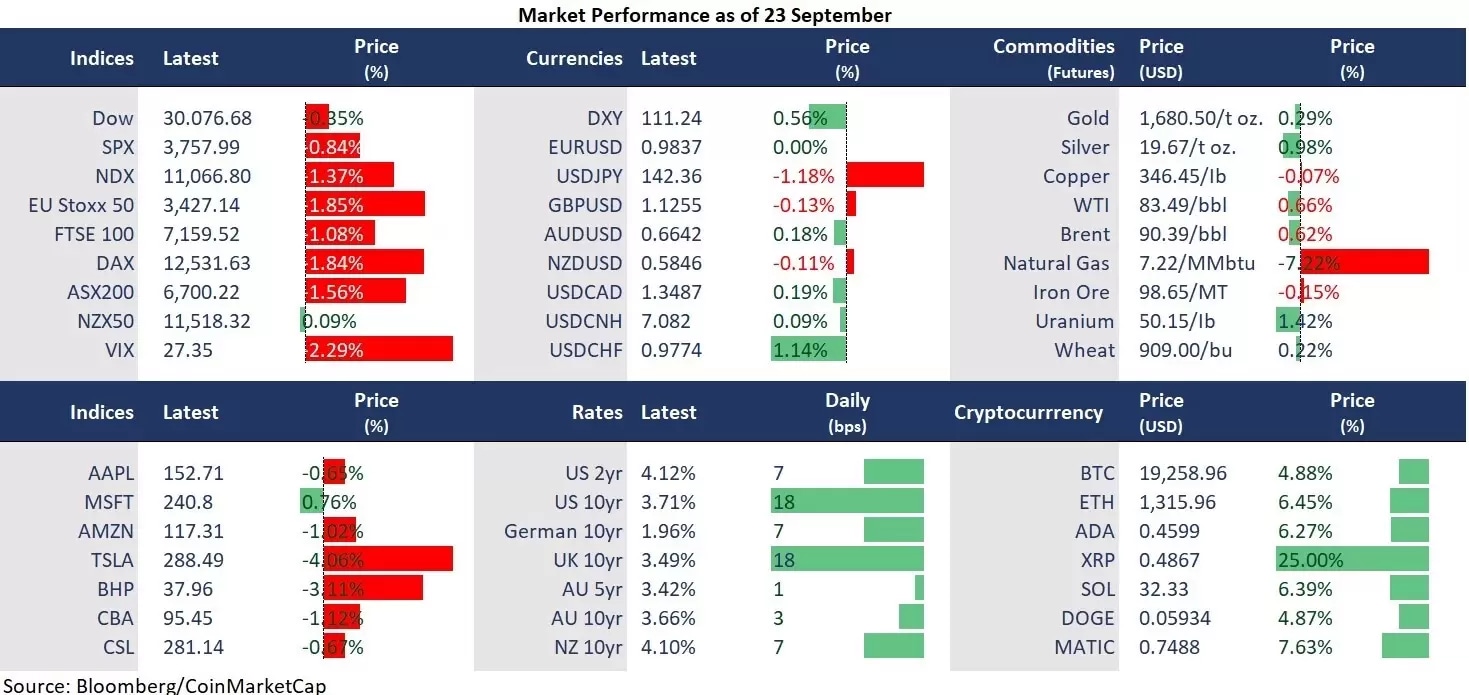

The US major averages fell for the third straight trading day as central banks’ rate hikes continued to weigh on sentiment. Following the Fed, Swiss National and Bank of England raised interest rates by 75 bps and 50 bps, respectively. The Bank of Japan intervened exchange rate by selling USD and buying Yen, for the first time since 1998, sending USD/JPY down by 1.2%. However, a further jump in the US bond yields continued to push up the US dollar, with dollar index up 0.6% on Thursday. In the face of decades high inflation, major central banks accelerate the pace on rate hikes, bringing their benchmark rates to the highest in more than a decade, which may lead the way to a global economic recession.

- Dow down 0.36%, the S&P 500 slipped 0.84% and Nasdaq fell 1.37%. Both Dow and S&P 500 declined 13% from their August high, and Nasdaq fell 16% during the same timeframe. 9 out of 11 sectors closed lower, with consumer discretionary (-2.16%) and financials (-1.66%) leading losses, while healthcare and communication services outperformed, up 0.51% and 0.06%, respectively.

- Boeing’s shares fell 3.2% after China confirmed to buy 40 jets from Airbus SE, worth $4.8 billion. The deal marked a loss of Chinese market of the world largest aerospace manufacturer in the wake of crashes of its 737 Max, along with intensifying geopolitical tensions between China and US.

- Swiss National Bank raised interest rate by 75 bps for the second time in a row, bringing the rate to 0.50%, out of the negative territory for the first time since 2011. The bank has kept its interest rate at -0.75% since 2015. However, the Swiss Franc dropped 2% against the Eurodollar as traders expected for a larger hike.

- Bank of England hiked rate by 50 bps to 2.25%, the highest since 2008. The bank said the UK may be already in a recession, with a forecast of contraction of 0.1% in GDP for the third quarter, following by a negative growth of 0.1% in the second quarter.

- Asian markets are set to open lower as the jump in the US bond yields put pressure on the local rates, which accelerates devaluation in the regional currencies and worsens their domestic inflationary pressure. ASX futures were down 0.26%. Nikkei225 futures fell 0.85% and Hang Seng Index futures declined 0.37%.

- Crude prices pulled back from session highs as commodities continued to be under pressure due to a strong US dollar and recession fears. Gold was flat but consolidated above the recent key support of 1,650, suggesting the safe haven asset is in favour of investors on the current risk-off sentiment.

- Bitcoin bounced off a two-year low level, which is a pivotal support of just above 18,000. Despite a drop in the equity markets, cryptocurrencies were generally up, with XRP up 23% in the last 24 hours. The resilient moves in the digital coins suggest that traders may seek for a bottom.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.