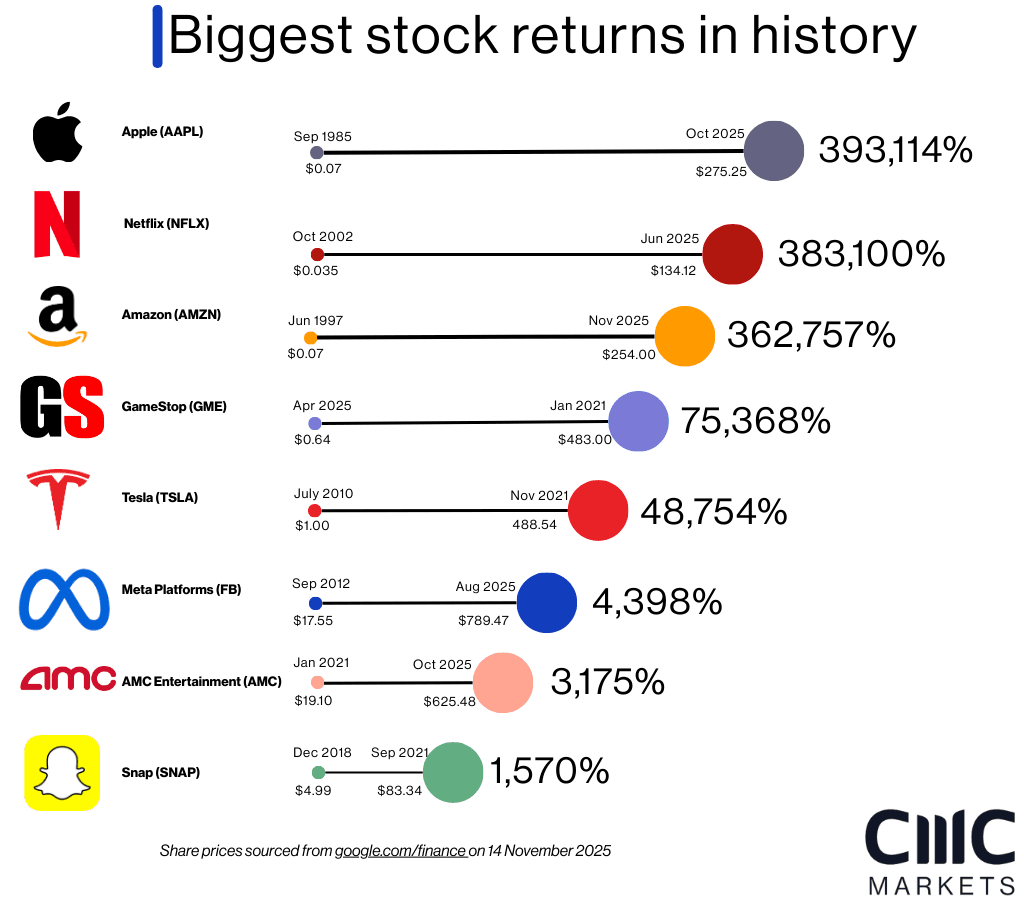

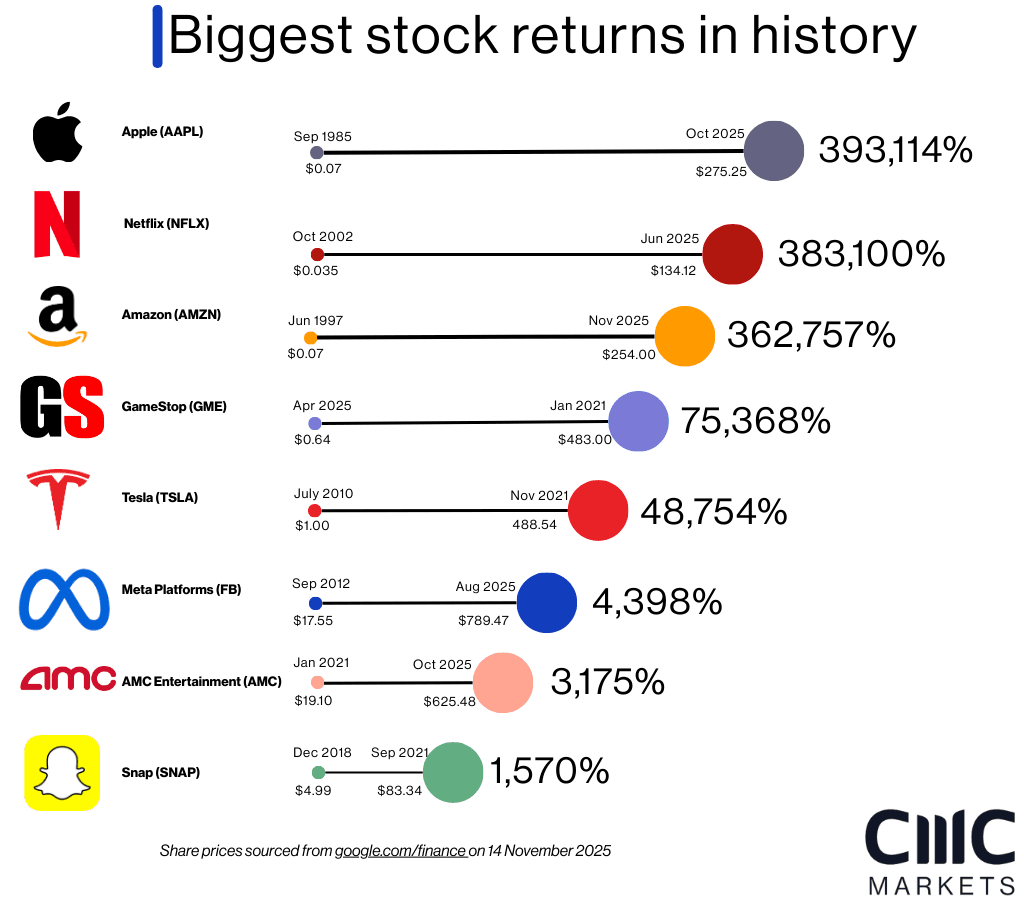

When looking at companies that have made the biggest stock returns, it’s helpful to have a point of comparison. Let’s take Wall Street’s benchmark stock index, the S&P 500. The first time this basket of blue-chip US stocks closed above 140 points was on 20 November 1980, about three weeks before Apple’s initial public offering (IPO). In the 45 years or so since then, the S&P 500 has risen to a record closing high of 6,890.89, on 28 October 2025. That’s an increase of 4,822%.

While that is certainly an impressive increase, some stocks have delivered even more staggering returns within that period. For example, if you’d invested in shares of Apple when they were at their low point in 1985, you could have seen your investment grow by an even greater percentage.

Of course, it’s easy to identify successful companies in hindsight. But when looking to the future, nothing is certain, and a positive return is never guaranteed. Nevertheless, it’s fascinating to look back in time and discover just how far some stocks have soared, from humble beginnings to today's mega-cap behemoths.

At the same time, a few of the stocks we've highlighted have had meteoric – but brief – rises, that for different reasons, they've been unable to sustain.

It's important to remember that past performance is not a reliable indicator of future results. 67% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider (October-December 2025).

Stock market success stories aren’t written every day. Some stocks soar, and some fall. Using (stock split-adjusted) price data available on Google Finance, we identified some of the biggest stock returns of recent years.

(AAPL)

1. Apple

Lowest intraday price: $0.07 (September 1985)

Peak intraday price: $275.25 (October 2025)

Share price increase from low to high: 393,114%

Perhaps unsurprisingly, our top spot goes to Apple. The iPhone maker is not just a tech giant, it’s one of the biggest companies in history. Founder Steve Jobs always believed that his Mac computers, iPods and smartphones would change the world, but some investors took longer to be convinced. In 2003, Apple shares could be had for as little as $0.25. Even in early 2009 the stock was trading for less than $3. However, after multiple years of unparalleled growth, Apple's stock has soared to more than $275. From the mid-1980s lows, it marks an astonishing share price jump.

(NFLX)

2. Netflix

Lowest intraday price: $0.035 (October 2002)

Peak intraday price: $134.12 (Jun 2025)

Share price increase from low to high: 383,100%

Netflix has evolved from a DVD rental company unable to secure funding from Blockbuster, to become the largest online streaming platform in the world. With over 300 million subscribers and annual revenue of $39bn in its fiscal 2024 year, Netflix has seen its share price increase by over 383,000% since 2002.

(AMZN)

3. Amazon

Lowest intraday price: $0.07 (June 1997)

Peak intraday price: $254.00 (November 2025)

Share price increase from low to high: 362,757%

As we reach our top three, the rates of share-price growth jump up several notches. Amazon is one of the most successful stocks in history. Founder Jeff Bezos, who began by selling books from his garage, has revolutionised the retail industry. Few investors saw it coming. After its IPO in 1997, Amazon’s share price spiked in the late nineties before the dot-com bubble burst, sending the stock crashing. But the company not only survived, it thrived, and today Amazon is the world’s largest retailer.

(GME)

4. GameStop

Lowest intraday price: $0.64 (April 2020)

Peak intraday price: $483.00 (January 2021)

Share price increase from low to high: 75,368%

Shares of video game retailer GameStop surged thanks to the meme-stock frenzy sparked by Reddit users from 2020 to 2021. As thousands of amateur traders took positions against institutional short sellers, GameStop shares increased in value by more than 18,000%, in an infamous short squeeze. Both AMC and GameStop have earned a place in our list of the highest-return stocks in history. It's important to highlight, however, that in both these cases, it was social media-driven demand that temporarily, and artificially, boosted the share prices.

(TSLA)

5. Tesla

Lowest intraday price: $1.00 (July 2010)

Peak intraday price: $488.54 (November 2021)

Share price increase from low to high: 48,754%

Tesla has been through more difficulties than most companies, with issues ranging from vehicle recalls to allegations of worker rights violations. However, under the leadership of CEO Elon Musk, Tesla has spearheaded the development of electric vehicles, pushing the company’s valuation over the $1tn mark. In the process, Musk has become one of the world’s richest people.

(FB)

6. Meta Platforms

Lowest intraday price: $17.55 (September 2012)

Peak intraday price: $789.47 (August 2025)

Share price increase from low to high: 4,398%

Facebook has evolved from a social media platform into one of the largest tech companies in the world. Under the guidance of founder Mark Zuckerberg, Meta has acquired messaging platforms, allocated its resources to virtual reality and spawned the Metaverse. These innovations have helped to made it one of the world's highest-return stocks in the world.

(AMC)

7. AMC Entertainment

Lowest intraday price, pre-peak: $19.10 (January 2021)

Peak intraday price: $625.48 (June 2021)

Share price increase from low to high: 3,175%

AMC is the largest movie theatre operator in the US, but almost went out of business as the coronavirus lockdowns that began in 2020 forced cinemagoers to stay at home. However, as the shares plunged to new lows in January 2021, social media users – many of them latching on to the “meme stock” buzz around GameStop – made AMC the target of rampant speculation. The sudden influx of investors inflated the stock to a short-lived high of more than $625, representing a jump in excess of 3,000% in the space of just five months. These days the picture looks very different, with the stock trading a little above $2 in late 2025.

(SNAP)

8. Snap

Lowest intraday price: $4.99 (December 2018)

Peak intraday price: $83.34 (September 2021)

Share price increase from low to high: 1,570%

The owners of the messaging platform Snapchat, Evan Spiegel and Bobby Murphy, took their company public in 2017. Although the stock closed its first day of trading at more than $24 a share, by December 2018 it had dropped below $5. Less than three years later, a share was worth more than $83, representing a rise of 1,500%. Since then, the stock has snapped back to pre-pandemic levels, at less than $10 a share.

Despite some of the huge share price rises we've highlighted in this article, success stories like some of the above stocks are rare. To be sustained, a share price may build over time, and experience ups and downs, and therefore may not be suitable for trading. Remember that past performance is not a reliable indicator of future results.

When picking stocks or planning your trades, it’s important to undertake research, which can help you to make more informed trading decisions, and prevent you from trading on emotion. It's also worth remembering that, with any trade, there will always be ups and downs, and it's therefore very important to manage your risk.