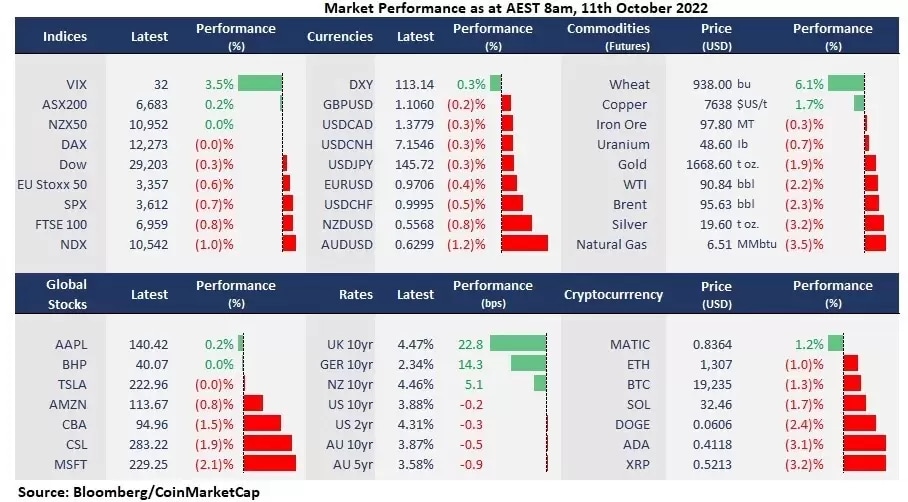

Wall Street finished lower on Monday following Friday’s decline due to strong job data. Investors are cautiously awaiting the key CPI data that is due for release this Thursday. The US bond yields stayed flat at their multi-year highs, supporting the US dollar index to rise for the fifth straight trading day, pressuring all the other major currencies and commodity prices, with both gold and oil futures down nearly 2%. While AMD’s revenue downgrade from last week continued to drag on tech shares, broad equity markets flirted with their year-low levels, suggesting that investors are growing bets for cooler inflation data, which may help the Fed to soften their hawkish tone, though the Fed officials, including the Chicago Fed President Charles Evans and Fed Vice Chari Lael Brainard, continued to back the aggressive rate hikes.

- Nasdaq closes at a two-year low level, down 1.04%, to 10,542.1, dragged by chip stocks, with Nvidia down 3.36%, Broadcom down 5% and AMD down 1%. 7 out of 11 sectors in the S&P 500 finished lower, with Energy and Technology leading losses, down 2.06% and 1.56%, respectively. While Industrial, Consumer Staples, Materials and utilities were slightly higher. Mega-cap tech shares were mixed, with Microsoft down 2.2%, while Apple and Meta Platforms were marginally up.

- JPMorgan Chase CEO Jamie Dimon warns of a global economic recession in mid-2023. He mentioned that soaring inflation, rapidly rising rates, along with Russia-Ukraine war may tip the US and the world into recession and believes that Europe is already in recession.

- USD/JPY closes at the highest level seen in August 1998, as the dollar index back to above 113. The Australian dollar tumbled to the lowest level against the greenback to just under 0.63 since April 2020 after the RBA’s smaller-than-expected rate hike of 25 basis points last week. USD/CHF rose back to a parity level, approaching the June high, which is also the highest seen in November 2009.

- Chinese markets declined sharply on the return trade after the golden week holiday as data shows that consumer spending shrank during the holiday time, along with concerns that Shanghai may enter renewed lockdowns due to a spike in the Covid cases ahead of the 20th National Congress of the Chinese Communist Party.

- Most of the Asian markets are set to open lower following a negative close on Wall Street. ASX futures were up 0.18%. Nikkei 225 futures fell 1.59% and Hang Seng Index futures declined 0.57%.

- Crude oil prices eased 5-day gains amid profit-taking and demand concerns due to China’s covid curbs. Recession fears again take the domain of investors’ sentiment amid the soaring US dollar and Fed’s rate hikes.

- Gold futures slumped $33 per ounce at the descending trendline resistance, paring gains from the last week. However, gold may still be fundamentally supported. While the western investors dump bullion, Asian buyers pile into the cheap metals, which makes a large volume inflow of gold to east from west, with China’s import hitting a four-year high, according to a report by Bloomberg.