Welcome to Michael Kramer’s pick of the top three market events to look out for in the week ahead, plus his latest US election update.

After a packed week of central bank rate decisions, the coming week looks comparatively quiet. That said, on Monday purchasing managers’ index (PMI) data from the US, the UK and elsewhere will check the pulse of manufacturing and service sector activity, offering insights on how the world’s major economies are faring in September. On Friday, the latest reading of the US personal consumption expenditures (PCE) price index – usually a closely watched measure of inflation – is likely to be less significant than normal after the US Federal Reserve on Wednesday lowered interest rates by a bumper 50 basis points and signalled that further cuts are imminent. That sent the S&P 500 to a record high on Thursday, but weakened the US dollar.

US election update

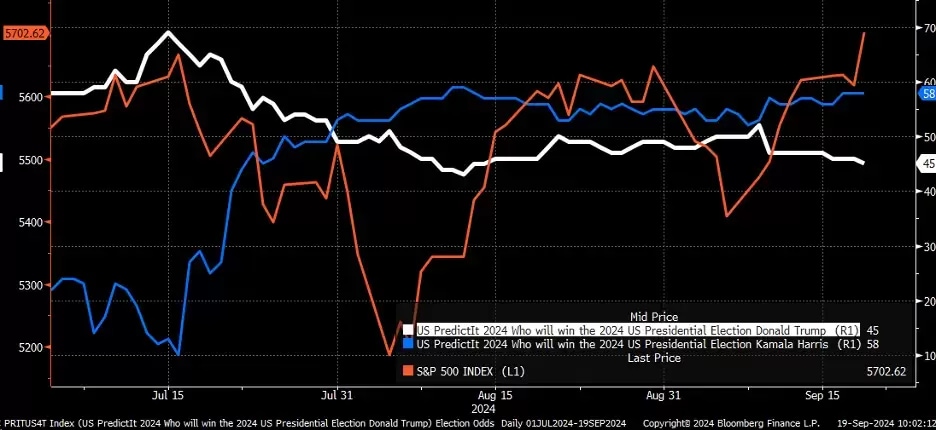

The betting market sees former president Donald Trump's odds of winning the US election slowly slipping away. PredictIt, an online betting site that covers political events, suggests that vice-president Kamala Harris has a commanding lead, with a 58% chance of winning the presidency compared to Trump’s 45%. This is a stunning turnaround given that Harris only entered the race in July, when Trump had a 70% chance of winning the election according to PredictIt.

Since then, the US equity market has been range-bound. However, Wall Street's benchmark index, the S&P 500, is at last breaking out of that range, suggesting that investors are becoming more comfortable with a Harris victory, though the index’s gains have primarily been driven by economic factors, particularly the Fed’s rate cut on Wednesday.

US election poll tracker, July 2024 - present

US, UK PMI data

Monday 23 September

The S&P Global US manufacturing PMI for September is expected to have risen to 48.5, up from 47.9 in August, while the service sector measure is forecast to have declined to 55.2, down from 55.7 in August. A reading above 50 suggests that the sector is expanding, while a reading below 50 indicates contraction.

Although estimates for the UK PMI weren’t available at the time of writing, the figures are unlikely to change the current trend in the GBP/USD rate. The pound seems set to continue to rise against the dollar. If the pound can break through resistance at $1.33, it has room to rise to around $1.365 to $1.375. However, a failure to break through resistance at $1.33 could create some downside potential, perhaps to around $1.314.

GBP/USD, January 2022 - present

Micron Technology Q4 results

Wednesday 25 September

Micron is set to report after the close that its fourth-quarter earnings climbed to $1.10 a share, up from a loss of $1.07 a share in the year-ago period, based on analyst estimates. Revenue is projected to have risen around 91% year-on-year to $7.65bn as gross margin widened to an estimated 34.6% from 28.1% in Q3. Looking ahead, analysts expect growth in Q1 to be even more robust, with earnings climbing to $1.58 a share on revenue of $8.39bn, with margins expanding to 37.9%. Options market pricing suggests that the Micron share price – which closed on Thursday at $89.25, up 8.4% year-to-date – could move higher or lower within a range of about 10% after the earnings announcement.

Micron shares have recently found support around $85. Bar any unexpected shocks, the Q4 results should ensure that this support level holds. The relative strength index (RSI), a measure of a financial instrument’s momentum, has begun to trend higher, suggesting that investor sentiment towards the stock may have turned bullish. There is a gap to be filled around $97 which could become a target if the Q4 results meet or exceed expectations. However, if the shares break below $84, they could fall to around $79.

Micron Technology share price, June 2023 - present

US August PCE price index

Friday 27 September

The PCE price index, often referred to as the Fed’s preferred inflation gauge, is expected to have risen 2.3% in the year to August, easing from 2.5% in July. Core PCE – which excludes volatile food and energy prices – is estimated to have increased 2.7% year-on-year in August, up from 2.6% in July. On a monthly basis, the headline figure is expected to be up 0.1% month-on-month, cooling from 0.2% in July, while core PCE is projected to have remained steady at 0.2%.

Any indication that inflation is continuing to cool could increase the likelihood of additional Fed rate cuts this year, potentially leading to further dollar weakness. In that scenario, the Japanese yen could be one of the biggest beneficiaries. USD/JPY has moved back to its 20-day moving average, with resistance at ¥144. If the pair breaks below the ¥140.90 level, it could undercut the 16 September low of around ¥139.50.

USD/JPY, June 2024 - present

Key economic and company events

Our rundown of notable economic announcements and US and UK company reports scheduled for the coming week:

Monday 23 September

• Eurozone, France, Germany, UK, US: September flash purchasing managers’ index (PMI) data

• Results: AAR (Q1), Oxford Biomedica (HY)

Tuesday 24 September

• Australia: Reserve Bank of Australia interest rate decision

• Germany: September IFO business sentiment index

• Japan: September flash PMI data

• US: July housing price index, September consumer confidence index

• Results: AutoZone (Q4), Card Factory (HY), KB Home (Q3), Raspberry Pi (HY), Smiths Group (FY)

Wednesday 25 September

• Australia: August consumer price index (CPI)

• US: August new home sales

• Results: Cintas (Q1), Jefferies Financial (Q3), Micron Technology (Q4)

Thursday 26 September

• Eurozone: European Central Bank economic bulletin

• Japan: September Tokyo CPI

• Switzerland: Swiss National Bank interest rate decision

• US: Q2 gross domestic product (third estimate), initial jobless claims to 20 September

• Results: Accenture (Q4), CarMax (Q2), Costco (Q4), Jabil (Q4), TD Synnex (Q3), Vail Resorts (Q4)

Friday 27 September

• Eurozone: September business climate index, September consumer confidence index

• France: September flash CPI

• Germany: September unemployment rate

• US: August personal consumption expenditures (PCE) price index, September University of Michigan consumer sentiment index

• Results: Ceres Power (HY)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.