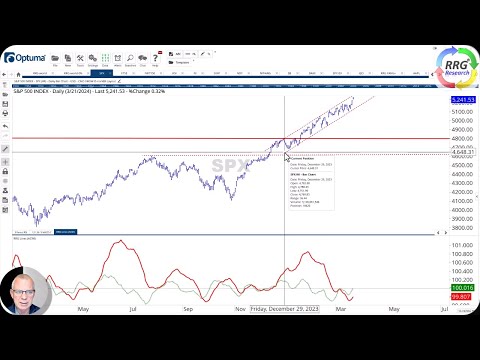

Welcome to Michael Kramer’s pick of the top three market events to watch in the week beginning Monday 25 March (below), and watch our week ahead video preview (above) from RRG Research's Julius de Kempenaer.

As we turn our attention forward, we're faced with a holiday-shortened trading week, with markets in the US, UK, and Europe closed for Good Friday. However, there is still likely to be plenty of market-moving news, including US Treasury auctions, GDP reports, and the all-important personal consumption expenditure (PCE) inflation report, the US Federal Reserve’s preferred inflation gauge.

Treasury auctions

Monday 25 March: These auctions are often key events, as the results can affect the direction of interest rates, currencies and equities. Watch for the bid-to-cover ratio, indirect acceptance rates, and high yield rates. Auctions that go well could push rates lower and, as a result, weaken the US dollar and boost stocks. Auctions that go poorly are likely to push rates higher, strengthen the dollar, and push shares lower.

Treasury auctions all take place at 9am (UK time) and start on Monday with the 2-year Treasury note, followed by the 5-year note on Tuesday, and the 7-year note on Wednesday. The 5-year Treasury rates remain at levels of resistance around 4.35%; a weak auction could be what finally causes the 5-year rate to break out and push higher, perhaps to as high as 4.5%. Conversely, a strong auction could result in a retreat to 4%.

US & UK GDP

Thursday 28 March: The US and UK release fourth-quarter GDP revisions on Thursday. In the US, GDP is expected to remain unchanged at 3.2%. These numbers aren’t likely to affect markets too much, unless there is a significant revision. The core PCE price index part of the GDP release, however, could warrant more attention. The latest revision showed core PCE rose by 2.1% quarter on quarter (q/q). An upward revision could suggest that inflation is not declining as quickly as the Fed anticipates, which could impact rates more at the front end of the yield curve and, as a result, lead to the US dollar strengthening.

The last GDP release showed that the UK economy contracted by 0.3% q/q and 0.2% y/y. Downward revisions could further weaken the pound, pushing the market to anticipate rate cuts sooner. The pound was severely affected following the Bank of England’s rate decision last Thursday, and GBP/USD appears to be heading towards support at 1.263. A breach of support could lead to a further drop to 1.25.

US PCE

Friday 29 March: The PCE report is scheduled for release on Friday morning, when US and UK markets are closed, which presents a challenging situation for traders, since the markets won’t reopen until Monday. The PCE index is anticipated to rise by 0.4% m/m, up from 0.3%, and 2.5% y/y, up from 2.4%. Meanwhile, core PCE is expected to increase by 0.3% m/m down from 0.4%, and remain steady at 2.8% y/y.

This scenario could lead to anxiety among traders and increased hedging activity, observable in metrics like the VIX volatility indexes. Typically, a rise in implied volatility signals heightened put option buying or hedging, potentially exerting downward pressure on equities heading into the extended weekend. Conversely, a cooler-than-expected PCE number might boost stocks when US trading resumes, as implied volatility levels decline.

A similar situation occurred following the CPI report, when the VIX 1-day soared to high levels the day before the report was released. Despite a hotter-than-expected CPI print, the S&P 500 rallied as implied volatility quickly subsided. This pattern could potentially repeat following the PCE report, suggesting that stocks may rally if implied volatility spikes after the data is released.

Key economic and company events

Here’s our rundown of notable economic announcements and company reports scheduled for the coming week:

Monday 25 March

- US Chicago Fed national activity index (Feb), new home sales (Feb)

- Australia Westpac consumer confidence (Mar)

- Results: BuzzFeed (Q4), Kingfisher (FY), Rekor Systems (Q4)

Tuesday 26 March

- US durable goods (Feb), Cash-Shiller home price index (Jan), consumer confidence index (Mar), 2-year Treasury note auction

- Results: Bellway (HY), John Wood Group (FY), Fevertree Drinks (FY), Flutter Entertainment (FY), GameStop (Q4), McCormick & Co (Q1), Ocado (Q1), Smiths Group (HY)

Wednesday 27 March

- Australia consumer price index (Feb)

- UK Nationwide house prices (Mar)

- Eurozone business climate (Mar), consumer confidence (Mar)

- US EIA weekly crude oil stocks change

- Results: Carnival corp (Q1), Cintas (Q3), Paychex

Thursday 28 March

- Australia retail sales (Feb)

- UK current account, final GDP (Q4)

- US final GDP (Q4)

- Results: Walgreens Boots Alliance (Q2)

Friday 29 March

- US PCE core price index (Feb), personal spending (Feb), trade balance (Feb)

- UK and US markets closed for Good Friday

- Results: No major announcements scheduled

Note: While we check all dates carefully to ensure that they are correct at the time of writing, the above announcements are subject to change.

Index dividend schedule

Dividend payments from an index's constituent shares can affect your trading account. View this week's index dividend schedule

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.