Wall Street rallied one day before the US midterm congressional elections as traders may look to a Republication win, which usually leads to less spending of government, boosting Treasuries and equity markets. However, a democratic win in congress may further lift the US dollar as the party tends to raise workers’ wages and spending on childcare, which could worsen the inflationary pressure, in turn driving up rates. Ultimately, the market movements will be policy-oriented whichever party wins. Investors will be also looking at the upcoming US CPI data due for release this Thursday, where a further cool-down in inflation may continue to support the rebound in risk assets.

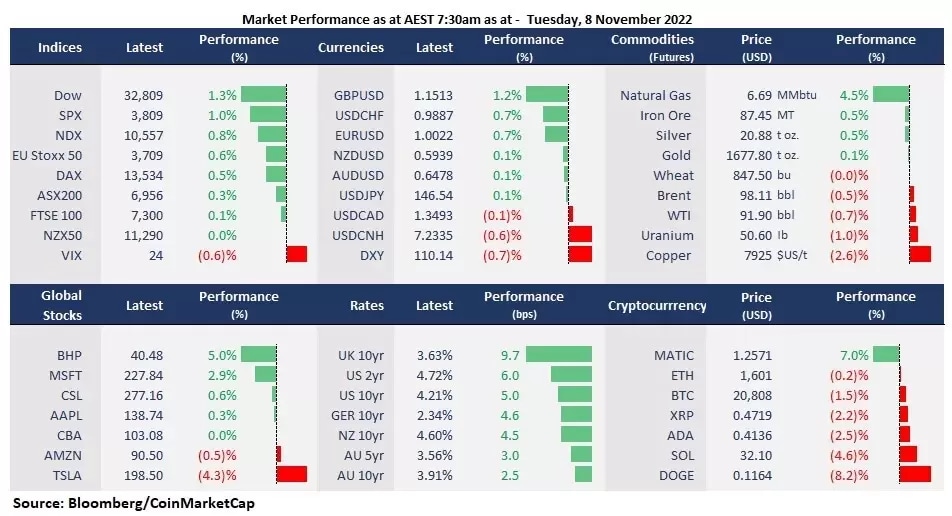

- Growth stocks played a comeback amid midterm optimism, with the S&P 500 testing key resistance of 3,800. 9 out of 11 sectors in the S&P 500 finished higher, with Energy, Communication Services, and Technology leading gains, all up more than 1.6%. While Utilities and Consumer Discretionary were lower, down 1.9% and 0.7%, respectively.

- Apple’s shares bounced off a session low despite production woes, and Meta Platforms’ stocks jumped 6.5% on staff layoffs. Apple’s shares reversed a five-day losing streak, though the iPhone maker warned of slowing shipment due to China’s covid curbs, with the company reducing 3 million iPhone 14 productions. Meta platforms’ shares surged on the news that the company plans start to lay off staff on a large scale as soon as Wednesday. Other social media shares such as Snap’s stocks were lifted, up 9% to $10.

- The Eurodollar climbed back to the parity level against the greenback, while the US dollar index fell for the second straight trading day. While the US bond yields stayed high, the US dollar continued to soften against the major currencies on faded haven demands amid the midterm optimism.

- Chinese stocks rose for the fifth straight trading day on the reopening bets. The Hang Seng Index rose 2.7% on Monday despite Beijing’s vows to stick to the Covid-zero policy, while the offshore Chinese Yuan stabilized at a one-week high, with USD/CNH closing just above 7.23. Seems traders believed that China’s exit from the covid-zero is inevitable.

- Most Asian equity markets are set to open mixed. ASX futures were up 0.56%, Nikkei 225 futures rose 0.54% and Hang Seng Index futures were down 0.42%, which may be due to profit taking of a week-long rally.

- Commodities trimmed their strong gains from last Friday amid weak China trade data, with copper futures down 2.3% and crude oil prices down 0.7%. Both manufacturing raw material and energy prices were boosted by China’s reopening optimism last Friday but fell on the confirmation of sticking to the covid-zero by the Chinese officials over the weekend and a surprising contract in China’s export data in October, which darkened the demand outlooks. However, a softened US dollar buffered the drop.

- Gold finished flat under key resistance of 1,680 after a 50-dollar jump due to a sharp decline in the US dollar on Friday. From a technical perspective, the precious metal has formed a potential triple-bottom reversal pattern, with pivotal support of around 1,614.

- Polygon surged further, up 7% to just above 1.24, the highest seen in April. Both Bitcoin and Ethereum were slightly down as profit-taking may be in play from the recent rally.