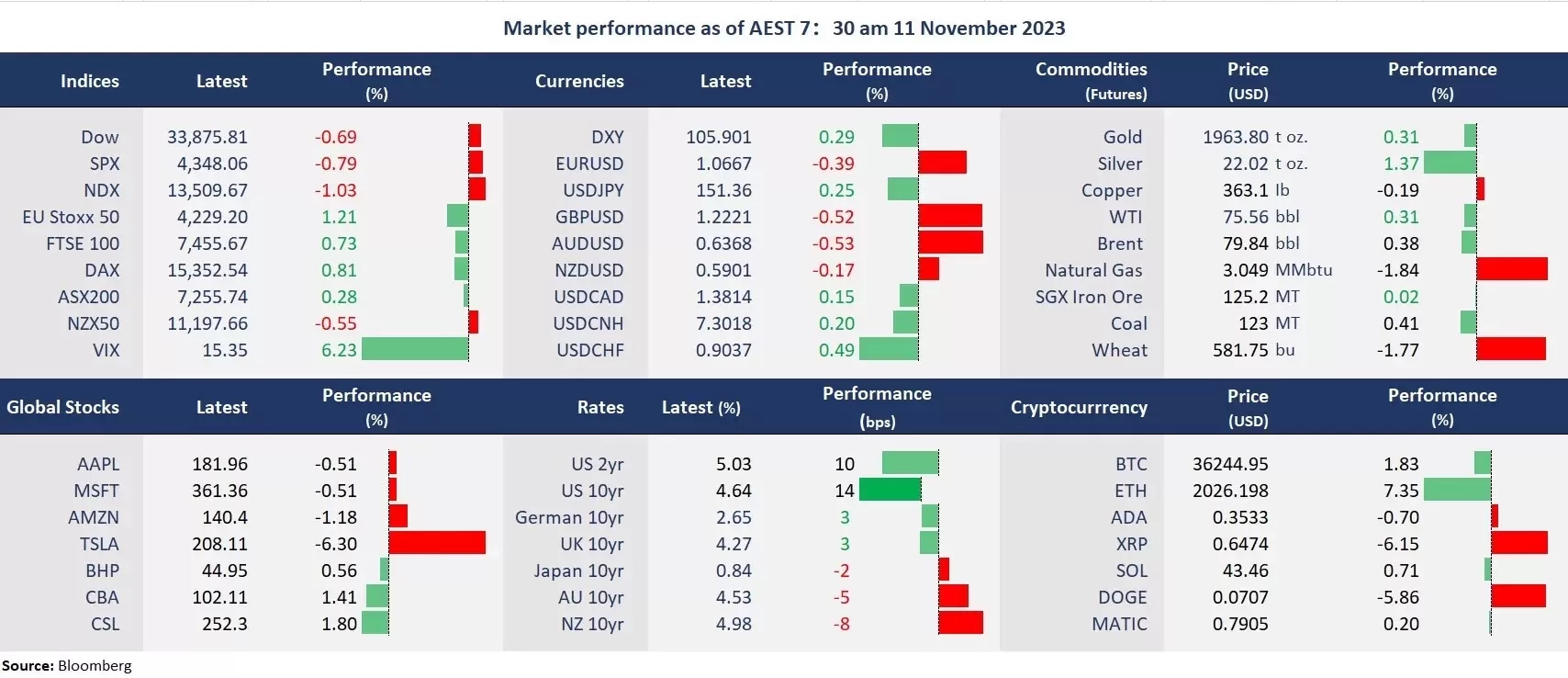

- Wall Street came off a session high following a $24 billion 30-year bond sale as yields spiked, while the fear gauge, the CBOE VIX, surged 7% to above 15.

- Fed Chair Powell said the US central bank is not confident that it has done enough to tame inflation and will not hesitate to tighten policy further if appropriate.

- Risk-off sentiment prevailed as the US dollar and gold climbed amid increased haven demands.

- Crude oil cut early gains and finished lower due to deteriorated demand outlooks on economic concerns.

- Bitcoin popped to nearly 38,000 before pulling back to around 36,300 on Spot ETF approval optimism.

- Chinese stock markets deepened losses as the October CPI data (-0.2% y/y) showed the country remained in deflation. Asian stock markets are set to open lower. ASX 200 futures were down 0.13%, and Hang Seng Index futures slid 0.59%.

Chart of the Day:

Bitcoin, daily

Company News:

- Disney (NYSE: DIS) jumped 7% following Q3 earnings result. The entertainment giant beat EPS expectations. Disney+ subscribers saw higher than expected growth of 150.2 million. The company raised its cost-cutting target to US$7.5 billion.

- Tesla (NDX: TSLA) fell 6% following analyst’s downgrade. HSBC set the price target at US$146, or 30% down from the current level, implying a “reduce” rating.

- Virgin Galactic (NYSE: SPCE) soared 19% following an announcement that it plans to spaceflight operations next year and laid off 185 staff.

ASX Corporate Actions:

- Light & Wonder Inc. (LNW) will release the Q3 FY23 earnings.

- News Corp (NWS) will release the Q1 2024 earnings.

Today’s Agenda:

- New Zealand Business Manufacturing Index

- RBA Monetary Policy Statement

- Chinese New Yuan Loans & M2 Money Supply