Explore the UK’s best spread betting platform¹

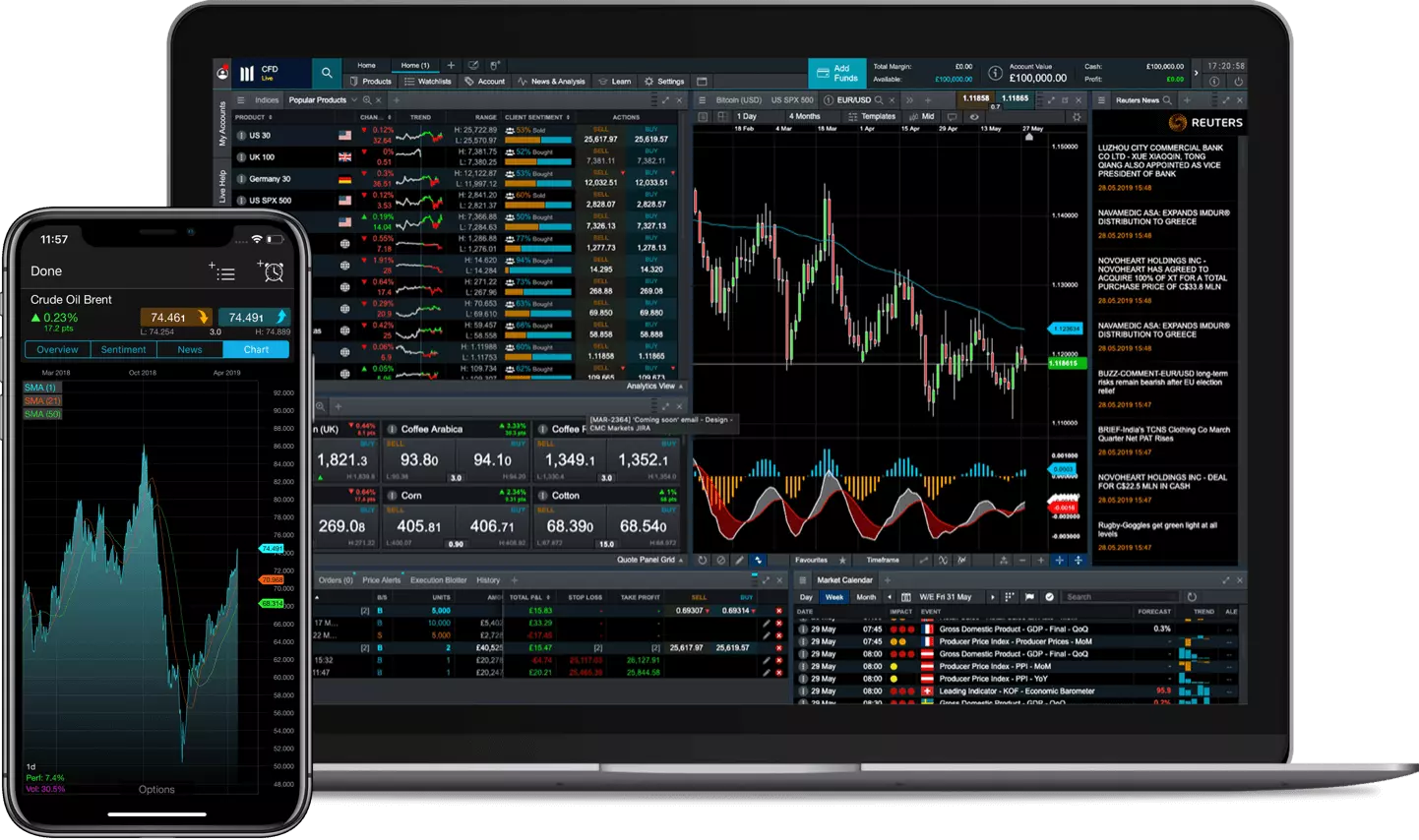

Discover our award-winning platform on the web or on our spread betting app

Trade on indices, forex, commodities, shares, ETFs and more

Open a live or demo account

Make use of our advanced charting features and trading tools

- Choose from 12,000 financial instruments

Control your risk management with multiple execution and order types

How to start spread betting

Our spread betting charting features

Our powerful provide a host of features to support your analysis, including multiple chart types, over 115 technical indicators and drawing tools, pattern recognition, and a chart forum community.

Why spread bet with CMC Markets?

Pricing is indicative only. Past performance is not a reliable indicator of future results.

FAQs

You can get trade execution alerts when pending orders are executed in your account. You can also choose price alerts, which notify you when an instrument hits a level specified by you. Find out more about trading alerts.

We’re constantly developing and enhancing a range of technical analysis. You can discover more about our charting features.

Yes, one-click trading is available with us. Find out more about how to activate one-click trading.

Whatever your experience, CMC Markets has the tools to help you take the next step on your trading journey. Discover our learn section.