While 2023 saw generative artificial intelligence (AI) products come to public prominence, 2024 looks set to be the year in which businesses start to use them. At their respective AI summits this year, Nvidia and UiPath unveiled suites of new products aimed at facilitating corporate adoption.

- Nvidia’s Blackwell chip promises a new era of generative AI computing.

- UiPath’s new LLMs can reduce error rates by over 75%.

- Nvidia stock has more than tripled over the past year.

The Future Is Generative

“Business leaders are done treating generative AI like a gimmick,” wrote Graham Sheldon, Chief Product Officer at UiPath [PATH], in a summary of the company’s 2024 AI summit.

With consumer applications such as ChatGPT having dominated headlines through 2023, AI producers are now focusing on how to apply the potential of large language models (LLMs) to business-specific use cases.

Nvidia [NVDA], which is widely considered the ‘picks and shovels’ stock of choice for AI investors, made a statement at its GTC summit in March when it announced a string of new generative AI partnerships, such as one with SAP [SAP] to build and deliver SAP Business AI.

This platform will give customers access to multiple LLMs via SAP’s generative AI hub and allow them to be customised for domain-specific purposes using Nvidia’s generative AI foundry service.

“SAP is sitting on a gold mine of enterprise data that can be transformed into custom generative AI agents to help customers automate their businesses,” said Jensen Huang, CEO of Nvidia, adding that the partnership will enable the companies to “bring customised generative AI to the thousands of enterprises around the world that rely on SAP to power their operations”.

| Discover top-performing stocks in Artificial Intelligence | YTD % performance |

|---|---|

| SUPER MICRO COMPUTER INC [SMCI] | +262.24% |

| SOUNDHOUND AI INC [SOUN] | +148.80% |

| ARM HOLDINGS PLC [ARM] | +82.37% |

Data correct as of Thursday, 4 April.

Underpinning Nvidia’s new generative AI capabilities is its new Blackwell chip. Huang, unveiling the chip at GTC, said that “the future is generative” and described the chip as having been built “for the generative AI era”.

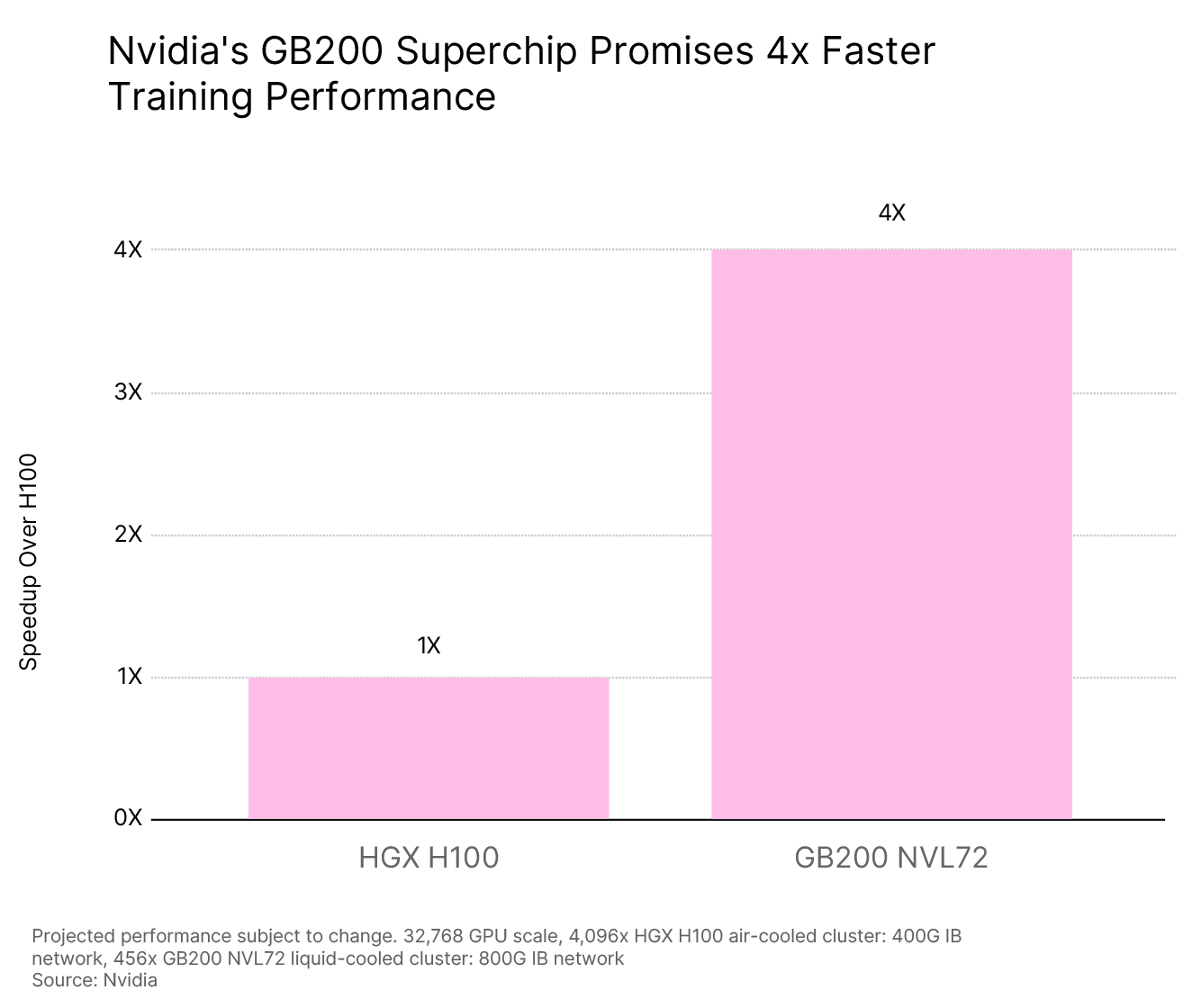

While Nvidia has soared to prominence on the back of its Hopper chips (such as the H100), which have until now been the gold standard in AI hardware, Blackwell promises a significant step up in terms of performance on this previous generation.

For example, the new GB200 Superchip — a combination of two Blackwell GPUs and one Grace CPU — promises 4x faster training performance than the Hopper GPU generation.

RAG to Riches

UiPath revealed at its AI summit that it, too, is launching products that put the latest AI technologies to new uses.

During the keynote talk, Sheldon said that the company is enabling retrieval augmented generation (RAG) patterns in its products.

These patterns, he said, are “absolutely essential for grounding the decisions that AI needs to make.”

UiPath’s new context-grounding functionality can make data LLM-ready by converting it into ‘embeddings’ that are optimised for searching and indexing by LLMs. This, claims UiPath, will make AI responses “more accurate, domain-specific and significantly less prone to producing misleading outputs, sometimes called ‘hallucinations’”.

UiPath also unveiled two new specialised LLMs that build on the popularity of its ‘document-understanding’ products.

DocPath is a document-understanding LLM that UiPath claims can reduce errors in data extraction by 45–76%, and reduce errors when extracting from complex tables by 30–65%.

CommPath, meanwhile, is a ‘communications-mining’ LLM that “delivers 2–3x less training effort for the same accuracy compared to traditional data annotation”, according to a March press release.

“Bringing together the best of specialised AI and generative AI, we’ve increased the accuracy of these models. They’re tailored for specific business documents and communications of different types. That enables us to get really advanced, unstructured data processing,” said Sheldon.

In Good Health

One of the talks at the UiPath AI summit focused specifically on applications in the healthcare sector.

“Using the intelligent document centre, we were able to automate at least five systems that we used to task before with a team of six people on a daily basis,” DS Suresh Kumar, Chief Transformation Officer at Expion Health, told UiPath’s AI Summit. This automation facilitated an almost 600% increase in the number of claims the company could process and nearly doubled both the success rate of claims and the productivity of staff.

Nvidia is also highly active in this sector. At GTC, Nvidia launched microservices, which allow healthcare researchers, developers, and practitioners to integrate AI applications either on-site or via the cloud.

“By helping healthcare companies easily build and manage AI solutions, we’re enabling them to harness the full power and potential of generative AI,” said Kimberly Powell, Vice President of Healthcare at Nvidia.

Starting a Conversation

Underscoring its status as the ‘picks and shovels’ stock for AI, Nvidia also featured one of its customers, Hippocratic AI, which is developing task-specific generative AI healthcare agents using Nvidia’s Avatar Cloud Engine microservices and its NIM suite.

These agents will be able to relieve staffing shortages in the healthcare sector by performing a wide range of administrative task such as scheduling appointments and conducting screening using speech recognition software.

“Nvidia’s technology stack is critical to achieving the conversational speed and fluidity necessary for patients to naturally build an emotional connection with Hippocratic’s Generative AI Healthcare Agents,” said Munjal Shah, Co-founder and CEO of Hippocratic AI.

An Upward PATH?

Benchmark analyst Cody Acree was among those impressed by Nvidia’s offerings at GTC, according to Benzinga, particularly regarding its positioning in the generative AI market.

Generative AI, he believes, is set for rapid adoption across the global economy, and Nvidia’s suite of systems, software and hardware positions the company to capitalise on this trend. Acree reiterated a ‘buy’ rating and $1,000 price target on the stock last month, an 11.8% upside from its most recent close on 2 April.

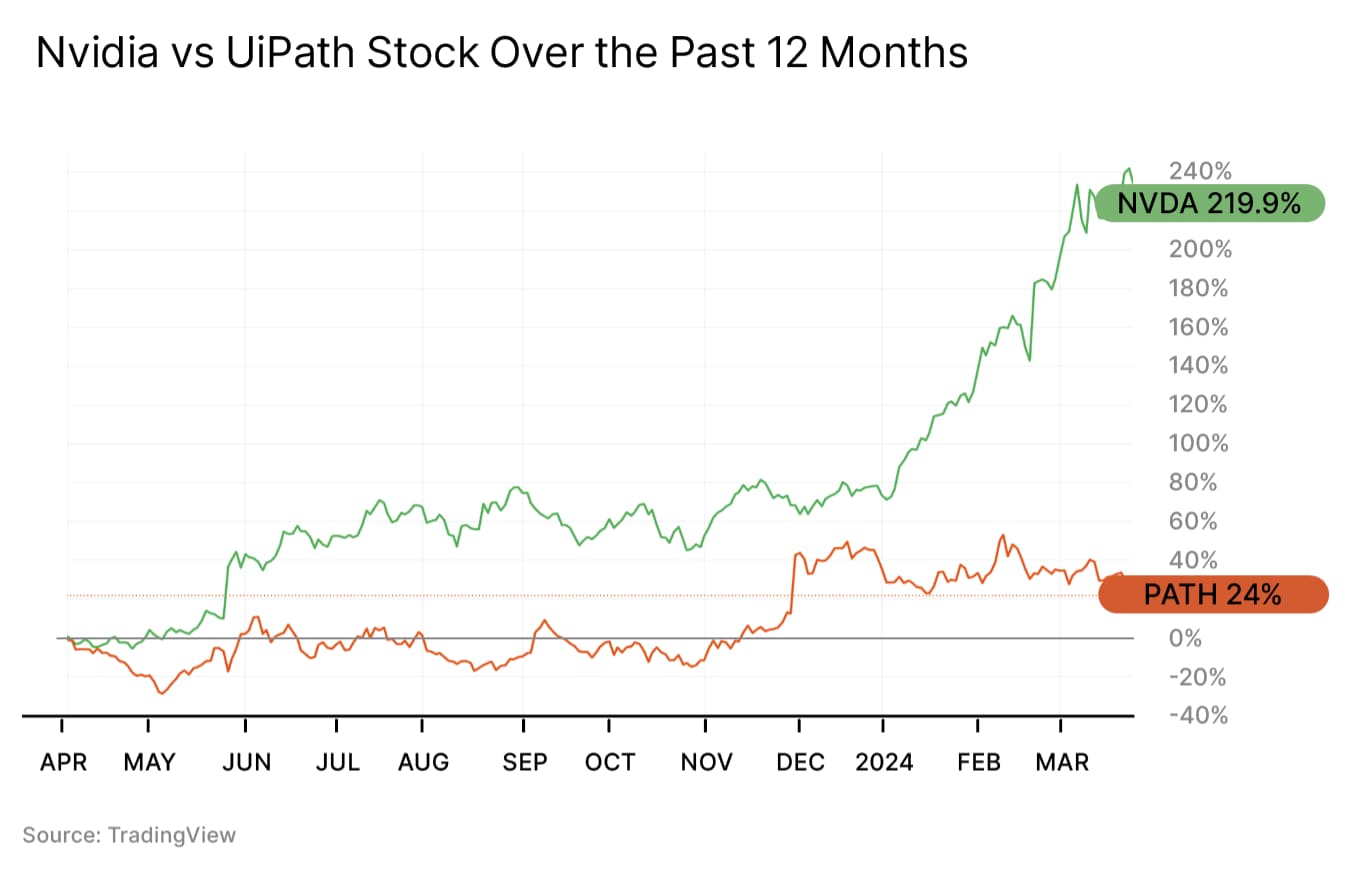

This optimism is reflected by investors, with the stock having gained 219.9% in the 12 months to 3 April.

UiPath hasn’t seen the same explosive growth, gaining 24% over the same period.

Nevertheless, Frederick Havemeyer gave the stock a boost following a positive earnings report in March. Havemeyer reiterated a ‘buy’ rating on UiPath shares and set a $29.00 price target, a 34.4% upside from the stock’s last close on 2 April.

Havemeyer cited the company’s first GAAP-profitable quarter and its 70% year-over-year revenue growth as tailwinds.

In 2024 to date, Nvidia has gained 80.6%, while UiPath has fallen 13.2%.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy