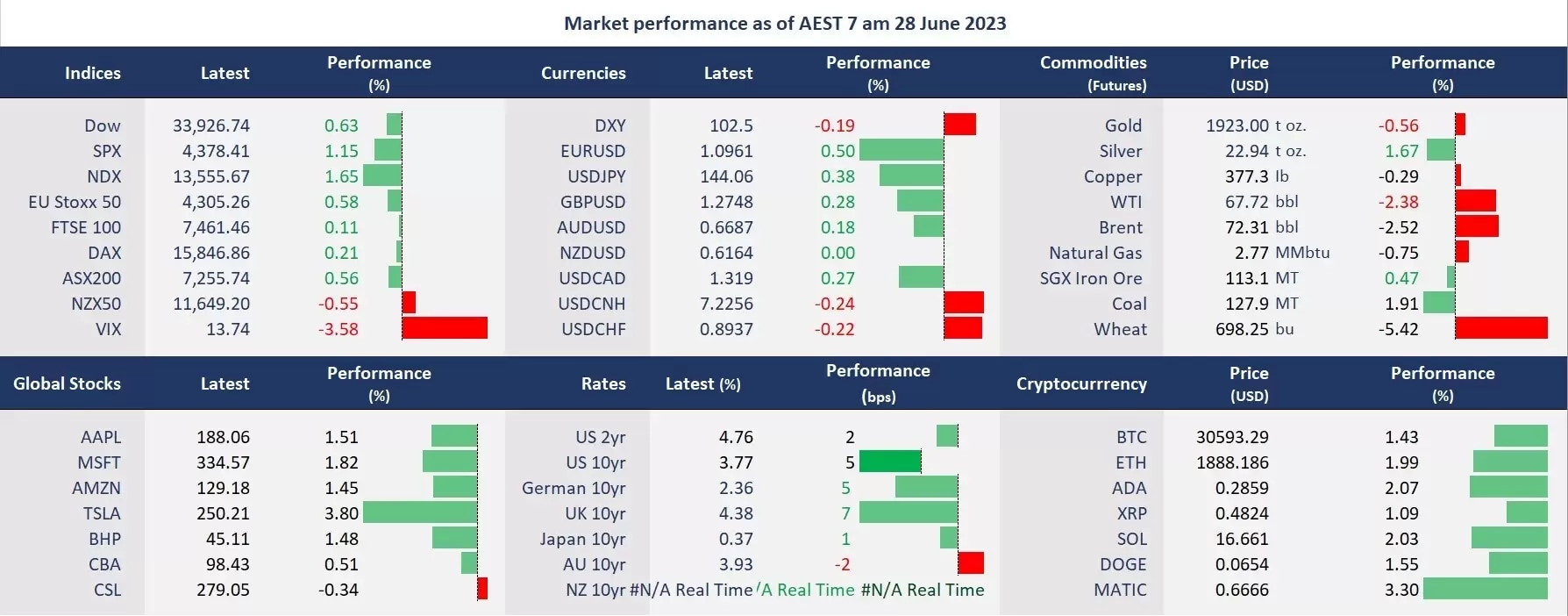

A slew of surprisingly strong economic data overrode recession fears and buoyed Wall Street on Tuesday. Tech stocks resumed jumbo gains, leading three benchmarks higher, with all the mega caps, including Apple, Microsoft, Amazon, Meta Platforms, Tesla, and Nvidia, rising between 1-3%. Dow snapped a 6-straight losing streak amid the broad-based rally. The June US CB consumer confidence index rose to 109.7, the highest since early 2022. And the new home sales for May grew at the fastest pace in more than a year. The May durable goods orders also advanced by 1.7%, well above an expected -0.8%.

The positive economic front may have strengthened bets for a mild recession and increased the chance of “higher for longer” rates. The US bond yields bounced back from Monday’s slide, but the US dollar weakened against the Eurodollar and the British Pound due to stronger hawkish tones of the ECB and the BOE than it was of the Fed. ECB President Christine Lagarde reiterated to continue raising rates to fight inflation as the Eurozone’s headline inflation for May printed at 6.1% and still well above the central bank’s 2% target.

In Asia, the Hang Seng Index also snapped a 5-day losing streak ahead of China’s manufacturing PMI later this week. Futures point to a higher open across Asian equity markets. The ASX 200 futures were up 0.37%, the Hang Seng Index futures rose 0.25%, and the Nikkei 225 advanced 0.61%.

Price movers:

- 10 out of 11 sectors in the S&P 500 finished higher, with growth sectors, including consumer discretionary, technology, and communication services, leading gains, up 2.06%, 2.04%, and 1.12%, respectively. Healthcare was the only sector that ended in the red, down 0.2%.

- Unity’s shares surged 12% on an announcement that the gaming platform launched a dedicated AI marketplace, allowing “developers to generate assets for use in their projects” for “generative AI solutions.” The company’s shares rose more than 70% from the low in May as it has been talking about its AI developments.

- Wise, a UK-based fintech company’s shares soared 16% amid strong earnings reports due to benefiting from high-interest rates. The company’s profit before tax tripled to £146.5 million, and overall income rose 73% annually to £964.2 million.

- USD/JPY hit a fresh 7-month high to above 144 as the Japanese Yen continued to decline against its peers. The diverging monetary policy that widens the gap in major economies’ government bond yields continues to weaken the Yen.

- Commodities fell broadly due to strengthened odds for the Fed to continue raising rates in the coming months. Gold futures erased the two-day gains, approaching potential imminent support of about 1,900. The WTI futures slumped again on China’s economic concerns, testing possible near-term support around 67.

ASX and NZX announcements/news:

- The New Zealand-based travel management and expense technology company Serko (ASX/NZX: SKO), will hold its Annual Meeting at 2 pm local time today. Its FY23 guidance is unchanged at between NZ$63 million and NZ$70 million, indicating that the result may be above the range if the June 23 quarter trends continue.

Today’s agenda:

- Australian monthly CPI for May y/y

- Fed Chair Powell speaks at Sintra central banking event in Portugal.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.