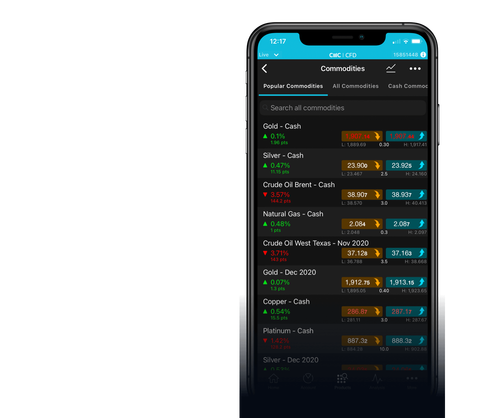

Our commodity indices group together individual commodities to make a commodities ‘basket’. The indices track the underlying prices of the commodities within that index. If the individual commodity prices in that index increase, then the value of the index will go up. Conversely, if the individual commodity prices decrease, then the value of that index will fall.

There are several benefits to commodity index trading as opposed to trading individual commodities. Firstly, it can be a more cost-effective and efficient way of trading the market, as it allows you to take a view on a commodity sector as a whole, without having to open a position on each individual commodity. Likewise, this can be a good way for you to diversify your portfolio.

However, it's important to be aware that spread bets and CFDs are high-risk, speculative products. High volatility combined with leverage could lead to significant losses. As with any leveraged product, both profits and losses will be based on the full value of your position. While you could make a profit if the market moves in your favour, you could just as easily make significant losses if the trade moves against you and you don’t have adequate risk-management in place.