Gold/silver ratio

The gold/silver ratio is the amount of silver needed to buy an ounce of gold. The relationship is used by many precious metal investors and gold traders as a fundamental indicator for determining the best time to buy or sell.

If the gold silver ratio is high, it means that it is the right time to buy silver, since the ratio is more favourable to silver. For example, assuming a gold silver ratio of 50 to 1, investors would have to only part with 1 ounce of gold to acquire 50 ounces of silver. Similarly, when the ratio is lower, it means that the price of gold has fallen and it is therefore time to invest. Precious metal traders can use this ratio to diversify their trading portfolios.

What is the gold/silver ratio?

The gold/silver ratio represents the number of ounces of silver required to purchase a single ounce of gold. Today, this ratio fluctuates as gold and silver prices are regulated by market forces, but this has not always been the case. In the past, the ratio used to be fixed by law, since governments seeking monetary stability were able to set their own ratio.

Negotiating the gold/silver ratio makes sense for those concerned with devaluation, deflation and monetary replacement. Precious metals have a proven track record of maintaining their value in the face of unforeseen events that could threaten currency value.

The origin of the gold/silver ratio dates back thousand of years. Around the year 3000 BC, the first Egyptian pharaoh, Menes, declared that two and half parts of silver were equivalent to one part of gold. Although the ratio refers to the difference between raw materials, it really reflects the replacement potential between the two metals. Gold and silver both have long-lasting backgrounds both as commodities and as currencies. For the past thousands of years, gold and silver have always been symbols of great wealth.

Many silver investors believe the ratio should be set at 16:1, which is the ratio of gold to silver in the earth’s crust. Others think this ratio should drop further, since nine times more silver than gold is currently mined. Silver proponents believe that given the amount of silver used in industrial processes, manufacturing and solar panels, the ratio should be more favourable to silver than gold.

Globally, the demand for gold has increased in 2023 due to the worldwide Covid-19 pandemic. In fact, traders are still buying gold as a safe haven in these uncertain market conditions. At the same time, silver has remained more stable than gold as industrial demand is low. Consequently, the gold/silver ratio could remain at the current levels, nearing 100, for an indefinite period of time.

Gold/silver ratio calculator

The gold/silver ratio does not predict future events. However, monetary economic theories state that when governments inject large amount of additional money into the economy, it is very unlikely that one dollar would still buy the same amount of gold. Investors who believe that fiat currencies cannot increase their purchasing power of gold and that the gold/silver ratio tends to revert to its mean can calculate the value of silver based on the price of gold.

Daily gold/silver ratio = current spot price of gold / current price of silver

For example, a gold level of $1,500 and a gold/silver ratio of 80 to 50 suggests silver being valued between $30 and $18 per ounce. On the other hand, a high gold/silver ratio of 120 to 90 suggests a value between $12.50 and $16.60.

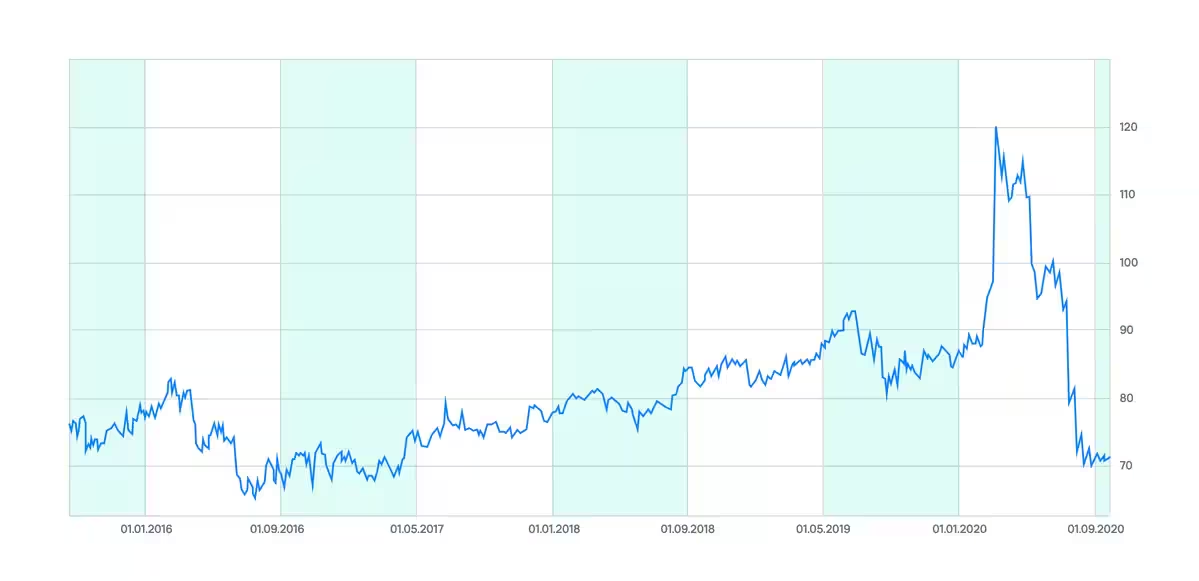

Gold/silver ratio chart

Chart showing price fluctuations of the gold/silver ratio between 2016-2020

What is the average gold/silver ratio?

In the modern era, the average price ratio between the two precious metals stands at around 55:1, as it was also at the beginning of 2020. The highest level ever recorded was in 1990 and the lowest in 1979. Historically, when the ratio is below its average level, silver is considered cheap compared to gold; on the other hand, when the ratio surpasses its average, silver is considered expensive.

Throughout 2020, the risk aversion tendency in the markets of all asset classes has pushed the price of silver to its lowest level since 2009, causing it to fall below $12 per ounce, which has sent the gold/silver ratio to a new all-time high.

How to trade the gold/silver ratio

Trading the gold-silver ratio is an activity mainly carried out by gold and precious metals traders, who use the gold/silver ratio to modify their holdings when the ratio fluctuates at historical extremes.

For example, if a trader owns one ounce of gold and the ratio rises to 100, the trader will exchange one ounce of gold for 100 ounces of silver. Subsequently, if the ratio drops to an opposite extreme of 50, the trader will sell their 100 ounces of silver for two ounces of gold. This method allows traders to accumulate metal, while seeking high and low ratio numbers in order to increase holdings.

To start trading on the price movements of gold and silver, open an account. You will be granted automatic access to a free demo account, where you can practise trading the gold/silver ratio.

Decide whether you prefer to spread bet or trade CFDs. These are the most popular derivative products for trading precious metals that you should familiarise yourself with.

Remember that spread bet and CFDs are leveraged products and come with a high risk of losses. Browse our range of risk-management tools such as stop-losses and take-profit orders.

Gold/silver ETFs

ETFs (exchange-traded funds) are a viable alternative to trading gold and silver assets. Some investors prefer to avoid trading gold or silver commodities and would rather keep open positions in gold and silver ETFs, which work instead by tracking the asset’s underlying price. When the ratio rises, they invest in silver ETFs and when it falls, they invest in gold ETFs. Read more about ETF trading.

A commodity is a physical good that can be bought or sold on commodity markets. Commodities can be categorised into either hard or soft varieties. Hard commodities are natural resources like oil, gold and rubber, and are often mined or extracted. Soft commodities are agricultural products such as coffee, wheat or corn.

The commodity sector can be a good introduction to the financial markets for beginner traders, although it’s important to remember that all markets have their own set of risks. Energy-focused commodities for example can be particularly volatile.

In order to become a commodity trader with us, you’ll need to decide whether you want to spread bet or trade CFDs, and then open an account. Once your account is open, you’ll be able to trade on our broad range of commodity derivatives, including Gold, Brent and West Texas crude oil, Natural Gas, Sugar, Live Cattle, Heating Oil and many more. We also offer our exclusive commodity indices, which allow you to take a view across the whole precious metals, energy, and agriculture sectors. With all our commodity instruments, you can take a position on either side of the market, depending on whether you think the price will rise or fall in value.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.