Wall Street extended gains, with the S&P 500 rising for the fourth consecutive trading day ahead of the crucial US job data on Friday. Despite the consistent reiteration of further rate hikes by the Fed members, investors looked beyond a continuation of the US benchmark bond yields inversion and piled into the previously beaten-up tech shares. Oil prices rebounded from the last two-day sharp decline, while bond yields climbed higher.

Asian equity markets are set to take the broad rebounding tailwind in today’s session, with futures pointing to a higher open. The semiconductor stocks led growth sector gains after the South Korean chipmaker, Samsung reported better-than-expected earnings, boosting optimism in tech. China’s Ministry of Finance is reportedly considering a US$220 billion bond sale to boost the sluggish economy, which also lifted the broad sentiment in Asia on Thursday.

AU and NZ day ahead

The S&P/ASX 200 is set to open higher as indicated by the SPI futures, up 0.75%. From a technical perspective, the benchmark index is now on the pace of a rebounding trend, heading to the high seen on 28 June at about 6,763. Energy and mining stocks may be further lifted by the commodity price rebound. And China’s further stimulus plan will certainly help to fuel the optimism.

The S&P/NZX 50 was up 0.52% in the first-hour trading, heading for the 5th consecutive winning day. The big caps local companies mostly opened on a front foot following the strong session in the US markets, with Fletcher Building up 1.9%, Air NZ advancing 1.19%, and F&P Healthcare rising 1.05%.

US

The Dow Jones Industrial Average was up 1.16%, the S&P 500 rose 1.49%, and Nasdaq jumped 2.28%.

The growth stocks again led the broad gains, with both the consumer discretionary and Technology sectors up more than 2%. Energy stocks played a big comeback, up 3.5%, as oil prices rebounded. The defensive sectors, including utility and consumer staples, are laggards, up 0.08%, and down 0.1% respectively.

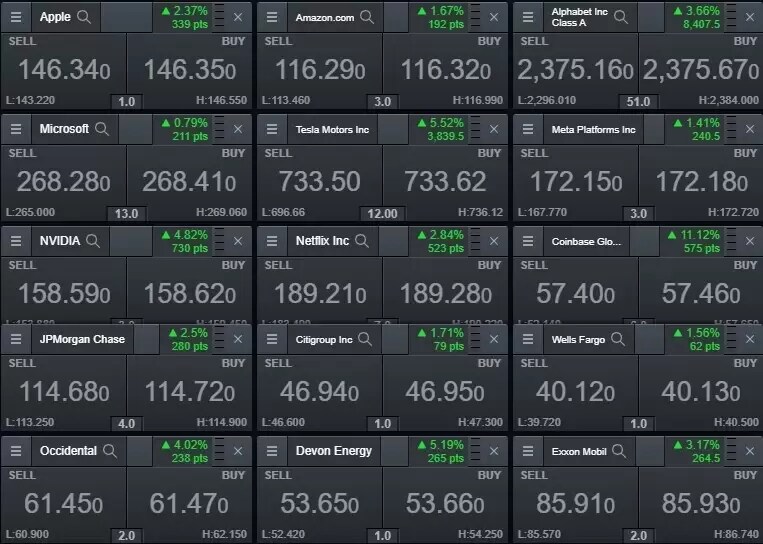

The major companies’ performance overnight (8 July 2022)

GameStop soared 15% after the company announced a 4-for1 stock split plan. Levi’s shares rose 3.84% on a stronger-than-expected company earnings report.

Europe

The Europe major indices all finished higher on the broad risk-on sentiment. The UK Prime Minister, Boris Johnson, steps down after a group of ministers’ resignations. The Stoxx 50 (+1.95%), FTSE 100 (+1.14%), DAX (+1.97%), CAC 40 (+1.60%). Read more

Commodities

The selloff in the commodity markets got a reprieve as traders shrugged off recession fears and turned their focus back to the undersupply issues. The broad stock markets’ comeback boosted the risk-on sentiment, coupled with China’s plan for more stimulus measures. However, the economic uncertainties remain with the inverted benchmark bond yields pointing to an unavoidable recession, which may continue to weigh on commodity prices.

Energy prices, including crude oil and natural gas, rebounded sharply. Precious metals were up slightly, while the resource metals jumped. The agricultural products were also higher.

WTI: US$102.73 per barrel (+4.26%), Brent: US$104.10 per barrel (+3.39%), Natural Gas per MMBtu: US$6.30 (-14.28%)

COMEX Gold futures: US$1, 739.00 per ounce (+0.18%), COMEX Silver futures: US$19.18 per ounce (+0.01%), Copper futures: US$354.30 per Ib. (+0.96%)

Wheat: US$836.50 per bushel (+3.98%), Soybean: US$1, 365.50 per bushel (+3.23%), Corn: US$596.25 per bushel (+1.92%).

Currencies

The US dollar index was slightly up to 106.885 as the Eurodollar continued to fall. EUR/USD dropped about 20 points, to just above 1.0160 this morning. USD/JPY stayed flat at around 136 for the third trading session. All the other major currencies firmed against the greenback. The British Pound rose 0.81%, to 1.2030 on Prime Minister, Boris Johan’s resignation.

Treasuries

The US bond yields climbed further as the bond markets priced in more 75-bps rate hikes to come. The yields on the US 10-year and 2-year notes stayed inverted, flashing an economic recession warning.

US 10-year: 2.99%, US 2-year: 3.01%.

Germany bund 10-year:1.31%, UK gilt 10-year: 2.12%.

Australia 10-year: 3.46%, NZ 10-year: 3.64%.

Cryptocurrencies

The crypto markets extended gains for the third session as the equity markets’ rally fuelled optimism. The global crypto markets cap rose 4.15%, to US$959.86 billion in the last 24 hours.

(See below prices at AEST 8:32 am according to Coinmarketcap.com)

Bitcoin: US$21.628 (+5.73%)

Ethereum: US$1,231 (+4.19%)

Cardano: US$0.4767 (+3.06%)

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.