If 2022 was the year that saw renewables consolidate after the surge to record highs in 2021, 2023 has been a more sobering affair with the sector sliding back to its lowest levels since August 2020 with the prospect of meaningful returns further away than ever.

While the political narrative is of one where investment in wind and solar power, along with other renewables is the right thing to do for the planet, the reality is the cost of doing so is proving ruinously expensive given the huge use of basic resources in the development of the technology as well as the delivery of the infrastructure.

Even now politicians try and push the misleading narrative that renewables are the cheapest long-term option, trying to sell the idea with political soundbites of the kind that the UK can be the Saudi Arabia of wind, when the reality is closer to being the Saudi Arabia of hot air.

Investors are already cottoning on to the shortcomings of the current strategy when it comes to the delivery of returns, and the distinct lack of them, compared to the availability, reliability and relative cheapness of current fossil fuel alternatives.

The key element here is reliability, given that for all the benefits of solar and wind it all counts for nothing when the wind doesn’t blow and the sun doesn’t shine and the battery storage technology doesn’t exist to be able to store and release the power required when needed.

It is this missing link along with the ability to cover the sunk costs required to build the extra infrastructure required to support new wind and solar farms, along with the upgrades to infrastructure required to deliver the power to where it is needed.

This is an area that so-called climate activists prefer not to dwell on, as well as the huge environmental damage that is likely to occur from the mining of huge amounts of copper, lithium, salt, sodium and other rare earth materials which are located in some of the most far-flung corners of the globe.

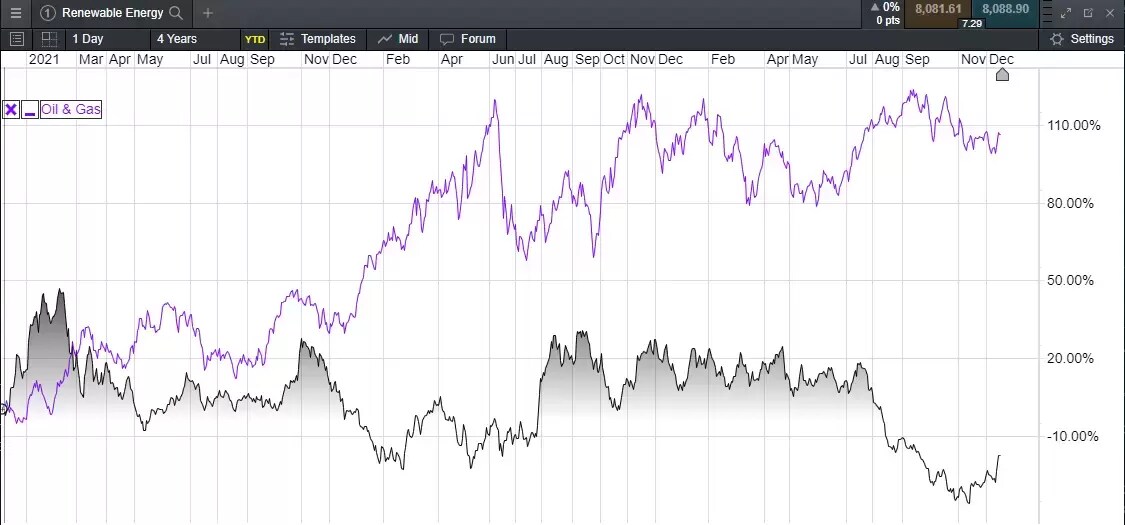

CMC Oil & Gas, CMC Renewable Energy basket since 2021

Source: CMC Markets

Since the renewables basket reached its peaks in early 2021 the reality of having to deliver on the optimism of the transition to renewables has collided with the reality of trying to do so. Even the Biden administrations huge tax breaks to encourage the transition haven’t been enough to help the sector as the rising costs of raw materials collides with the reality of trying to deliver.

To be fair the uncertain geopolitical environment hasn’t helped with the Russian invasion of Ukraine in 2022, followed by the horrific events in the Middle East which has served to keep oil and gas prices quite high relative to their long-term mean.

This is especially true when it comes to gas prices which are still well above their pre-Covid levels and unlikely to return there in the face of high demand, as the dirtier options of coal get pared back further.

As we look towards 2024 the renewables sector is likely to continue to be a challenging environment as the challenges facing it become more apparent when it comes to the huge amounts of raw materials required to deliver on net zero targets.

With the pressure from climate activists unlikely to relent as they continue to push unrealistic policy positions, which offer little in the way of solutions to high energy prices, politicians continue to pander to their infantile positions, preferring to pander to that zeitgeist rather than focus on the world as it is now. Instead, they choose to focus on how they would like the world to be, rather than showing the pragmatism and leadership required which would help hard pressed consumers and businesses who are having to cope with sharp increases in energy costs.

YTD performance - Oil & Gas vs Renewable Energy

Source: CMC Markets

As far as markets concerned the bleeding in the renewables story has continued this year while the oil and gas giants have realised that for all of the benefits of renewables from a CO2 point of view, the global economy is nowhere near to being able to wean itself off fossil fuel use, meaning that they have become much more discerning when it comes to prioritising capex spend.

This year the oil and gas sector has consolidated the gains seen from the record energy prices of 2022, prioritising production output efficiency, and returns to shareholders, while renewables valuations have continued to slide, and we’re not just talking new solar and battery powered startups here but established players with the likes of Vestas Wind Systems, Siemens Gamesa and Orsted struggling to make any type of return on their renewable assets.

Over the past few months, we’ve seen the likes of Orsted cancel 2 US offshore wind farm projects, while Siemens Energy decided not to build a wind turbine manufacturing plant in Virginia in the wake of suffering €4.3bn of losses in its Siemens Gamesa renewables business in its most recent trading update.

The problems in the wind turbine division are expected to cost around $1bn to fix due to supply chain issues, along with the rising costs of raw materials, and competition from China, which is also hammering profit margins, and which fell to -47.8% in 2023, pushing the shares to record lows in October this year, and down almost 60% year to date.

European renewables YTD

Source: CMC Markets

Orsted shares have done little better the shares were also down 60% year to date in October, although we have seen a bit of a rebound in the sector since then, with problems in the US prompting an acceleration of the weakness seen throughout the year. The decision to call time on 2 US wind farms saw the company take a $5.6bn impairment on its Ocean 1 and 2 wind projects in New Jersey.

The problems in this area also manifested themselves into impairments for the likes of BP and Equinor who also booked small impairments on their renewable’s exposure to this area of the US.

Similarly, Vestas Wind Systems has seen problems of its own, again related to wind turbines due to higher costs as well as some quality control issues, although at least Vesta shares are above pre pandemic levels unlike its peers.

Costs for an existing backlog of wind turbine orders and services agreements rose by €3.7bn to over €51bn.

Comparison chart Orsted/Vestas Wind Systems since 2020

Source: CMC Markets

These two companies have a much better and durable pedigree in this space, and did very well in the aftermath of the pandemic lockdowns, as shown by the graph above, however its notable that in the last two years they have struggled to move higher, with Orsted seeing ever bigger losses in the last 12 months, despite seeing a big jump in revenues during 2022 to DKK132.28bn, a figure that the company has fallen well short of this year as energy prices have fallen.

Investment in wind power, and renewables is a capital-intensive process, with lots of sunk costs that are now much higher than they were 3 years ago. Margins aren’t anywhere near as large as they are for fossil fuels, and will never likely be so.

To breakeven, strike prices need to be much higher for companies to sign up to commit the capex necessary to embark on, or complete a windfarm or solar project given the rising upfront costs of putting in place the necessary resources to finish a project and that’s even before connecting it up to the grid.

Renewables companies’ biggest problem is that unlike the oil majors who can create and sell by-products of their core product, they don’t have any other income, which means committing to future capex comes fraught with difficulties in terms of raising the sums of money needed.

Between now and 2030 Orsted recently upped the amount of money it said it was looking to commit to renewable projects from DKK350bn to DKK475bn or $60bn, with the company committing earlier this month to complete Hornsea 3 on Britain’s Yorkshire coastline by 2027, for the sum of almost $11bn, with most of the capex already contracted at pre inflationary level prices.

Of that money the company said it would commit DKK145bn, to onshore wind, DKK260bn to offshore wind and DKK70bn to solar, while also committing to investment in green hydrogen and sustainable biofuels.

While wind power has struggled to generate returns the outlook hasn’t been much better for solar power operators either as can be seen from the returns in the CMC Renewables Basket which comprises a mixture of wind, solar, hydroelectric, along with the development of battery technology.

This basket as shown in a previous graph is down over 30% year to date and comprises 18 different companies with similarly different weightings.

The companies with the biggest weightings are First Solar at 13.28%, BWX Technologies at 12.33% and Hannon Armstrong Sustainable Infrastructure Capital with 12.29%, all of which haven’t performed too badly this year, and yet the basket has still taken a beating, which gives an indication that while some companies have managed to perform well, the majority have taken a beating.

The big outperformer has been BWX Technologies which has seen its share price rise over 30% year to date.

As with last year First Solar has retained its high weighing and is a US renewable energy company and leading global provider of solar solutions, whose share price has remained steady this year after some hefty gains in 2022 with a market cap of over $17bn.

Annual revenues this year are expected to be $3.47bn, finally pushing it above the seen in 2019 when the company turned over $3bn. The company was founded in 1999 and is based in Tempe, Arizona. It manufactures solar panels and is a provider of photovoltaic (PV) power plants and other supporting services. According to its website, First Solar has the lowest carbon footprint, lowest water usage and fastest energy payback of any PV technology firm, and delivers cost-competitive alternatives to fossil fuels. It currently operates many of the world’s largest grid-connected PV power plants.

Hannon Armstrong Sustainable Infrastructure Capital is a private equity company that provides financing to the renewable energy sector, and according to its website has $11bn of assets under management, focussing on climate solutions. Investment in projects ranges from, wind, solar as well as hydro projects including a tidal restoration project in the Sacramento River Delta. The company also has small stakes in various solar projects across 6 US states.

BWX Technologies is a nuclear technology company whose customers include both public and private sector customers. The company designs, engineers and manufactures the propulsion systems for the US navy and specifically its submarines and aircraft carriers. It also supplies the components for private sector and its nuclear industry, supplying the steam generators, pumps and other critical systems to ensure that nuclear power plants run in a safe manner. The company’s expertise doesn’t stop there as given its expertise in dealing with radioactive materials it also supplies the medical isotopes that are used in imaging and the treatment of cancer, as well as other diseases. Give the current environment with respect the global transition towards carbon neutral technology it’s not surprising that the company’s share price has performed so well in the last 2 years, up over 30% year to date and up over 70% from its 2022 lows.

While the technology may not be classed as a renewable source of energy the fact it is carbon free means that nuclear is likely to be a key component in the transition towards a future that has a lower carbon footprint.

With the cost of raw materials like copper becoming more expensive the transition to wind as well as solar is likely to become more challenging as margins become thinner, although rising prices will ameliorate some of that effect.

Looking at some of the companies within the CMC Renewables basket we can see how some of the market leaders in this space are adapting to higher demand for their products, and how that is being reflected in share price performance, at a time when calls for a transition to renewables has got louder, along with calls that governments actively discourage funding for new sources of fossil fuels.

We’re already starting to realise that moving to renewables won’t be a light switch transition, much as many people would like or wish it to be. The UK government’s decision to push back the deadline for all new cars to be zero emission/electric to 2035 attracted a great deal of criticism at the time but was merely an acceptance of the folly of trying to move too quickly in a market that is running into capacity constraints, as well as starting to get significant push back from fed up consumers.

The transition to low or zero carbon technologies needs to be done on a slow burn basis so that energy price rises don’t drive millions of people into fuel poverty, in a mirror of what is currently happening now.

As can be seen from the examples above there is a huge amount of interest in the renewable energy sector, with a lot of innovation, however when looking at the fundamentals, the most notable trend has been the huge rise in costs, not only from raw materials, but also in labour.

Despite these problems, the long-term prognosis suggests there is scope for growth, however unless governments and companies can prove that the costs of moving to more sustainable fuels will mean lower bills then the likelihood of pushback over the course of the next few years is expected to increase.

At the end of 2020 it was estimated that only 3% of US households had solar panels, and this has increased to 3.7% by the end of 2023, with California having the most, at 10.5% of available single-family homes.

President Biden’s climate agenda has a target of 40% by 2035 which looks increasingly ambitious. That’s a lot of solar panels, as well as semiconductors, and all the other related grid upgrades that need to happen for that target to be met.

The next few years are likely to be interesting times for renewables with winners and losers alike. In times like this spreading your risk is safer than adopting a pick and mix approach to investing and baskets can be helpful in spreading that risk.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.