What are indices and how do you trade them?

Published on: 23/12/2021 | Modified on: 25/01/2023

Indices trading is a popular strategy for those who are looking to gain exposure to an entire market, investment theme or sector. In this guide, we explain the meaning of indices, how they are calculated, and how you can gain access to benchmarks across the world such as the FTSE 100.

Indices can be categorised by market cap, sector, theme, region or asset class

They can help to diversify a trader’s portfolio as risk is spread across multiple stocks

The US's benchmark index is the S&P 500, which measures the top companies in the country by market capitalisation

Other major global indices include the FTSE 100 (UK), DAX (Germany), Nikkei 225 (Japan) and Hang Seng (Hong Kong)

You can’t invest directly in spot or cash indices but instead, you can trade derivative instruments based on the original index or exchange-traded funds that track the same stocks

What is an index?

An index is a basket of assets that shows how different parts of the financial universe are performing. It can track stocks, forex, bonds, and commodities, for example, reflecting the fluctuating values of the constituents within it. The price movement up, down, or flat shows how that area is performing, as a whole. Benchmarking can be used to measure a fund or stock’s performance.

Some are categorised by the size of the companies they represent, such as the S&P Small Cap 600 and S&P Composite 1500. Businesses within an index must meet specific criteria. Companies within the S&P 500, for example, must have a certain market capitalisation.

Typically, when people refer to trading indices, they are talking about gaining exposure to global stock markets like the FTSE 100, S&P 500 and Nasdaq 100. They can be quite specific, only holding assets from a certain stock market sector, industry or particular country.

What is a volatility index?

The VIX volatility index was created in order to assess the S&P 500 market but is often used by investors and traders to study the volatility of the US market as a whole. It represents the market’s expectations of price changes within the S&P 500 over the next 30 days.

A very high volatility often represents fear amongst investors, which is why the VIX is commonly known as the "fear index" or "fear gauge". When there is fear within the market, the VIX percentage value tends to increase in times of high volatility and decrease when the market stabilises.

How are they calculated or weighted?

Indices are calculated and weighted in different ways, and this is usually down to the managing company (such as index providers like S&P, FTSE and MSCI). Here are some common methods used:

Equal-weighted: constructed by putting the same amount of capital into each stock, so they have equal weight within the portfolio.

Market capitalisation-weighted: made up of a set number of companies that have the highest market value. These tend to have a higher impact on the overall value of the index.

Price-weighted: give the most weight to stocks that are priced the highest. Stocks that are priced the lowest will have the smallest effect on the index.

They can be rebalanced periodically, such as daily, weekly, monthly, or quarterly, to ensure that the weighting of each stock is in line with its formula and objective.

The value of an index depends upon many factors such as company productivity, prices, and employment. In order for a company to be added, it could be selected by a committee, as is the case with the S&P 500. The committee will consider the eligibility of each new addition based on strict criteria, such as market capitalisation, financial viability, and length of time it has been publicly traded on the stock exchange.

Why are they so attractive to traders?

There are a number of reasons why traders may decide to invest in an index rather than several individual stocks, including the following:

It’s more of a low-cost method. When trading index CFDs, there are no minimum commission charges to pay, unlike when you trade on multiple stocks at once (other fees may apply).

They might pose a lower risk than individual stocks. As the risk is spread out across a number of assets, an index is unlikely to go to zero or go bankrupt, like an individual stock could.

Longer-term investors aim to diversify their portfolio, since a wide range of stocks or other assets can be purchased with a single transaction. They are also popular for day trading, since indices are often discussed regularly in the news and have price movements throughout the day that day traders attempt to capitalise on.

When an index is rising, it is said to be in a bull market. During such times, opening a long (buy) position allows traders to potentially profit from the rise without having to buy, trade or research individual stocks. Similarly, when one falls 20% or more, it’s said to be in a bear market and traders can potentially attempt to profit by shorting in a downward trending market if they think the market will fall down further.

How to trade indices

With CMC Markets, you don’t trade on or invest directly in the global index. Instead, through spread bets and CFDs, you can trade on derivative instruments that are based on the FTSE 100 and more. Traders can take a position based on whether they think the value of an instrument will rise or fall, and subsequently make a profit or loss depending on which way the markets move. Here’s a breakdown of how this can be done:

Fund your trading account or practise with virtual funds on a demo account first. Within the product library on the platform, select ‘Indices’.

Choose an instrument to trade. We offer spread betting and CFDs on instruments that are based on the FTSE 100 and more.

Click on the index name to bring up a chart. Here, you can customise by chart type and timeframe, and add technical indicators and draw tools for technical analysis.

Pick a strategy. Decide whether you want to go long (buy button) if you think the index will rise in price or go short (sell button) if you think it will fall.

Input the relevant fields. This includes order type, entry price, and how much you are willing to risk per point of movement (spread betting account) or position size (CFD account).

Control risk on your trade. Many traders opt to use stop-loss orders to control losses as much as possible.

Place the order and monitor. You may decide to hold your position if you are making a profit or adjust or close your trade if you are experiencing a loss in order to protect your capital. Remember that all your deposits are at risk, so you should ensure you are comfortable with the risk management tools available on the platform.

Open and fund a live account to access the market straight away, or practise first using our risk-free demo account with £10,000 worth of virtual funds.

What are some of the most popular globally?

Here’s a list of the most traded global indices and their main constituents:

S&P 500 includes 500 of the largest US companies by market cap, including Apple, Microsoft, and Amazon.

Dow Jones Industrial Average (or Dow 30) includes 30 blue-chip US companies, such as American Express, 3M, and Walmart.

NASDAQ 100 tracks 100 of the largest US technology stocks, with major holdings including Advanced Micro Devices, Adobe, and Alphabet.

FTSE 100 tracks 100 of the UK’s biggest companies, including AstraZeneca, Unilever, and Diageo.

Russell 2000 tracks 2,000 US small-cap companies, including Plug Power, Penn Gaming, and GameStop.

CAC 40 tracks 40 of the largest companies in France, including L’Oreal, Total, and Sanofi.

Nikkei 225 tracks 225 of the largest companies in Japan, including Mitsubishi, Kobe Steel, and Nippon Yusen.

DAX 40 features 40 of the largest German companies, such as Linde, SAP, and Siemens.

Hang Seng is composed of the largest stocks in Hong Kong, including Industrial and Commercial Bank of China, Xiaomi Corporation, and CNOOC Limited.

EURO STOXX 50/600 is composed of the largest companies in the Eurozone, including ASML, Linde, and Sanofi.

MSCI World holds stocks from multiple countries around the world, with its largest holdings tending to be US stocks.

The CBOE Volatility Index or VIX calculates the 30-day expected volatility in the US stock market.

NIFTY 50 represents the 50 largest stocks in India, including Reliance Industries, Tata Consultancy Services, and HDFC Bank.

S&P/TSX 60 is a benchmark for Canada, featuring 60 stocks like Shopify, Royal Bank of Canada, and Toronto-Dominion Bank.

KOSPI tracks 900 Korean stocks such as Samsung Electronics, Naver, and Hyundai Motor Company.

What are some specific strategies to use?

Trading intermarket correlations?

Stocks are affected, and can have an effect, on other assets. For example, a rising VIX tends to correlate with falling stock indices. Rising bond prices tend to be good for stocks as it shows interest rates are getting lower, while falling bond prices means lack of demand to own bonds, higher interest rates, and downward pressure on indices.

Trading index internals?

This is where traders look at the health of the stocks in the underlying index, which are called market internals. These include market breadth indicators such as:

The number of advancing stocks versus the number of declining stocks (also known as the A/D line).

The number of stocks making new highs or new lows.

The number of stocks above or below a 50 or 200 day moving average.

The Arms Index [TRIN], which compares the AD ratio to AD volume.

The TICK index, which measures the minimum upward or downward price movement.

These indicators either confirm what the index is doing, or they are diverging. When market internal direction diverges with the stock index direction, this forewarns of a potential reversal.

Trading market positioning

Market positioning show the extent to which traders are long or short on an index. When positioning reaches an extreme, which will vary by each asset, that may indicate a potential reversal in price. As an example, if 99% of positions are long, that shows there are very few people who have shorted or think the market could correct lower. Such a scenario may end with a price drop.

When trading on our Next Generation platform, we use a client sentiment indicator that shows the percentage of clients that are long and the value of those trades, which can be used to inform your view on market positioning and take trades according to your strategy

Trading with mutual funds

Mutual funds are another popular asset type to trade, which are essentially portfolios that match the performance of a particular index, such as the FTSE 100. If on average the share prices of the constituents go up, the value of the index should rise along with them, and vice versa. Since indices are made up of many stocks, their value tends to fluctuate. Some are even more volatile than individual shares. This has the benefit of numerous trading opportunities but can also add risk for the trader.

What factors move index prices?

Politics and geopolitics can create stability and confidence, or instability and lack of confidence in the markets. When investors are confident, they tend to be more willing to buy stocks, which helps to push indices higher. When investors aren’t confident or don’t trust the stability of a political situation, they tend to save their money, which leads to stock prices to decline or be flat.

Monetary policy is used to control the amount of money in circulation. When central banks increase the amount of money in circulation, more of that money finds its way into the stock market, which helps to elevate stock prices. When central banks decrease money supply, this has a dampening effect on indices since there are fewer dollars in the economy for buying stocks or for businesses to spend on the pursuit of growth.

Fiscal policy, including tax cuts and spending, affects consumers, investors, and companies. Corporate tax cuts mean more profit for the company. That means better earnings and typically higher stock prices. The same concept applies to tax cuts for consumers, which gives people more money to invest in the stock market. Tax hikes tend to have the opposite effect by hurting corporate profits and leaving consumers with less cash.

Economic performance and indicators can tell investors how the economy is doing. Data on inflation and employment shows whether there is likely to be more or less money flowing into stocks. A strong labour market is typically good for stocks, while increasing unemployment is not. Lower inflation is usually better for stocks, while higher inflation tends to dampen an index’s performance.

Financial shocks and unforeseen negative events (sometimes referred to as black swan events) can lead to a stock market crash, such as unexpected incidents like a pandemic or a dramatic decline in another asset class that rattles investor confidence. It could be the failure of a major bank or corporation that affects many people and investors, or it could be a drastic change in tax law or government policy.

Investor sentiment is how investors feel toward stocks. As a group, are investors more likely to buy or sell? This is what pushes prices up and down. Sentiment is determined by all the other factors mentioned above. When sentiment gets extremely high, or euphoric, that is potentially a sign of a stock market bubble.

Constituent performance is what directly affects the performance of stock indices, as this is what gives them their value. If the vast majority of stocks inside are falling, it should fall, and if the stocks inside are rising, it should rise.

Example of spread betting indices

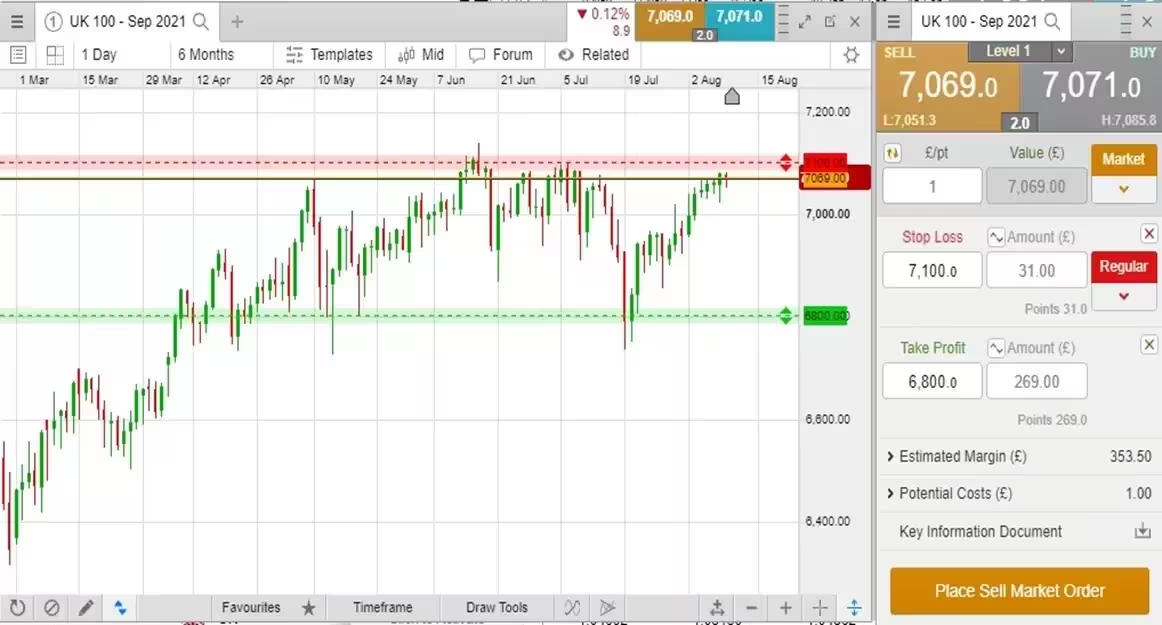

Assume a trader believes that UK stocks will fall, and they want to potentially profit from the decline by trading on our UK 100 – Cash instrument (based on the FTSE 100). Using a spread betting account, they open a position on our derivative instrument.

They determine how much they wish to risk per point of movement. Let’s say they go short at 7,069, and they are willing to risk £1 per point (with a margin rate of 5%, this requires an initial margin of £354). They believe that if the price falls, it will fall to 6,800. This is where they place the profit target, 269 points below the entry. If the price falls and reaches the target price, the trade is closed for a £269 profit.

They place a stop loss at 7,100, which is 31 points above their entry price. This means that they are risking £31 on the trade. If the price moves up to 7,100, they could exit the trade at a loss. In case of slippage or gapping, they might lose more than £31. Learn about our guaranteed stop-losses , which are not subject to slippage and gapping.

Spread betting and CFDs are leveraged products., Whilst you only need a fraction of the notional value of the transaction to open a trade, your profits or your losses might be greater, as they are equally magnified by the leverage. For instance, using the example above, the worst-case scenario where the UK 100 drops to 0 may cause you to lose up to £7,069.

[Diagram is for illustration purposes only. Past performance is not indicative of future results.]

Cash vs forward indices

We offer both cash and forward assets on our Next Generation trading platform. Whereas forward contracts have an expiry date, a cash contract does not, but you can automatically roll your position over into the next contract on expiry. With a cash index, you pay an overnight holding cost but with forward trading, you do not. This makes forwards cheaper to trade than cash contracts if you are holding over a longer period.

Spreads are usually wider on forwards than on cash contracts, therefore, depending on your trading strategy, it might be more cost efficient to trade either forwards or cash products. Cash prices and forward prices will often be slightly different since a forward doesn’t mature/expire until sometime in the future.

What are the risks?

Indices trading is considered by many to be a lower-risk strategy, as you are spreading your risk across an entire segment or sector, as opposed to a single stock. However, there are still some risks involved, such as the use of leverage, which can amplify losses and cause traders to lose their entire deposit if a trade is unsuccessful. However, please note that Retail clients benefit from a negative balance protection.

You are trading a derivative instead of a physical asset. Here, a derivative is an instrument that obtains its value from the price of an underlying asset, such as an individual stock or stock index. The risk is that the movement of just one stock or security could have a major impact on the overall value.

It’s therefore important to do some research prior to trading indices. It’s a good idea to make use of risk-management tools to protect your positions against sudden market moves. These include stop-loss orders such as guaranteed stop-losses. A stop-loss order will close a losing trade once price passes a trigger value pre-decided by the investor. These are very effective in the event of sharp price action.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Some global exchange-traded funds (ETFs) that track the performance of major stock indices include Vanguard FTSE All-World ex-US ETF, Vanguard FTSE Emerging Markets Index ETF and Vanguard FTSE Developed Markets ETF, all of which can be traded on our Next Generation platform.

When indices rebalance, there is negligible impact on the index since it always reflects the value of the constituents at any given time. But when a new stock is dropped or added to an index, the price of that company can sometimes see a substantial movement in price, so it may be a good idea to keep an eye out for constituent changes.

A forex index tracks a basket of currency pairs that share the same base currency, giving you exposure to a particular currency’s movement. Learn more about forex indices we offer, from GBP, USD, JPY & CHF all the way to CNH & SGD.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.