costly and there can be no assurance that the necessary approvals will be obtained or maintained. Companies in the medical equipment industry group may be affected by the expiration of patents, litigation based on product liability, industry competition, product obsolescence and regulatory approvals, among other factors.

Investing in foreign and emerging markets involves risks relating to political, economic, or regulatory conditions not associated with investments in U.S. securities and instruments. In addition, the fund is exposed to currency risk.

Because the Fund evaluates ESG factors to assess and exclude certain investments for non-financial reasons, the Fund may forego some market opportunities available to funds that do not use these ESG factors.

Tema Global Limited serves as the investment adviser to Tema Cardiology and Metabolic ETF (the “Fund”), and NEOS Investments, LLC serves as a sub-adviser to the Fund. The Fund is distributed by Foreside Fund Services LLC, which is not affiliated with Tema Global Limited nor NEOS Investments, LLC. Check the background of Foreside on FINRA’s BrokerCheck.

For inquiries: info@temaetfs.com

Diabesity: Diabetes and Obesity

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy