What is leverage in forex trading?

Published on: 08/12/2021 | Modified on: 15/08/2022

Leverage in forex is a technique that enables traders to 'borrow' capital in order to gain a larger exposure to the forex market, with a comparatively small deposit. It offers the potential for traders to magnify potential profits, as well as losses.

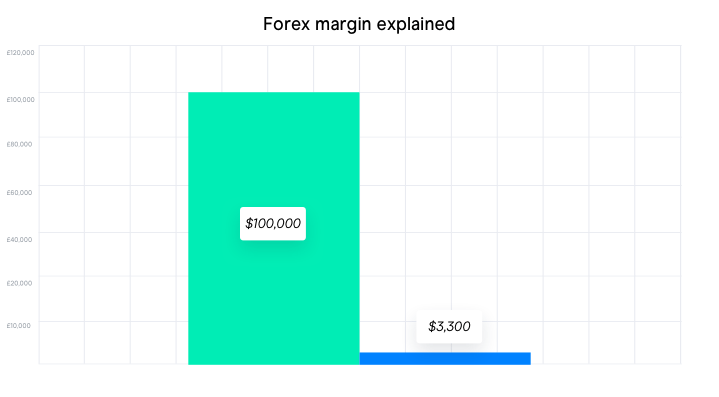

The forex market offers some of the lowest margin rates (and therefore highest leverage ratios) compared to other leveraged assets, making it an attractive proposition for forex traders who like to trade using leverage. Forex is traded on margin, with margin rates as low as 3.3%. A margin rate of 3.3% can also be referred to as a leverage ratio of 30:1. This means you can open a position worth up to 30 times more than the deposit required to open the trade.