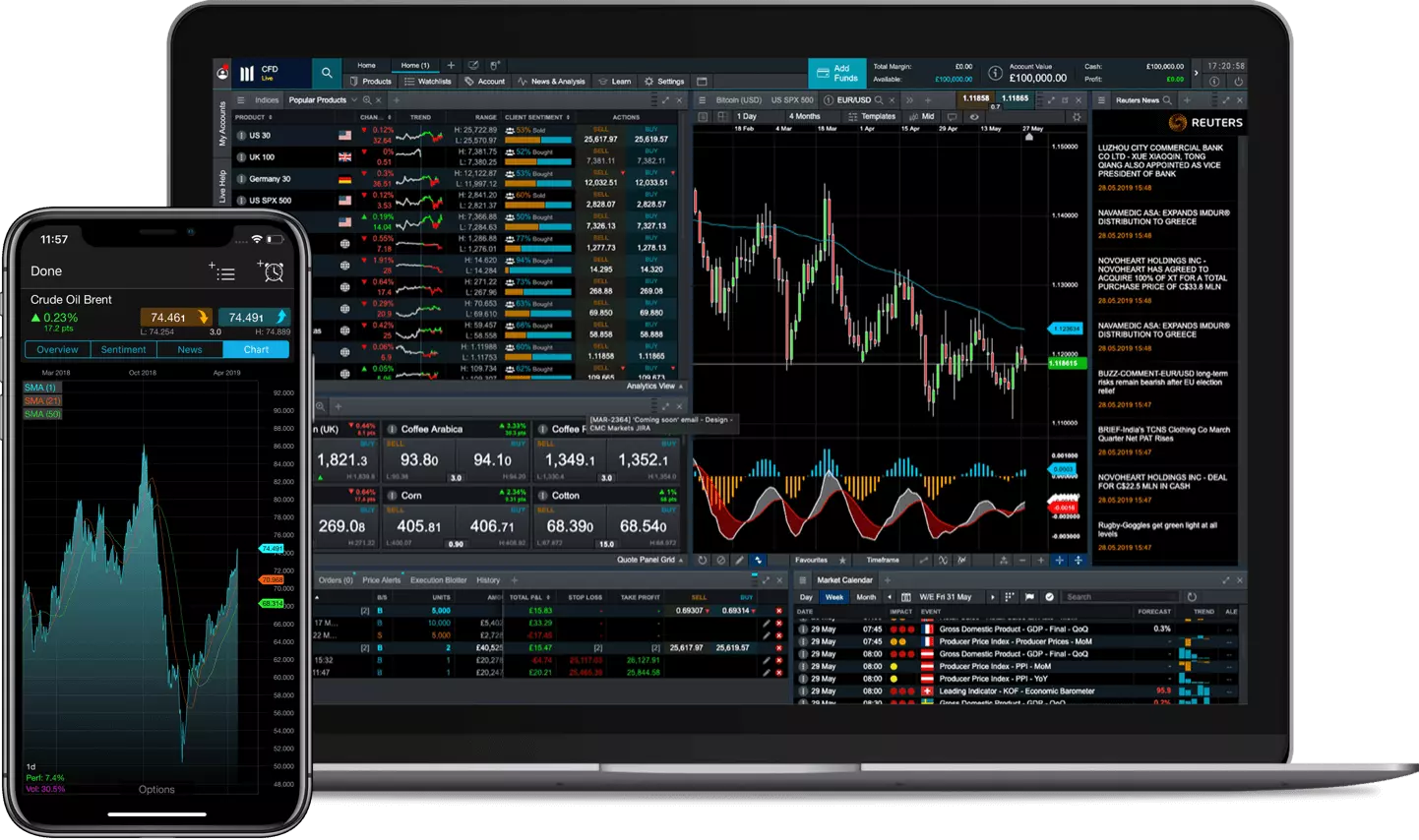

The UK’s best CFD trading platform*

Trade CFDs with a live or demo account on our award-winning platform

Analyse price performance with advanced charts, technical indicators and drawing tools

Discover CFDs on more than 12,000 financial instruments, including indices, forex, shares, commodities and treasuries

Enjoy exclusive platform features, such as our trading forum, pattern recognition scanner and client sentiment tool

How to start CFD trading

Why trade CFDs with CMC Markets?

We combine powerful analytics tools with professional analyses and helpful training materials to help you implement your individual strategy.

Best-in-class features*

Our industry-leading charts provide a host of features to support your analysis, including multiple chart types, over 115 technical indicators and drawing tools, pattern recognition and a chart forum community.

*No1 Web-Based Platform, ForexBrokers.com Awards 2021; Best Telephone & Best Email Customer Service, based on highest user satisfaction among spread betters, CFD & FX traders, Investment Trends 2020 UK Leverage Trading Report; Best Platform Features & Best Mobile/Tablet App, Investment Trends 2019 UK Leverage Trading Report; Most Currency Pairs, Forex Brokers 2020 Awards.