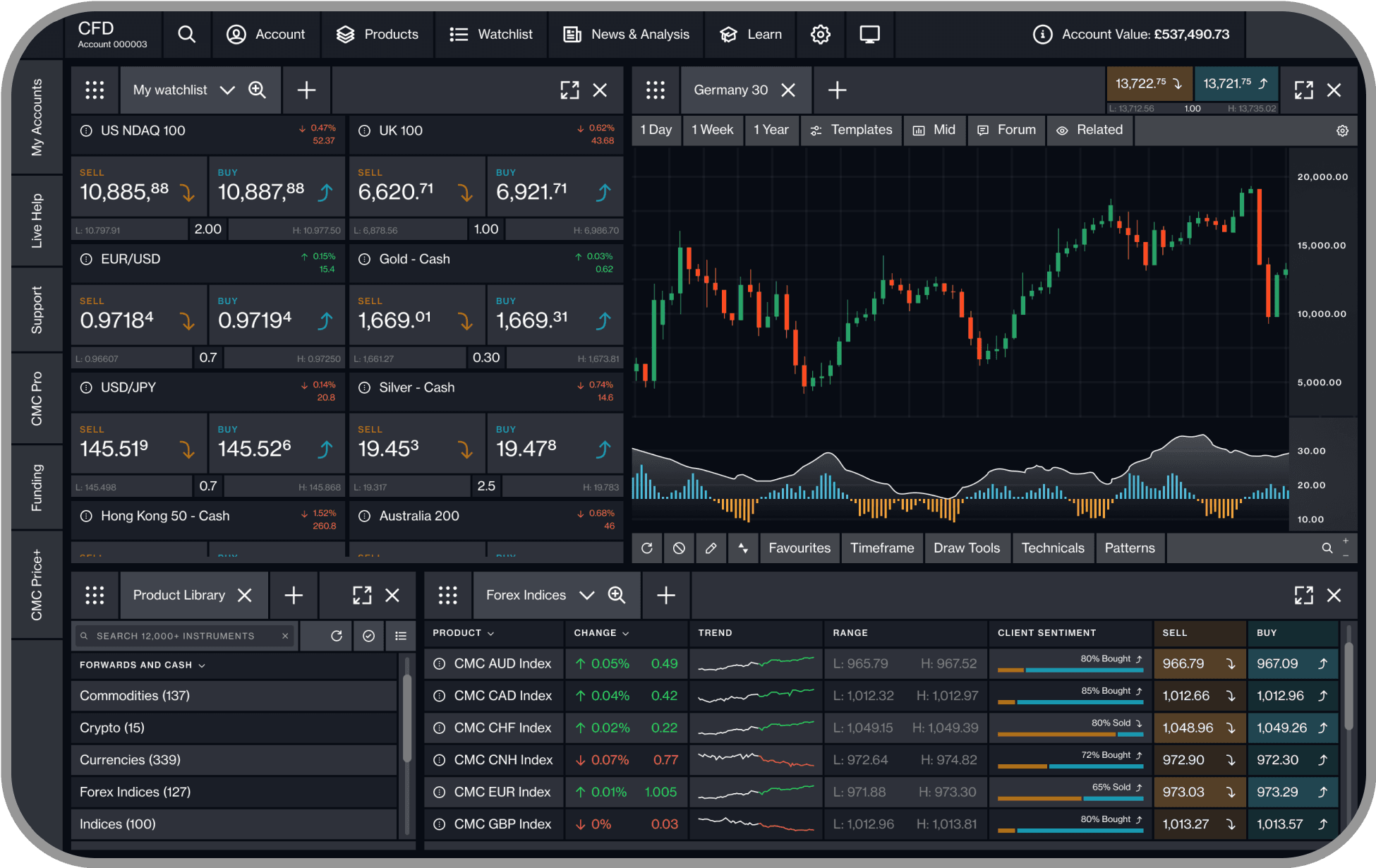

SPREAD BET ONLY

Shares additional spread

There's an additional spread on share spread bets when you enter and exit a trade, which is built into the prices displayed on our platform.

Any questions?

Email us atclientmanagement@cmcmarkets.co.uk

or call on +44 (0)20 7170 8200We're available whenever the markets are open, from Sunday night through to Friday night.

1FSCS is an independent body that offers protection to customers of financial services firms that have failed. The compensation amount may be up to £85,000 per eligible person, per firm. Eligibility conditions apply. Please contact the FSCS for more information.

Loading...

Loading...