A little defence goes a long way when markets move. Manage risk with Shield Mode on a Next Generation CFD account.

Shield Mode

Find your feet with Shield Mode

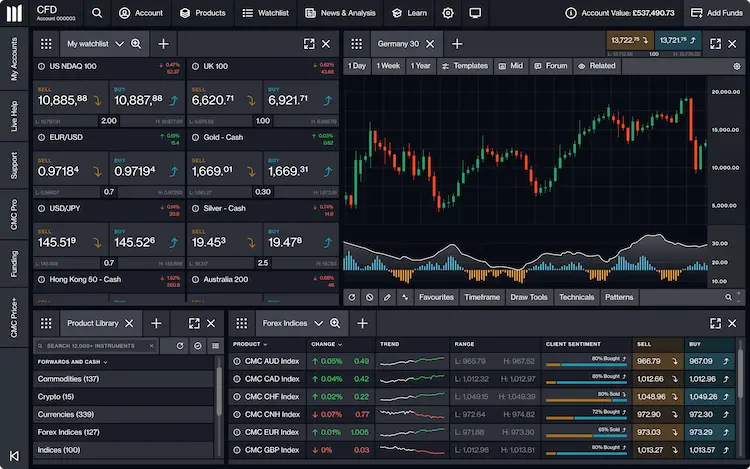

- Extra protection on popular productsTrade a range of FX, Indices, Commodities, ETFs and shares.

- Guaranteed stop loss orderClose out every trade at a specified price regardless of volatility.*

- Negative balance protectionNever lose more than your deposit.

- 24/5 support

Our support team is available 24 hours, Monday – Saturday (in line with global market hours).

*IMPORTANT: Shield Mode is an account setting on our platform that caps your potential losses to your deposited amount, facilitated by the use of Guaranteed Stop Loss Orders (which come with associated costs). Activating Shield Mode significantly reduces the range of products available to trade. After activation, a list of products eligible for trading under Shield Mode can be accessed directly on our platform.

Shield Mode is an extra layer of protection on your CFD account. It includes built-in risk management tools such as guaranteed stop-loss on every trade and negative balance protection to help manage risk if markets move against you.

Trade a range of FX, indices, commodities, ETFs and shares with more confidence. Shield Mode limits your risk while you get comfortable moving in markets.

To activate Shield Mode, email support@cmcmarkets.co.nz or phone 0800 26 26 27.

Small tweaks. Big protection.

CFD account with Shield Mode | Standard Next Generation CFD account | |

|---|---|---|

FX | 54 | 325 |

Indices | 64 | 101 |

Commodities | 96 | 134 |

ETFs | 624 | 1191 |

Shares | 2467 | 10049 |

Treasuries | No | Yes |

Forex Indices | No | Yes |

Share Baskets | No | Yes |

Crypto | No | Yes |

GSLO | Mandatory | Optional |

GSLO Costs Refund | Yes | Yes |

Account Netting | On | Optional |

Negative Balance Protection | Yes | No |

Accurate as of 15.10.2024. Product numbers are subject to change.

IMPORTANT: Shield Mode is an account setting on our platform that caps your potential losses to your deposited amount, facilitated by the use of Guaranteed Stop Loss Orders (which come with associated costs). Activating Shield Mode significantly reduces the range of products available to trade. After activation, a list of products eligible for trading under Shield Mode can be accessed directly on our platform.

How to open a Shield Mode account

^ Email support@cmcmarkets.co.nz or call 0800 26 26 27

Shield Mode

Frequently asked questions

Contact us on at 0800 26 26 27 or support@cmcmarkets.co.nz to activate Shield Mode.

A guaranteed stop-loss order (GSLO) works in the same way as a stop-loss order except that it guarantees to close out a trade at the price specified, regardless of market volatility or gapping. If you wish to place a GSLO on a trade, you will be required to pay a small cost, called a 'GSLO premium'. The GSLO premium amount to be paid when placing a guaranteed stop-loss order on a trade is calculated as follows: premium rate x number of units. Learn more about Guaranteed stop-loss here.

Guaranteed stop loss orders (GSLOs) work the same as regular stop loss orders except, for a small premium charge, they guarantee to close out a trade at the price you specify, regardless of market volatility or gapping. If the GSLO is not triggered, we'll refund 100% of the original premium. If you add a GSLO to an open trade then the margin required will be the margin rate set by CMC, or the maximum loss for that trade – whichever amount is greater. This GSLO-specific margin type is called 'Prime Margin' and will be displayed at the foot of the order ticket. Learn more here.

The cost of Shield Mode on your CFD account is the same as having a standard CFD account with CMC Markets. The only difference being a GSLO needs to be attached to each trade and it will incur a premium. The GSLO premium (100%) will be refunded to you if the GSLO is cancelled before it’s executed. An additional premium is not required to modify an existing GSLO.

Shield Mode reduces some key risk associated with a standard CFD account, but market risk and loss of trading capital still exists. Find more information on the risks of trading CFDs here.

You can trade a range of FX, indices, commodities, ETFs and shares with a limited range versus our standard account.

Winner 2023

#1 web platform

ForexBrokers

Winner 2024

Best Mobile Trading Platform

ADVFN International Financial Awards 2024

Winner 2025

Most Currency Pairs

ForexBrokers

Winner 2025

#1 Commissions & Fees

ForexBrokers