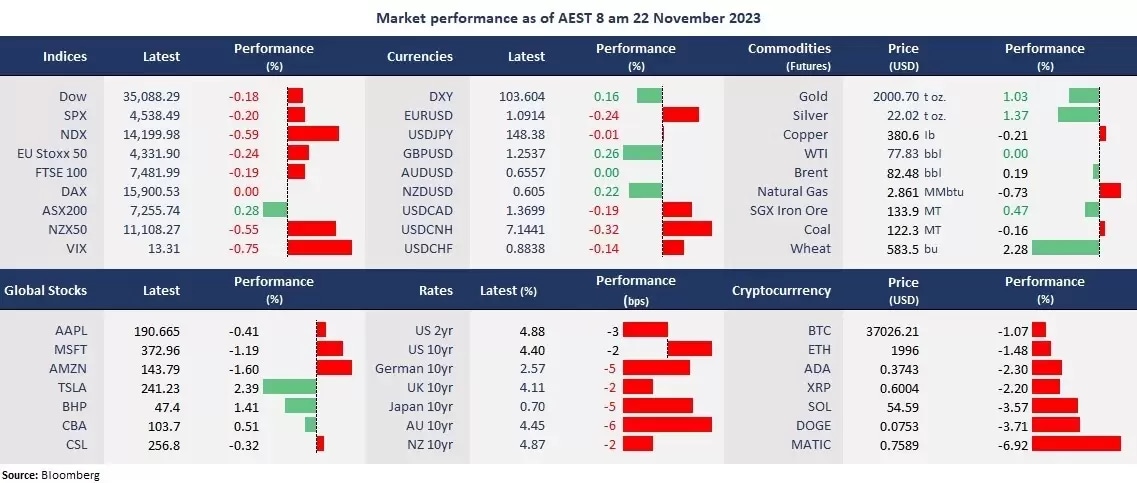

- Stock market fell: Wall Street was lower as the tech-fuelled rally took a breather. Most big tech shares retreated from an overbought level. The Fed minutes for November show that members see further tightening needed if inflation stays sticky.

- Chinese Yuan strengthened: The USD index was slightly higher but remained at a nearly three-month low level. The Chinese Yuan was particularly strong as USD/CNH fell for the third straight trading day, thanks to Beijing’s efforts to stabilize the exchange rates.

- Gold topped 2,000: Both spot gold and gold futures rose to above US$2,000 per ounce, the highest since late October. Falling US bond yields and a softened US dollar are the primary bullish factors for precious metal prices. Silver also jumped 1.4% to above US$22 per ounce.

- Crude oil was flat: Crude oil prices were little changed ahead of the OPEC meeting. The organization is expected to cut outputs further next year amid a global economic growth slowdown. Oil price is under pressure of the 50-day moving average from a technical perspective.

- Asian markets to open lower: The Hang Seng Index futures were down 0.26%, and the ASX 200 futures fell 0.04%.

Chart of the Day:

Gold, daily – Gold is testing the key resistance of 2,000, with near-term potential support at the 50-day moving average of 1,931. While a possible pullback is expected, a bullish breakout of 2,000 may take it to an all-time high again.

Source: CMC Markets as of 22 November 2023

Company News:

- NVIDIA (NDX: NDVA) was flat in after-hours trading despite a strong earnings beat. The AI chipmaker’s overall revenue surged 206% year on year, beating an estimated 170%. Its data center’ s revenue jumped 239%, thanks to its near monopoly AI chip market shares.

- Amazon (NDX: AMZN) fell nearly 2% on the news that founder and Executive chair Jeff Bezos may sell more of his stakes, which could take the total amount of selling to more than US$1 billion. But it only accounts for less than 0.1% of Amazon’s market cap.

- Microsoft (NDX: MSFT) fell 1.4% as the OpenAI board has opened negotiations to reinstate former CEO Sam Altman, who was ousted last Friday. Microsoft CEO offered Altman a position to lead a new in-house AI team on Tuesday.

- Binance Coin (BNB) fell nearly 5% as the world’s largest crypto exchange, Binance’s CEO, Chang Peng Zhao, resigned amid the court charges. Binance was charged with money laundering violations, suspicious transactions with terrorists, and unlicensed money transmitting business.

Today’s Agenda:

- Australian MI leading index for October

- US Unemployment Claims

- US Durable Goods Orders