Welcome to Michael Kramer’s pick of the top market events to look out for in the week ahead.

With the busiest part of earnings season behind us, the focus in the coming week shifts back to central bank monetary policy, with the US Federal Reserve and the Bank of England each holding rate-setting meetings this week. Although earnings season may have peaked, a few big names are still to report, including chip industry heavyweights Arm and Qualcomm, both on Wednesday. But perhaps the most significant upcoming event is Tuesday’s US presidential election – more on that below.

US election

Tuesday 5 November

The US election is likely to have a significant impact on financial markets, both in the short and long term. Traders and investors are bracing themselves for a period of volatility in what the polls suggest is an extremely close race for the White House. The truth is that nobody knows what will happen, but it seems likely that the result will be decided by voting in seven swing states, with Pennsylvania carrying the most electoral votes of the group. The tightness of the race suggests that it may take a few days for a clear winner to emerge.

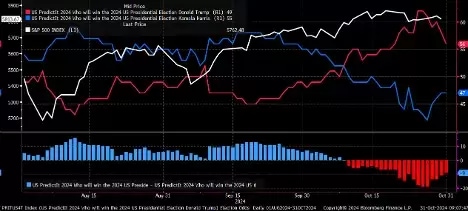

With just a few days left until voters head to the polls, former president Donald Trump’s lead over vice-president Kamala Harris in the betting market has narrowed. The US betting site PredictIt gives Trump a 56% chance of winning, down from 58% last week, with Harris on 47%, up from 44% last week. (Put another way, among those betting on Trump 56% back him to win and 44% bet he’ll lose. Among those betting on Harris, 47% back her to win and 53% bet she’ll lose). As we commented last week, it’s important to take the betting market data with a pinch of salt. It’s possible that a small number of large stakes skewed the data in Trump’s favour, perhaps in a bid to shape voter perceptions of the two main candidates. It’s also possible that Trump supporters may be more likely to place bets than Harris supporters.

Wall Street’s benchmark share index the S&P 500, represented by the white line on the below chart, has been essentially flat since mid-August, suggesting that traders are adopting a wait-and-see approach ahead of the election.

Trump remains ahead of Harris in the US betting market

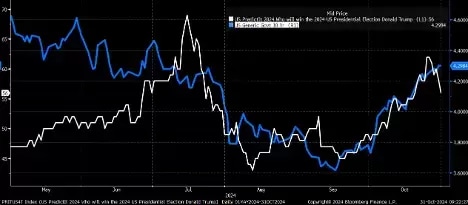

Some commentators have attributed the recent rise in the yield – effectively the US government’s borrowing cost – on 10-year Treasury notes to expectations of a Trump win. However, over the past few days, we have seen the link decouple, with Trump’s betting-market odds of victory falling and 10-year yields continuing to rise towards 4.3%. This divergence suggests that the rise in long-term borrowing rates since mid-September may not be connected to the prospect of a Trump win.

Are Trump’s odds of winning linked to US government borrowing costs? It appears not

Arm Q2 results

Wednesday 6 November

Chip designer Arm Holdings is set to report that earnings fell 28.4% in the fiscal second quarter of 2025 to $0.26 a share, while revenue grew 0.5% year-on-year to $810.1m, according to analyst estimates. Meanwhile, adjusted gross margins are expected to remain unchanged compared to a year ago at 96.8%. Looking ahead to the third quarter, analysts project earnings to grow 17.2% to $0.34 a share, on revenue growth of 15.4% to $950.9m. Adjusted gross margins are expected to rise to 96.9% from 95.6%. The market is anticipating significant volatility in the Arm stock price following the Q2 results, with a potential rise or fall of as much as 11.7%, based on current options pricing.

Shares of the UK-based, Nasdaq-listed company are up 105% year-to-date, having closed on Thursday at $141.30. The stock has benefited from the AI craze and the company’s potential to capitalise on growth in this industry. However, the technical chart below reveals a possible bear flag pattern, typically an indicator of a potential continuation of a downtrend. Additionally, the relative strength index (RSI) at the bottom of the chart has fallen steadily in the past few months, signalling weakening momentum. A break below support at $136 could trigger a decline towards $116 over the medium term. Upside potential appears limited, with resistance at $157.

Arm share price, May 2024 - present

Bank of England interest rate decision

Thursday 7 November

The market indicates that there is a 91% probability that the Bank of England will cut interest rates by a quarter of a percentage point to 4.75% on Thursday. After a quarter-point cut on 1 August, the Bank held rates at 5% when it last met on 19 September.

After Thursday’s meeting, the future becomes less clear. The market does not expect another rate cut until March. Traders will likely want to hear some guidance from governor Andrew Bailey on the future path of monetary policy, especially considering the Budget that chancellor Rachel Reeves set out on Wednesday.

The pound has struggled against the dollar recently, slipping from $1.34 in late September to current levels of around $1.29. If the BoE pushes back against calls for further rate cuts, the pound could strengthen against the dollar. However, with the Federal Reserve making its own interest rate announcement later on Thursday, we may not get the full picture until the day is out. If the Fed also pushes back against rate cuts, the pound could weaken significantly, especially if the UK government’s Budget continues to be a concern. At present, GBP/USD faces resistance at $1.30, while support is at $1.279.

GBP/USD, January 2024 - present

US Federal Reserve interest rate decision

Thursday 7 November

With the Federal Reserve’s interest rate decision coming just two days after the US election, the market appears uncertain about what could unfold. Recent US economic data – from the labour market to GDP growth – has been better than expected, forcing the market to re-evaluate the likelihood of future rate cuts. At present, the market is pricing in an 80% chance that the Fed will cut rates by a quarter of a percentage point to a target range of 4.5% to 4.75%. In some ways, the Fed’s half-point cut in September is beginning to look like a mistake.

A more hawkish-than-expected Fed could lead to equity prices falling, especially with indexes like the Nasdaq 100 very close to breaking support levels. Moving in a rising wedge pattern, the tech-heavy index is nearing the lower trendline and support at 19,965. A break of that support level could pave the way for a drop towards 19,315, and potentially to the 5 August levels below 18,000 if a sell-off gains momentum.

US 100, June 2024 - present

Key economic and company events

Our rundown of notable economic announcements and US and UK company reports scheduled for the coming week:

Saturday 2 November

• Results: Berkshire Hathaway (Q3)

Monday 4 November

• Australia: October Judo Bank purchasing managers’ index (PMI) data

• Eurozone, France, Germany, Italy, Spain: October HCOB manufacturing PMI

• US: September factory orders

• Results: BioNTech (Q3), Constellation Energy (Q3), Fox (Q1), Marriott (Q3), New York Times (Q3), NXP Semiconductors (Q3), Palantir (Q3), Vertex Pharmaceuticals (Q3), Zoetis (Q3)

Tuesday 5 November

• Australia: Reserve Bank of Australia interest rate decision

• China: October Caixin services PMI

• Japan: Bank of Japan monetary policy meeting minutes

• New Zealand: Q3 unemployment rate and employment change

• US: Presidential election, October S&P Global PMI data, October ISM services PMI

• Results: Apollo Global Management (Q3), Asos (FY), Associated British Foods (FY), Gartner (Q3), Smiths News (FY), Super Micro Computer (Q1), Yum! Brands (Q3)

Wednesday 6 November

• Eurozone, France, Germany, Italy, Spain: October HCOB services PMI

• Eurozone: September producer price index (PPI)

• Germany: September factory orders

• Results: Arm Holdings (Q2), CVS Health (Q3), Duolingo (Q3), Gilead Sciences (Q3), Lyft (Q3), Qualcomm (Q4)

Thursday 7 November

• Australia: September exports, imports and trade balance

• China: October exports, imports and trade balance

• Eurozone: September retail sales

• Germany: September exports, imports, trade balance and industrial production

• UK: Bank of England interest rate decision

• US: Federal Reserve interest rate decision, initial jobless claims to 1 November, Q3 flash non-farm productivity, Q3 flash unit labour costs

• Results: Air Products (Q4), Airbnb (Q3), Arista Networks (Q3), AutoTrader (HY), BT (HY), Dropbox (Q3), Duke Energy (Q3), Endeavour Mining (Q3), Expedia (Q3), J Sainsbury (HY), Match (Q3), Moderna (Q3), Molson Coors (Q3), Motorola Solutions (Q3), National Grid (HY), Pinterest (Q3), Ralph Lauren (Q2), Rivian (Q3), Trainline (HY), Transdigm (Q4), Warner Bros. Discovery (Q3), Wizz Air (HY)

Friday 8 November

• Canada: October net change in employment, October average hourly wages

• Eurozone: EU leaders summit

• Results: International Consolidated Airlines (Q3), Lamar Advertising (Q3)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.