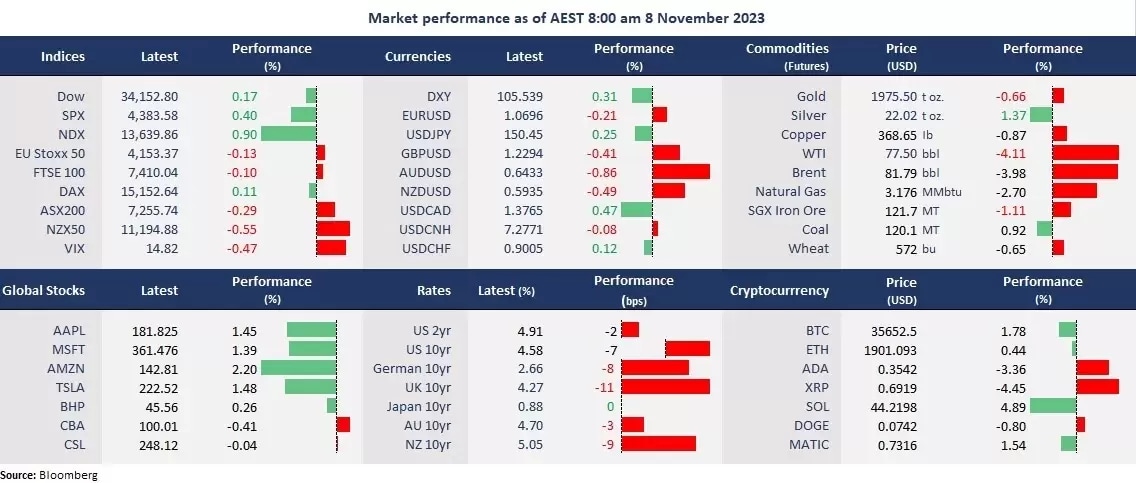

Here are today's main market standouts as China data sends oil lower, while US IT monitoring and analytics company Datadog's shares leapt higher.

- Global government bond yields slumped as peak rate bets are still in play.

- Tech powered Wall Street’s rally as the S&P 500 extended a seven-day winning streak. Amazon led gains.

- The US dollar strengthened as the BOE’s official hinted rate cuts in 2024, and the RBA did a dovish hike.

- Chinese data sank oil prices, with WTI and Brent futures hitting the lowest level since July.

- Gold retreated further due to a firmed USD, whilst risk-off abated.

- Asian stock markets are set to open slightly higher. ASX 200 futures were up 0.08%, and Hang Seng Index futures rose 0.18%.

Chart of the day

WTI, daily

Company news

- WeWork filed for Chapter 11 bankruptcy, which threatens office closures in the US and London.

- Datadog (NDX: DDOG) soared 28% as AI-powered cloud revenue beat estimates and raised full-year guidance. CEO Olivier Pomel said “AI native customers” contributed 2.5% of its annualized revenue.

- Uber (NYSE: UBER) rose 3.7% despite an earnings miss as gross bookings, trips and active consumers saw strength.

ASX corporate actions

- JHX to release Q2 FY24 earnings call. Consensus calls for EPS at a 9.7% average growth in the past three years.

- WDS is set to launch Investor Day

- RMD Dividend Ex. US$0.48. Pay Date: 12/14/23

Today’s agenda

- New Zealand Inflation Expectations

- Japan’s Leading Indicators

- ECB’s President Lagarde Speaks

- BOE’s Governor Bailey Speaks

- Fed Chair Powell Speaks