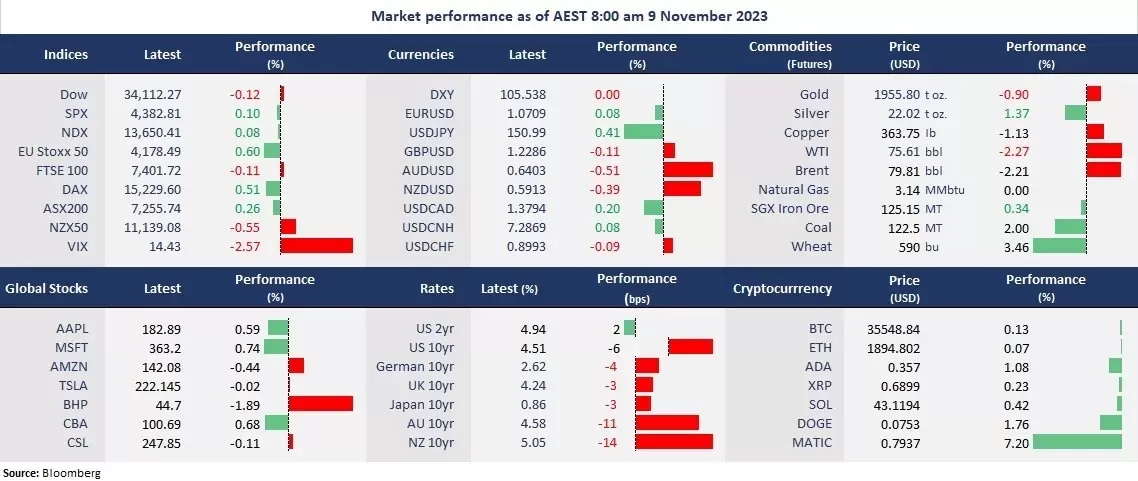

The Wall Street rally lost steam as the tech-led rebound slowed, with the energy sector continuing to lag. Here are the headlines:

- The Wall Street rally lost steam as the tech-led rebound slowed, and energy continued lagging

- Long-dated US bond yields fell after a US$40bn auction, with the 30-year Treasury yield slumping to a month-low

- The US dollar was slightly higher, while Asian currencies weakened amid ongoing China’s property woes

- USD/JPY reclaimed 151, which may spark intervention bets again

- Crude oil deepened losses on economic concerns. WTI and Brent futures fell off the 200-day moving averages at a fresh three-month low

- Gold extended a three-day losing streak, testing key support as haven demands abated

- Asian stock markets are set to open slightly higher. ASX 200 futures were up 0.38%, and Hang Seng Index futures rose 0.19%

Chart of the day

Gold, daily

Company news

- Disney (NYSE: DIS) rose 2% in after-hours trading following Q3 earnings result. The entertainment giant beat EPS expectations but missed revenue estimates. Disney+ subscribers saw higher than expected growth of 150.2 million...

- Robinhood (NDX: HOOD) tumbled 15% due to a miss on earnings expectations. Its third-quarter revenue fell short of market’s prediction due to reduced trading volume.

- Rivian (NDX: RIVN) cut early gains and finished flat following an earnings beat. The EV maker upgraded its full-year guidance to 54,000 vehicles from 52,000 vehicles.

- Roblox (NYSE: RBLX) soared 12% following the strong quarterly earnings report. The gaming platform’s third-quarter bookings and revenue far exceeded expectations.

ASX corporate actions

- VEA is set to launch the Investor Day.

- XRO is due to report S1 2024 earnings.

- WBC is on Dividend Ex. US$0.72. Pay Date: 19/12/23

Today’s agenda

- Japanese Current Account for September

- China’s PPI and CPI for October

- US Unemployment Claims