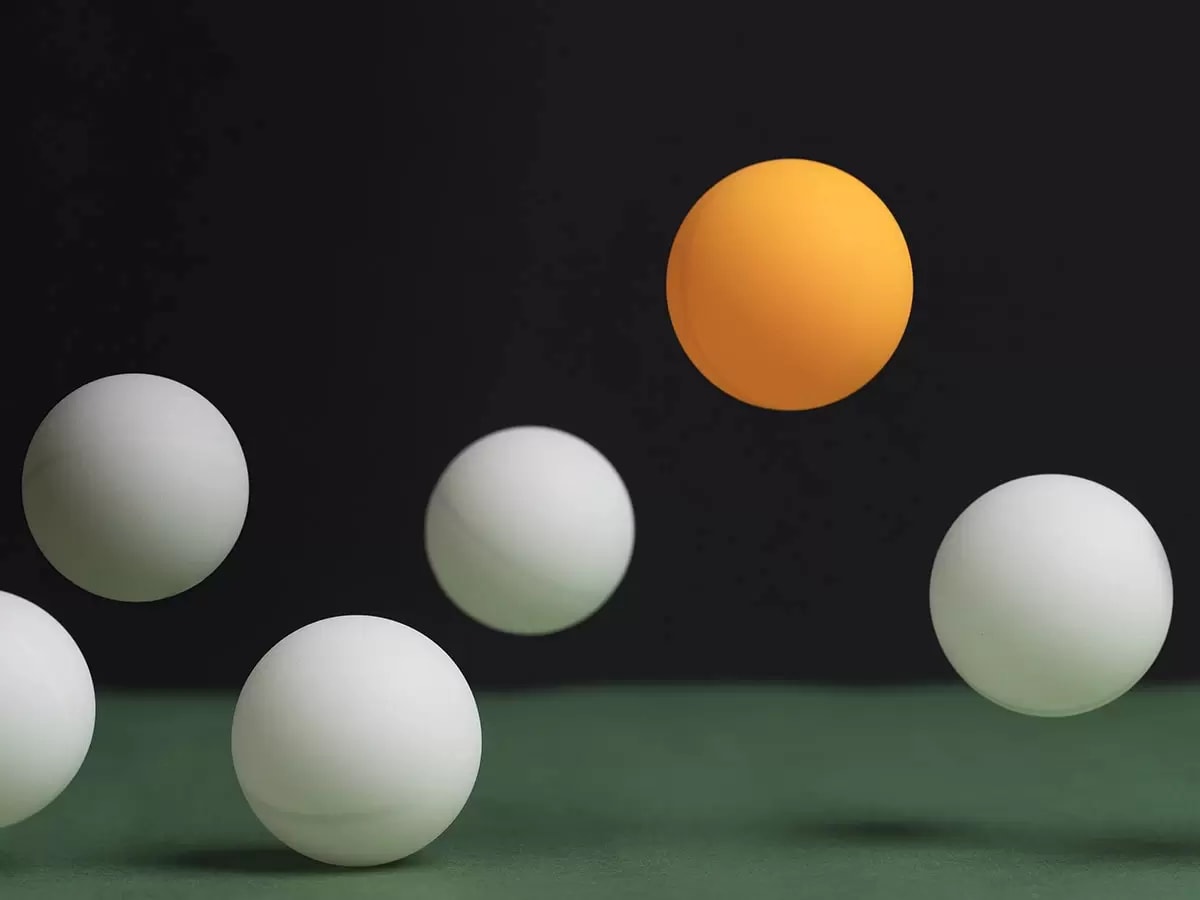

Contrarian investing: what it is and how to get started

The ability to take a look at the markets and stay ahead of the game is what makes a contrarian investor stand out from the crowd. While having the foresight to see hidden opportunities is beneficial, going against general market sentiment can be difficult. If an investor can keep their conviction, there are potential profits to be made. Read on to learn what contrarian investing is and some strategies that contrarian investors typically use.