Recent declines in the price of Brent crude oil and gold increase our confidence in the downward paths we wrote about last week. With new pattern segments forming, we can now refine our price targets.

While our charts last week featured daily price candles, today we're working with 240-minute candles to show how an Elliott Wave trader might anticipate price movements over a shorter time frame. We still have bearish expectations for both markets on daily and weekly time frames, even though some of the daily and intraday moves are likely to be upward.

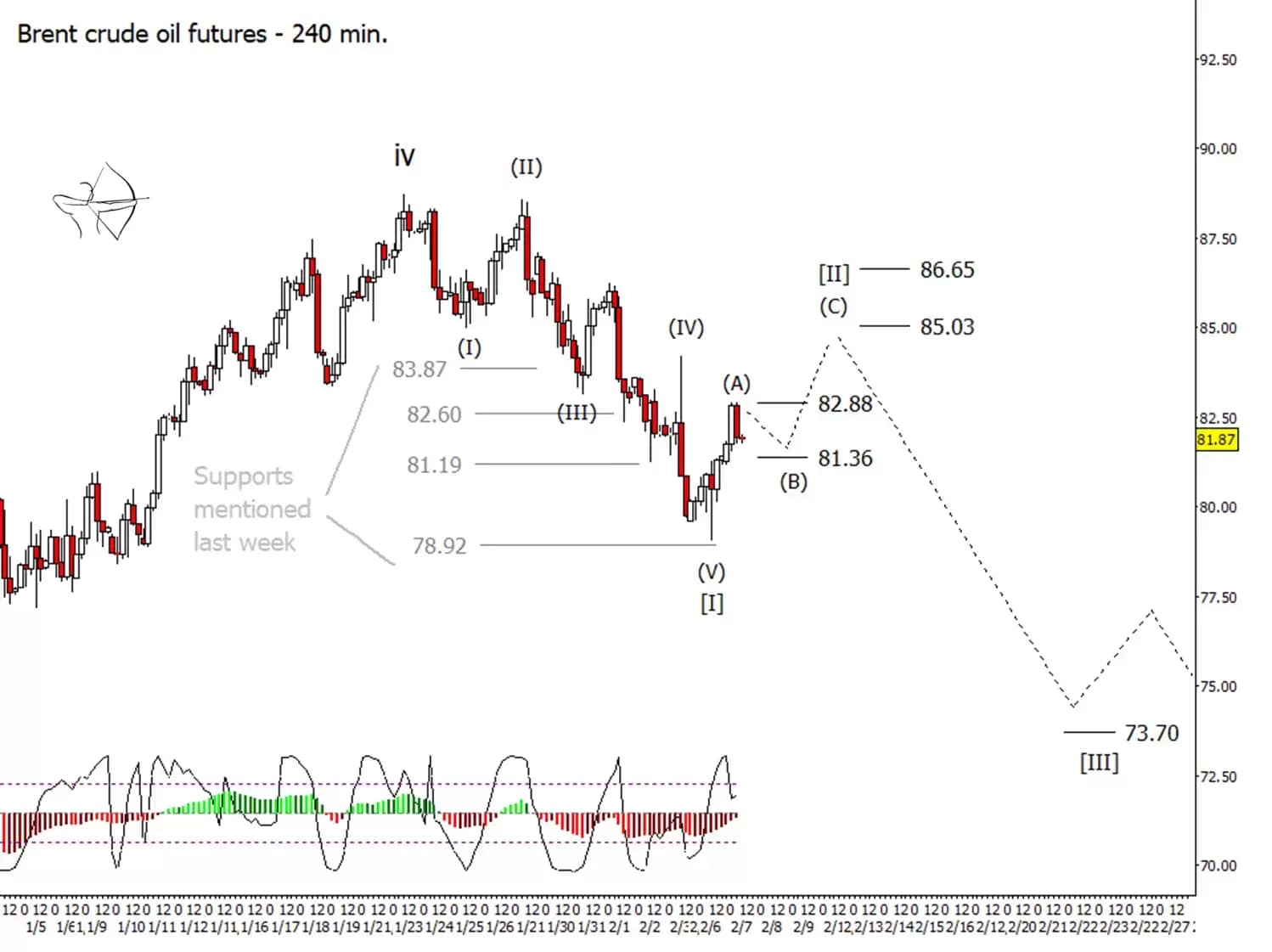

Could oil futures tick higher before downtrend resumes?

Earlier this week, Brent crude oil futures found support near the $78.92 level we marked previously. The sharpness of the bounce from that area leads us to believe that downward wave [I] of ‘v’ might be complete, with price now tracing upward wave [II]. Based on that conjecture, we’d like to see price interact for a few days with key retracement levels and resistance targets near $81.36, $82.88, $85.03 and possibly $86.65 before starting the next downward impulse.

Nimble day traders can sometimes play off those interactive levels with a combination of long and short trading strategies, although we prefer to stay pointed mostly in the direction of the trend.

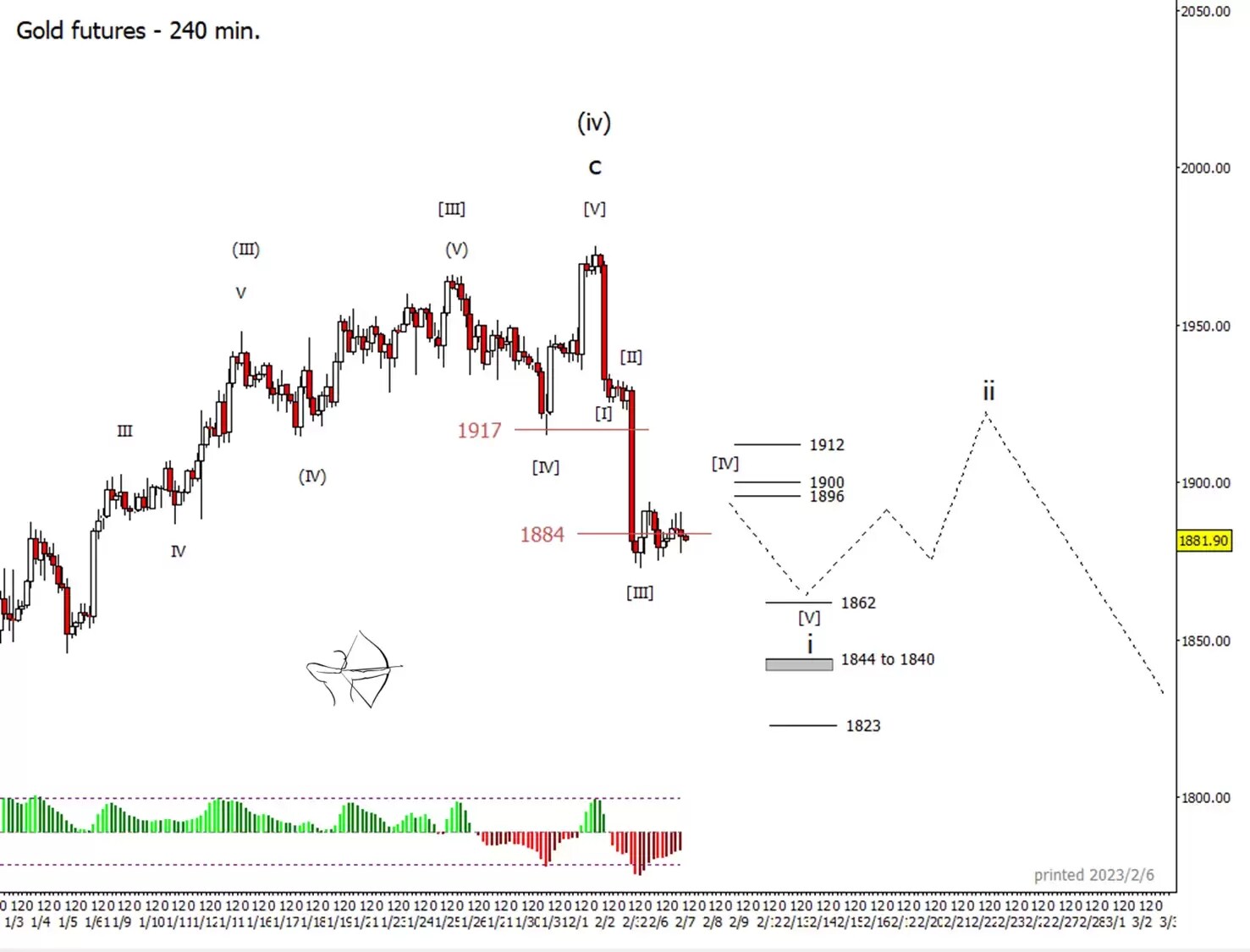

Gold futures plummeted in line with our forecasts

The daily close below $1,917 that we signposted in our bear scenario last week eventually came to pass. That decline led to a fast plunge through minor supports. Now price is oscillating around $1,884 in what looks like a small fourth wave.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.