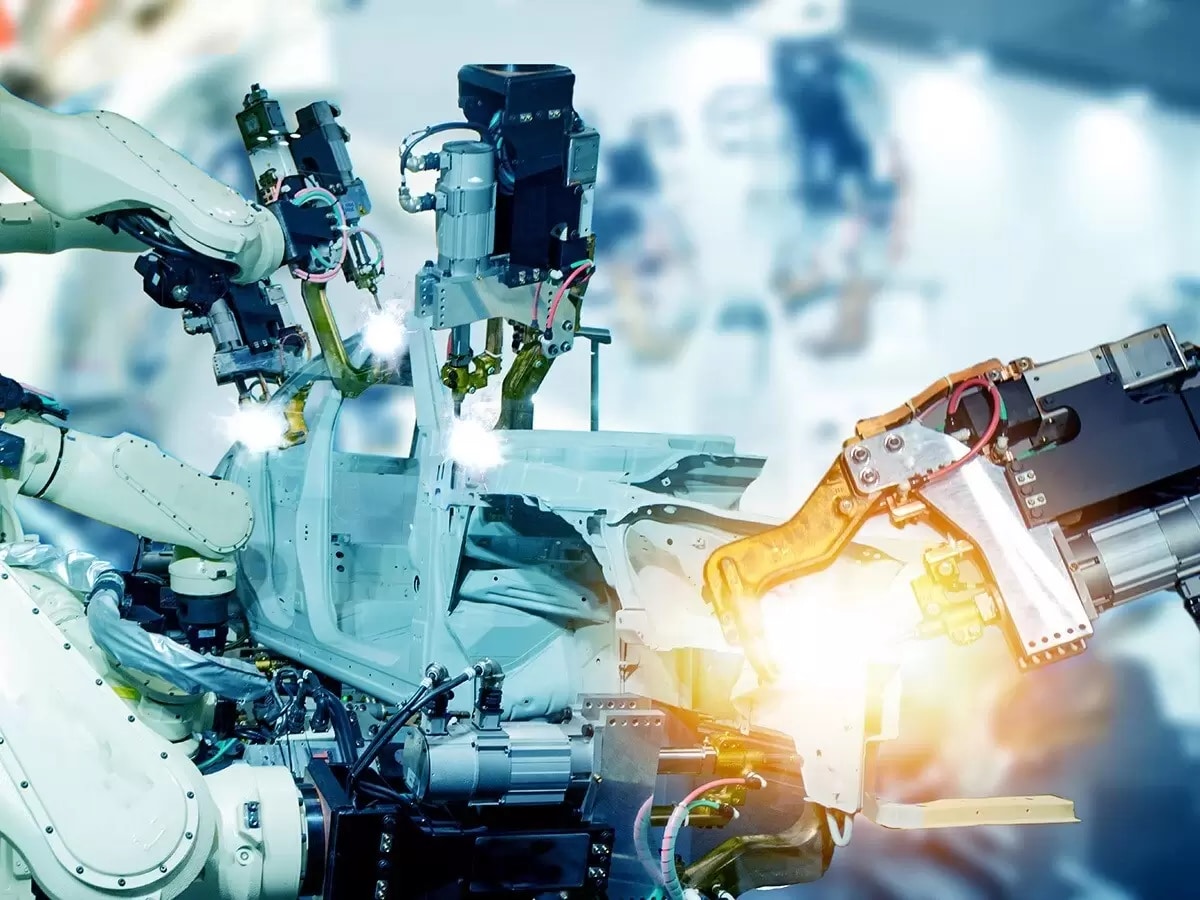

Robotics and automation stocks to watch in 2022

Robotics stocks are companies related to the booming industries of automation and robots, which are having an increasingly important role in our everyday lives. The use of automation and robotics is only growing, backed by advances in artificial intelligence (AI). These advances create investing opportunities. As the demand for automation increases, that potentially means increased revenues and profits for the industry. Learn why this sector may continue to expand in the long-term and read about some of the top robotics and automation stocks and ETFs to watch this year.