US stocks rallied for the third straight trading day as risk-on returned after the Fed paused rate hikes for the second consecutive time. The committee unanimously agreed to keep the rate on hold. Chairman Jerome Powell signalled that rising long-term government bond yields reduced the probability of further rate hikes but kept the door open for more, and the board members are not considering rate cuts. Markets took the rhetoric more dovish than expected, causing a relief rally across the board.

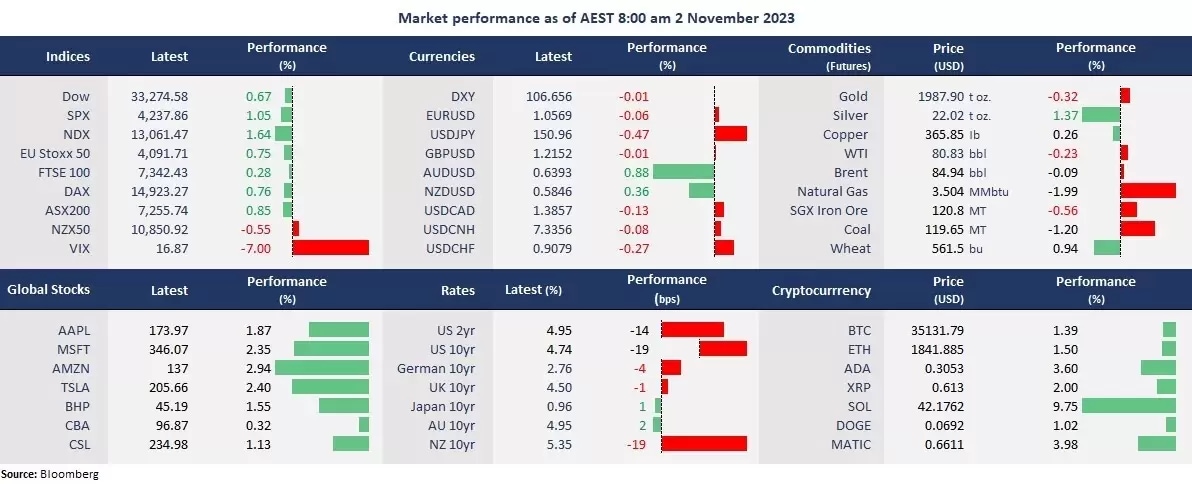

The US Treasury yields fell sharply following the decision, with the 10-year bond yield down 14 basis points, and those on the 2-year yield slipped 12 basis points to below 5% for the first time since 10 October. The tech stocks led broad gains as the growth sectors tend to benefit from the low bond yields the most, given higher corporate debt levels. 9 out of 11 sectors in the S&P 500 finished higher, with Technology, leading gains, up 2.08%. Telecommunication services and Consumer Discretionary were also strong, up 1.84% and 1.44%, respectively.

The US dollar weakened against all the other G-10 currencies, lifting the commodity currencies, such as the Australian dollar and the New Zealand dollar, the most. Bitcoin was also boosted by the macro tailwind, topping 35,000 for the first time since May 2022. However, both gold and oil extended losses as risk-on sentiment faded off, and asset class rotation may see a new round into November.

Asian markets are set to open higher. ASX 200 futures were up 0.70%, Hang Seng Index futures rose 0.15%, and Nikkei 225 futures climbed 0.98%.

Fed Meeting’s Key Takeaways:

- Fed members unanimously agreed to keep the interest rate unchanged at between 5.25% and 5.50% but kept the door open for more rate hikes.

- The central bank will proceed carefully, and the Fed’s decision is a meeting-by-meeting case, and there is a long way to tame inflation to the target level of 2%.

- The efficacy of dot-plot forecasts erodes over time, suggesting reduced probabilities for more rate hikes.

- As for rate hikes, the risks of doing too little versus doing too much are now getting more balanced.

Fed’s Policy Indication:

- The Fed reduced its hawkish tone on its policy path, implying a higher chance for no more rate hikes. The immediate reaction was a sharp decline in the bond yields, offering a relief rally on the stock markets. But this could be seen as the last round of a bull market (possibly leading to a Christmas rally) before a recession-fear-led selloff

- Higher-for-longer interest rates are still on the table, but rising long-term bond yields weigh on future decisions. High rates will slowly show their impact on the economy when corporate debts and household mortgages roll over in the next one or two years.

- US dollar could have hit a peak, following the bond market movements. This could lead to a decent rebound in riskier currencies, particularly the AUD and NZD.

- Gold may still have the potential to continue rising amid a backdrop of softened dollar, high inflation, economic uncertainties, and geopolitical tensions. Bonds have a similar nature, which could see an opportunity here.

- US big techs may continue to ride on the policy tailwind to the year-end, but the recent earnings signalled a continuous slowdown in growth as improved profit margin was most from cost-cutting measures, coupled with the AI frenzy. Weakened demands are a common tone in earnings reports.

Today’s agenda:

- BOE Rate Decision