More than a commodity trading platform

100+ cash and forward commodities

Including popular commodities such as Copper and Natural Gas, as well as lesser-traded instruments like Palladium and Wheat.

Trade out of hours

Favourites like Brent and West Texas oil trade up to 23 hours a day, so you don't have to stop when the commodity markets do.

Trade the whole sector

Take a view across a whole commodity sector from a single position, with our bespoke commodity indices.

'Cash' markets

Tighter spreads, no rollovers and charting back as far as 1992 to help your analysis.

Dedicated customer service

Experienced customer service available to support you in your trading.

No partial fills

Get the trade you want – we don't reject or partially fill trades based on size.

What other traders are saying about CMC Markets

As a financial services pioneer, we‘ve got the expertise allied to over 34 years‘ industry experience.That‘s why 1 million+ global traders and investors put their confidence in us.*

Major commodity indices to trade

Agricultural Index

The Agricultural Index contains Soybean, Corn, Soybean Meal, Wheat, Coffee Arabica, Soybean Oil, Sugar Raw, Cotton, US Cocoa, Coffee Robusta, Sugar White and Oats, covering a broad spectrum of the soft commodities sector.

Energy Index

The Energy Index is designed to give an indication of how the energy sector is performing. Its constituent commodities are Heating Oil, Natural Gas, Crude Oil Brent & WTI, Gasoline and Low Sulphur Gasoil. Crude oil is one of the most popular raw materials to trade across the world.

Precious Metals Index

The Precious Metals Index groups together several precious metals so you can get exposure to the sector as a whole. It consists of Gold, Silver, Platinum and Palladium.

Commodity index details

View the spreads, margin rates and trading hours for our three major commodity indices in the table below.

Instrument | Margin rate | Minimum spread | Trading hours |

|---|---|---|---|

| Agricultural Index | 10% | 3.4 | 09:45 - 13:45 / 14:30 - 17:30 (Mon to Fri) |

| Energy Index | 10% | 2.4 | 01:00 - 22:00 (Mon to Fri) |

| Precious Metals Index | 10% | 1.8 | 23:00 - 22:00 (Sun to Fri) |

How do commodity indices work?

Our commodity indices group together individual commodities to make a commodities 'basket'. The indices track the underlying prices of the commodities within that index. If the individual commodity prices in that index increase, then the value of the index will go up. Conversely, if the individual commodity prices decrease, then the value of that index will fall.

There are several benefits to commodity index trading as opposed to trading individual commodities. Firstly, it can be a more cost-effective and efficient way of trading the market, as it allows you to take a view on a commodity sector as a whole, without having to open a position on each individual commodity. Likewise, this can be a good way for you to diversify your portfolio.

However, it's important to be aware that CFDs are high-risk, speculative products. High volatility combined with leverage could lead to significant losses. As with any leveraged product, both profits and losses will be based on the full value of your position. While you could make a profit if the market moves in your favour, you could just as easily make significant losses if the trade moves against you and you don't have adequate risk-management in place.

How our commodity indices are weighted

For the Energy Index and Agricultural Index, the components were initially weighted according to the average daily trade value of the nearest six futures contracts, where available, for the 12 months preceding the index launch date, based on the initial index value of $10m. For the Precious Metals Index, Gold and Silver are split equally to collectively make up 70% of the index weight. The remaining two components, Platinum and Palladium, are also split equally and collectively make up 30% of the index weight. Subsequent index reviews are applied as shown in the index methodology.

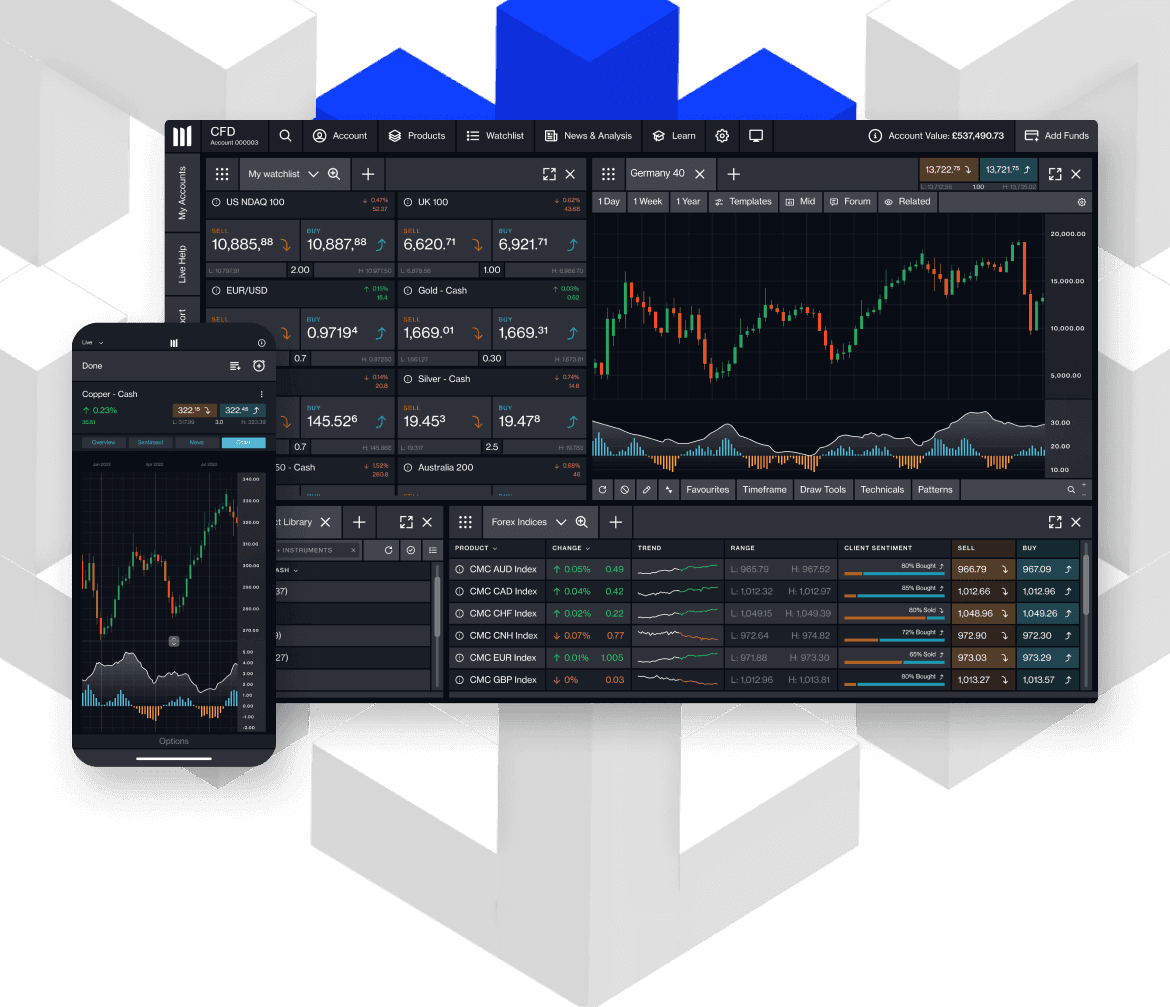

Award-winning broker

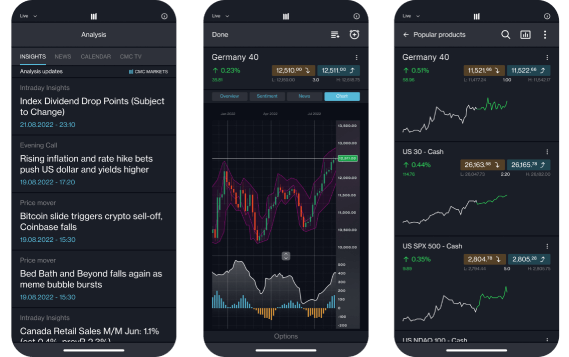

Best Mobile Trading Platform

ADVFN International Financial Awards

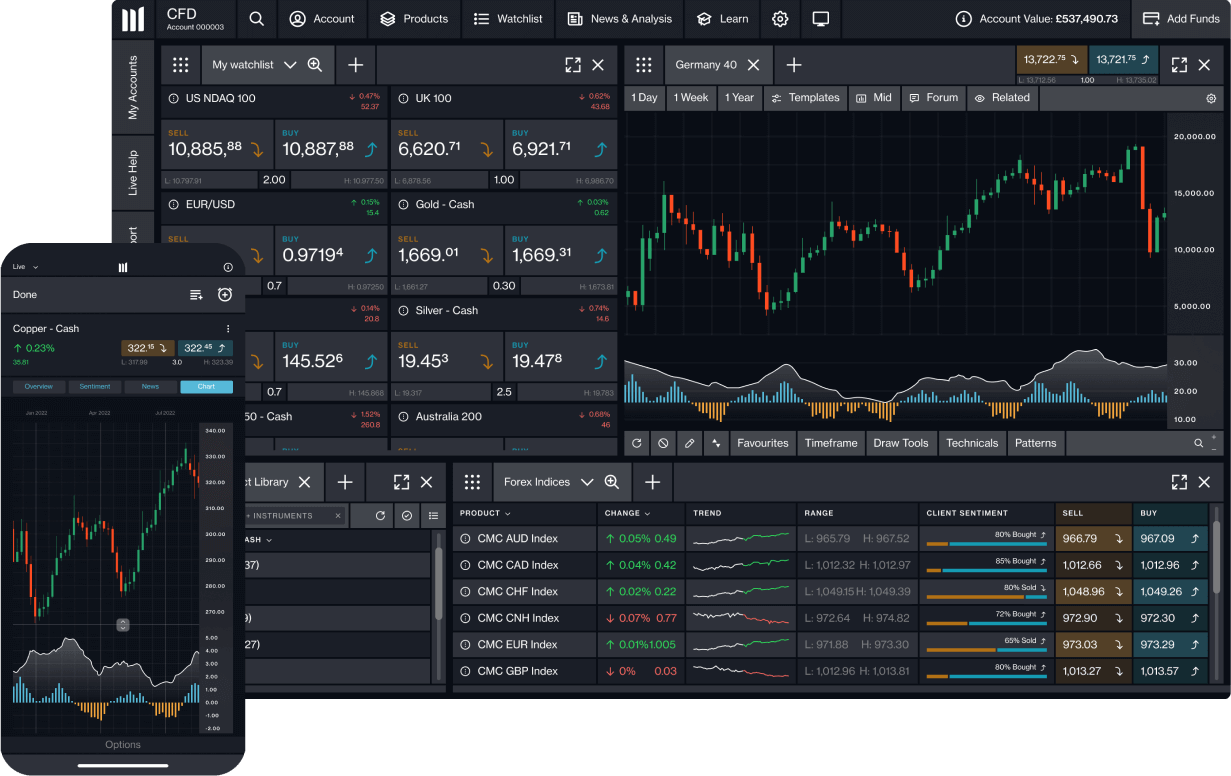

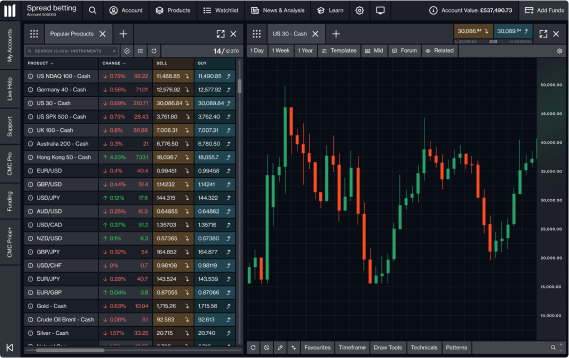

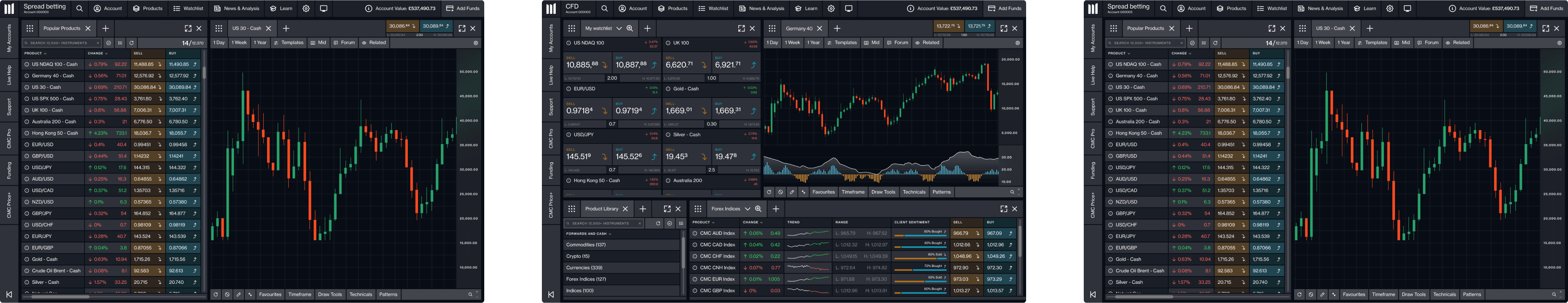

No.1 Web Platform

ForexBrokers.com Awards

CFD Trading

Ready to get started?

Start trading with a live account or try a demo with €10,000 of virtual funds.

Do you have any questions?

Email us at eusupport@cmcmarkets.com or call us on +49 (0) 69 22 22 440 44 (Lines open 8am to 6pm, Monday to Friday)

**Best Mobile Trading Platform, ADVFN International Financial Awards 2024; No.1 Web Platform, ForexBrokers.com Awards 2023; No.1 Most Currency Pairs, ForexBrokers.com Awards 2023; Best Charting (Germany), Investment Trends Leverage Trading Report 2023; Best Customer Service (Germany), Investment Trends Leverage Trading Report 2023; Best In-House Analysts, Professional Trader Awards 2023; No.1 Platform Technology (UK), ForexBrokers.com Awards 2022; Best CFD Provider (UK), Online Money Awards 2022; Industry Pioneer with "Outstanding" Customer Rating (Germany), Focus Money Test Edition 36/2022, "Very good" Trading Platform (Germany), Deutsches Kundeninstitut (DKI) Survey 2022.