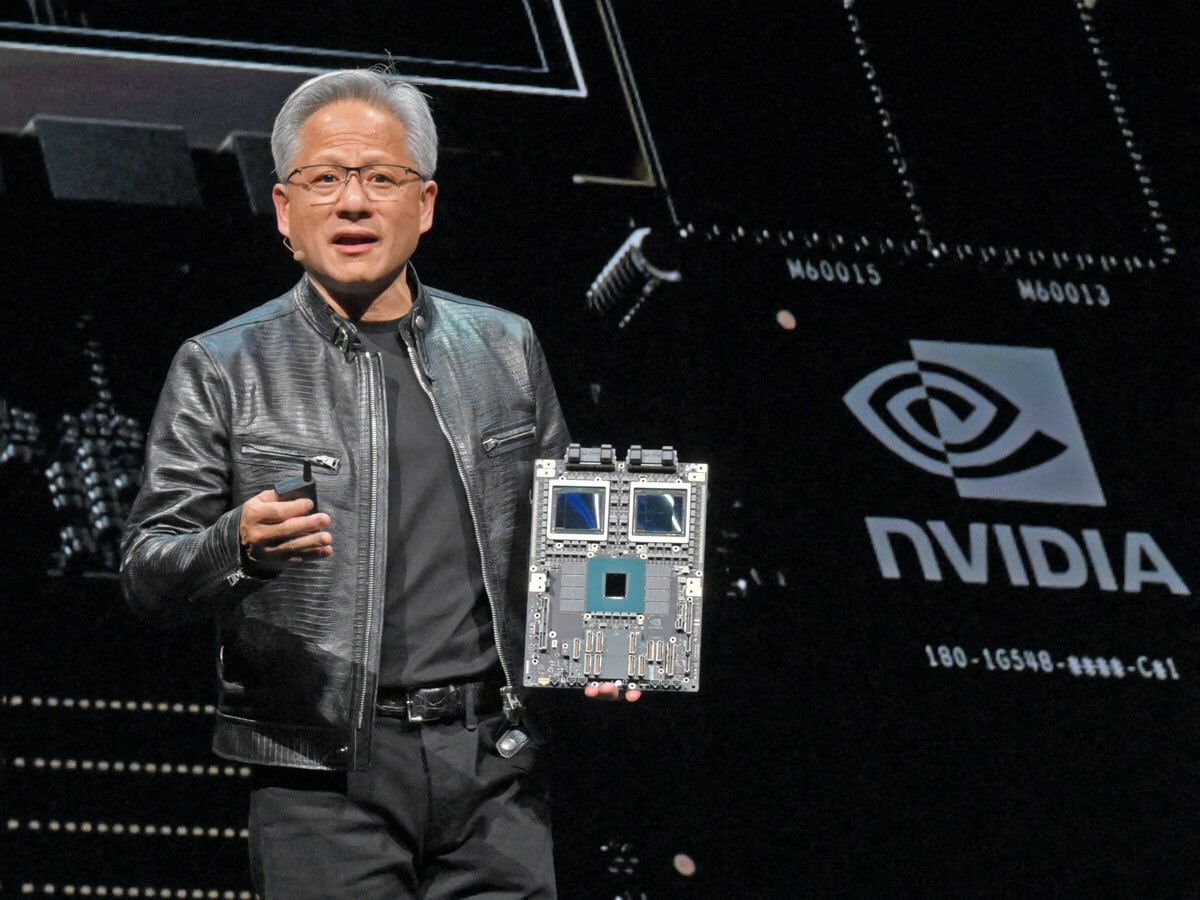

Nvidia’s share price is on everyone’s lips due to its dominant position in the AI industry, backed by cutting-edge technology and software. While its success is undeniable, investors should also consider potential risks and how the market perceives them. For example, positive developments like development updates on Nvidia’s upcoming Rubin chip are having little impact on its stock price, suggesting much of Nvidia's success may already be priced into the share.

While Nvidia is the current benchmark, its market dominance could face challenges from competitors, particularly in AI inference, where specialised hardware might disrupt its GPU-focused approach. The key question is whether Nvidia's current valuation justifies its upside potential, given the risks posed by emerging players like Amazon with its Tranium chip and other tech giants developing AI hardware solutions.

Market assessment

The market’s price/earnings (P/E) ratio is currently at its highest level in decades. The S&P 500's performance has been heavily driven by the magnificent seven stocks: Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla. These few companies have accounted for a significant share of the index’s recent gains.

Price-earnings ratio

Stocks are valued using price/earnings multiples, reflecting a company's projected earnings for the next year; buying a stock means purchasing a share of the company’s future earnings, assuming the company makes money over several years.

The S&P 500 has averaged a P/E ratio of 16 since World War II, which could be seen as paying for 16 years of earnings. However, the process of discounting future earnings makes $1 in the future worth less than $1 today, so a P/E ratio of 16 represents paying for more than 20 years of earnings, (depending on the discount rate used).

During market bubbles or in periods of overheating, hot stocks can trade far above the typical P/E ratio of 16. For example, during the dot-com bubble, some stocks traded at 60 to 90 times future earnings, if they had any earnings at all. For investors, the P/E is often just a number, and it's right until it's not.

Nvidia's current forward P/E ratio is just over 30, just under double the post-war S&P 500 average but far below dot-com bubble levels. A P/E ratio in the 30s suggests investors expect Nvidia to remain successful for decades, with steady earnings growth and resilience against competitors. However, sustaining dominance in high-tech industries is challenging, as new technologies and competitors can quickly disrupt the landscape.

AI is here to stay

Artificial intelligence (AI) will likely remain a key market theme, but investor focus may shift as AI adoption evolves. Companies, even those previously seen as "AI losers" that struggled with the initial transition to AI, could now find ways to leverage the technology, potentially signalling a broader, more balanced integration across industries.

It is unclear which companies could emerge as winners, but software companies integrating AI into their solutions could gain an edge. Many firms now view AI as an opportunity rather than a threat, signalling a possible strategic shift. Even industry leaders like Nvidia must continuously evaluate their position, and investors should stay alert in this dynamic market

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.