Welcome to Michael Kramer’s pick of the top three market events to look out for in the week ahead.

It will be a holiday-shortened week. US markets will be closed on Monday 2 September for the Labor Day holiday, and trading will resume on Tuesday 3 September. However, it will be a quick return to reality, with a jam-packed and important economic calendar, which will be topped off by Friday morning's all-important US August jobs report.

US election update

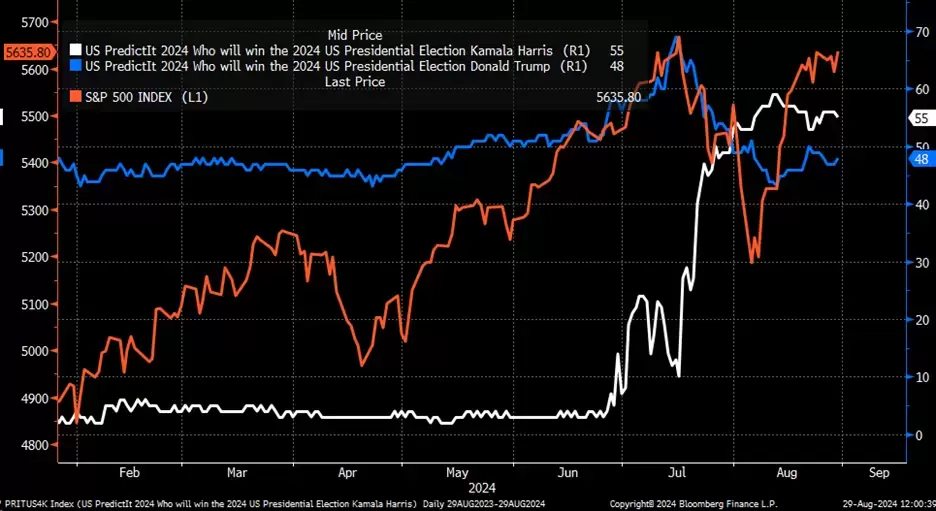

This past week, former president Donald Trump’s odds fell in the betting markets, widening the gap with vice-president Kamala Harris. At this point, it seems the equity markets have grown detached from the election and don’t appear to favour either candidate. That could change once we get into September and possibly after the first debate on Tuesday 10 September.

US election poll tracker, February 2024 - present

ISM manufacturing report

Tuesday 3 September

The report is expected to show that the manufacturing sector remains in contraction but improved slightly in August, rising to 47.7, up from 46.7 in July. The market has been paying close attention to the data from this sector over the previous few months, and this month’s data may be critical given the signs that the US economy has started softening. EUR/USD has benefited from softer US data and could continue to do so now that it has consolidated after reaching overbought conditions. If the ISM data comes in weaker than expected, and EUR/USD finds support around its 20-day moving average, it could advance beyond its recent highs and head to $1.125, or the upper end of the Bollinger Band.

EUR/USD, January 2023 - present

Sources: TradingView, Michael Kramer

Broadcom earnings

Thursday 5 September

Broadcom is expected to report that earnings grew 15.4% to $1.22 a share, as revenues surged 46.7% to $13bn. Most of the revenue growth is expected to come from its acquisition of VMWare. The all-important semiconductor portion of the business is only expected to have grown 6.8% to $7.4bn. Currently, the market is pricing in a 7.8% post-earnings move for Broadcom. The stock is currently at an essential level of technical support, around $160 a share, with a break of that support potentially setting up a drop to around $129. There is also a confirmed downtrend, which suggests that momentum is lower for now. However, breaking that downtrend could send the stock up to around $175 a share.

Broadcom share price, January 2023 - present

US job report

Friday 6 September

Analysts are forecasting August payrolls to have increased by 160,000, compared to an increase of 114,000 in July. Meanwhile, the unemployment rate is expected to fall to 4.2% from 4.3%, with average hourly earnings up 0.3% month-on-month (up from 0.2%) and 3.7% year-on-year (up from 3.6%).

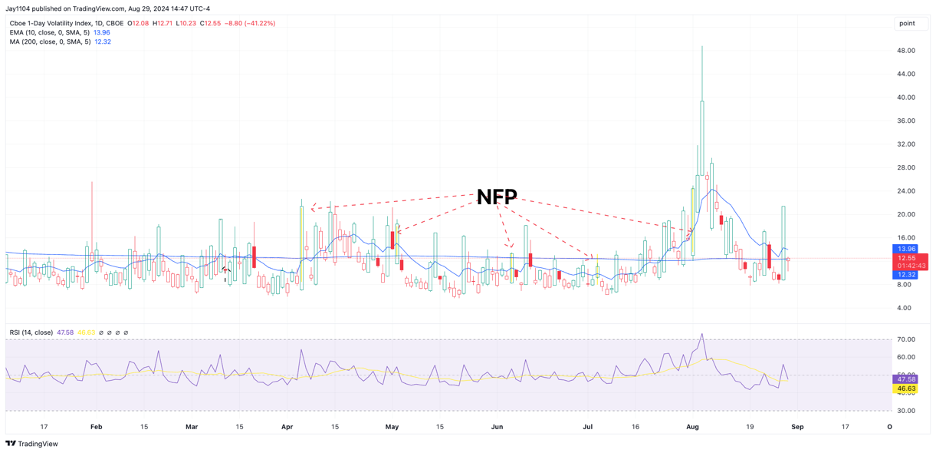

VIX 1-day index, January 2023 - present

The jobs report may again be more of a play on implied volatility than the actual data point and what happens afterwards. Typically, implied volatility moves higher the day before the non-farm payroll report, which can be tracked using the VIX 1-day index. If implied volatility rises quickly and significantly, it could even create selling pressure in the equity market the day before the data is released. The VIX 1-day typically falls after the report as the event risk passes. This decline in implied volatility could temporarily boost equity prices, pushing the equity markets higher. The one exception came following the July jobs report in early August. However, even in that case, when the market opened, the VIX 1-day dropped sharply before it started rising again, providing a brief boost to S&P 500 futures, only for them to turn lower as the news settled in.

Key economic and company events

Here’s our rundown of notable economic announcements and company reports scheduled for the coming week:

Monday

• UK: August manufacturing purchasing managers’ index (PMI)

Tuesday

• US: August ISM manufacturing report

• Earnings: Zscaler (Q4)

Wednesday

• Australia: Q2 gross domestic product (GDP)

• Canada: Bank of Canada interest rate decision

• Earnings: Barratt Developments (FY), Copart (Q4), Dick’s Sporting Goods (Q2), Direct Line (HY), Dollar Tree (Q2)

Thursday

• Eurozone: July retail sales data

• US: August ISM services PMI

• Earnings: Broadcom (Q3)

Friday

• Eurozone: Q2 GDP

• US: August job report

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.