Wall Street managed to finish mixed following the US regulator's rescue package to limit SVB’s contagion to the broader economy. Bond yields plummeted as the well-known bank's failure strengthened bets for the US Federal Reserve to pause rate hikes in March.

A wider rippling effect may heighten the systemic risk and call the Fed to pause its rate-hike cycle. Markets are perhaps pricing for a financial crisis and a possible Fed pivot, ahead of key inflation data that is due for release later on Tuesday.

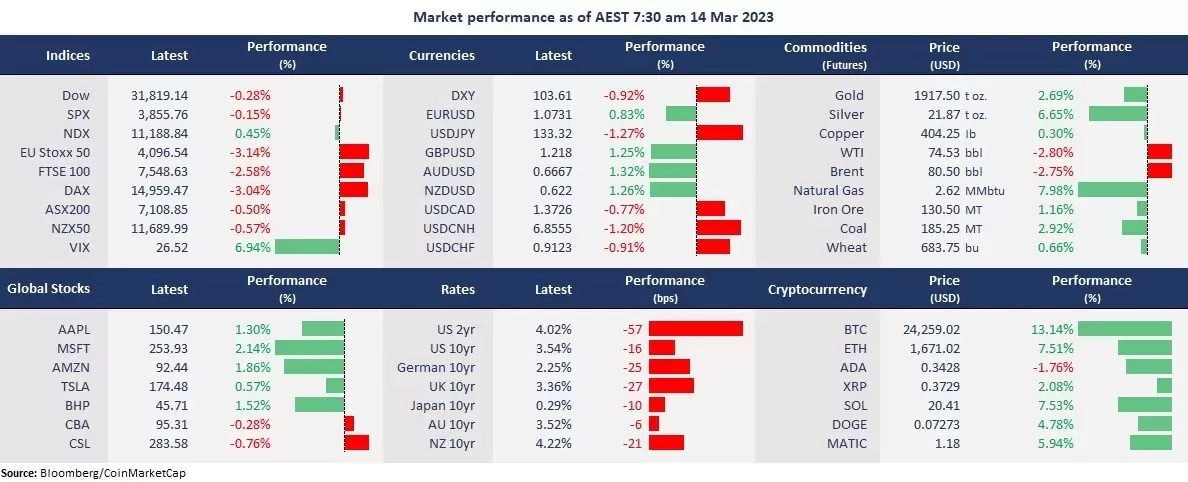

The US 2-year bond yield tumbled 57 basis points, the biggest one-day drop in decades, boosting risk sentiment in tech, and leading the Nasdaq to climb higher, while banking stocks continued to slump, with banks heavily relying on lending, such as Citigroup and Wells Fargo plunging more than 7%. The sell-off spread to European banks, leading the regional markets sharply lower. The volatility index jumped another 7% to above 26, the highest since early November.

The US dollar slipped for the third straight trading day following a slump in the bond yields, with risk-off sentiment firing up buying frenzy in gold and silver. On the other hand, oil prices tumbled as traders may see a possible sooner economic recession.

Asian markets are set to open sharply lower. The ASX futures fell 1.79%. Hang Seng index futures were down 0.29%, and Nikkei 225 futures fell 1.52%.

- Four out of 11 sectors in the S& P 500 finished lower, with financial stocks leading losses, down 3.78%. The energy, material, and industrial sector were also laggards, down 1.96%, 1.09%, and 0.61%, respectively. Notably, the growth sectors, including technology, communication services, and consumer discretionary outperformed amid a sharp decline in the bond yields. The defensive sectors, such as utilities, healthcare, and consumer staples also held up strongly.

- HSBC’s shares slumped 3.9% following the £1 ($1.21) acquisition to take over SVB’s UK arm, excluding the assets and liabilities of SVB’s parent company. SVB UK had a loan of approximately £5.5 billion ($6.7 billion) and deposits of about £6.7 billion ($8.1 billion), with £88 million ($106.5 million) of full-year profit before tax in 2022 according to the HSBC statement last Friday.

- Gold futures soared for the second straight trading day as a slump in the US dollar and US bonds boosted precious metal prices. Silver futures also surged 1.4 dollars per ounce, or 6.8%, to a one-month high. Risk-off sentiment also offered an upside push to gold prices.

- Cryptocurrencies rose sharply on the Fed pivot bets, along with a drop in the dollar. Traders have shrugged off fears towards Silvergate’s liquidation risk, fuelled by the optimism for bets on a Fed policy turnaround. Both Bitcoin and Ethereum reached their highest level in almost a month.

- Crude oil fell after bouncing session lows as a softened US dollar buffered its downside movement. Recession fears again become the major bearish factor for the energy markets. Key support for the WTI futures is seen around $70, the lowest since early December 2022.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.