Any questions?

Email us atWe're available whenever the markets are open, from Sunday night through to Friday night.

2Overall profit takes into account spreads and commissions. 'Top Clients' refers to overall account performance and is not specific to performance in that particular CMC Markets product.

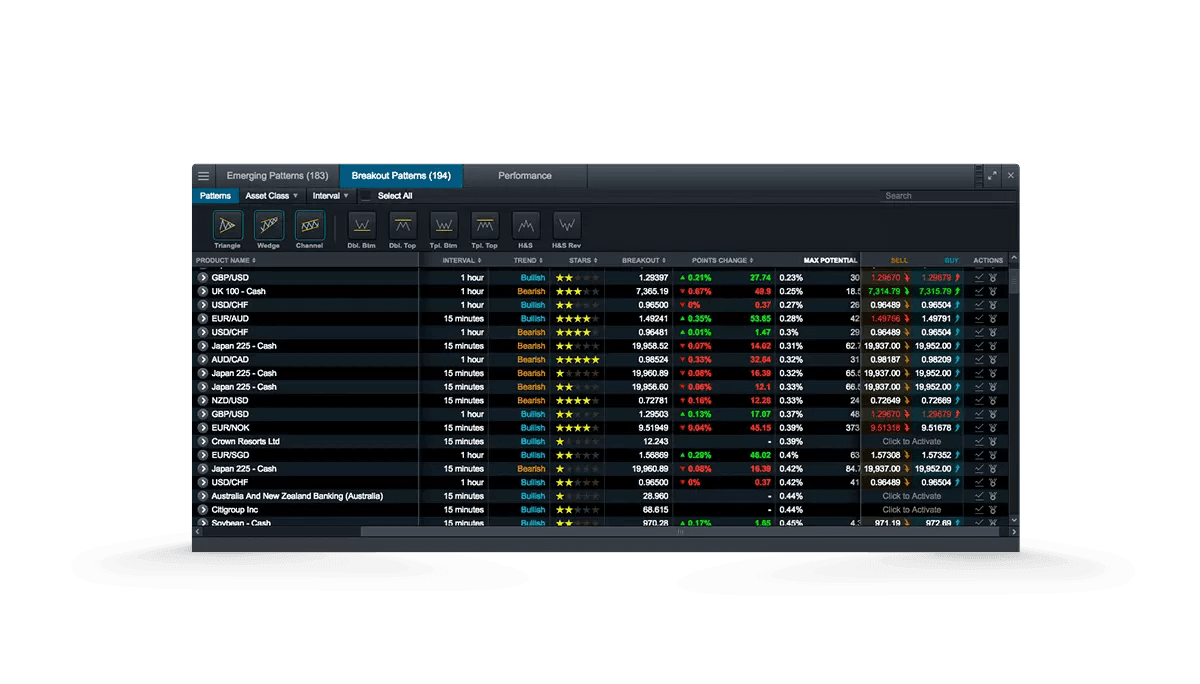

3The pattern recognition scanner is for general information only and is not intended to provide trading or investment advice. We do not guarantee the accuracy, completeness or timeliness of the data. All analysis, resulting conclusions and observations in the Pattern Recognition Scanner are based upon historical chart information and patterns, which are in turn based upon historical CMC Markets trading data and not data relating to the ultimate underlying instrument(s). Note that our charts display prices denominated in the underlying currency for the instrument. Any information relating to past performance does not necessarily guarantee future performance. The use of charting data has inherent limitations, and you should not use this data solely to decide (or assist you in determining) which instrument to buy or sell.