At the time of writing, since the beginning of 2021, the S&P 500 is up 23.8%, or accounting for the inclusion of dividends, up 25.5%.

While there has been around a dozen pullbacks in the year’s upward trend in the S&P 500, and three of the pullbacks have been more than 5%, the upward trend in the S&P 500 over 2021 remained intact. The first decline of 5.7% occurred in mid-February to early March. The second decline of 5.8% occurred in late September to early October, and the third decline of 5.2% occurred in late November to early December. The S&P 500 was down slightly just before Christmas.

A number of factors contributed to the pullbacks in the S&P 500 during the year. In the first three months of the year, the US ten-year treasury yield almost doubled from 0.90% to 1.77%, driven by rising inflation concerns. Higher U.S. treasury yields will typically work to reduce valuation metrics in stockmarket analysis. Adding further fuel to the episodes of selling were varying concerns about the implications of rising covid cases, and levels of strength in the US labour market.

However, over the course of 2021, US weekly jobless claims trended down, non-farm payroll employment growth rose, and the unemployment rate declined from 6.3% at the start of 2021 to 4.2% (in November) as at late December. The improvements in the labour market helped support the picture of solid U.S. economic growth.

Rising U.S. inflation concerns brought forward the timing of the Fed’s decision to begin tapering asset purchases in November. The market pricing for the first lift in the Fed funds rate was also brought forward to early-to-mid 2022.

On the positive side, a number of factors assisted to drive the S&P 500 to its year-to-date total return of 25.5%, which built on the total return of 18.4% in 2020 (despite the early 2020 pandemic-led fall) and the total return of 31.5% in 2019. Three consecutive years of solid double-digit stock returns.

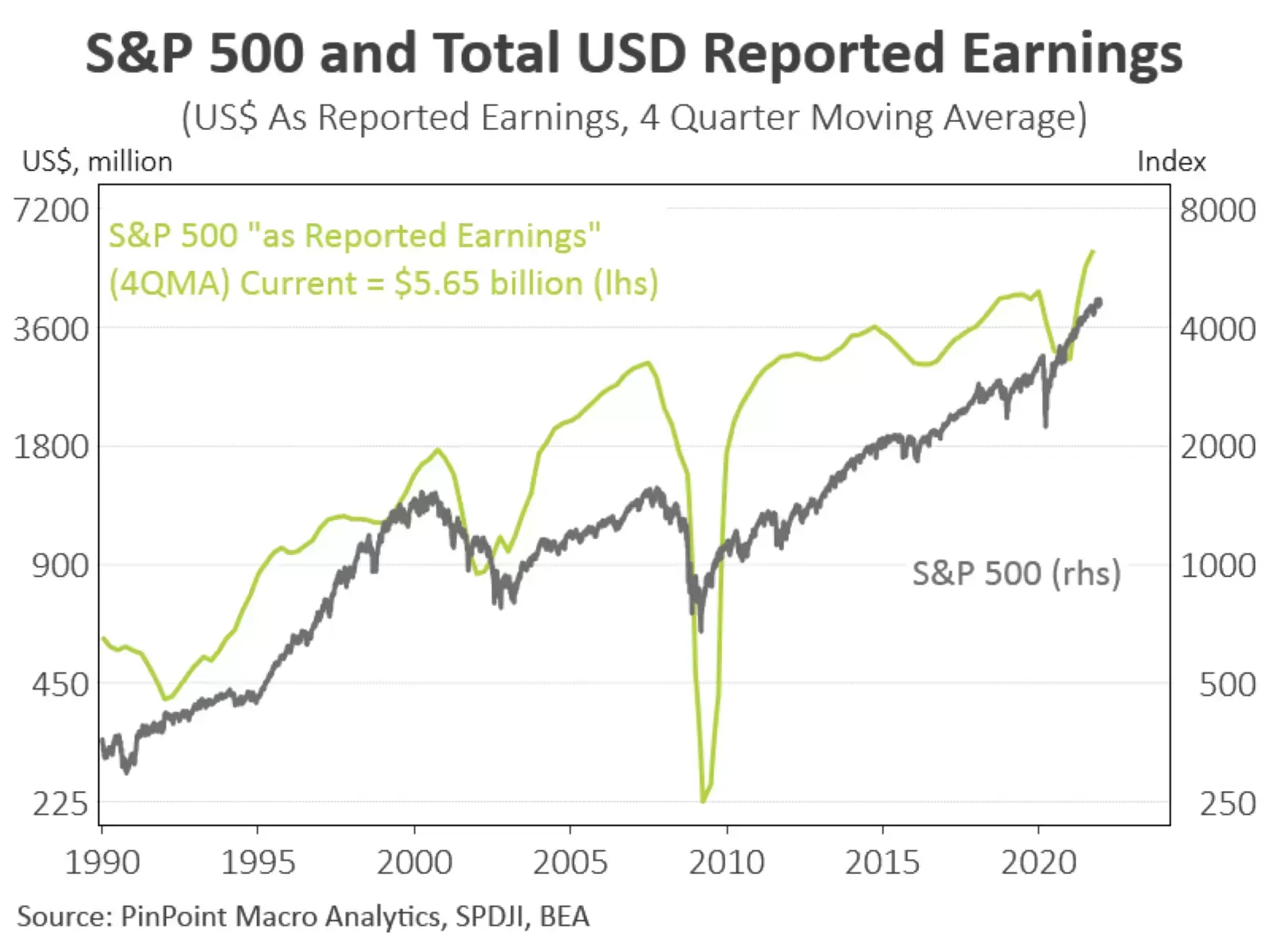

The combination of a well-performing US economy, as well as improvements in the global economy, helped lift U.S. corporate earnings. S&P 500 “as reported earnings” lifted to a record high in 2021, helping to support strong double-digit percentage gains in the S&P index over 2021 (see chart).

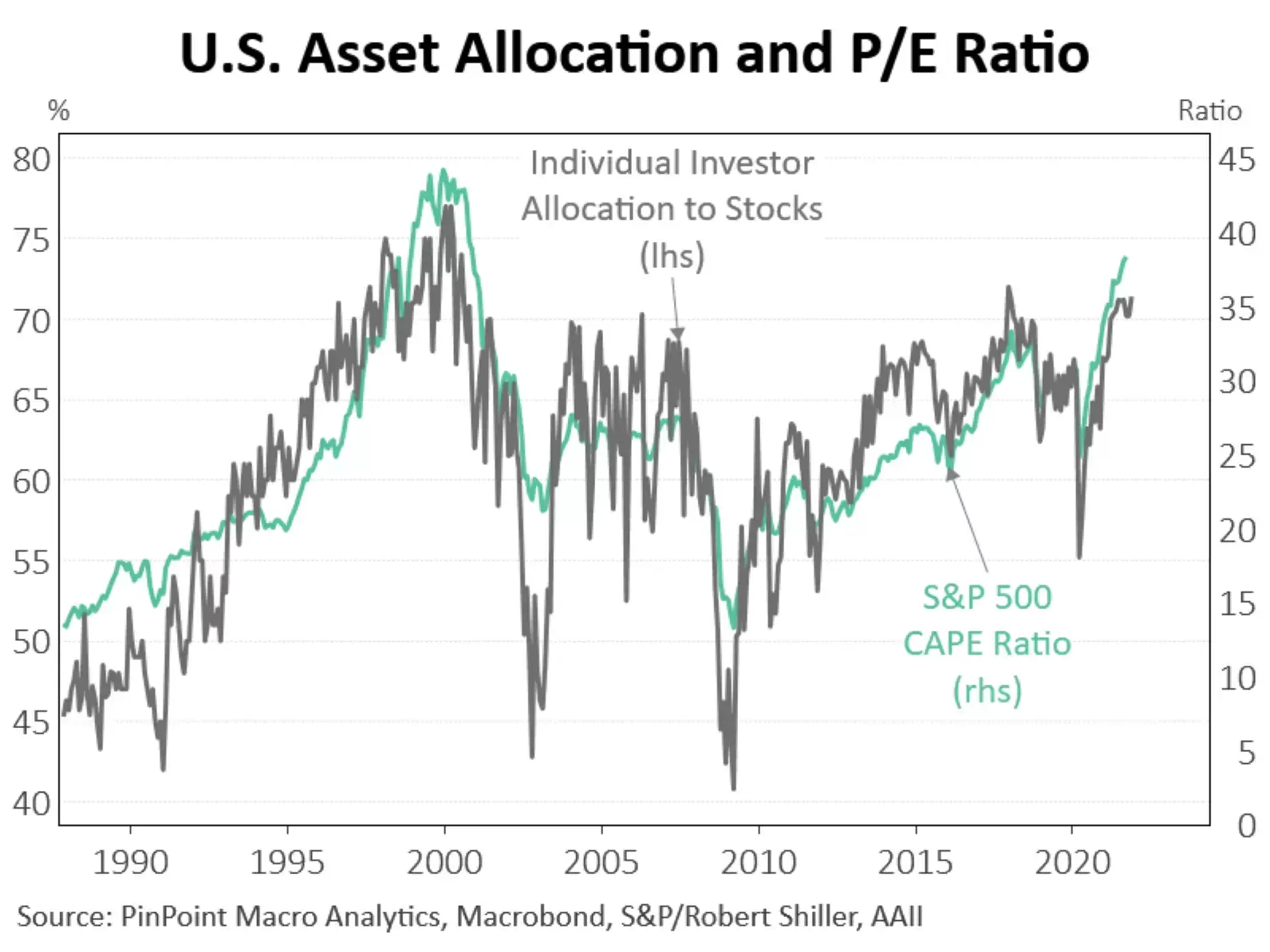

Adding further strength to the stockmarket’s 2021 performance was a lift in investor’s allocation to equities, to over 70% of total US financial assets, the highest on record as percentage of financial assets. As a percentage of total asset allocation, the allocation to US stocks lifted to multi-year highs, helping to drive the S&P 500 price-to-earnings ratio to multi-year highs too (see chart).

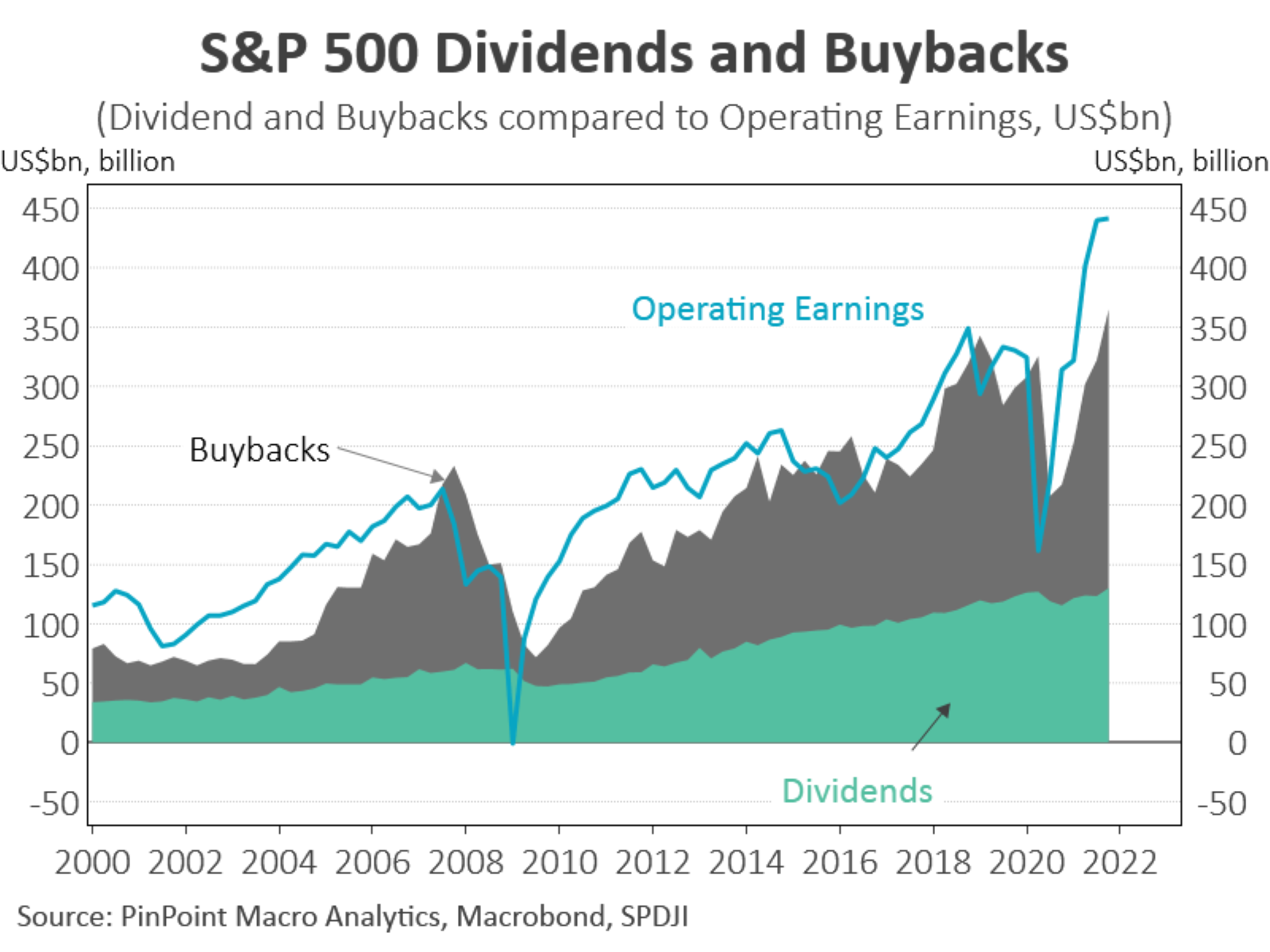

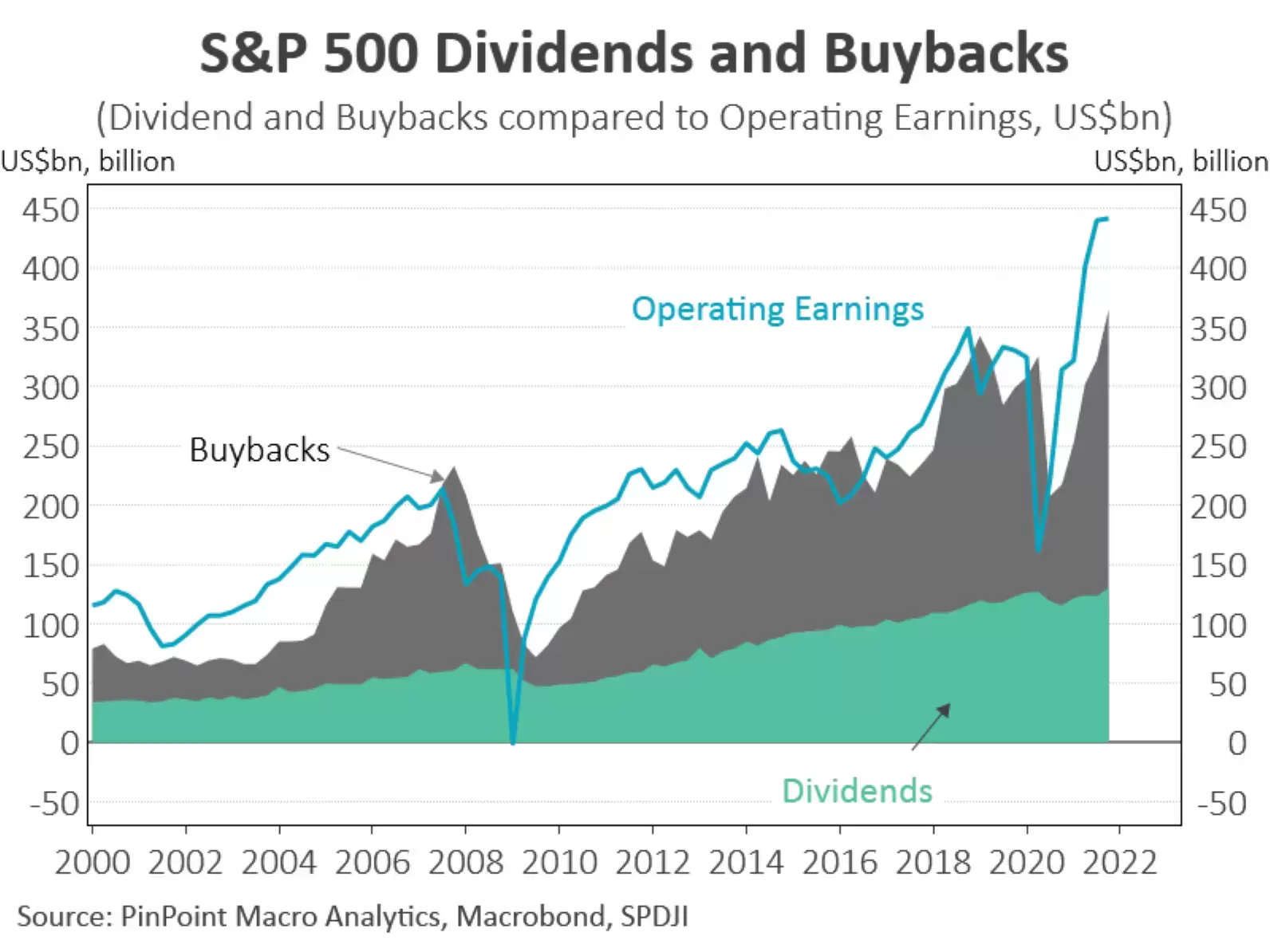

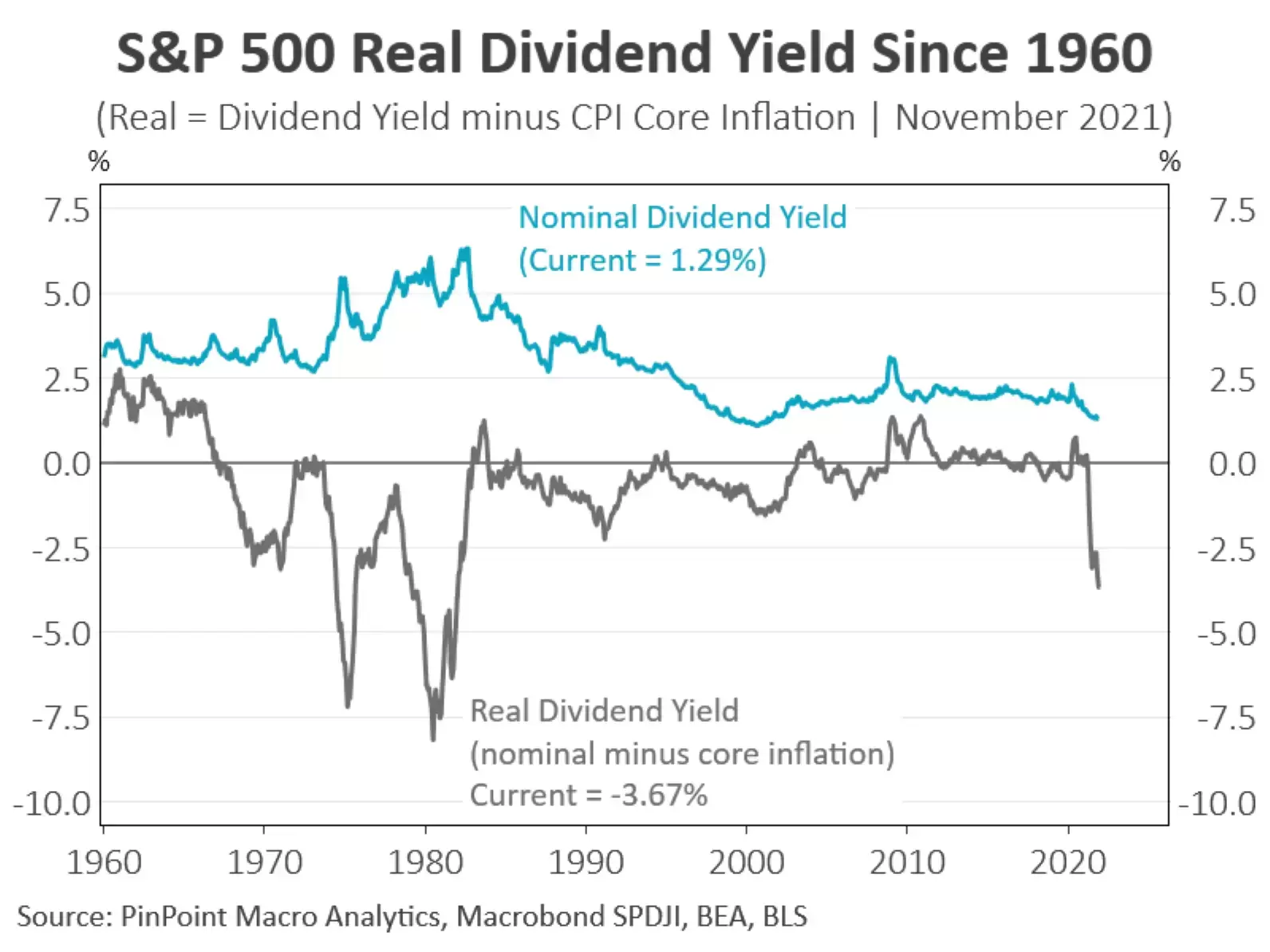

Two other factors adding to the S&P 500’s impressive 2021 returns were a lift in dividends, and an increase in buy backs by S&P 500 companies (see chart). Despite a lift in dividend payments over 2021, the average dividend yield for S&P 500 companies edged lower to 1.29% in 2021 as US stock prices advanced. The large lift in inflation over 2021 meant the real (inflation-adjusted) dividend yield declined to its lowest level since the early 1980s. Real dividend yields declined to -3.67% (see chart).

The outlook for the S&P 500 over 2022 is somewhat less rosy than in 2021 because of the macro headwinds facing US equity markets as we enter 2022. These headwinds include high inflation, low real dividend yields, a high P/E ratio (currently 22.06%) and reduced fiscal and monetary stimulus. Additional macro headwinds include the likelihood the US Federal reserve will lift interest rates for the first time in more than six years in 2022, and a slowing in US earnings growth because of USD appreciation and reduced stimulus in the US and global economy.

PinPoint Macro Analytics

IMPORTANT INFORMATION AND DISCLAIMER

Factual Information Only. No Investment Advice is Provided.

The information contained on this document is factual information only. We do not provide trade recommendations or investment advice. The information contained on this document is not opinion. Macro Analytics Pty Ltd, ABN 65 642 332 045, is trading as "PinPoint Macro Analytics".

The source of all content on this document is believed to be accurate and reliable. All content on this document is provided in good faith. However, PinPoint Macro Analytics takes no responsibility for errors in the content provided on this document.

Any content contained on this document is not to be construed as a solicitation or an offer to buy or sell any securities or financial instruments, or as a recommendation and/or investment advice. Before acting on the information contained in this document, you should consider the appropriateness and suitability of the information to your own objectives, financial situation and needs, and, if necessary seek appropriate professional or financial advice, including tax and legal advice.

PinPoint Macro Analytics will not accept liability for any loss or damage (including indirect or consequential damages) or costs which might be incurred as a result of the information being inaccurate or incomplete in any way and for any reason. This includes without limitation any loss of profit, which may arise directly or indirectly from content viewed on this document.

This document may contain hypertext links, frames or other references to other parties and their documents. PinPoint Macro Analytics cannot control the contents of those other sites, and make no warranty about the accuracy, timeliness or subject matter of the material located on those sites. PinPoint Macro Analytics do not necessarily approve of, endorse, or sponsor any content or material on such sites. PinPoint Macro Analytics make no warranties or representations that material on other documents to which this document is linked does not infringe the intellectual property rights of any person anywhere in the world.

PinPoint Macro Analytics are not, and must not be taken to be, authorising infringement of any intellectual property rights contained in material or other sites by linking or allowing links to, this document to such material on other sites.

If you have any concerns regarding the content of the document, please contact PinPoint Macro Analytics at info@pinpointmacroanalytics.com.au