Multiple order types

Our range of order types allow flexible order placement, and our risk-management tools are customisable and easy to use. You can set default stop-loss and take-profit orders to manage risk on every trade. However, all stop-order types except guaranteed stop-loss orders are susceptible to market slippage and gapping.

Guaranteed stop-loss orders

For a premium, our GSLOs give you 100% certainty that your stop-loss will be executed at the exact price you want, regardless of market volatility or gapping. We refund the premium if the GSLO is not triggered.More about GSLOs

Market orders

Use market orders to open or close trades at the current market price. Our automated execution means market orders get filled at the next available price.

Limit and stop entry orders

Limit orders and stop-entry orders are used to trigger a trade execution at a specific price above or below the current market price, and within a set time period.

Partially close trades

Stop-loss orders

Stop-loss orders allow you to specify a price at which a position will be closed out by the platform, if the market moves against you.

Trailing stop-loss orders

A trailing stop-loss will follow a price as it moves favourably for you, remaining at the distance specified when the order was placed.

Take-profit orders

Advanced order features

The platform includes an array of advanced order features that allow for even greater control, flexibility and customisation when it comes to orders and trade execution.

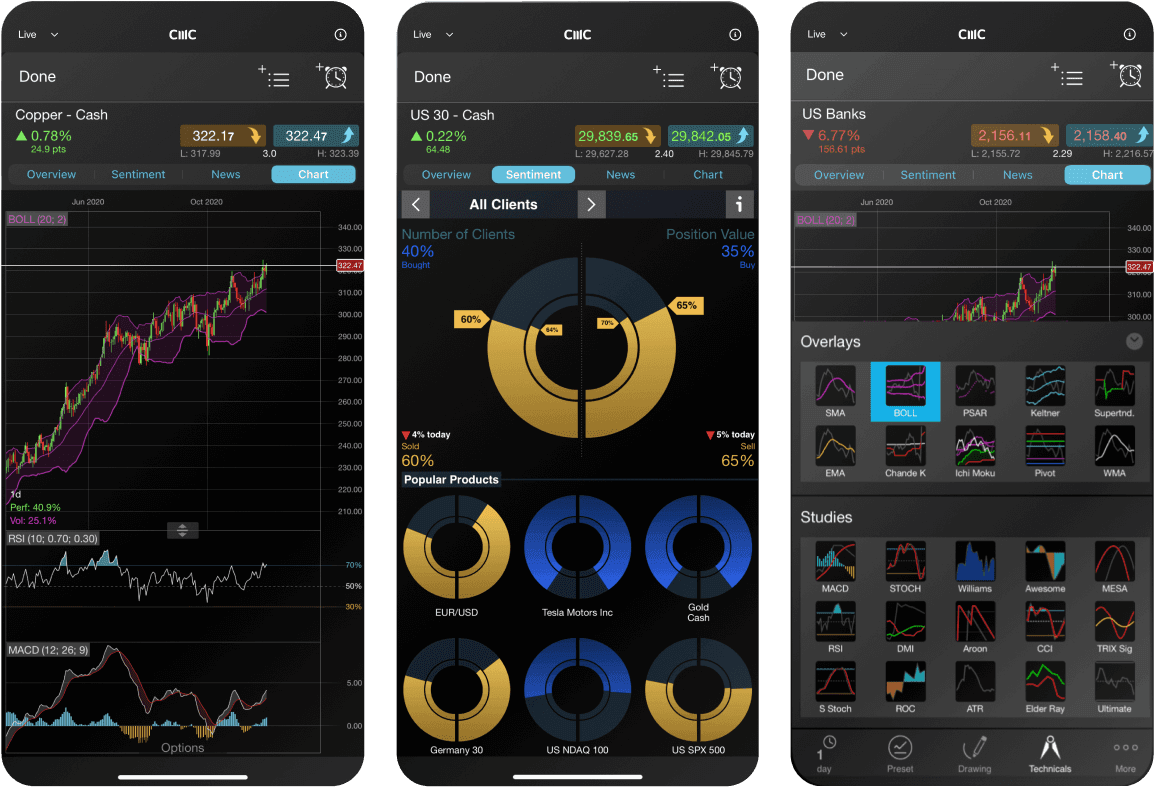

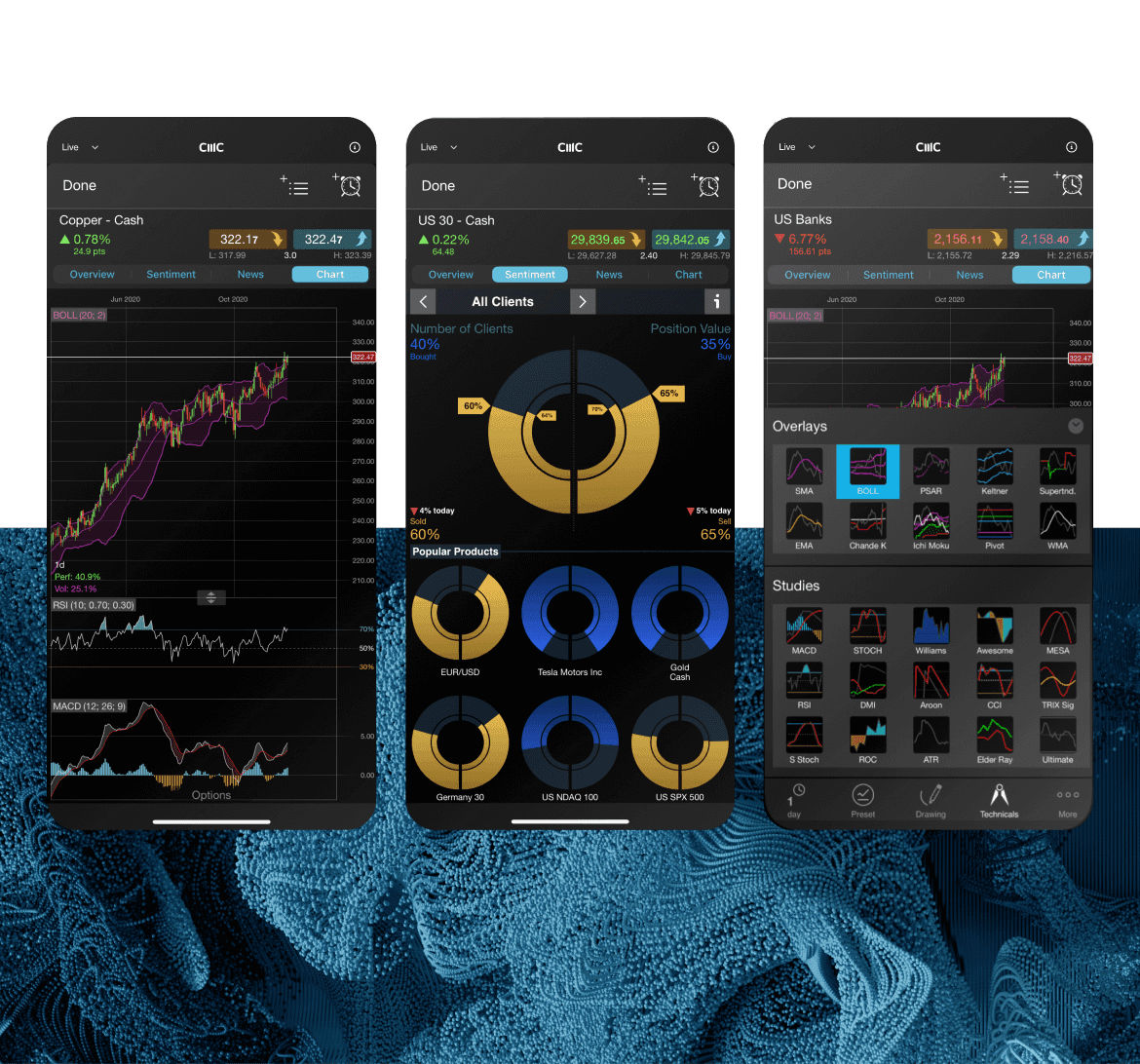

Trade from charts

Open, close and amend orders directly from charts and view levels against historical price action. Once a position has been opened, just click the triangular trade entry icon on the chart and drag stop-loss and take-profit levels to change them. '1-Click Trading' allows you to place trades immediately by clicking on any streaming buy or sell price. Your usual default risk-management and order settings will automatically be applied.Explore our trading charts

Use boundary orders in volatile markets

Price ladder trading for large orders

Our price ladder displays prices for trades that are larger than what's available at the first bid and offer price. It lets you enter trades which you otherwise wouldn't be able to enter, with just one order, but with a wider spread. Our automated trade execution ensures that positions up to our maximum trade size will always be executed through price ladder trading.

Go long and short simultaneously

Trade using unrealised profit

Pre-set order preferences

Rollover discount on forwards

When you manually roll a forward to the next contract, you enter the new trade at the mid-price and save 50% on the spread cost. You can also set forward settlement behaviour to 'Auto Roll-Over' to have this rule applied to all of your forward positions.

Execution alerts

Set up our alerts system to notify you when important price levels are breached or when your pending orders are triggered. Receive platform pop-ups and have alerts emailed to you, sent to you by SMS, or pushed to your mobile device.

Via email, SMS or push

Get trade execution alerts, including mobile push notifications, when pending orders (such as stop entry, limit, stop-loss or take-profit orders) are executed in your account. To complement execution alerts, we also offer price alerts. These enable you to receive notifications when the price of a product you're interested in reaches a significant level specified by you, such as a major support or resistance level.How to set up trading alerts

Account close-out

You can choose the account close-out method* used by the platform to automatically close out your trades if your account revaluation amount** falls below your close-out level. Change the close-out method in 'Account Settings' on the platform.

Complete close-out

Last trade in, first out

Largest position loss first

Largest position margin first

CFD Trading

Ready to get started?

Open a demo account with €10,000 of virtual funds or open a live account.

Do you have any questions?

Email us at eusupport@cmcmarkets.com or call us on +49 (0) 69 22 22 440 44 (Lines open 8am to 6pm, Monday to Friday)

*If at account close-out you have an open position in a product that is greater than the maximum CFD margin trade size in that product, then the account close-out will be performed on a 'last in, first out' basis, irrespective of which account close-out method has been selected.

**Cash + net unrealised profit or loss.

^Each of the account close-out methodologies is applied to the CMC products that are within their applicable trading hours and where trading is not otherwise suspended. After any initial account close-out, as and when the trading hours for any remaining positions on your account recommence and/or remaining positions on your account cease to be suspended, one or more subsequent account close-outs may be carried out.

Trades relating to the same CMC product may be aggregated by our platform during an account close-out, in which case each relevant trade will be closed at the relevant sell price or buy price on the price ladder, applicable to a market order for the aggregated number of units.

Each initial alternative close-out or subsequent alternative close-out will attempt to increase your account revaluation amount above the reset level. (The reset level is a percentage of your total margin displayed on the platform at any given time.) If following the completion of any initial alternative close-out or subsequent alternative close-out your account revaluation amount increases above the close-out level, then the alternative account close-out will stop.