Welcome to Michael Kramer’s pick of the top three market events to look out for in the week ahead, plus his latest US election update.

At the top of the economic news agenda in the coming days are the US jobs report and, before that, a pair of US purchasing managers’ index (PMI) prints. These data points will give traders and investors a fresh look at how well the US economy is performing and could signal whether more interest rate cuts are on the horizon. Plus, on Monday we’ll get September inflation data from Germany.

US election update

The betting market’s view of who will win the US presidential election on 5 November hasn't shifted significantly in the past week. Vice-president Kamala Harris continues to hold a solid lead over former president Donald Trump, according to data from the online betting site PredictIt. Users of the site bet on whether the two main candidates will win or lose. Among those betting on Harris, 56% back her to win while 44% bet she’ll lose. As for Trump, 47% of bettors back him to win while 53% bet he’ll lose. That said, a national lead arguably matters little in an electoral system in which the winner will ultimately be decided by voters in six or seven swing states, where Harris and Trump are almost neck and neck.

US election poll tracker, July 2024 - present

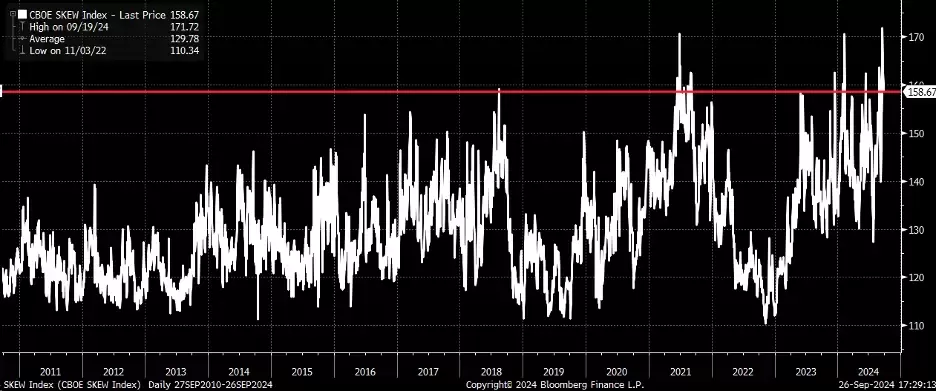

Despite the uncertainty, US equity markets seem unfazed. The S&P 500, represented by the red line on the chart above, posted a fresh record high of 5,767.37 on Thursday. The situation could change as we enter the final month before the election, since hedging is likely to increase as we approach 5 November. The Skew index – which measures the difference between the cost of derivatives that protect against big market drops on one side, and the right to benefit from a rally on the other – has risen to around 160, suggesting that investors are beginning to consider the potential impact of the election outcome. It is rare for this index to reach such a high level.

CBOE Skew Index, 2011 - present

Germany September CPI

Monday 30 September

Germany’s annual inflation rate eased to 1.9% in August, down from 2.3% in July, while the country’s EU-harmonised consumer price index (CPI) cooled to 2% in August from 2.6% in July. The declines bring German inflation back down to the Bundesbank’s 2% target rate. If the disinflationary trends in Europe’s largest economy persisted in September, the European Central Bank may feel emboldened to proceed with further interest rate cuts before the end of the year.

The market is pricing in almost two more ECB rate cuts by year-end. However, further cuts may have little impact in weakening the euro against the US dollar, as the market expects the Federal Reserve to cut rates three more times. If economic data from the US comes in weaker than expected, the euro could strengthen further against the weakening dollar. After consolidating around $1.12, EUR/USD could be poised to move higher in the coming days. A breakout could potentially send the pair to around $1.148 in the near term, supported by the bullish momentum that is building in the pair’s relative strength index (RSI).

EUR/USD, April 2021 - present

US September ISM data

Tuesday 1 October (manufacturing) and Thursday 3 October (services)

The US Institute of Supply Management (ISM) is set to release two key PMI readings this week, with analysts expecting the manufacturing sector to have contracted in September while the services sector is thought to have expanded. The ISM manufacturing PMI is forecast to come in at 47.7 for September, up from 47.2 in August, while the ISM services PMI is predicted to come in at 51.5, the same level as in August. A PMI reading above 50 indicates that the sector is generally expanding, while a score below 50 indicates that it is generally declining.

The two reports could impact investor perceptions of the US economy, potentially affecting traders’ expectations for oil prices. US oil benchmark West Texas Intermediate (WTI) has declined from more than $85 a barrel in April to current levels of around $68. Any signs that the US economy is slowing further could push WTI prices down towards a key level of support near $66. The daily price chart shows that WTI appears to have formed a bear flag, suggesting that weak ISM data may be all that is needed for the commodity to break below $66, potentially sending prices below $60 for the first time since 2021.

US crude oil, 2019 - present

US September jobs report

Friday 4 October

Analysts estimate that the US economy added 140,000 jobs in September, in line with the August tally of 142,000 new payrolls. The unemployment rate is expected to have remained at 4.2%, while average hourly earnings are forecast to have risen 0.3% month-on-month and 3.7% year-on-year in September, down from August growth of 0.4% and 3.8%, respectively. The report’s data points are important not only in terms of highlighting the direction of the US economy but also in shaping the path of US monetary policy.

For traders, the jobs report has once again become a potential play on short-dated implied volatility. Last time out, the 1-day Volatility Index – commonly known by its ticker, Vix1d – climbed to nearly 22 points the day before the release of the jobs report. It could reach similar levels again ahead of the next jobs report on Friday. However, once the report is released, implied volatility should drop quickly, potentially giving equity futures a knee-jerk move higher. What happens after that will depend on the data.

CBOE 1-day Volatility Index, April 2024 - present

Key economic and company events

Our rundown of notable economic announcements and US and UK company reports scheduled for the coming week:

Monday 30 September

• China: September purchasing managers’ index (PMI) data

• Germany: July retail sales, September flash consumer price index (CPI)

• UK: Q2 gross domestic product (GDP)

• US: Speech by Federal Reserve chair Jerome Powell in Nashville

• Results: Carnival Corporation (Q3)

Tuesday 1 October

• Australia: August retail sales

• Eurozone: September flash CPI

• US: September ISM manufacturing PMI

• Results: Acuity (Q4), McCormick (Q3), Nike (Q1), Paychex (Q1)

Wednesday 2 October

• Australia: September Judo Bank PMI data

• Eurozone: August unemployment rate

• US: September ADP employment change

• Results: Conagra (Q1), JD Sports Fashion (HY), Lamb Weston (Q1), Levi Strauss (Q3), RPM International (Q1)

Thursday 3 October

• Australia: August imports, exports and trade balance

• Switzerland: September CPI

• UK: Bank of England monetary policy report hearings

• US: September ISM services PMI, initial jobless claims to 27 September

• Results: Constellation (Q2), Tesco (HY)

Friday 4 October

• Eurozone: August producer price index (PPI)

• US: September jobs report, including non-farm payrolls, average hourly earnings and the unemployment rate

• Results: JD Wetherspoon (FY)

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.