Wall Street extended its losing streak for the fifth straight trading day as the selloff in tech intensified amid the US’s restrictions on the Chinese chip makers, with shares of Taiwan Semiconductor Manufacturing Co Ltd. tumbling 6.5%. On the macro scene, the Bank of England’s governor, Andrew Bailey, warned of “serious risk to UK financial system stability” and clarified that the current bond-buying program would be only temporary, which will be ended by the end of the week. His rhetoric sent a strong message that the bond market rout may be far away from an end. The British Pound gave up early gains and nosedived against the US dollar due to his speech, while the US bond yields regained upside momentum, with the 10-year Treasury yield rising to 3.93% from 3.88% a day ago, worsening the decline in high multiple stocks.

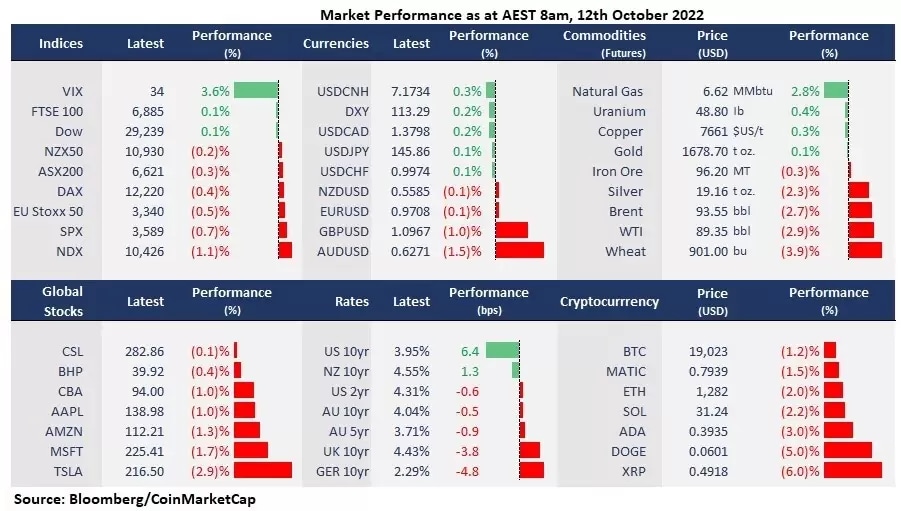

- Nasdaq finished at a fresh two-year low due to tech wreck, down 1.1%, to 10,426.19. 7 out of 11 sectors in the S&P 500 finished lower, with growth stocks leading losses, while defensive sectors, such as Consumer Staples and Healthcare were higher. Real Estate also performed strongly, up 1.02%. All the mega-cap tech shares fell between 1-3%, with Meta Platforms tumbling to a fresh 52-week low, down 3.9%.

- Meta debuts Quest Pro VR headset that costs $1,100 with advanced reality technologies, such as an advanced mobile Snapdragon computer chip developed with Qualcomm (-3.93%). Microsoft (-1 65%) CEO Nadella is reportedly to join Meta CEO Mark Zuckerberg in its VR development with Teams.

- Coinbase shares outperformed the broad tech stocks, up 3%, after Google confirmed to partner with the company to explore services to allow some customers to pay for could services with cryptocurrencies.

- IMF cuts global growth forecast for global growth to 2.7% from 2.9% in July. The organisation warns of worsening outlooks due to high inflation, the Ukraine war, and China’s economic slowdown, citing that “worse is yet to come”.

- Selloff intensified in Chinese US-listed tech shares amid the Biden administration’s curbs on companies that partner with Chinese chipmakers. The major Asian chip makers, including TSMC (-6.5%) and Samsung (-1.4%), both suffered badly from the conflict following last week’s AMD revenue downgrade. The Chinese tech giants, including Alibaba, Baidu, Tencent and JD.com were all down between 2-5% on the Hong Kong Stock Exchange.

- Credit Suisse faces a tax probe by the US Justice Department on an investigation of whether the bank continued to aid clients in tax evasion. The bank paid a $2.6 billion settlement while pledging to solve the issue in 2014.

- Asian markets are set to open lower following the sharp decline in broad tech stocks. ASX futures were down 0.33%. Nikkei 225 futures fell 0.19% and Hang Seng Index futures declined 0.88%.

- US dollar cut early losses, with Asian currencies finishing mixed. The dollar index finished higher after BOE governor Bailey’s speech at the IMF conference. The New Zealand dollar outperformed the major Asian currencies after the RBNZ’s hawkish indication on its rate hike path last week, along with a 50-bps hike for the fifth consecutive time.

- Crude oil prices fell for the second session as recession fears returned amid the bond market rout and a strong US dollar. The WTI futures were grasping at the 50-day MA after the last two-day falls. A breakout of this level may take oil prices lower.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.