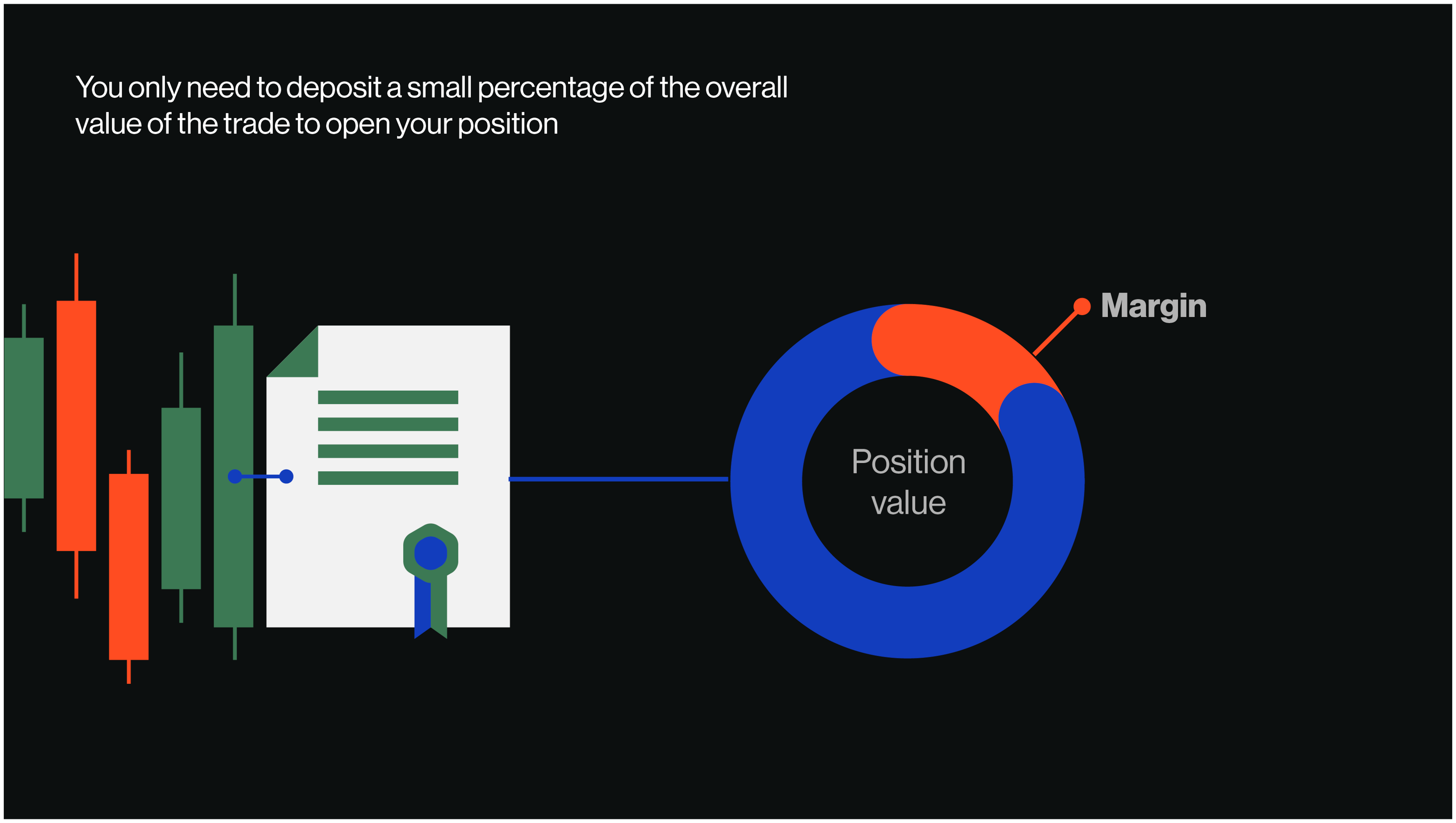

Buying on margin means that a trader or investor does not need to have the full value of the trade in cash, only part of it, to go long. Because profit and loss are based on a trade’s full position, margin trading can amplify both.

The margin amount or percent is how much of the transaction value you need to have in your account to make the trade.

For example, assume a trader wishes to buy 100 shares priced at £100, and the margin rate is 20%. This trade has a value of £10,000, but the trader doesn’t need £10,000 in their account to make the trade, they only need £2,000 (20% of £10,000). Again, it’s worth noting that when spread betting and trading CFDs, you don’t actually own the underlying asset; you only gain exposure to its price movements.

Trading with leverage or margin are similar concepts, expressed in different ways. Margin trading is how much of the trade value you need in your account to initiate the trade, such as the 20% discussed above. Leverage is the size of the position relative to the amount of capital required to initiate the position. For example, a £10,000 trade with £2,000 in the account means a leverage ratio of 5:1 is being used.

Different financial instruments have different margin requirements. For example, at CMC Markets, we offer 20% margin when trading on shares, 5% or less on many forex pairs and 5% margin on most indices.