Currency correlations: what are they and how can you trade them?

Published on: 12/07/2022 | Modified on: 31/01/2023

Currency correlations or forex correlations are a statistical measure of the extent that currency pairs are related in value and will move together. If two currency pairs go up at the same time, this represents a positive correlation, while if one appreciates and the other depreciates, this is a negative correlation.

Understanding and monitoring currency correlations is important for traders because it can affect their level of risk when trading in the forex market. In this article, we will look at how forex correlation is determined and calculated, how it affects trades and trading systems, and what tools can be used to track currency correlations.

Forex pairs can move together in a positive or negative correlation

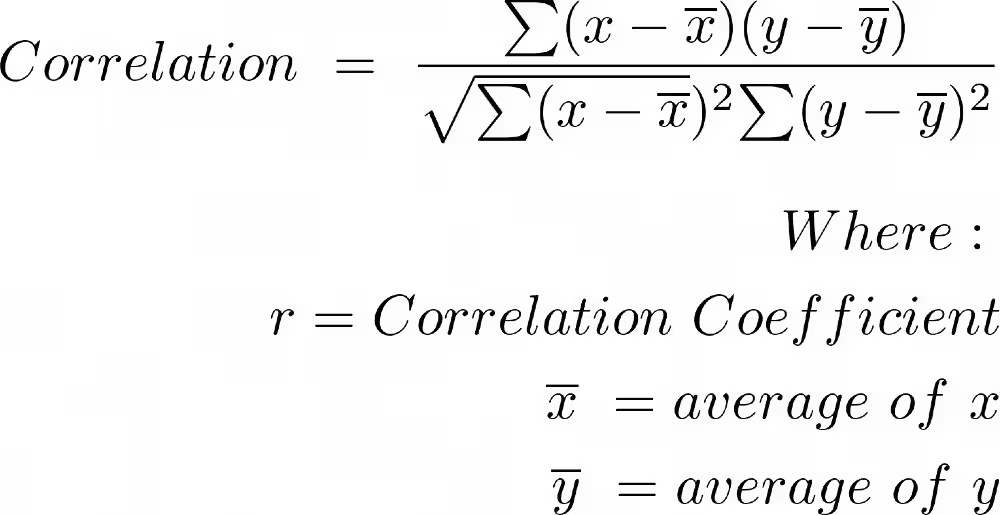

The correlation coefficient formula represents how strong or weak their connection

A reading below -70 and above 70 is considered strong, whereas a readings between -70 and 70 is considered weaker

Traders may choose to hedge their positions by purchasing negatively correlated forex pairs, hoping that the gains in one may be offset by losses in the other

Commodities may also have a correlation with each other, as well as with forex

What is correlation in forex trading?

A foreign exchange correlation is the connection between two currency pairs. There is a positive correlation when two pairs move in the same direction, a negative correlation when they move in opposite directions, and no correlation if the pairs move randomly with no detectable relationship. A negative correlation can also be called an inverse correlation.

Currency correlation is important for traders to understand because it can have a direct impact on forex trading results, often without the trader’s awareness.

As an example, assume that a trader buys two different currency pairs that are negatively correlated. The gains in one may be offset by losses in the other, which is often used as a hedging strategy. Meanwhile, buying two correlated pairs may double the risk and profit potential, since both trades will result in a loss or profit. They are not fully independent since the pairs move in the same direction.

What is the correlation coefficient?

A correlation coefficient represents how strong or weak a correlation is between two forex pairs. Correlation coefficients are expressed in values and can range from -100 to 100, or -1 to 1, with the decimal representing the coefficient.

Anything in the negative range of -100 means that the pairs move nearly identically but in opposite directions, whereas, if it is above 100, it means that the pairs move nearly identically in the same direction. “Nearly identically” is an important distinction to make because correlation only looks at direction but not magnitude. For example, one pair may move up 100 pips (percentages in point) while another moves down 70 pips. Both pairs may have a very high inverse correlation, even though the size of the movement is different.

If a reading is below -70 and above 70, it is considered to have strong correlation, as the movements of one are largely reflected in movements of the other. Readings anywhere between -70 and 70, on the other hand, mean that the pairs are less correlated. With forex correlation coefficients near the zero mark, both pairs are showing little or no detectable relationship with one another.

Correlation coefficient formula

While this formula looks complicated, the general concept is that it is taking data points from two pairs, x and y, and then comparing them to average readings within these pairs. The top part of the equation is the covariance and the bottom part is the standard deviation.

For example, think of the data points as closing prices for each day or hour. The closing price of x (and y) is compared to the average closing price of x (and y), so a trader can enter closing and averaged values into the formula to extract how the pairs move together. To get the average requires tracking multiple closing prices in a program such as Microsoft’s Excel spreadsheet. Once multiple closing prices have been recorded, an average can be determined, which is continually updated as new prices come in. This is plugged into the formula along with new values for x.

Forex correlation pairs

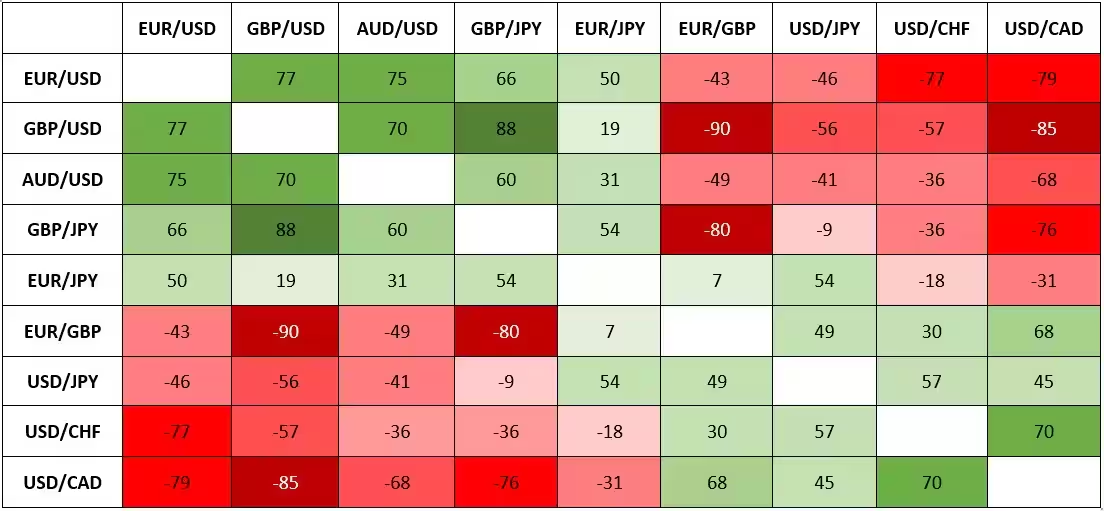

The following table shows the correlation between some of the most traded currency pairs across the world. You can compare each currency on the y-axis to those on the x-axis to see how they are correlated to one another. For instance, the correlation between the EUR/USD and GBP/USD is 77, which is quite high.

While the pairs won’t always move in exactly the same direction, they do move mostly together. In comparison, the GBP/USD and EUR/GBP have a strong negative correlation at -90, meaning they move in opposite directions much of the time.

Monitoring currency correlations is important because, even in this small table of currency pairs, there are several strong correlations. A trader could unwittingly buy the GBP/USD and sell the EUR/GBP thinking that they have two different positions, for example. However, because the pairs have a high negative correlation, they are known to move in opposite directions. Therefore, the trader will likely end up winning or losing on both, as they are not fully independent trades.

What are some examples of currency correlation?

Forex correlation hedging strategy

Correlation allows traders to hedge positions by taking a second trade that moves in the opposite direction to the first position. A currency hedge is achieved when gains from one pair are offset by losses from another, or vice versa. This may be useful if a trader doesn’t want to exit a position but wants to offset or reduce their loss while the pair pulls back.For example, the EUR/USD and AUD/USD share a strong positive correlation in the table above at 75. Buying the EUR/USD and selling the AUD/USD creates a partial hedge. It is partial because the correlation is only 75 and correlation doesn’t account for magnitude of price movements, only direction.

In the case of the GBP/USD and EUR/GBP, there is a negative correlation. Therefore, buying or selling both creates a hedge. Buying the GBP/USD will make money if the GBP/USD goes up, but those gains will be offset by the long position on EUR/GBP falling because of the negative correlation.

Read more about forex hedging strategies.

Pairs trading

A pairs trade involves looking for two currency pairs that share a strong historical correlation, such as 80 or higher, and taking both long and short positions on the assets. A trader can buy the currency that is moving down and sell the currency pair that is moving up. The idea of this is that they will eventually start moving together again, given their long history of a high correlation. If this occurs, a profit may be realised.

However, there is a danger that the pairs don’t go back to being highly correlated. Therefore, some traders may place a stop-loss order on each position to control the loss. There is also a danger that the loss on one trade isn’t offset by a gain on the other, resulting in a loss, even if the pairs move back to their previous correlation. Ideally, the bought pair would move up and the sold position move down as the pairs mean-revert, which could result in a profit on both trades.

When using any currency correlation strategy, and any strategy, position sizing is a key component to risk management. Based on where the stop loss is placed, many traders opt to risk a small percentage of their account, for example, if the stop loss is reached. For instance, if the stop loss is 30 pips in the EUR/USD (with a USD account), taking a micro lot position means there is a risk of $3 on the trade (30 x $0.10). For that $3 of risk to be equal to only 1% of the account, the trader would need to have at least $300 in the account. This way, the risk on the trade and risk to the account is controlled.

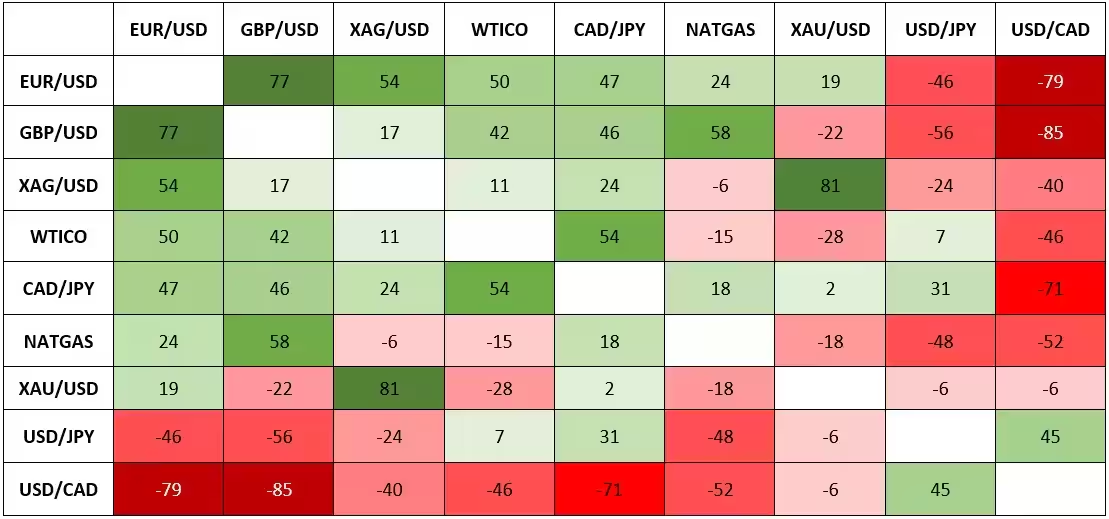

Commodity currency correlation

Commodities or raw materials also have a correlation with each other as well as with currencies. In the table below, the data shows that during this timeframe, gold (XAU/USD) had little correlation with other major currencies. However, it does indicate that it shared a strong positive correlation of 81 with silver (XAG/USD). For someone trading gold and holding positions in other currency pairs, this type of analysis is important.

For example, it is worth noting that natural gas doesn’t share a high correlation with any currency pairs, or with precious metals like gold or silver. Meanwhile, crude oil (WTICO) also doesn’t show a high correlation to currencies, but it often does have a correlation with the USD/CAD and CAD/JPY. This is because both Canada and Japan are major oil importers.

Commodities can hedge or be hedged by currencies when there is a strong correlation present in the same way that currencies hedge each other. A commodity may move much more in percentage terms than a currency, so gains or losses in one may not be fully offset by the other. Read our commodity guides on oil trading and gold trading.

Is it possible to trade for a living?

It is possible to make money trading, but it comes with many risks and extra costs that must be taken into consideration. Consult our section on ‘what else do you need to know’ before opening a potentially risky trade. After all, not all positions will end in profit.

To see whether you could make money from spread betting or trading CFDs, you could try out our risk-free demo account, which allows you to practise first using £10,000 of virtual funds. Once you feel confident enough to enter the live markets using real funds, you can then switch to a live account.

What do non-correlated forex pairs mean?

Currency pairs are non-correlated when they move independent of each other. This can happen when the currencies involved in each pair are different, or when the currencies involved have different economies.

For example, the EUR/USD and GBP/USD both contain the US dollar, and the Eurozone and Great Britain are in close proximity with closely tied economies. Therefore, they tend to move together in the same direction, although this is not always the case, as we will see further on in the article. Meanwhile, the EUR/JPY and AUD/USD have no matching currencies. In fact, the Eurozone, Japan, Australia and the US all have distinct and separate economies. Therefore, the correlation between these pairs tends to be lower.

How to trade correlation

There are many ways that correlations can be used as part of a forex trading strategy, such as through hedging, pairs trading and commodity correlations. To get started, follow the steps below.

Choose your product. Forex is often traded through derivatives such as spread betting or CFDs, so read about the differences between them.

Research the forex market. Improve your knowledge of currency pairs and what affects them, such as inflation, interest rates and other economic data.

Pick a strategy. It is often a good idea to build a trading plan beforehand.

Explore risk-management tools. For example, stop-loss and take-profit orders can be useful for managing risk in volatile markets, although these do not always protect you from market gapping or slippage.

Place your trade and monitor. Decide whether to buy or sell and determine entry and exit points, keeping an eye out for profit or loss.

What else do you need to know before trading?

Trading on the financial markets can be a daunting process, especially for a beginner, so it may be a good idea to brush up your knowledge on the following things beforehand:

Costs (including spreads, margin rates, overnight fees, commissions)

The risk that your chosen market or instrument presents

How trading with leverage works (also known as trading on margin)

How to prevent margin calls and account close-outs

Risk-management tools, indicators and market data that can help with every trade

Getting started on our forex correlation trading system

While a number of currency correlation strategies have been discussed in this article, using them on a trading system means defining exact entry and exit points, both for winning and losing trades. Next Generation is an award-winning web trading platform* that allows you to view and trade forex correlations in real time.

On our platform, any currency can be dragged from the product list onto an existing chart of any currency pair to show both currency pairs on the same chart. The following chart compares the EUR/USD (candlestick) with the GBP/USD (line). These pairs typically move together, but in this example, they moved in opposite directions. This set up is a potential mean-reversion trade.

So, have you finished reading this article and want to get started spread betting or trading CFDs on our platform? Follow the simple steps below to sign up for an account.

Open a trading account to access our product library. You’ll be able to practise first using £10,000 of virtual funds on our risk-free demo account.

With a demo, you can access financial markets such as commodities, forex, indices and treasuries for an unlimited period of time, as well as one-month free access to shares and ETFs.

Deposit funds to open your live account and access unlimited instruments. Your subscription will also include exclusive market data, Morningstar reports and a Reuters news feed.

Currency correlation indicator for MT4

There is no default currency correlation indicator on the MT4 trading platform; however, it does have a vast library of downloadable indicators in the Market and Code Base sections of the platform. These are often created and shared by third party users, so some indicators may be better than others. Some are also free, while others come at a cost. You can filter indicators by name, so typing in “correlation” in the Code Base section will often find relevant add-ons for the system. These can be installed to the MT4 platform easily.

Open an MT4 account now to get started.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

Any questions?

Email us atWe're available whenever the markets are open, from Sunday night through to Friday night.