Somewhat surprisingly, the S&P 500 closed at 5,344 points on Friday 9 August, down just two points from 2 August, but essentially flat over the week. That's quite something when you consider that the index started last week with a 3% loss on Monday. That move was the S&P 500’s biggest one-day fall in nearly two years.

Crisis averted?

Does this turnaround mean normal service has been resumed? Well, there has certainly been a rebound in confidence, at least in the short-term. The percentage of stocks in the S&P 500 trading above their five-day moving average rebounded to 82% by Friday’s close, compared to a low of just 7.35% on Monday 5 August.

The equivalent measure for the Nasdaq 100 also rallied sharply across the week. Having touched a low of 4.95%, it closed on Friday at 83.16%.

Digging deeper into the S&P 500 information technology sector, which has driven the overall market for most of this year, we find that more than 65% of its constituents finished up over the last five trading days, and that the average gain among its 67 stocks was 1.48%.

However, despite the positivity, traders can’t just forget about last Monday’s near-meltdown. Not least because we have inflation data from the US due to be published on Wednesday. The July consumer price figures could influence investors’ thinking with relation to the prospect of a Federal Reserve interest rate cut, an issue which contributed to last week’s sell-off.

UK second-quarter GDP and China’s July retail sales, both due on Thursday, are among the coming week’s other major economic data releases.

Trade Desk trading higher as US earnings season winds down

Several large-cap stocks had a good run last week, posting five days of gains in a row. These include the Nasdaq-listed online advertising platform Trade Desk [TTD], which finished the week up 19.52%, and the New York-listed shares of Brazil's Banco Bradesco [BBD], which climbed 21.27% over the week.

Q2 earnings season is now coming to an end in the US, with 91% of companies on the S&P 500 having announced their latest quarterly results as of Friday's close. Of those businesses that have already reported, 78% posted an upside earnings surprise, and 59% of them beat analysts’ revenue estimates.

The earnings growth rate for the quarter is currently running at 10.8%, which would be the strongest growth rate since Q4 2021, according to research from Factset.com

In Europe, earnings per share (EPS) beats have been reported by around 56% of STOXX 600 constituents, a figure that is just above the quarterly average. It's a similar story as far as revenues are concerned, with 60% of companies that have reported so far beating on their top line, versus an average of around 58%, according to data from LSEG.

European stock indices have started the new week on a positive note. On the morning of Monday 12 August, France’s CAC 40 and Germany’s DAX were both up around 0.35%, while the FTSE 100 had added 0.5%.

Point of interest: Will Japanese stocks rebound?

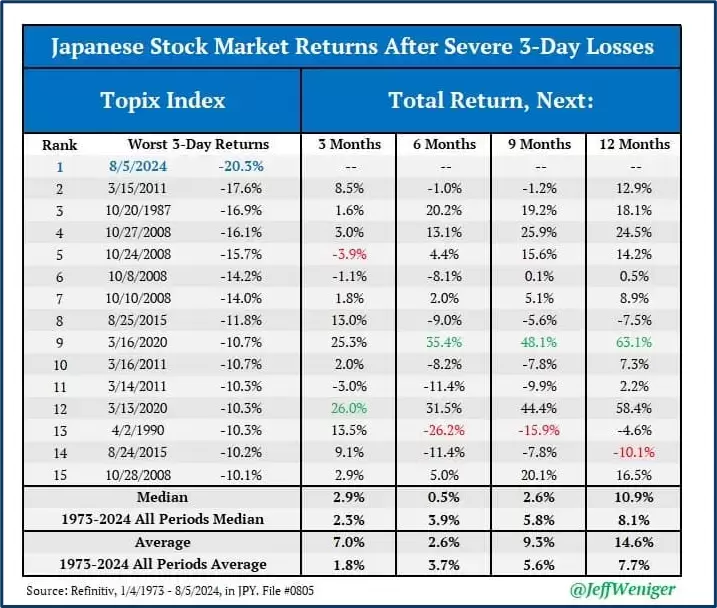

The table below illustrates how the Japanese market has performed following previous instances of severe three-day losses, such as the plunge we saw last week. The omens are generally positive. However, historical rebounds for Japan's stock market – when they’ve happened – haven't always been immediate.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.